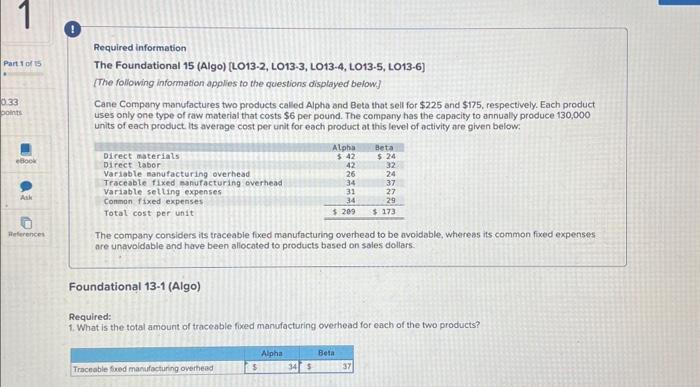

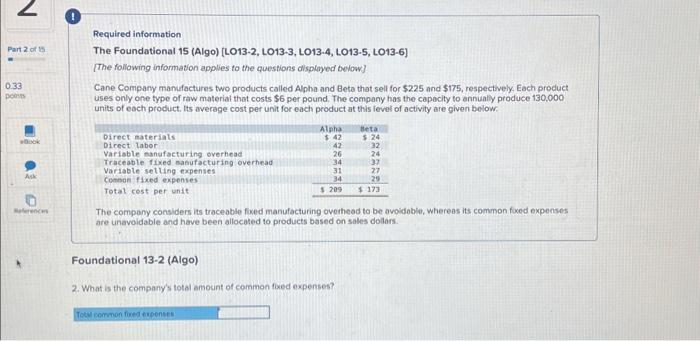

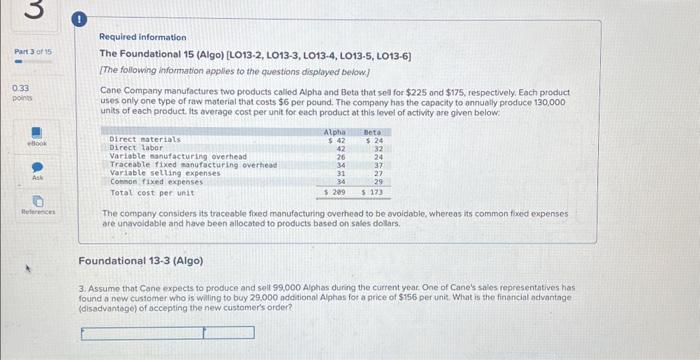

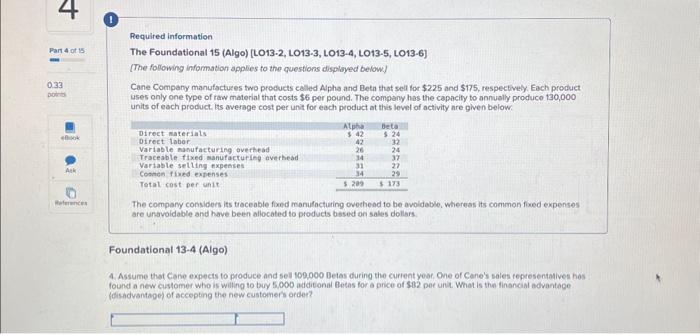

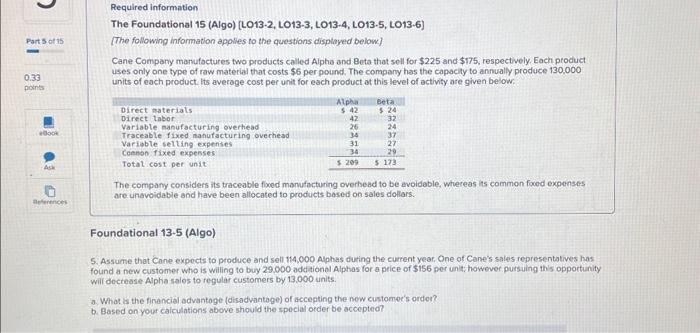

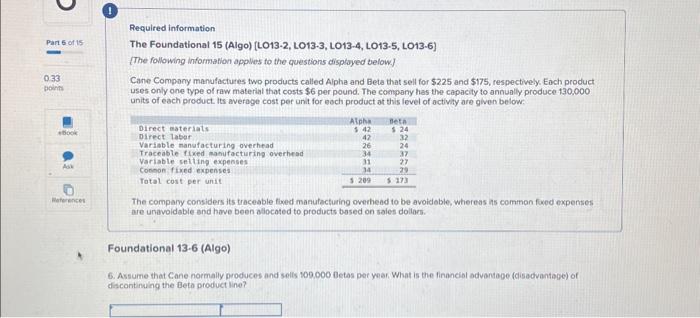

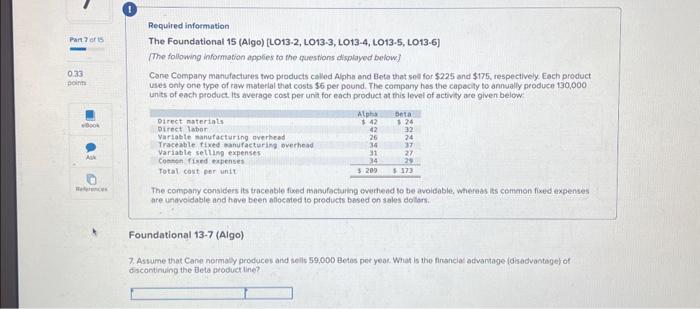

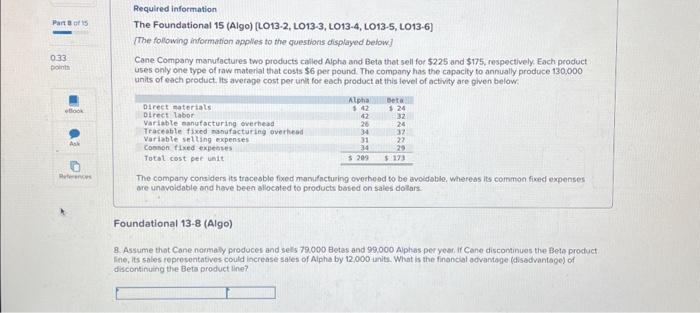

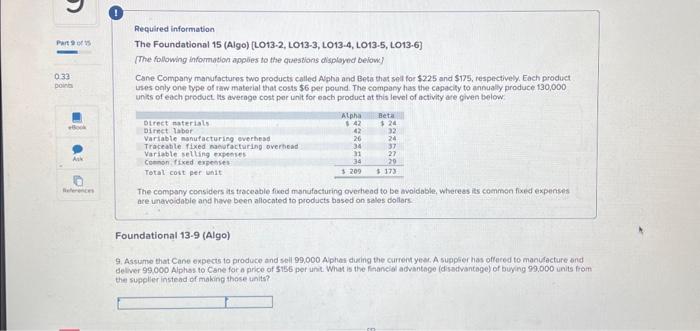

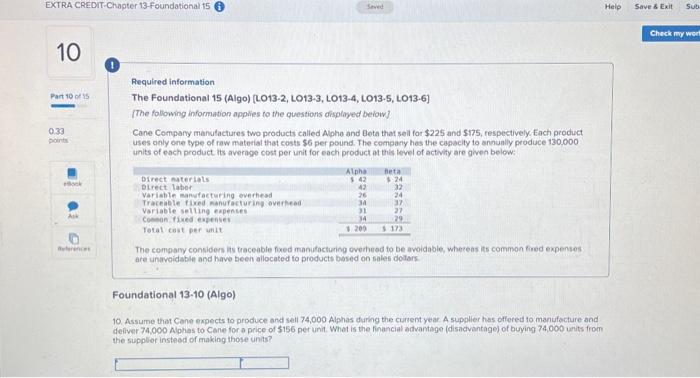

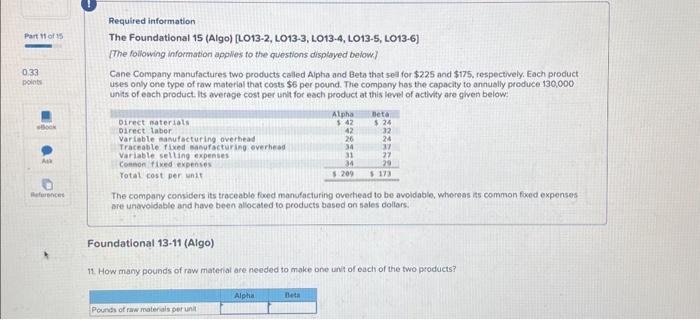

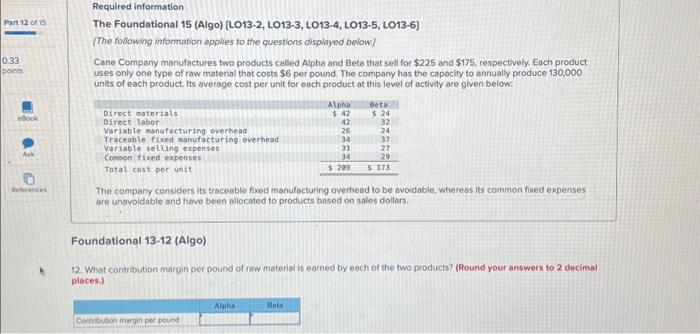

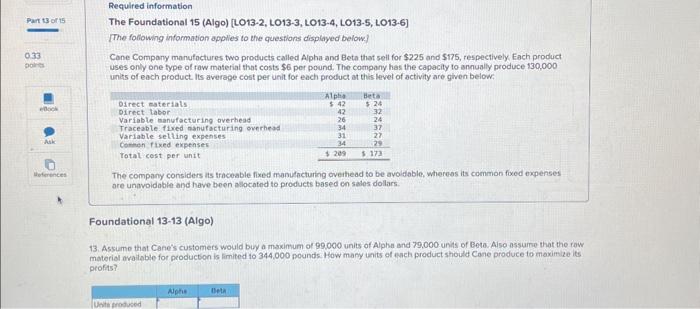

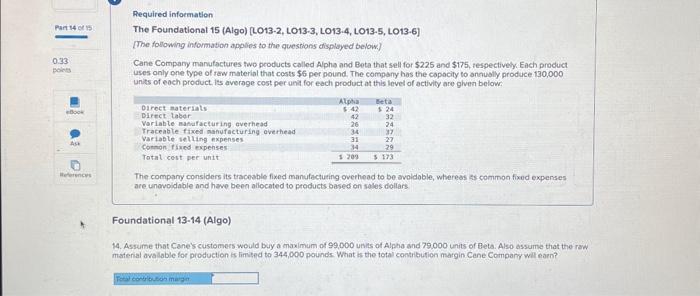

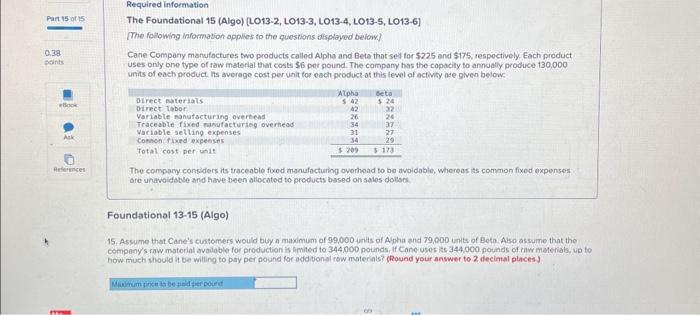

Required information The Foundational 15 (Algo) [LO13-2, LO13-3, LO13-4, LO13-5, L013-6] (The following information applies to the questions displayed below] Cane Company manufactures two products called Alpha and Beta that sell for $225 and $175, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annualiy produce 130,000 units of each product its averoge cost per unit for each product at this level of activity nre given below: The company considers its traceabie fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoldable and have been allocated to products based on sales dollars: Foundational 13-1 (Algo) Required: Required: 1. What is the total amount of traceable fixed manufacturing overhead for each of the two products? Required information The Foundational 15 (Algo) [LO13-2, LO13-3, LO13-4, LO13-5, LO13-6] [The following information applies to the questions disployed below] Cane Company manufactures two products called Alpha and Beta that sell for $225 and $175, respectively, Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 130,000 units of each product. Its average cost per unit for each product at this fevel of activity are given below. The company considers its traceable foced manufacturing overtheod to be avoidable, whereas its common foced expenses are unavoidable and have been allocated to products based on sales dolars. Foundational 13-2 (Algo) 2. What is the company's total amount of common fixed expenses? Required information The Foundational 15 (Algo) [LO13-2, LO13-3, LO13-4, LO13-5, LO13-6] The following infornation applies to the questions displayed below] Cone Company manufactures two products calied Alpha and Beta that sea for $225 and $175, respectively, Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annuelly produce 130,000 units of each product. its average cost per unit for each product at this level of activity are given below: The company considers its traceable foed manufacturing overhead to be ovoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dolars. Foundational 13-3 (Algo) 3. Assume thot Cane expects to produce and sell 99.000 Alphas during the current year. One of Cane's sales representatives has found a new customer who is willing