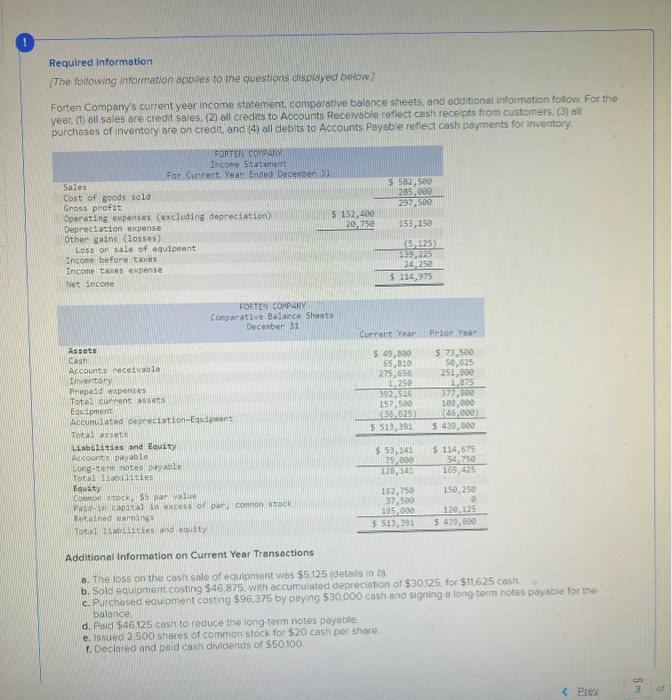

Required information The following intormation apyilas to the questions disployed beiow? Foten Company's current year income statement, compsratwe balance sheets, and odditional informiation follow For-the year. (1) all sales are credit 5ales, (2) all credirs to Accounts Recelvable fetlect cash rece pts from customers. (3) all purchoses of inventory are on credit, and 4) all debits to Accounts Payabe reflect cash poyments for inventocy: Additional Information on Current Year Transactions a. The loss on the cash sale of nquipment was $5.125 (detaits in b. b. Sold equipmens costing $46,875. with accumulated deprecietion of $30125. for $11625 casin c. Puicnosed equ pment costing $96,375 by poying $30,000 cashand signing a long-term notes paysble for the balance. d. Paid $46125 cosh to reduce the long-term notes payable e. Ispued 2.509 shares of common stock for $20 cash per shore f. Declared and poid cash dividends of $50100 Additional Information on Current Year Transactions a. The loss on the cash sale of equiprieat wos $5.125 (oetails in b) b. Sold equ pment costing $46,875. With accum ulated depreciation af $30.25. for $11,625 cash c. Purchased equpment costlng $96,375 by paylag $30,000 cash and signing o long term notes payable for the batarke d. Pald $46125 cash to reduce the longtem notes bayable e. Issued 2.500 shares of common stock fon 320 cash per share. 1. Declared and paid casn divicends of 550900 Required: Rresore a complete stotement of cash flows using the cirect merhod Note: Amounts to be deducted should be indicated with a minus sign. Required information The following intormation apyilas to the questions disployed beiow? Foten Company's current year income statement, compsratwe balance sheets, and odditional informiation follow For-the year. (1) all sales are credit 5ales, (2) all credirs to Accounts Recelvable fetlect cash rece pts from customers. (3) all purchoses of inventory are on credit, and 4) all debits to Accounts Payabe reflect cash poyments for inventocy: Additional Information on Current Year Transactions a. The loss on the cash sale of nquipment was $5.125 (detaits in b. b. Sold equipmens costing $46,875. with accumulated deprecietion of $30125. for $11625 casin c. Puicnosed equ pment costing $96,375 by poying $30,000 cashand signing a long-term notes paysble for the balance. d. Paid $46125 cosh to reduce the long-term notes payable e. Ispued 2.509 shares of common stock for $20 cash per shore f. Declared and poid cash dividends of $50100 Additional Information on Current Year Transactions a. The loss on the cash sale of equiprieat wos $5.125 (oetails in b) b. Sold equ pment costing $46,875. With accum ulated depreciation af $30.25. for $11,625 cash c. Purchased equpment costlng $96,375 by paylag $30,000 cash and signing o long term notes payable for the batarke d. Pald $46125 cash to reduce the longtem notes bayable e. Issued 2.500 shares of common stock fon 320 cash per share. 1. Declared and paid casn divicends of 550900 Required: Rresore a complete stotement of cash flows using the cirect merhod Note: Amounts to be deducted should be indicated with a minus sign