Answered step by step

Verified Expert Solution

Question

1 Approved Answer

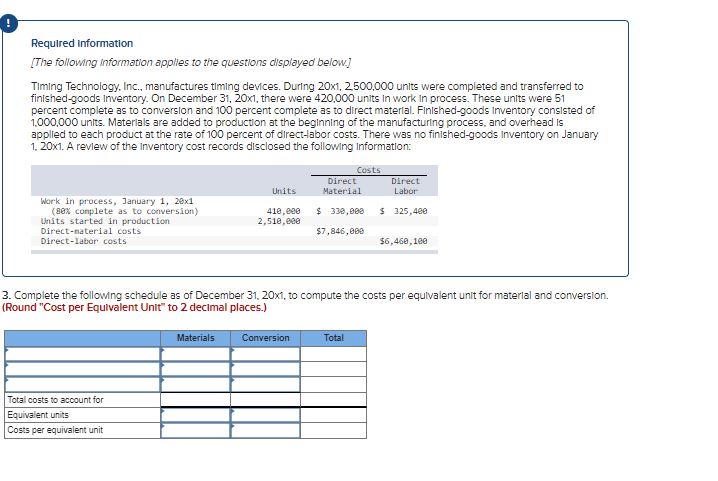

Required information [The following Information applies to the questions displayed below.] Timing Technology, Inc., manufactures timing devices. During 20x1, 2,500,000 units were completed and

