Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information [The following information applies to the questions displayed below.] As of December 31, 2022, Sandy Beach had $8,200,000 in 6.0 percent serial

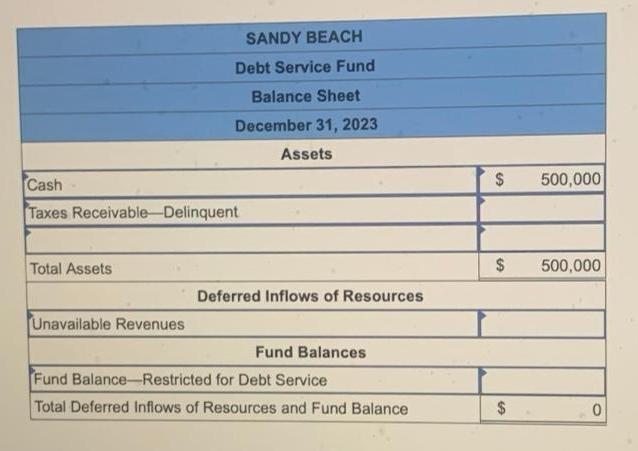

Required information [The following information applies to the questions displayed below.] As of December 31, 2022, Sandy Beach had $8,200,000 in 6.0 percent serial bonds outstanding. Cash of $551,000 is the debt service fund's only asset as of December 31, 2022, and there are no liabilities. The serial bonds pay interest semiannually on January 1 and July 1, with $500,000 in bonds being retired on each interest payment date. Resources for payment of interest are transferred from the General Fund, and the debt service fund levies property taxes in an amount sufficient to cover principal payments. Required c. Prepare a balance sheet for the debt service fund as of December 31, 2023. Cash Taxes Receivable-Delinquent Total Assets SANDY BEACH Debt Service Fund Balance Sheet December 31, 2023 Assets Unavailable Revenues Deferred Inflows of Resources Fund Balances Fund Balance-Restricted for Debt Service Total Deferred Inflows of Resources and Fund Balance S $ $ 500,000 500,000 0

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Cash Taxes receivables Total Assets SANDY BEACH Debt Servic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started