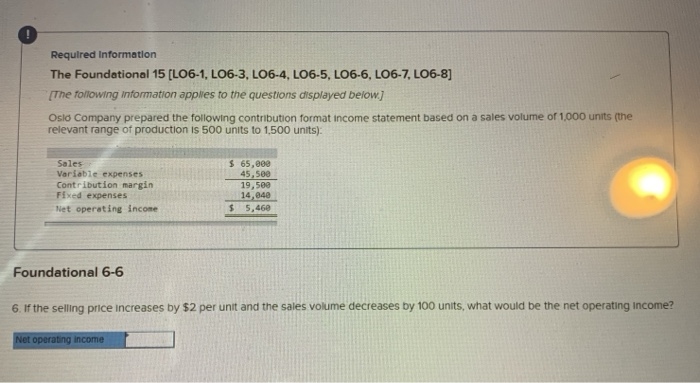

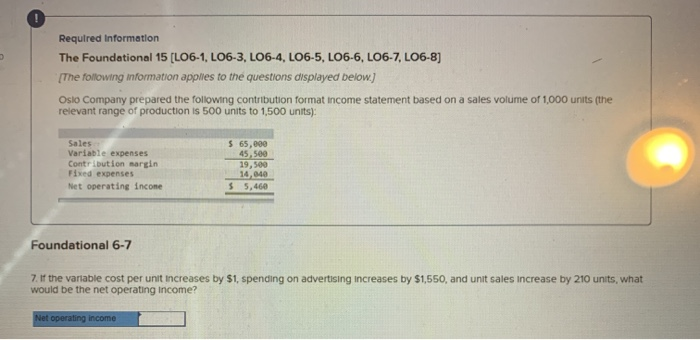

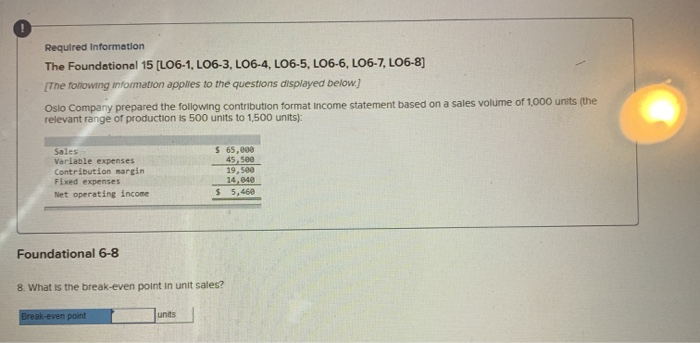

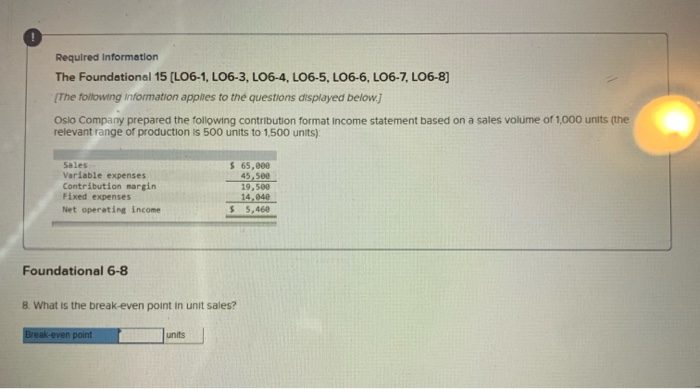

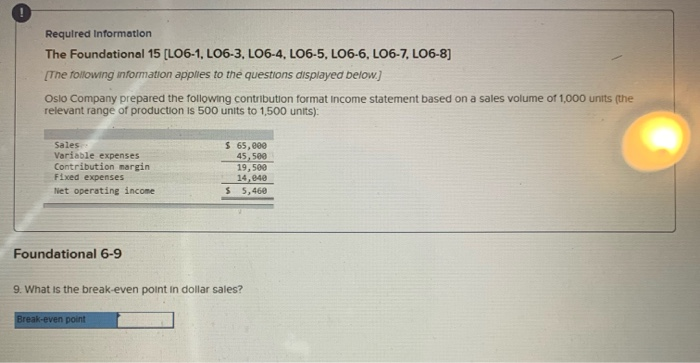

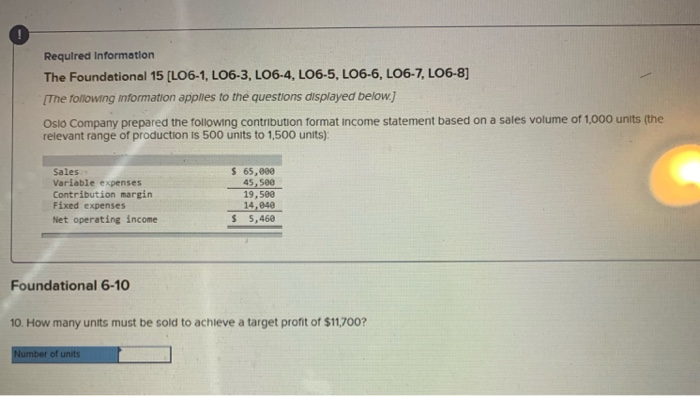

Required Information The Foundational 15 (L06-1, L06-3, L06-4, LO6-5, L06-6, L06-7, LO6-8] The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1.500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 65,000 45,500 19.500 14,040 $ 5.460 Foundational 6-6 6. If the selling price increases by $2 per unit and the sales volume decreases by 100 units, what would be the net operating Income? Net operating income Required Information The Foundational 15 (LO6-1, L06-3, L06-4, L06-5, LO6-6, LO6-7, LO6-8) The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 65,000 45.500 19,500 14,040 $ 5,460 Foundational 6-7 7. If the variable cost per unit increases by $1, spending on advertising increases by $1,550, and unit sales increase by 210 units, what would be the net operating Income? Net operating income Required Information The Foundational 15 (LO6-1, LO6-3, L06-4, LO6-5, L06-6, LO6-7, LO6-8) The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format Income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1.500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $65.000 45,500 19.509 14,040 $ 5,460 Foundational 6-8 8. What is the break-even point in unit sales? Break even point units Required Information The Foundational 15 (LO6-1, LO6-3, LO6-4, LO6-5, LO6-6, LO6-7, LO6-8) The following information applies to the questions displayed below] Oslo Company prepared the following contribution format Income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units) Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 65,000 45.500 19,500 14.040 $ 5.460 Foundational 6-8 8. What is the break-even point in unit sales? Break-even point units Required Information The Foundational 15 (L06-1, LO6-3, LO6-4, LO6-5, L06-6, LO6-7, LO6-8) [The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format Income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 65, eee 45,500 19,500 14,840 $ 5.468 Foundational 6-9 9. What is the break-even point in dollar sales? Break-even point Required Information The Foundational 15 (L06-1, LO6-3, LO6-4, LO6-5, LO6.6, LO6-7, LO6-8) [The following information applies to the questions displayed below.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 65,000 45,500 19,500 14,040 $ 5,460 Foundational 6-10 10. How many units must be sold to achieve a target profit of $11,700? Number of units