Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information [The following information applies to the questions displayed below.] The following post-closing trial balance was drawn from the accounts of Little Grocery

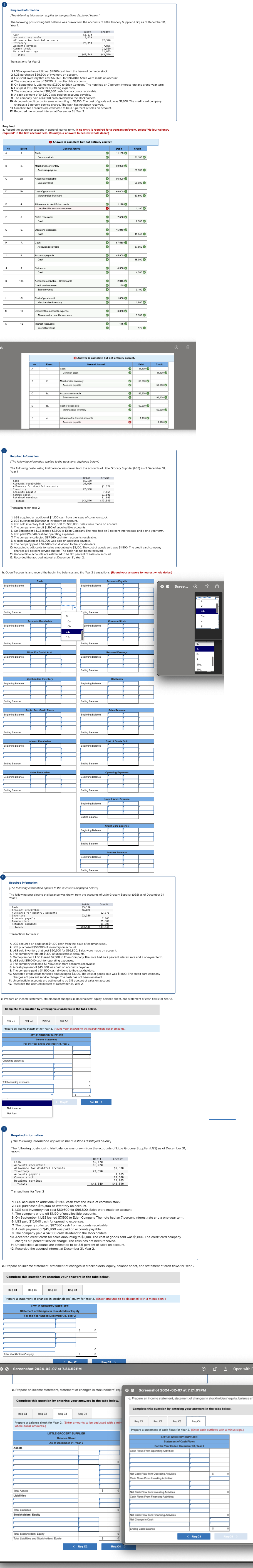

Required information [The following information applies to the questions displayed below.] The following post-closing trial balance was drawn from the accounts of Little Grocery Supplier (LGS) as of December 31, Year 1 Debit Credit Cash $5,170 Accounts receivable 16,020 Allowance for doubtful accounts $2,370 Inventory 22,350 Accounts payable 7,865 Common stock 21,500 Retained earnings 11,805 Totals $43,540 $43,540 Transactions for Year 2 1. LGS acquired an additional $11,100 cash from the issue common stock. 2. LGS purchased $59,900 of inventory on account. 3. LGS sold inventory that cost $60,600 for $96,800. Sales were made on account. 4. The company wrote off $1,190 of uncollectible accounts. 5. On September 1, LGS loaned $7,500 to Eden Company The note had an 7 percent interest rate and a one-year term. 6. LGS paid $15,040 cash for operating expenses. 7. The company collected $87,560 cash from accounts receivable. 8. A cash payment of $45,900 was paid on accounts payable. 9. The company paid a $4,500 cash dividend to the stockholders. 10. Accepted credit cards for sales amounting to $3,100. The cost of goods sold was $1,800. The credit card company charges a 5 percent service charge. The cash has not been received. 11. Uncollectible accounts are estimated to be 3.5 percent of sales on account. 12. Recorded the accrued interest at December 31, Year 2. Required a. Record the given transactions in general journal form. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to nearest whole dollar.) ot Answer is complete but not entirely correct. No Event General Journal Debit Credit A 1. Cash 11,100 Common stock 11,100 B 2. Merchandise inventory Accounts payable 59,900 59,900 C 3a. Accounts receivable Sales revenue 96,800 96,800 D 3b. Cost of goods sold Merchandise inventory 60,600 60,600 E 4. Allowance for doubtful accounts 1,190 Uncollectible accounts expense 1,190 F 5. Notes receivable Cash 7,500 7,500 G 6. Operating expenses Cash H 7. Cash Accounts receivable I 8. Accounts payable Cash J 9. Dividends Cash 00 00 00 00 00 000 15,040 15,040 87,560 87,560 45,900 45,900 4,500 4,500 K 10a Accounts receivable - Credit cards Credit card expense 2,945 155 Sales revenue 3,100 L 10b Cost of goods sold 1,800- Merchandise inventory 0 1,800 M 11 Uncollectible accounts expense 3,388 Allowance for doubtful accounts 3,388 N 12 Interest receivable Interest revenue 175 175 Answer is complete but not entirely correct. No Event A Cash Common stock General Journal Debit Credit 0 11,100 O 11,100 B 2. Merchandise inventory Accounts payable 0 59,900 Q 59,900 C Accounts receivable 0 96,800 Sales revenue 0 96,800 D 3b. Cost of goods sold O 60,600 Merchandise inventory 60,600 E Allowance for doubtful accounts 0 1,190 Accounts payable * 1,190 Required information [The following information applies to the questions displayed below.] The following post-closing trial balance was drawn from the accounts of Little Grocery Supplier (LGS) as of December 31, Year 1. Debit Credit Cash $5,170 Accounts receivable 16,020 Allowance for doubtful accounts $2,370 Inventory 22,350 Accounts payable 7,865 Common stock 21,500 Retained earnings 11,805 Totals $43,540 $43,540 Transactions for Year 2 1. LGS acquired an additional $11,100 cash from the issue of common stock. 