to buy 29.000 additional Aphas for a price of $156 per unis. What is the financial advaritage (disadvantage) of accepting the new customer's order? Required information The Foundational 15 (Algo) [LO13-2, LO13-3, LO13-4, LO13-5, LO13-6] (The following information spplies fo the questions clisplisyed below.) Cane Compary manufactures two products celled Alphe and Betn that sell for $225 and $175, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacify to annually produce 130,000 units of each product. its average cost per unit for each product at this level of activity are given below. The company considers its traceable foed manufacturing ovethend to be avoldable, whereas its common fixed expenses are unavoidable and have been allocated to products bised on sales dollars. Foundational 13-4 (Algo) 4. Assume that Cane expects to produce and sel 109,000 Detes during the curient year. One of Cane's sales tepresentalives hes found a new cistomer who is wiling to buy 5,000 additional Aetas for a price of $82 pac unit. What is the financial advantage Leticadusntages of accepting the new customer arder? Required information The Foundational 15 (Algo) [LO13-2, LO13-3, LO13-4, LO13-5, LO13-6] [The following information applies to the questions displayed below] Cane Company manufactures two products called Alphe and Beta that sell for $225 and $175, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capocity to annually produce 130,000 units of each product. Its average cost per unit for each product ot this level of activity are given below: The company considers its traceable foxed manufacturing overhead to be avoidable, whereas its common foxod expenses are unevoidabie and have been allocated to products based on sales dollars. Foundational 13-5 (Algo) 5. Assume that Cane expocts to produce and sell 114,000 Alphas duting the current year. One of Cane's sales representatives has found a new customer who is wilting to buy 29,000 additional Alphas for a price of $156 per unit: however pursuing this opportunity will decteose Alpha sales to regular customers by 13.000 units. a. What is the financial advantoge (disadvantage) of accepting the new customor's orden? b. Based on your calculations above should the special order be accepted? Required information The Foundational 15 (Algo) [LO13-2, LO13-3, LO13-4, LO13-5, LO13-6) [The following information applies to the questions dispiayed below] Cane Compony manufactures two products called Alpha and Beta that sell for \$225 and \$175, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 130,000 units of each product. its average cost per unit for each product at this fevel of activily are given below: The company considers its traceable flved manufacturing overhead to be avoidable, whereas is common fxod expenses are unavoidable and have been aliocated to products