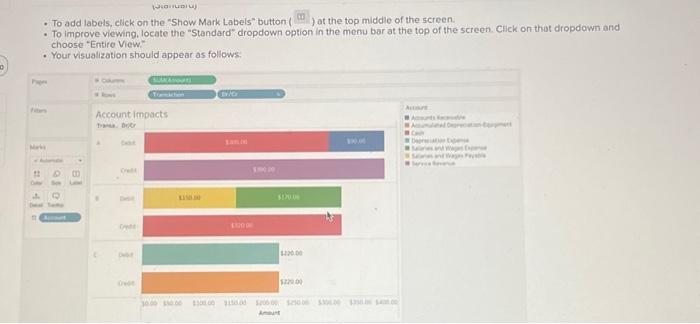

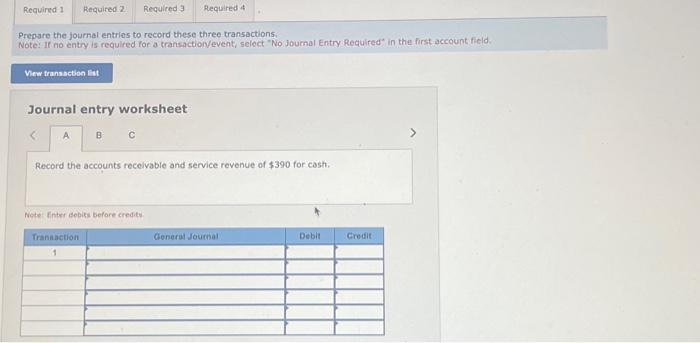

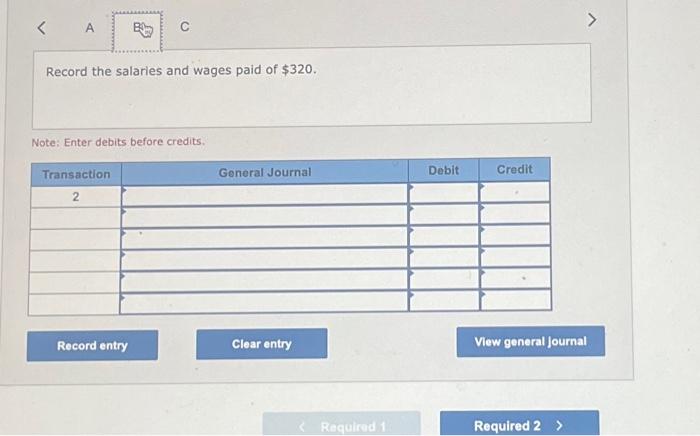

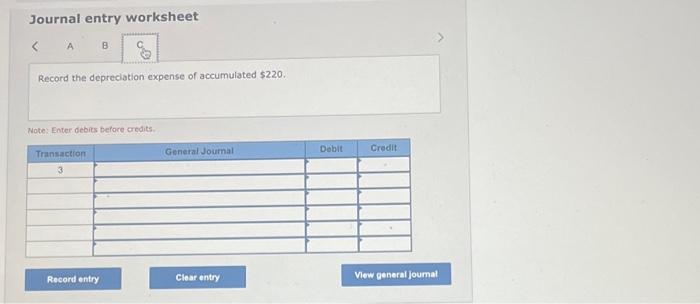

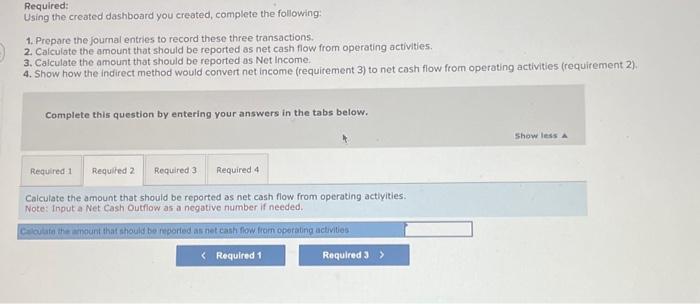

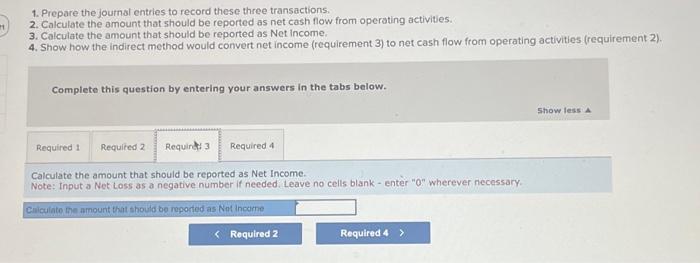

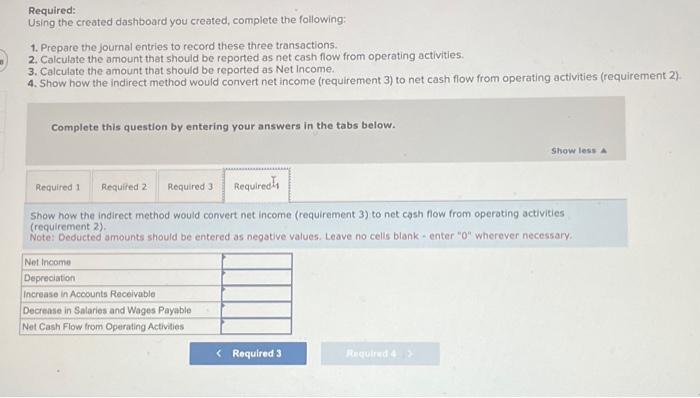

Required information [The following information applies to the questions disployed below.] To complete this exercise, you will need to download and install Tableau on your computer Tableau provides free instructor and student licenses as well as free videos and support for utiizing and learning the software, Onco you are up and running with Tobleau, watch the three "Gerting Started" Tableau videos. All of Tableau's short training videos can be found here: Fring Developers hove asked you to help them visualize and understand the cash impacts of three recent transactions. These transactions are as follows: A. The company sells services of $390 for $300 in cash and $90 on account B. The company pays $320 int safaries and wages, which includes $150 that was payable at the end of the previous month and $170 for salaries and wages of this month. C. The company records $220 in depreciation related to equipment. Downlead the Excel file, which you will use to create the Tableau visualizations requested by the company. Upload the Excel file into Tobleau by doing the following: 1. Open the Tableau Deskiop applicetion. 2. On the lenthand side, under the "Connect" header and the "To a file" sub-header, click on "Microsoft Excet," 3. Choose the Excel file and click "Open" 4. Since the only worksheet in the Excel File is "12-1" it will default as a selection with no further import steps needed. Create a stacked bar chart demonstrating each of the three transactions provided by Fring: - Double-click on "Sheet 1 at the bottom of your workbook and rename it "Account impacts" - On the left hand side under "Tables", elick on "Transaction" and drag and drop it to the "Rows" section above the blank sheec. - On the len hand side under "Tables", click on "DR/CR" and drag and drop it to the "Rows" section to the right of the "Transaction" pili you just added. - On the left-hand side under "Tables", click on "Amount" and drag and drop it to the "Columns" section, above the previous two attributes you added. - In the resulting visualization, we want to show debits before credits, to fit with the norm in accounting. To do this, go to the visualization, and within transaction "A", click on "Debit" and drag it above "Credit - This will modify all three transactions - On the lefthand side under "Tabies", click on "Account" and drag it to the "Color" " ) card in the "Marks" card area. - To clean up the visualization do the following: Right-click on the X-axis - Choose "format" - A "Format' window will appear on the left. - On the "Axis" pane, click on the "Numbers" dropdown in the "Scale" section and choose, "Currency ( (Standard) - On the "Pane" pane, click on the "Numbers" dropdown in the "Scale" section and choose, "Currency (Standard)" - To add labels, click on the "Show Mark Labels" button ( ) at the top middie of the screen. - To improve viewing. locate the "Standard" dropdown option in the menu bar at the top of the screen. Click on that dropdown and choose "Entire View." - Your visualization should appear as follows: - To add labels, cisck on the "Show Mark Labels" button( ) at the top middie of the screen. - To improve viewing. locate the "Standard" dropdown option in the menu bar at the top of the screen. Click on that dropdown and choose "Entire View" - Your visualization should appear as follows. Account impacts Thene oris Required: Using the created dashboard you created, complete the following: 1. Prepore the journal entries to record these three transactions. 