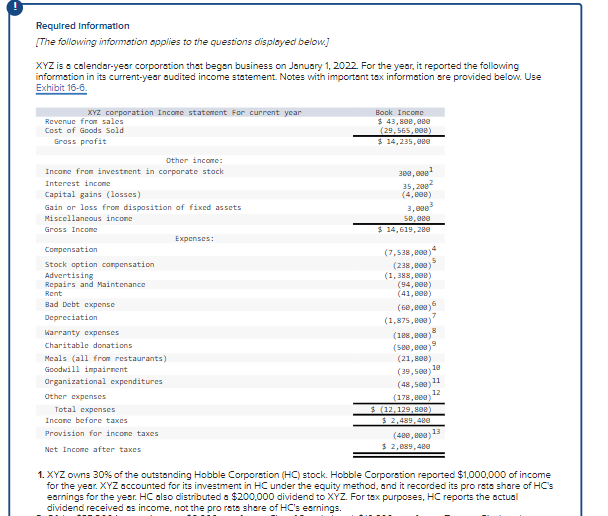

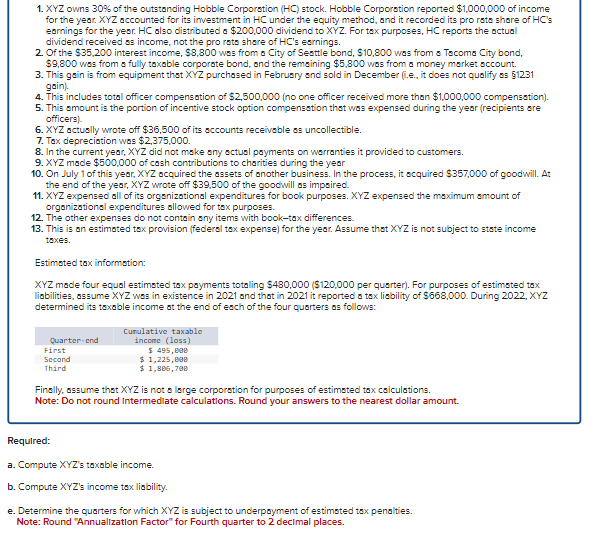

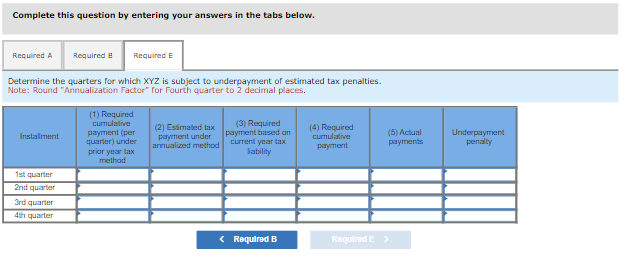

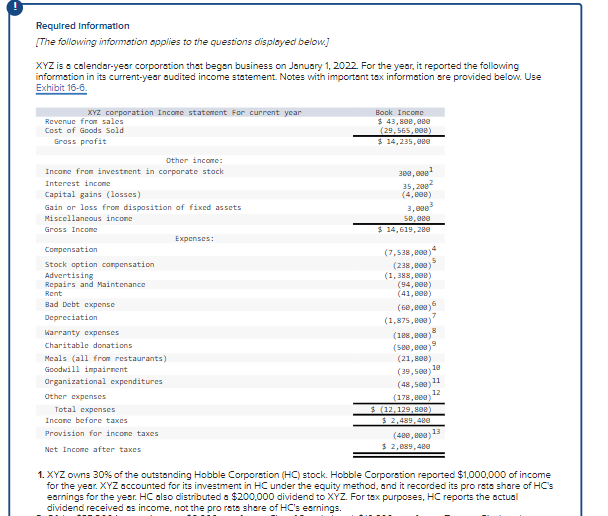

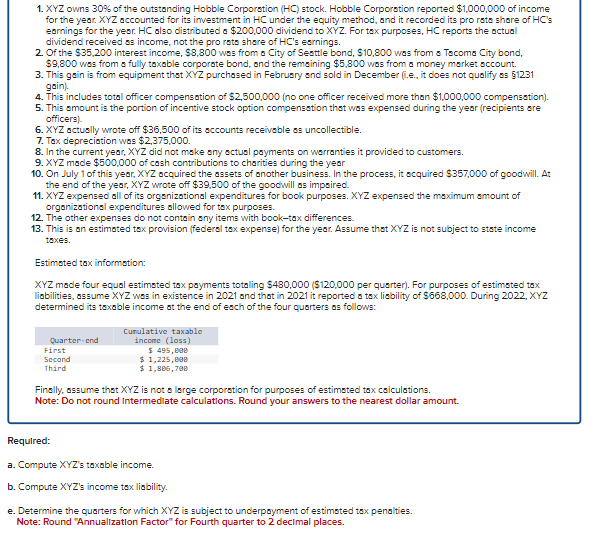

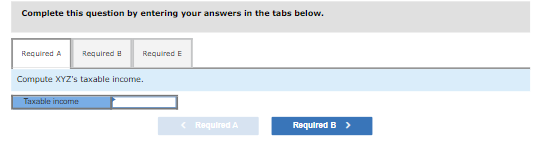

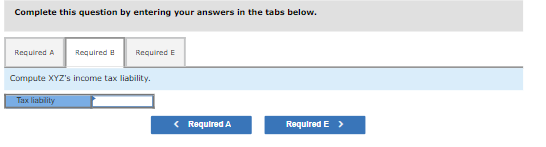

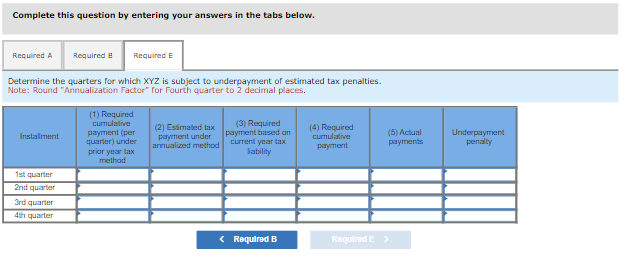

Required Information [The following informotion opplies to the questions displayed below.] XYZ is a calendar-year corporation that begen business on January 1, 2022. For the year, it reported the following informstion in its current-year oudited income statement. Notes with importent tax information are provided below. Use Exhibit 166. 1. XYZ owns 30% of the outstanding Hobble Corporation (HC) stock. Hobble Corporation reported $1,000,000 of income for the year. XYZ accounted for its investment in HC under the equity method, and it recorded its pro rata shere of HCs earnings for the year. HC also distributed s $200,000 dividend to XYZ. For tax purposes, HC reports the actusl dividend received ss income, not the pro rato share of HC's earnings. for the year. XYZ accounted for its investment in HC under the equity method, and it recorded its pro rata share of HC s earnings for the yeor. HC also distributed a $200,000 dividend to XYZ. For tax purposes, HC reports the octusl dividend received as income, not the pro rata share of HC 's earnings. 2. Of the $35,200 interest income, $8,800 wes from a City of Sesttle bond, $10,800 was from a Tecoms City bond, $9,800 was from a fully taxsble corporste bond, and the remaining $5,800 wos from s money market account. 3. This gain is from equipment thet XYZ purchased in Februery and sold in December (i.e., it does not qualify as Gi1231 gain). 4. This includes total officer compensation of $2,500,000 (no one officer received more then $1,000,000 compensation). 5. This amount is the portion of incentive stock option compensation that was expensed during the year (recipients are officers). 6. XYZ actuslly wrote off $36,500 of its accounts receivable ss uncollectible. 7. Tox depreciation wos $2,375,000. 8. In the current year, XYZ did not make any actusl poyments on warranties it provided to customers. 9. XYZ made $500,000 of cash contributions to charities during the year 10. On July 1 of this yeor, XYZ scquired the sssets of another business. In the process, it scquired $357,000 of goodwill. At the end of the year, XYZ wrote off $39,500 of the goodwill us impeired. 11. XYZ expensed all of its orgenizational expenditures for book purposes. XYZ expensed the maximum amount of orgonizztional expenditures ollowed for tax purposes. 