based on sales dollars. Foundational 13-6 (Algo) 6. Assume that Cane normally produces and sells 100.000 eetas per yar What is the financiol advantape (disadvantape) of discontinuing the Bete product line? Required information The Foundationat 15 (Algo) [LO13-2, LO13-3, LO13-4, LO13-5, LO13-6] (The following information applies to the cuestions displayod below] Cane Company manufactures two products called Alpho end Beta that sod for $22$ and $175, respectively. Each product uses only one type of raw materlal that costs $6 per pound. The company has the capacity to annually produce 130,000 units of each product its average cest per unit for ench product at this tevel of activity are given below. The company considers its traceable foxed manufactuing everhend to be avoidable, whereas iss common fixed expenses are unawoidable and have been abocated to products bised on sales dolors: Foundational 13-7 (Algo) 7. Assume that Cane namaly produces and sells 59,000 Betas per year. What is the financias advantage (disadvantagef of discontinuing the Bete product line? Required information The Foundational 15 (Algo) [LO13-2, LO13-3, LO13-4, LO13-5, LO13-6] [The following information applies to the guestions displayed below] Cane Compary marufactures two products called Alpha and Beta that sell for $225 and $175, respectively. Each prodict uses only one type of raw material that costs $6 per pound. The company has the copacity to annually produce 130,000 units of esch product. Its avetape cost per unit for each product at this level of activity are given below: The company considers its tracesble fixed manufacturing overbeod to be avoidable, whereas its common fixed expenses ore unavoldable and have been allocated to products bosicd on sales dolars. Foundational 13-8 (Algo) 8. Assume that Cone normaly prodoces and sels 79.000 Betas and 99,000 Aphes per year, ir Cane discontinues the Beto proctuct Ine, its sales reprosentatives could increase sales of Alpha by 12,000 units. What is the finencial odvantege (disedvantage) of discontinuing the Bets product line? Required information The Foundational 15 (Algo) [LO13-2, LO13-3, LO13-4, LO13-5, LO13-6) (The following information applies to the civestions disploynd belows] Cane Compary manufactures two products called Apha and Beta that sell for $225 and $175, respectively. Each product uses only one type of riw material that costs $6 per pound. The company has the cepacity to annualy produce 130,000 units of each prodvct. its average cost par unit for each product at this level of activity are oiven below: The company considers its traceable fixed manufacturing overhead to be avidable, whereas its commen fixed expenses are unavoidable and have been allocated to products based on sales dollers: Foundational 13-9 (Algo) 9. Assume that Cane expects 10 produce and