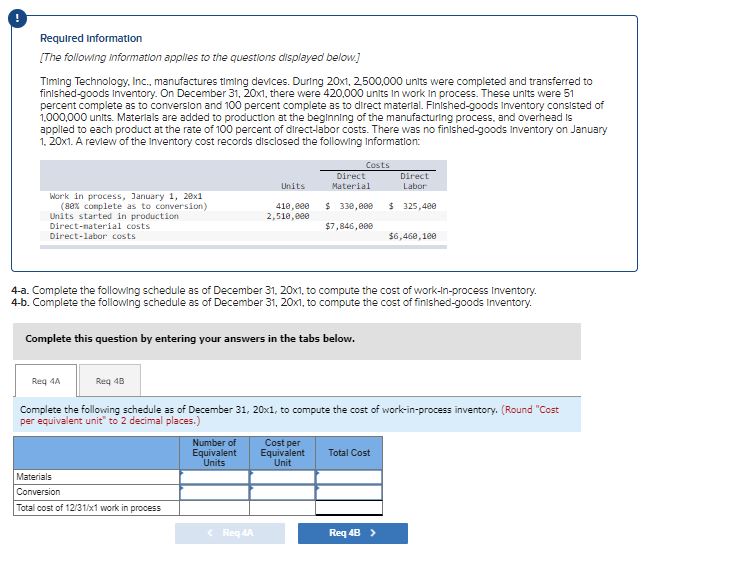

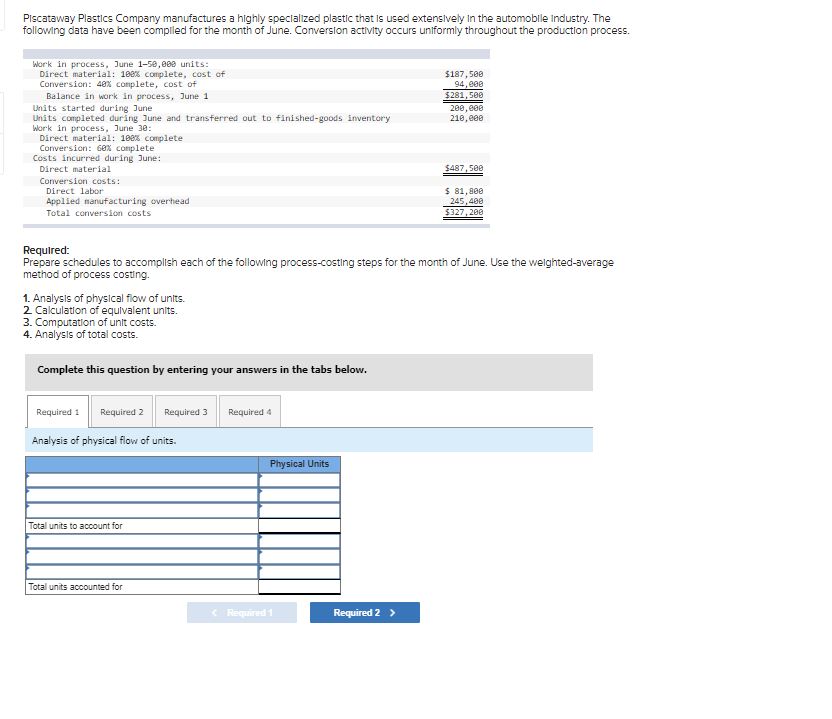

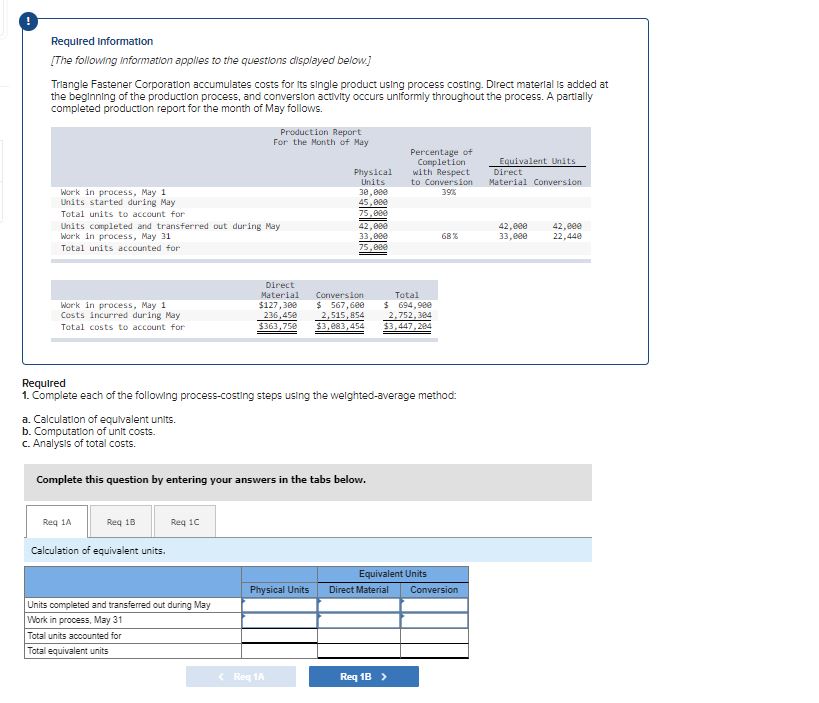

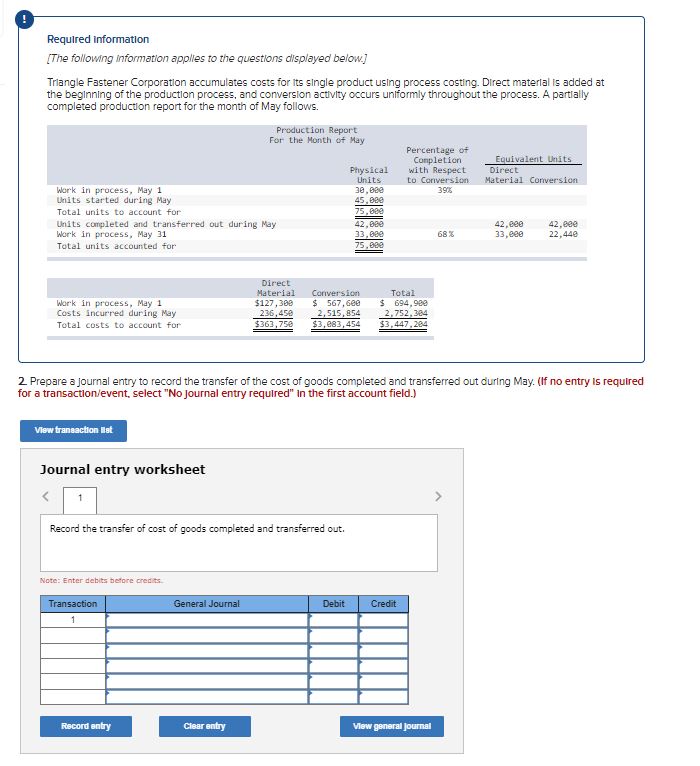

Required information [The following Information applies to the questions displayed below.] Timing Technology, Inc., manufactures timing devices. During 20x1, 2,500,000 units were completed and transferred to finished-goods Inventory. On December 31, 20x1, there were 420,000 units in work in process. These units were 51 percent complete as to conversion and 100 percent complete as to direct material. Finished-goods Inventory consisted of 1,000,000 units. Materials are added to production at the beginning of the manufacturing process, and overhead is applied to each product at the rate of 100 percent of direct-labor costs. There was no finished-goods Inventory on January 1. 20x1. A review of the Inventory cost records disclosed the following Information: Direct Material Costs Units Direct Labor Work in process, January 1, 20x1 (80% complete as to conversion) Units started in production Direct-material costs Direct-labor costs 410,000 2,510,000 $ 330,000 $ 325,400 $7,846,000 $6,460,100 3. Complete the following schedule as of December 31, 20x1, to compute the costs per equivalent unit for material and conversion. (Round "Cost per Equivalent Unit" to 2 decimal places.) Total costs to account for Equivalent units Costs per equivalent unit Materials Conversion Total Required Information [The following information applies to the questions displayed below.] Timing Technology, Inc., manufactures timing devices. During 20x1, 2,500,000 units were completed and transferred to finished-goods Inventory. On December 31, 20x1, there were 420,000 units in work in process. These units were 51 percent complete as to conversion and 100 percent complete as to direct material. Finished-goods Inventory consisted of 1,000,000 units. Materials are added to production at the beginning of the manufacturing process, and overhead is applied to each product at the rate of 100 percent of direct-labor costs. There was no finished-goods Inventory on January 1. 20x1. A review of the Inventory cost records disclosed the following Information: Costs Units Direct Material Direct Labor Work in process, January 1, 20x1 (80% complete as to conversion) Units started in production Direct-material costs Direct-labor costs 410,000 2,510,000 $ 330,000 $ 325,400 $7,846,000 $6,460,100 4-a. Complete the following schedule as of December 31, 20x1, to compute the cost of work-in-process Inventory. 4-b. Complete the following schedule as of December 31, 20x1, to compute the cost of finished-goods Inventory. Complete this question by entering your answers in the tabs below. Req 4A Req 4B Complete the following schedule as of December 31, 20x1, to compute the cost of work-in-process inventory. (Round "Cost per equivalent unit" to 2 decimal places.) Number of Equivalent Units Cost per Equivalent Total Cost Unit Materials Conversion Total cost of 12/31/x1 work in process Piscataway Plastics Company manufactures a highly specialized plastic that is used extensively in the automobile Industry. The following data have been compiled for the month of June. Conversion activity occurs uniformly throughout the production process. Work in process, June 1-50,000 units: Direct material: 100% complete, cost of Conversion: 40% complete, cost of $187,500 94,000 Balance in work in process, June 1 $281,500 Units started during June 200,000 Units completed during June and transferred out to finished-goods inventory 210,000 Work in process, June 30: Direct material: 100% complete Conversion: 60% complete Costs incurred during June: Direct material Conversion costs: Direct labor Applied manufacturing overhead Total conversion costs $487,500 $ 81,800 245,400 $327,200 Required: Prepare schedules to accomplish each of the following process-costing steps for the month of June. Use the weighted-average method of process costing. 