12. The other expenses do not contain any items with book-tax differences. 13. This is on estimoted tax provision (federal tax expense) for the year. Assume that XYZ is not subject to state income taxes. Estimsted tax information: XYZ made four equal estimated tax poyments totaling $480,000 (\$120,000 per quarter). For purposes of estimated tax liabilities, sssume XYZ wos in existence in 2021 and that in 2021 it reported o tax liability of $668,000. During 2022, XYZ determined its toxable income at the end of esch of the four quarters as follows: Finally, ossume that XYZ is not a large corporation for purposes of estimated tax calculations. Note: Do not round intermedlate calculations. Round your answers to the nearest dollar amount. Required: a. Compute XYZs taxable income. b. Compute XYZ 's income tox liability. e. Determine the quarters for which XYZ is subject to underpoyment of estimsted tax penalties. Note: Round "Annualization Factor" for Fourth quarter to 2 decimal places. Complete this question by entering your answers in the tabs below. Compute XYZ's taxable income. Complete this question by entering your answers in the tabs below. Compute XYZ's income tax liability. Complete this question by entering your answers in the tabs below. Determine the quarters for which XYZ is subject to underpayment of estimated tax penalties. Note: Round "Annualization Factor" for Fourth quarter to 2 decimal places. Required Information [The following informotion opplies to the questions displayed below.] XYZ is a calendar-year corporation that begen business on January 1, 2022. For the year, it reported the following informstion in its current-year oudited income statement. Notes with importent tax information are provided below. Use Exhibit 166. 1. XYZ owns 30% of the outstanding Hobble Corporation (HC) stock. Hobble Corporation reported $1,000,000 of income for the year. XYZ accounted for its investment in HC under the equity method, and it recorded its pro rata shere of HCs earnings for the year. HC also distributed s $200,000 dividend to XYZ. For tax purposes, HC reports the actusl dividend received ss income, not the pro rato share of HC's earnings. for the year. XYZ accounted for its investment in HC under the equity method, and it recorded its pro rata share of HC s earnings for the yeor. HC also distributed a $200,000 dividend to XYZ. For tax purposes, HC reports the octusl dividend received as income, not the pro rata share of HC 's earnings. 