2. LGS purchased $59,900 of inventory on account. 3. LGS sold inventory that cost $60,600 for $96,800. Sales were made on account. 4. The company wrote off $1,190 of uncollectible accounts. 5. On September 1, LGS loaned $7,500 to Eden Company The note had an 7 percent interest rate and a one-year term. 6. LGS paid $15,040 cash for operating expenses. 7. The company collected $87,560 cash from accounts receivable. 8. A cash payment of $45,900 was paid on accounts payable. 9. The company paid a $4,500 cash dividend to the stockholders. 10. Accepted credit cards for sales amounting to $3,100. The cost of goods sold was $1,800. The credit card company charges a 5 percent service charge. The cash has not been received. 11. Uncollectible accounts are estimated to be 3.5 percent sales on account. 12. Recorded the accrued interest at December 31, Year 2. b. Open T-accounts and record the beginning balances and the Year 2 transactions. (Round your answers to nearest whole dollar.) Cash Beginning Balance Accounts Payable Beginning Balance Ending Balance "ding Balance Accounts Receivable 10a. Common Stock Beginning Balance 10b ginning Balance 11. 12. Ending Balance Allow. For Doubt. Acct Beginning Balance 0 Scree... 0 Ending Balance 7. Retained Earnings 8. Beginning Balance 9. Ending Balance Merchandise Inventory Dividends Beginning Balance Beginning Balance Ending Balance Ending Balance Accts. Rec. Credit Cards Sales Revenue Beginning Balance Beginning Balance Ending Balance Ending Balance Interest Receivable Cost of Goods Sold Beginning Balance Beginning Balance Ending Balance Ending Balance Notes Receivable Operating Expenses Beginning Balance Beginning Balance Ending Balance Ending Balance Uncoll. Acct. Expense Beginning Balance Ending Balance Credit Card Expense Beginning Balance Ending Balance Interest Revenue Beginning Balance Ending Balance Required information [The following information applies to the questions displayed below.] The following post-closing trial balance was drawn from the accounts of Little Grocery Supplier (LGS) as of December 31, Year 1. Cash Debit $5,170 Credit Accounts receivable 16,020 Allowance for doubtful accounts $2,370 Inventory 22,350 Accounts payable 7,865 Common stock 21,500 Retained earnings 11,805 Totals $43,540 $43,540 Transactions for Year 2 1. LGS acquired an additional $11,100 cash from the issue of common stock. 2. LGS purchased $59,900 of inventory on account. 3. LGS sold inventory that cost $60,600 for $96,800. Sales were made on account. 4. The company wrote off $1,190 of uncollectible accounts. 5. On September 1, LGS loaned $7,500 to Eden Company The note had an 7 percent interest rate and a one-year term. 6. LGS paid $15,040 cash for operating expenses. 7. The company collected $87,560 cash from accounts receivable. 8. A cash payment of $45,900 was paid on accounts payable. 9. The company paid a $4,500 cash dividend to the stockholders. charges a 5 percent service charge. The cash has not been received. 10. Accepted credit cards for sales amounting to $3,100. The cost of goods sold was $1,800. The credit card company 11. Uncollectible accounts are estimated to be 3.5 percent of sales on account. 