1. Analysis of physical flow of units. 2. Calculation of equivalent units. 3. Computation of unit costs. 4. Analysis of total costs. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Analysis of physical flow of units. Total units to account for Physical Units Total units accounted for Required Information [The following Information applies to the questions displayed below.] Triangle Fastener Corporation accumulates costs for its single product using process costing. Direct material is added at the beginning of the production process, and conversion activity occurs uniformly throughout the process. A partially completed production report for the month of May follows. Work in process, May 1 Production Report For the Month of May Units started during May Total units to account for Units completed and transferred out during May Work in process, May 31 Total units accounted for Direct Material Work in process, May 1 Costs incurred during May Total costs to account for $127,300 236,450 $363,750 Physical Units Percentage of Completion with Respect to Conversion Equivalent Units Direct Material Conversion 30,000 39% 45,000 75,000 42,000 42,000 42,000 33,000 68% 33,000 22,440 75,000 Conversion Total $ 567,600 $ 694,900 2,515,854 $3,083,454 2,752,384 $3,447,284 Required 1. Complete each of the following process-costing steps using the weighted-average method: a. Calculation of equivalent units. b. Computation of unit costs. c. Analysis of total costs. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 1C Calculation of equivalent units. Units completed and transferred out during May Work in process, May 31 Total units accounted for Total equivalent units Equivalent Units Physical Units Direct Material Conversion Required Information [The following information applies to the questions displayed below.] Triangle Fastener Corporation accumulates costs for its single product using process costing. Direct material is added at the beginning of the production process, and conversion activity occurs uniformly throughout the process. A partially completed production report for the month of May follows. Production Report For the Month of May Physical Units Percentage of Completion with Respect to Conversion Equivalent Units Direct Material Conversion Work in process, May 1 30,000 39% Units started during May 45,000 Total units to account for 75,000 Units completed and transferred out during May 42,000 Work in process, May 31 Total units accounted for 33,000 75,000 68% 42,000 33,000 42,000 22,440 Work in process, May 1 Costs incurred during May Total costs to account for Direct Material $127,300 236,450 $363,750 Conversion Total $ 567,600 $ 694,900 2,515,854 $3,083,454 2,752,384 $3,447,284 2. Prepare a journal entry to record the transfer of the cost of goods completed and transferred out during May. (If no entry is required for a transaction/event, select "No Journal entry required" in the first account field.) View transaction st Journal entry worksheet Record the transfer of cost of goods completed and transferred out. Note: Enter debits before credits. Transaction 1 General Journal Debit Credit Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started