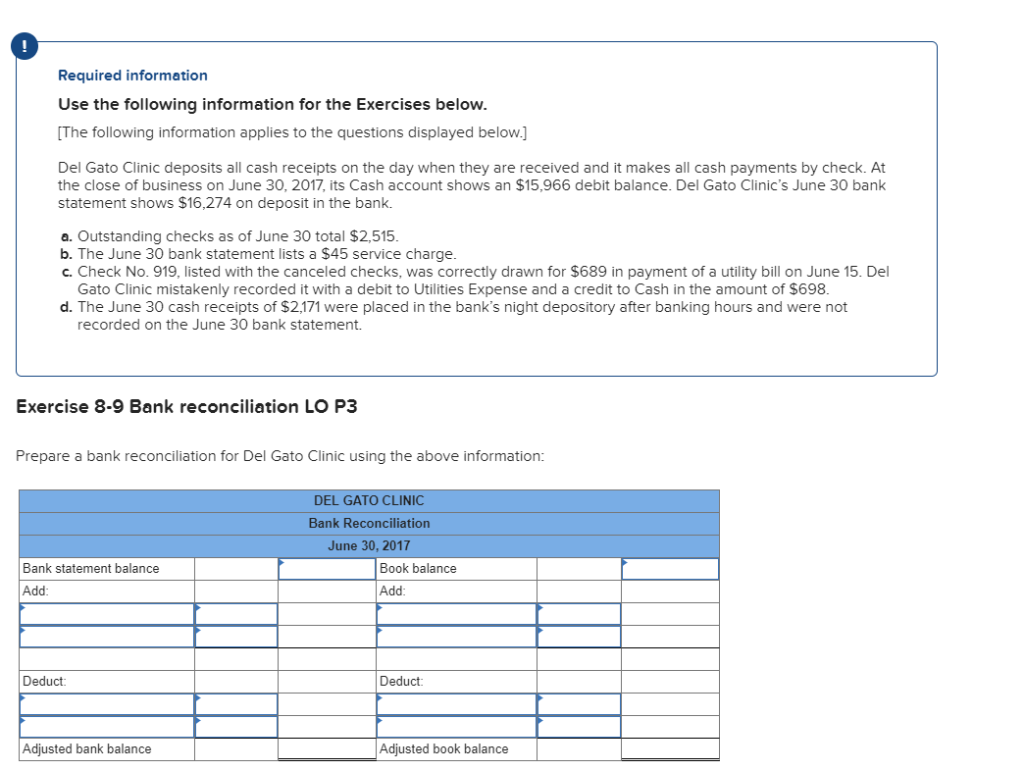

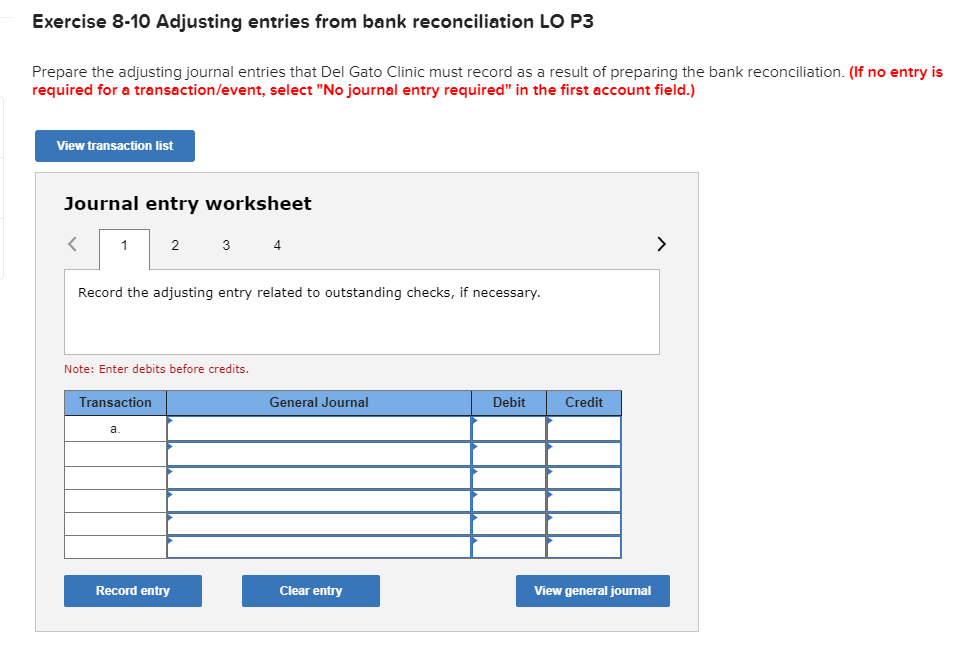

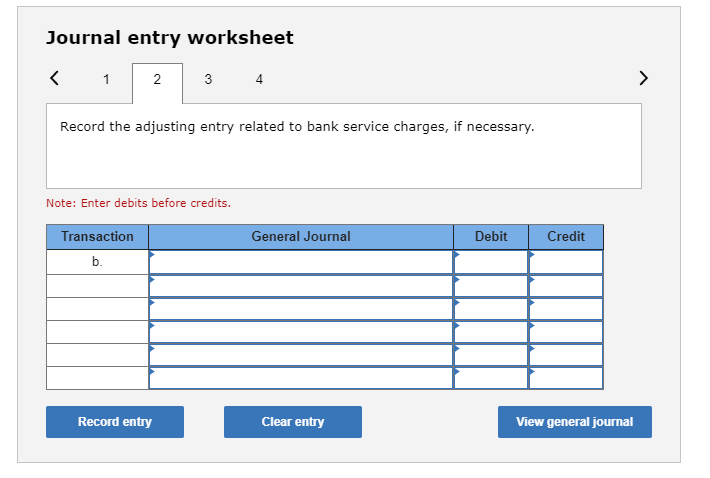