sell 99,000 Aphes duing the current yew. A suppleer has offered to manufecture and detwer 99.000 Alphss to Cane for o price of $156 per unit. What is the financid advantage (dsadvantage) of buying 99,000 units from the supplier instead of making those units? Required information The Foundational 15 (Algo) [LO13-2, LO13-3, LO13-4, LO13-5, LO13-6] The following information applies to the questions displayed beiow] Cone Compary manutactures two products called Aloho and Beta that seil for $225 and $175, respectively Each product uses anly one type of raw material that costs $6 per pound. The company has the capacity to annunliy produce 130,000 units of each product its averape cost per unit for each product at this tevel of activity are given below: The compary considens its traceable fixed manufacturing overtered to be avoidable, whereas its common fined expenses are unavoidsbit and have been aliocated to products based on sales dodars: Foundational 13-10 (Algo) 10. Assume that Cane expects to produce and sell 74,000 Alphas during the current year. A supplier has offered to manufecture and deliver 74,000 Alohes to Cane for o price of $156 per unit. What is the financial advantage (disadvantage) of buying 74,000 units from the supplior instead of making those units? Required information The Foundational 15 (Algo) [LO13-2, LO13-3, LO13-4, LO13-5, LO13-6] The following information applies to the questions displayed below] Cane Company manufactures two products called Alpha and Beta that sea for $225 and $175, respectively, Each product uses only one type of raw material that costs $6 per pound. The compeny has the capacity to annuelly produce 130,000 units of each product. its average cost per unit for each product at this level of activity are given below: The company comiders its traceable faed manufactufing ovechead to be avoidable, whereas its common foxed expenses are unovolidable and have been allocated to products based on sales doltars. Foundational 13-11 (Algo) 11. How many pounds of raw material are needed to make one unit of each of the two products? Required information The Foundational 15 (Algo) [LO13-2, LO13-3, LO13-4, LO13-5, LO13-6] [The following information applies to the questions displayed below] Cane Company manufactures two products calied Alpha and Beta that sell for $225 and \$175, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 130,000 units of each product its average cost per unit for each product at this level of activity are given below: The company considers its traceable fixed manufocturing overhead to be ovoidable, whereas its common fixed expenses are unevoidoble and hove been aliocnted to products bosed on soles dollars. Foundational 13-12 (Algo) 12. What contribution margin per pound of raw meterial is earned by each of the two products? (Round your answers to 2 