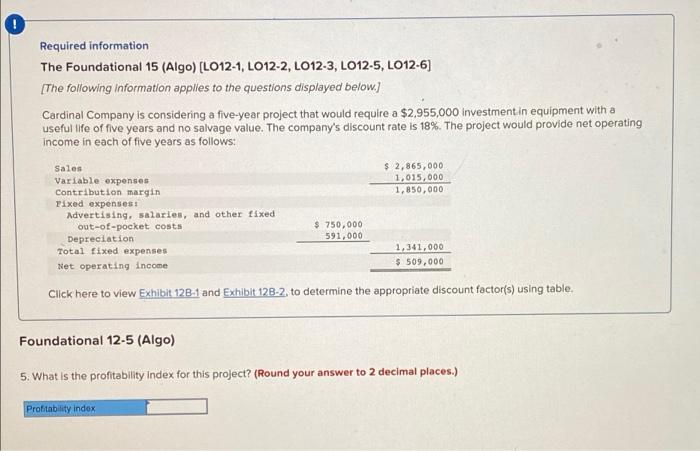

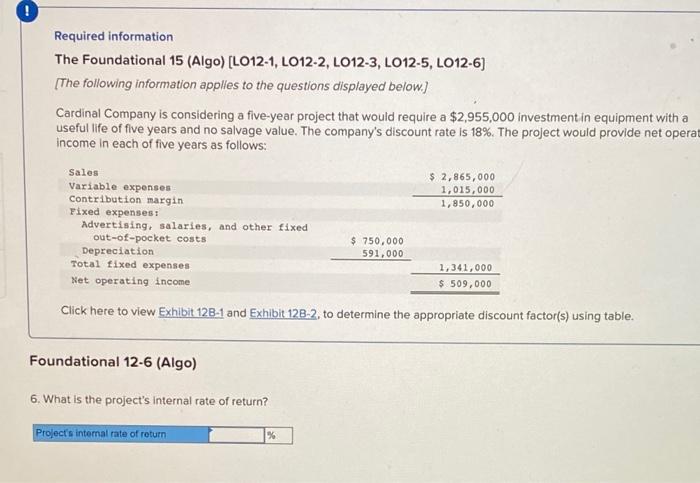

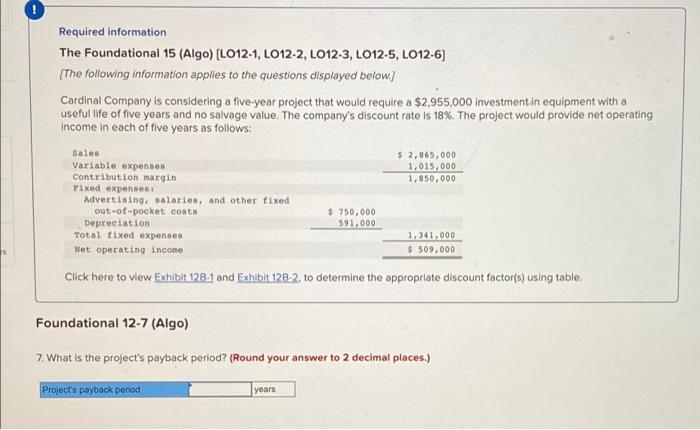

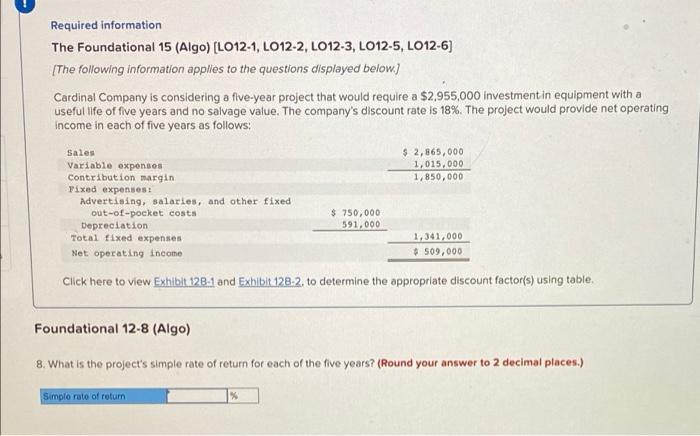

Required information The Foundational 15 (Algo) (L012-1, LO12-2, LO12-3, LO12-5, LO12-6) [The following information applles to the questions displayed below.) Cardinal Company is considering a five-year project that would require a $2,955,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 18%. The project would provide net operating Income in each of five years as follows: $ 2,865,000 1,015,000 1,850,000 Sales Variable expenses Contribution margin Fixed expenses Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses Net operating income $ 750,000 591,000 1,341,000 $ 509,000 Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. Foundational 12-5 (Algo) 5. What is the profitability Index for this project? (Round your answer to 2 decimal places.) Profitability index Required information The Foundational 15 (Algo) (LO12-1, LO12-2, LO12-3, L012-5, LO12-6) [The following information applles to the questions displayed below.) Cardinal Company is considering a five-year project that would require a $2,955,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 18%. The project would provide net opera income in each of five years as follows: $ 2,865,000 1,015,000 1,850,000 Sales Variable expenses Contribution margin Fixed expenses Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses Net operating income $ 750,000 591,000 1,341,000 $ 509,000 Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. Foundational 12-6 (Algo) 6. What is the project's Internal rate of return? Project's internal rate of return % Required information The Foundational 15 (Algo) (L012-1, LO12-2, LO12-3, L012-5, L012-6) The following information applies to the questions displayed below) Cardinal Company is considering a five-year project that would require a $2,955,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 18%. The project would provide net operating income in each of five years as follows: 5 2,865,000 1,025,000 1,850,000 Sales Variable expenses Contribution margin Fixed expenses Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses Net operating income $750,000 591,000 1,341,000 $ 509,000 Click here to view Exhibit 128-1 and Exhibit 128-2. to determine the appropriate discount factor(s) using table, Foundational 12-7 (Algo) 7. What is the project's payback period? (Round your answer to 2 decimal places.) Project's payback period years Required information The Foundational 15 (Algo) (LO12-1, L012-2, L012-3, L012-5, L012-6) [The following information applies to the questions displayed below.) Cardinal Company is considering a five-year project that would require a $2,955,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 18%. The project would provide net operating Income in each of five years as follows: $ 2,865,000 1,015,000 1,850,000 Sales Variable expenses Contribution margin Tixed expenses Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses Net operating income $ 750,000 591,000 1,341,000 $509,000 Click here to view Exhibit 128.1 and Exhibit 128-2. to determine the appropriate discount factor(s) using table, Foundational 12-8 (Algo) 8. What is the project's simple rate of return for each of the five years? (Round your answer to 2 decimal places.) Simplorato of return %