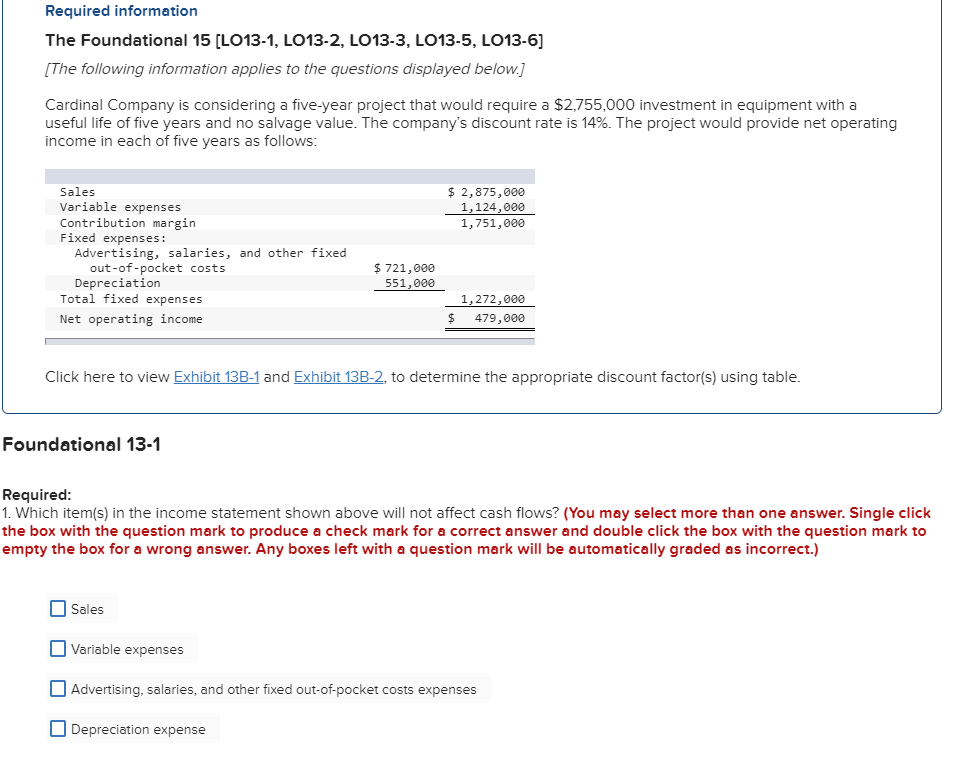

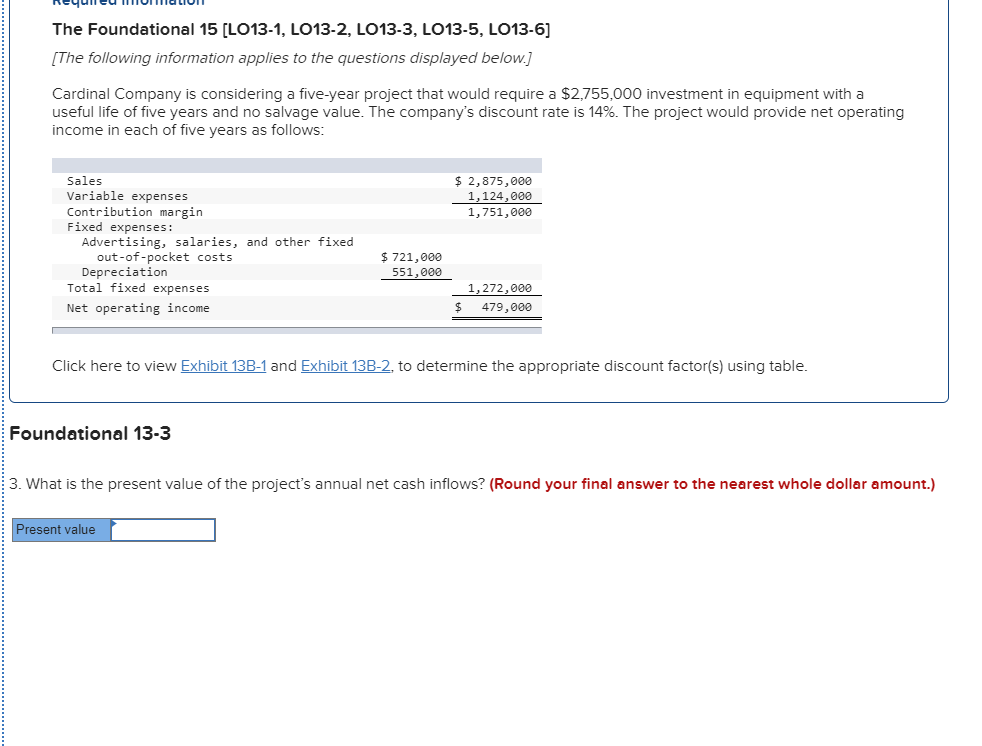

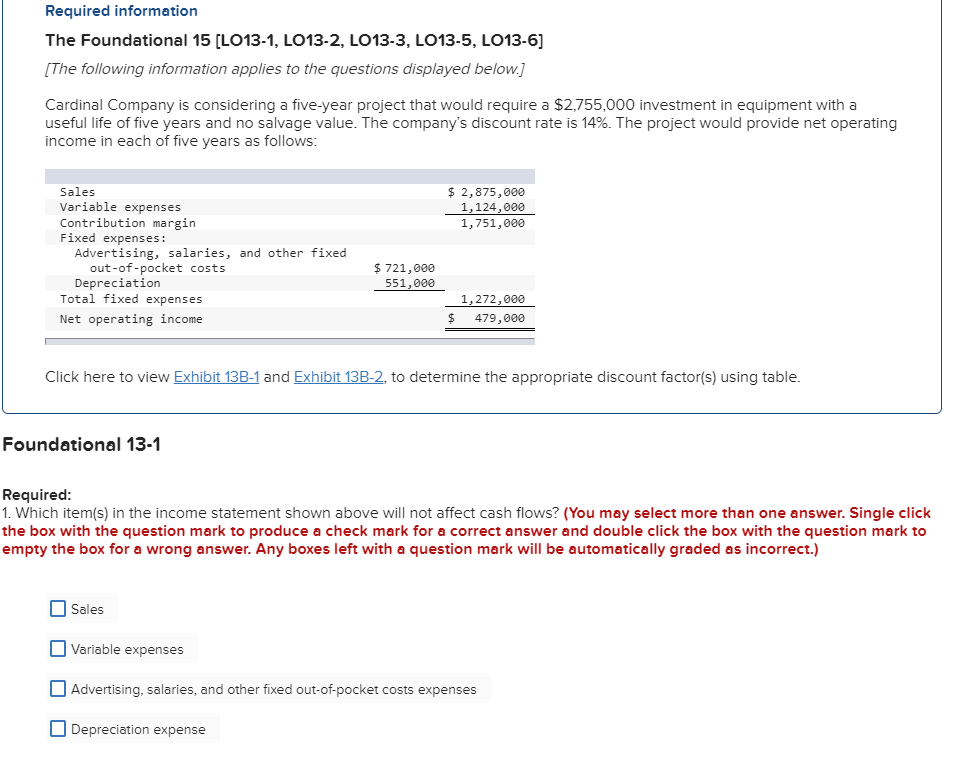

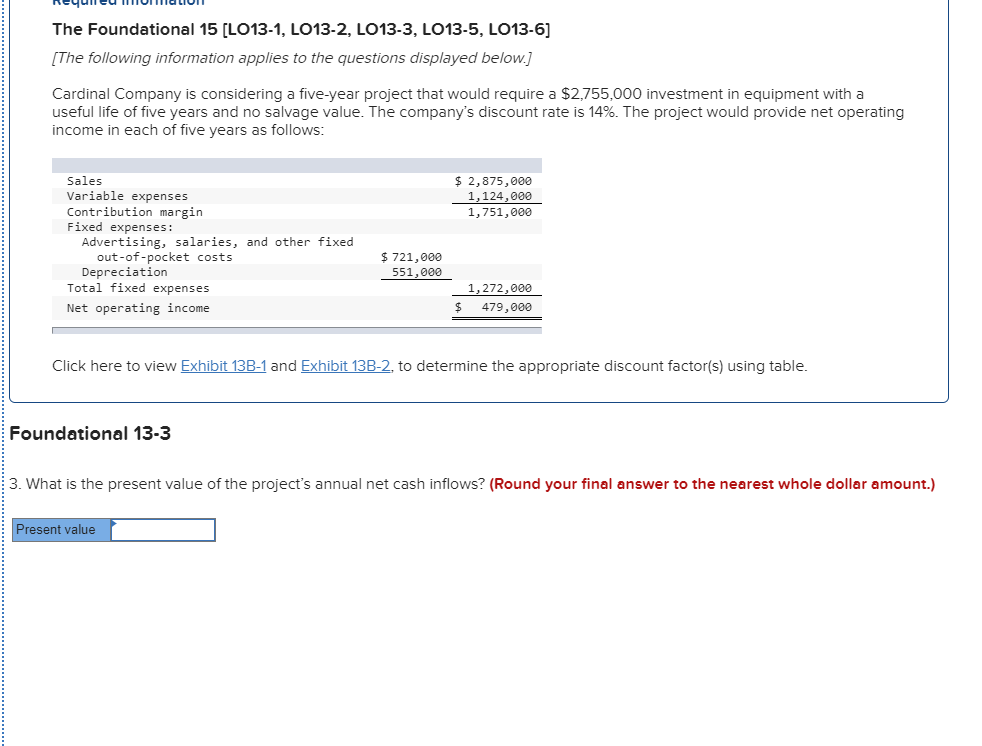

Required information The Foundational 15 [LO13-1, LO13-2, LO13-3, LO13-5, LO13-6] [The following information applies to the questions displayed below.] Cardinal Company is considering a five-year project that would require a $2,755,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: $ 2,875,000 Sales Variable expenses Contribution margin 1,124,000 1,751,000 Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses $721,000 551,000 1,272,000 Net operating income 479,000 Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using table. Foundational 13-1 Required: 1. Which item(s) in the income statement shown above will not affect cash flows? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Sales Variable expenses Advertising, salaries, and other fixed out-of-pocket costs expenses Depreciation expense The Foundational 15 [LO13-1, LO13-2, LO13-3, LO13-5, LO13-6] [The following information applies to the questions displayed below.] Cardinal Company is considering a five-year project that would require a $2,755,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: 2,875,000 1,124,000 1,751,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed O Ket costs Der 721,000 551.000 Total fixed expenses 1,272,000 Net operating income 479,000 Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using table. Foundational 13-3 3. What is the present value of the project's annual net cash inflows? (Round your final answer to the nearest whole dollar amount.) Present value