12. Recorded the accrued interest at December 31, Year 2. c. Prepare an income statement, statement of changes stockholders' equity, balance sheet, and statement of cash flows for Year 2. Complete this question by entering your answers Req C1 Req C2 Req C3 Req C4 the tabs below. Prepare an income statement for Year 2. (Round your answers to the nearest whole dollar amounts.) LITTLE GROCERY SUPPLIER Operating expenses Income Statement For the Year Ended December 31, Year 2 Total operating expenses Net income Net loss Required information [The following information applies to the questions displayed below.] The following post-closing trial balance was drawn from the accounts of Little Grocery Supplier (LGS) as of December 31, Year 1. Debit Credit Cash $5,170 Accounts receivable 16,020 Allowance for doubtful accounts $2,370 Inventory 22,350 Accounts payable 7.865 Common stock Retained earnings 21,500 11,805 Totals $43,540 $43,540 Transactions for Year 2 1. LGS acquired an additional $11,100 cash from the issue of common stock. 2. LGS purchased $59,900 of inventory on account. 3. LGS sold inventory that cost $60,600 for $96,800. Sales were made on account. 4. The company wrote off $1,190 of uncollectible accounts. 5. On September 1, LGS loaned $7,500 to Eden Company The note had an 7 percent interest rate and a one-year term. 6. LGS paid $15,040 cash for operating expenses. 7. The company collected $87,560 cash from accounts receivable. 8. A cash payment of $45,900 was paid on accounts payable. 9. The company paid a $4,500 cash dividend to the stockholders. 10. Accepted credit cards for sales amounting to $3,100. The cost of goods sold was $1,800. The credit card company charges a 5 percent service charge. The cash has not been received. 11. Uncollectible accounts are estimated to be 3.5 percent of sales on account. 12. Recorded the accrued interest at December 31, Year 2. 10b c. Prepare an income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Year 2. Complete this question by entering your answers in the tabs below. Reg C1 Req C2 Reg C3 Req C4 Prepare a statement of changes in stockholders' equity for Year 2. (Enter amounts to be deducted with a minus sign.) LITTLE GROCERY SUPPLIER Statement of Changes in Stockholders' Equity For the Year Ended December 31, Year 2 Total stockholders' equity 0 Screenshot 2024-02-07 at 7.24.52 PM 1 2. . 4. 5. Open with F c. Prepare an income statement, statement of changes stockholders' equ Complete this question by entering your answers in the tabs below. Screenshot 2024-02-07 at 7.21.01 PM c. Prepare an income statement, statement of changes in stockholders' equity, balance sh Complete this question by entering your answers in the tabs below. Req C1 Req C2 Req C3 Req C4 Prepare a balance sheet for Year 2. (Enter amounts to be deducted with a min whole dollar amounts.) Req C1 Req C2 Req C3 Req C4 Assets Total Assets Liabilities Total Liabilities Stockholders' Equity LITTLE GROCERY SUPPLIER Balance Sheet As of December 31, Year 2 Total Stockholders' Equity Total Liabilities and Stockholders' Equity Prepare a statement of cash flows for Year 2. (Enter cash outflows with a minus sign.) LITTLE GROCERY SUPPLIER Statement of Cash Flows For the Year Ended December 31, Year 2 Cash Flows From Operating Activities: Net Cash Flow from Operating Activities $ Cash Flows From Investing Activities: $ Net Cash Flow from Investing Activities Cash Flows From Financing Activities: < Req C2 Req C4 Net Cash Flow from Financing Activities Net Change in Cash Ending Cash Balance < Req C3 Req C4 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started