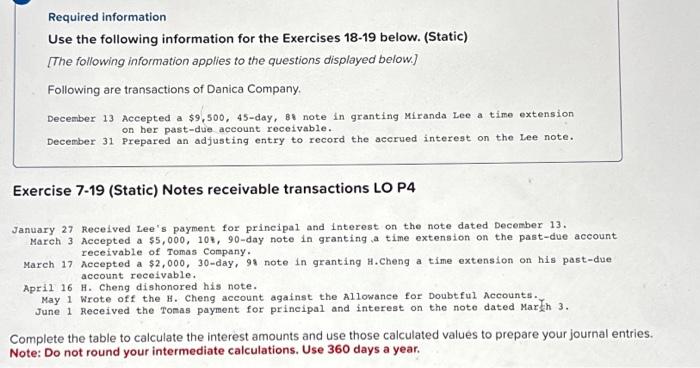

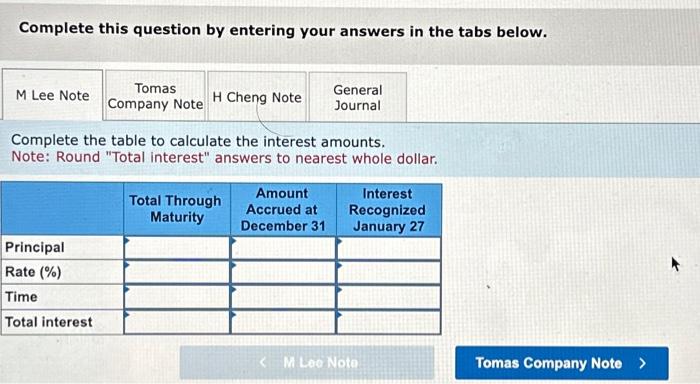

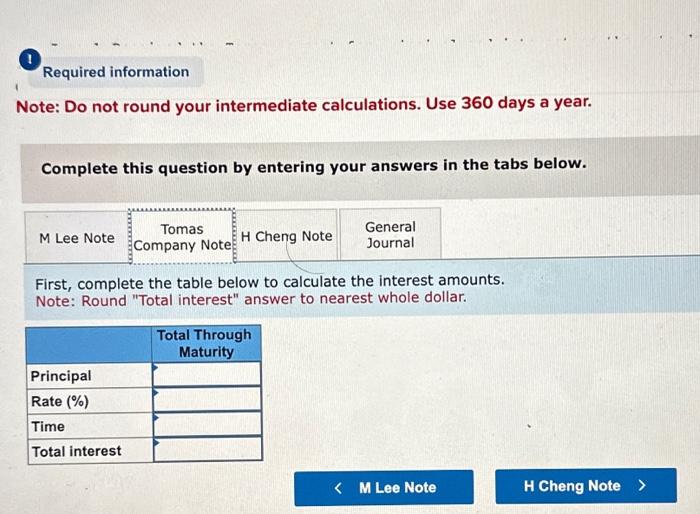

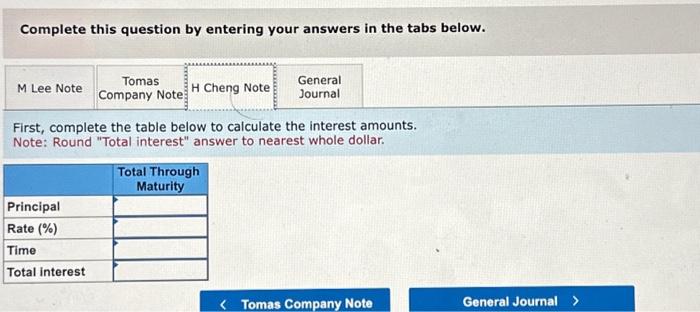

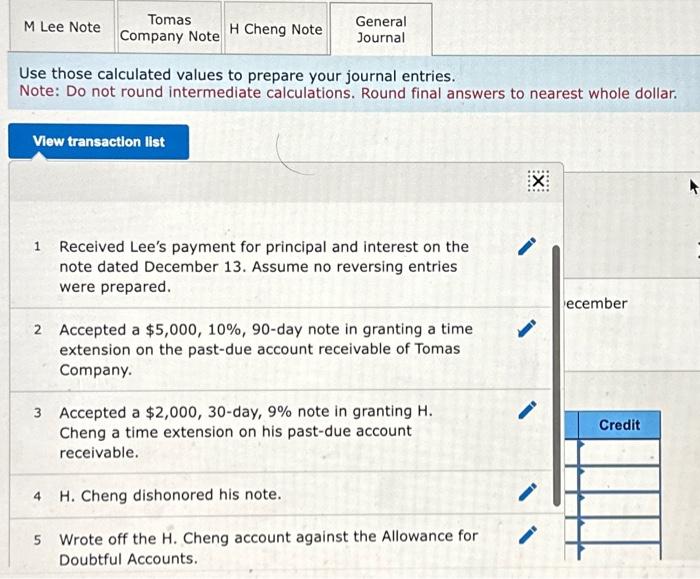

Required information Use the following information for the Exercises 1819 below. (Static) [The following information applies to the questions displayed below.] Following are transactions of Danica Company. December 13 Accepted a $9,500,45-day, 88 note in granting Miranda Lee a time extension on her past-due account receivable. December 31 Prepared an adjusting entry to record the accrued interest on the lee note. Exercise 7-19 (Static) Notes receivable transactions LO P4 January 27 Received Lee's payment for principal and interest on the note dated December 13. March 3 Accepted a $5,000,10%,90-day note in granting a time extension on the past-due account receivable of Tomas Company. March 17 hecepted a $2,000,30-day, 98 note in granting H. Cheng a time extension on his past-due account receivable. April 16 H. Cheng dishonored his note. May 1 Wrote of the H. Cheng account against the Allowance for Doubtful Accounts. June 1 Received the Tonas payment for prineipal and interest on the note dated Marjh 3 , Complete the table to calculate the interest amounts and use those calculated values to prepare your journal entries. Note: Do not round your intermediate calculations. Use 360 days a year. Complete this question by entering your answers in the tabs below. Complete the table to calculate the interest amounts. Note: Round "Total interest" answers to nearest whole dollar. Note: Do not round your intermediate calculations. Use 360 days a year. Complete this question by entering your answers in the tabs below. First, complete the table below to calculate the interest amounts. Note: Round "Total interest" answer to nearest whole dollar. Complete this question by entering your answers in the tabs below. First, complete the table below to calculate the interest amounts. Note: Round "Total interest" answer to nearest whole dollar. Use those calculated values to prepare your journal entries. Note: Do not round intermediate calculations. Round final answers to nearest whole dollar. 1 Received Lee's payment for principal and interest on the note dated December 13. Assume no reversing entries were prepared. 2 Accepted a $5,000,10%,90-day note in granting a time extension on the past-due account receivable of Tomas Company. 3 Accepted a $2,000, 30-day, 9% note in granting H. Cheng a time extension on his past-due account receivable. 4 H. Cheng dishonored his note. 5 Wrote off the H. Cheng account against the Allowance for Doubtful Accounts