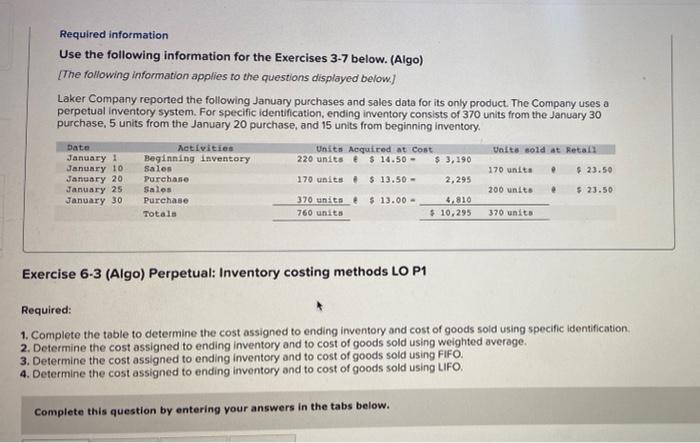

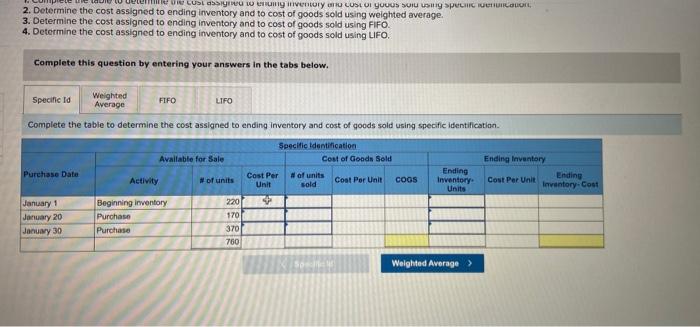

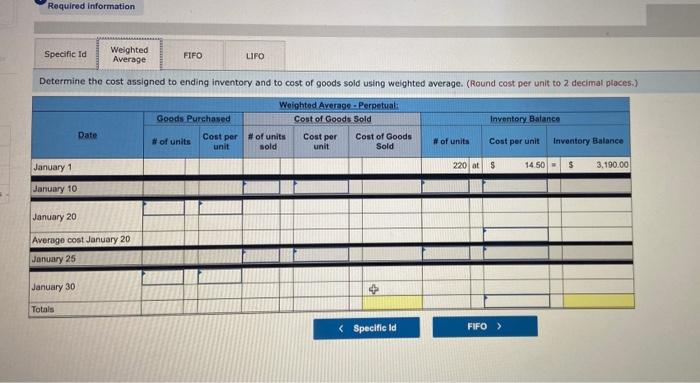

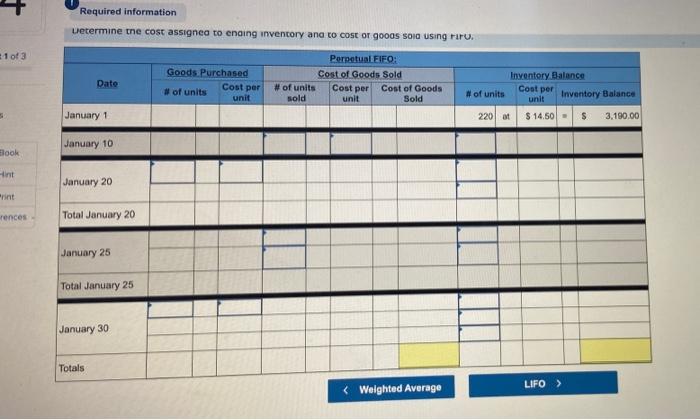

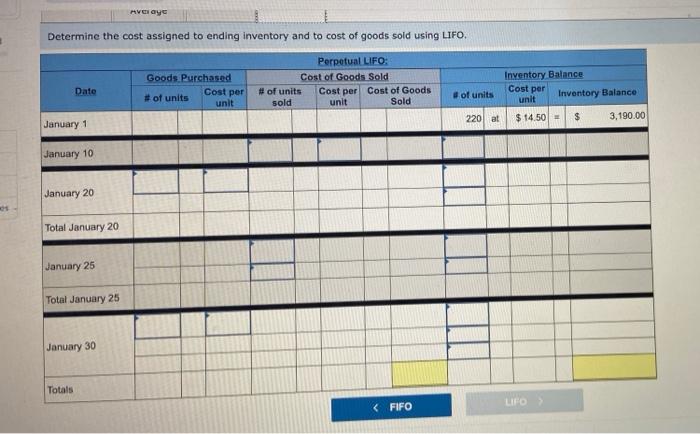

Required information Use the following information for the Exercises 3-7 below. (Algo) [The following information applies to the questions displayed below.) Laker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 370 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory Date Activities Units Aequired at Cost Voits sold at Retal January 1 Beginning inventory 220 units $ 14.50 - $ 3,190 January 10 Sales 170 units $23.50 January 20 Purchase 170 units . $13.50 - 2,295 January 25 Sales 200 units $23.50 January 30 Purchase 370 units $13.00 - 4.810 Totala 760 units $ 10,295 370 units Exercise 6-3 (Algo) Perpetual: Inventory costing methods LO P1 Required: 1. Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification 2. Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. 3. Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. 4. Determine the cost assigned to ending inventory and to cost of goods sold using LIFO. Complete this question by entering your answers in the tabs below. CUSSI og inventory U LOSE YOUS SOUH PULCO, 2. Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. 3. Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. 4. Determine the cost assigned to ending inventory and to cost of goods sold using LIFO. Complete this question by entering your answers in the tabs below. Specific Id Weighted Average FIFO LIFO Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification Specific Identification Cost of Goods Sold Available for Sale Ending Inventory Purchase Date Activity #of units Cost Per Unit # of units sold Cost Per Unit COOS Ending Inventory Units Ending Cost Per Unit Inventory.com 4 January 1 January 20 January 30 Beginning inventory Purchase Purchase 220 170 370 760 SEN Weighted Average > Required information Specific Id Weighted Average FIFO LIFO Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. (Round cost per unit to 2 decimal places.) Weighted Average - Perpetual: Goods Purchased Cost of Goods Sold Cost per #of units Cost per # of units Cost of Goods unit sold unit Sold Inventory Balance Date # of units Cost per unit Inventory Balance January 1 220 at 5 $ 14.50 3.190.00 January 10 January 20 Average cost January 20 January 25 January 30 Totals 1 of 3 Required information Uetermine the cost assigned to enaing inventory and to cost or goods sold using Firu. Perpetual FIFO: Goods.Purchased Cost of Goods Sold Inventory Balance Dato # of units Cost per #of units Cost per Cost of Goods Cost per unit sold unit # of units Sold unit Inventory Balance January 1 220 at $14.50 - $ 3.190.00 January 10 Book int January 20 rences Total January 20 January 25 Total January 25 January 30 Totals LIFO >