2. Of the $35,200 interest income, $8,800 wes from a City of Sesttle bond, $10,800 was from a Tecoms City bond, $9,800 was from a fully taxsble corporste bond, and the remaining $5,800 wos from s money market account. 3. This gain is from equipment thet XYZ purchased in Februery and sold in December (i.e., it does not qualify as Gi1231 gain). 4. This includes total officer compensation of $2,500,000 (no one officer received more then $1,000,000 compensation). 5. This amount is the portion of incentive stock option compensation that was expensed during the year (recipients are officers). 6. XYZ actuslly wrote off $36,500 of its accounts receivable ss uncollectible. 7. Tox depreciation wos $2,375,000. 8. In the current year, XYZ did not make any actusl poyments on warranties it provided to customers. 9. XYZ made $500,000 of cash contributions to charities during the year 10. On July 1 of this yeor, XYZ scquired the sssets of another business. In the process, it scquired $357,000 of goodwill. At the end of the year, XYZ wrote off $39,500 of the goodwill us impeired. 11. XYZ expensed all of its orgenizational expenditures for book purposes. XYZ expensed the maximum amount of orgonizztional expenditures ollowed for tax purposes. 12. The other expenses do not contain any items with book-tax differences. 13. This is on estimoted tax provision (federal tax expense) for the year. Assume that XYZ is not subject to state income taxes. Estimsted tax information: XYZ made four equal estimated tax poyments totaling $480,000 (\$120,000 per quarter). For purposes of estimated tax liabilities, sssume XYZ wos in existence in 2021 and that in 2021 it reported o tax liability of $668,000. During 2022, XYZ determined its toxable income at the end of esch of the four quarters as follows: Finally, ossume that XYZ is not a large corporation for purposes of estimated tax calculations. Note: Do not round intermedlate calculations. Round your answers to the nearest dollar amount. Required: a. Compute XYZs taxable income. b. Compute XYZ 's income tox liability. e. Determine the quarters for which XYZ is subject to underpoyment of estimsted tax penalties. Note: Round "Annualization Factor" for Fourth quarter to 2 decimal places. Complete this question by entering your answers in the tabs below. Compute XYZ's taxable income. Complete this question by entering your answers in the tabs below. Compute XYZ's income tax liability. Complete this question by entering your answers in the tabs below. Determine the quarters for which XYZ is subject to underpayment of estimated tax penalties. Note: Round "Annualization Factor" for Fourth quarter to 2 decimal places