2. Calculate the amount that should be reported as net cash flow from operating activities: 3. Calculate the amount that should be reported as Net income. 4. Show how the indirect method would convert net income (requirement 3) to net cash flow from operating activities (requirement 2) Complete this question by entering your answers in the tabs below. Prepare the journal entries to record these three transactions. Note: If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field. Journal entry worksheet Record the accounts recelvable and service revenue of $390 for cast. Note: finter sebifi before creditw Record the salaries and wages paid of $320. Note: Enter debits before credits. Journal entry worksheet Record the depreciation expense of accumulated $220. Wote: Enter debits before credits Required: Rsing the created dashboard you created, complete the following: Usul 1. Prepare the journal entries to record these three transactions. 2. Calculate the amount that should be reported as net cash flow from operating activities. 3. Calculate the amount that should be reported as Net income. 4. Show how the indirect method would convert net income (requirement 3) to net cash flow from operating activities (requirement 2) Complete this question by entering your answers in the tabs below. Calculate the amount that should be reported as net cash flow from operating actlyities: Note: Input a Net Cash Outfiow as a negative number if needed. c-iculafe the mount that should be reporied as net cash fow fiein operaling activites 1. Prepare the journal entries to record these three transactions. 2. Calculate the amount that should be reported as net cash flow from operating activities. 3. Calculate the amount that should be reported as Net income. 4. Show how the indirect method would convert net income (requirement 3) to net cash flow from operating activities (requirement 2). Complete this question by entering your answers in the tabs below. Calculate the amount that should be reported as Net Income. Note: Input a Net Loss as a negative number it needed. Leave no cells blank - enter " 0 " wherever necessary. Ciliculate the amourt that thould be reported as Not income Required: Using the created dashboard you created, complete the following: 1. Prepare the journal entries to record these three transactions. 2. Calculate the amount that should be reported as net cash flow from operating activities 3. Calculate the amount that should be reported as Net income. 4. Show how the indirect method would convert net income (requirement 3) to net cash flow from operating activities (requirement 2 ) Complete this question by entering your answers in the tabs below. Show how the indirect method would convert net income (requirement 3) to net cash flow from operating activities (requirement 2). Note: Deducted amounts should be entered as negative values. Leave no cells blank- enter " 0 " wherever necessary