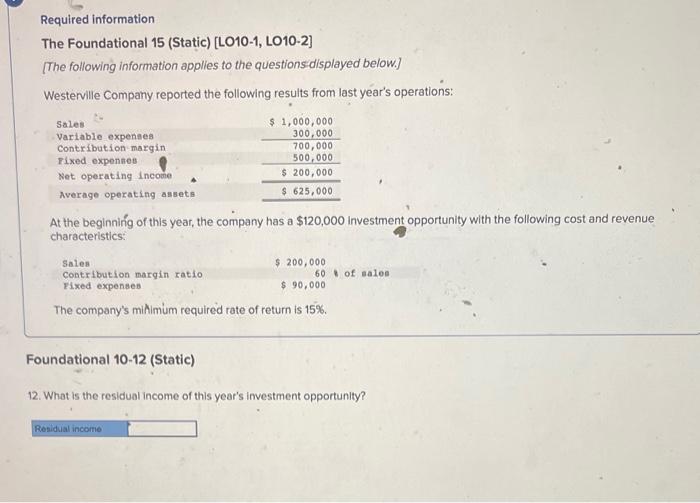

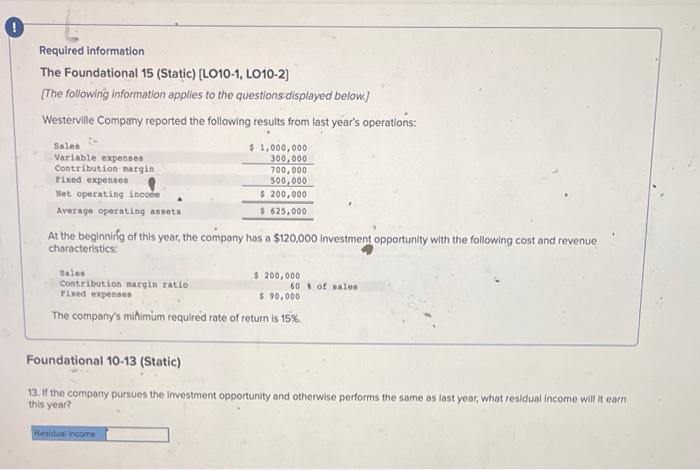

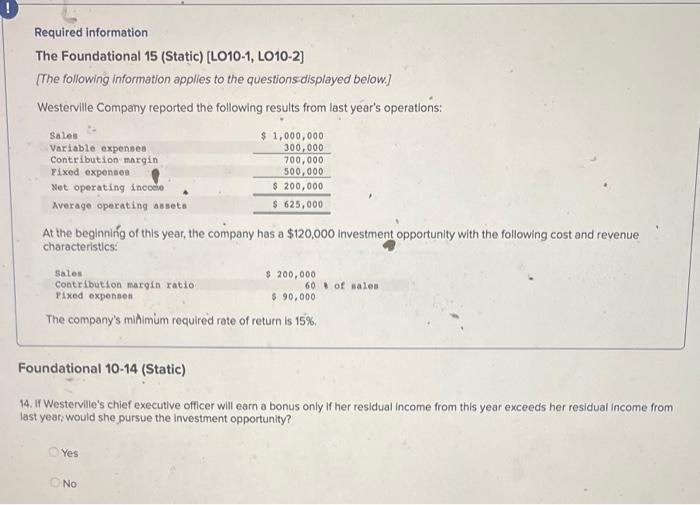

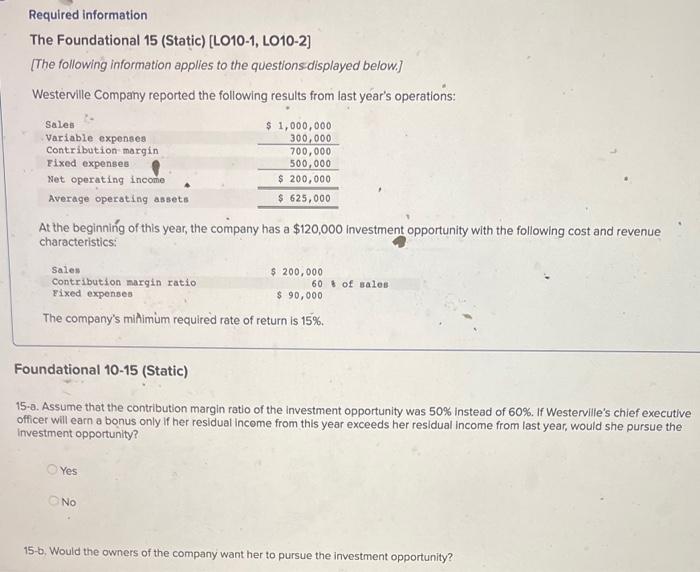

Required information The Foundational 15 (Static) [LO10-1, LO10-2] [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: At the beginning of this year, the company has a $120,000 investment opportunity with the following cost and revenue characteristics: The company's minimum required rate of return is 15%. Foundational 10-12 (Static) 12. What is the residual income of this year's investment opportunity? Required information The Foundational 15 (Static) [LO10-1, LO10-2] [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: At the beginning of this year, the company has a $120,000 investment opportunity with the following cost and revenue characteristics: The company's mitimm required rate of return is 15%. Coundational 10-13 (Static) 3. If the company pursues the investment opportunity and otherwise performs the same as last year, what residual income will it earn this year? Required information The Foundational 15 (Static) [LO10-1, LO10-2] [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: At the beginning of this year, the company has a $120,000 investment opportunity with the following cost and revenue characteristics: The company's minimum required rate of return is 15%. Foundational 10-14 (Static) 14. If Westerville's chief executive officer will earn a bonus only if her residual income from this year exceeds her residual income from last year; would she pursue the investment opportunity? Yes Required information The Foundational 15 (Static) [LO10-1, LO10-2] [The following information applies to the questionsedisplayed below.] Westerville Company reported the following results from last year's operations: At the beginning of this year, the company has a $120,000 investment opportunity with the following cost and revenue characteristics: The company's mithimum required rate of return is 15%. Foundational 10-15 (Static) 15-a. Assume that the contribution margin ratio of the investment opportunity was 50% instead of 60%. If Westerville's chief executive officer will earn a bonus only if her residual income from this year exceeds her residual income from last year, would she pursue the Investment opportunity? Yes No 15-b. Would the owners of the company want her to pursue the investment opportunity