Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information [The following information applies to the questions displayed below.] Jordan Company began operations on January 1, year 1, by issuing common stock

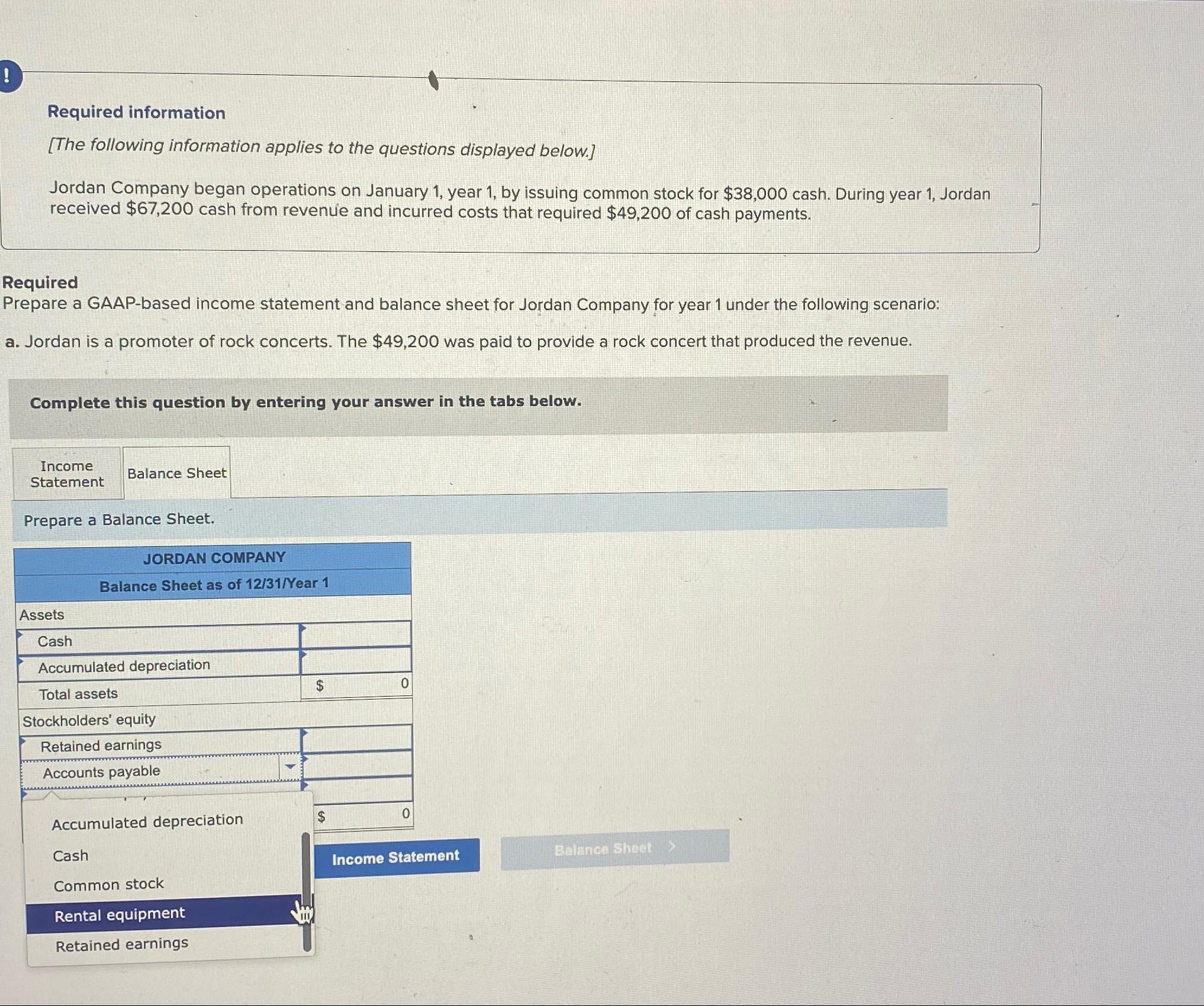

Required information [The following information applies to the questions displayed below.] Jordan Company began operations on January 1, year 1, by issuing common stock for $38,000 cash. During year 1, Jordan received $67,200 cash from revenue and incurred costs that required $49,200 of cash payments. Required Prepare a GAAP-based income statement and balance sheet for Jordan Company for year 1 under the following scenario: a. Jordan is a promoter of rock concerts. The $49,200 was paid to provide a rock concert that produced the revenue. Complete this question by entering your answer in the tabs below. Income Statement Balance Sheet Prepare a Balance Sheet. JORDAN COMPANY Balance Sheet as of 12/31/Year 1 Assets Cash Accumulated depreciation $ 0 Total assets Stockholders' equity Retained earnings Accounts payable Accumulated depreciation $ 0 Cash Common stock Rental equipment Retained earnings Income Statement Balance Sheet >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started