decimal places.) Required information The Foundational 15 (Algo) [LO13-2, LO13-3, LO13-4, LO13-5, LO13-6] The following information opplles to the questions displayed below] Cane Company manufactures two products called Alpha and Beta that sell for $225 and $175, respectively. Each product uses only one type of raw materiat that costs $6 per pound. The company has the capacity to annually produce 130,000 units of each product. Its average cost per unit for each product at this level of activity are given below. The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based cn salos dolars. Foundational 13-13 (Algo) 13. Assume that Cane's customers would buy a maximum of 99,000 units of Alpha and 79,000 units of Beta. Also assurne that the row materiel available for production is limited 10344,000 pounds. How many units of ench product should Cone produce to maximize its profits? Required information The Foundational 15 (Algo) [LO13-2, LO13-3, LO13-4, LO13-5, LO13-6] The following information applies to the questions displayed below] Cane Company manufactures two products called Alpha and Beta that sell for $225 and $175, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the copacity to annusly produce 130,000 units of eoch product. is average cost per unit for each product at this ievel of activity are given below: The company considers its tracoable fixed manufacturing overhead to be avoldable, whereas is common fixed expenses are unowoidable and hawe been aliocated to products based on soles dollars. Foundational 13-14 (Algo) 14. Assume that Cane's customers would buy a maximum of 99,000 units of Alpha and 79,000 units of Bets. Also assume that the raw material ovaloble for production is limited to 344,000 pounds. What is the total contribution margin Cene Compary wilt earn? Required information The Foundational 15 (Algo) [LO13-2, LO13-3, LO13-4, LO13-5, LO13-6] [The following information applies to the questions displayed belonk] Cane Company manufactures two products called Alpha and Beta that sel for $225 and $175, respoctively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annualiy produce 130,000 units of each product. its average cost per unit for each product at this lewel of activity ase given below: The compary considers its traceable fixed manufacturing ovorhead to be avoidable, whereas its common fixed expenses are unawoidoble and have been allocatod to products based on sales dolser. Foundational 13-15 (Algo) 15. Assume that Cane's cuntomers would biy a maximum of 99,000 units of Alpha and 79,000 units of Beta. Also assume that the compenys raw material available for production is limited to 344,000 pounds, If Cone user its 344,000 pounds of raw meterials, up to how much should it be willing to payy per pound for additional row nuterials? (Round your answer to 2 decimal places)