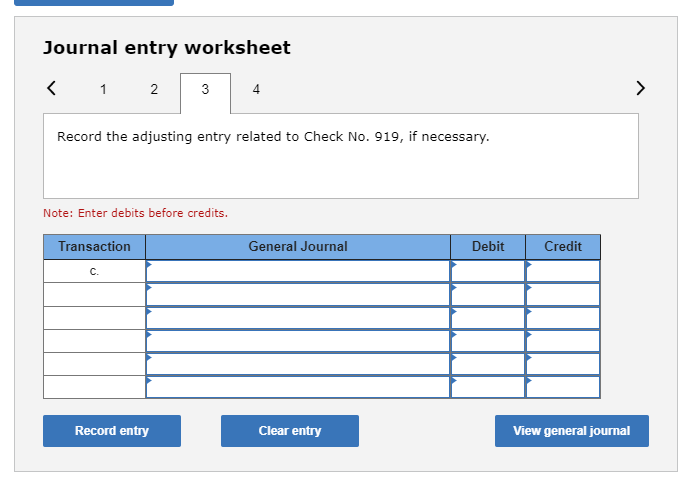

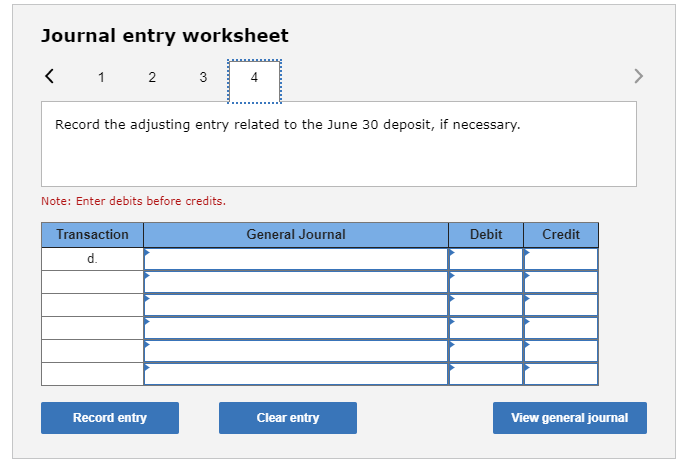

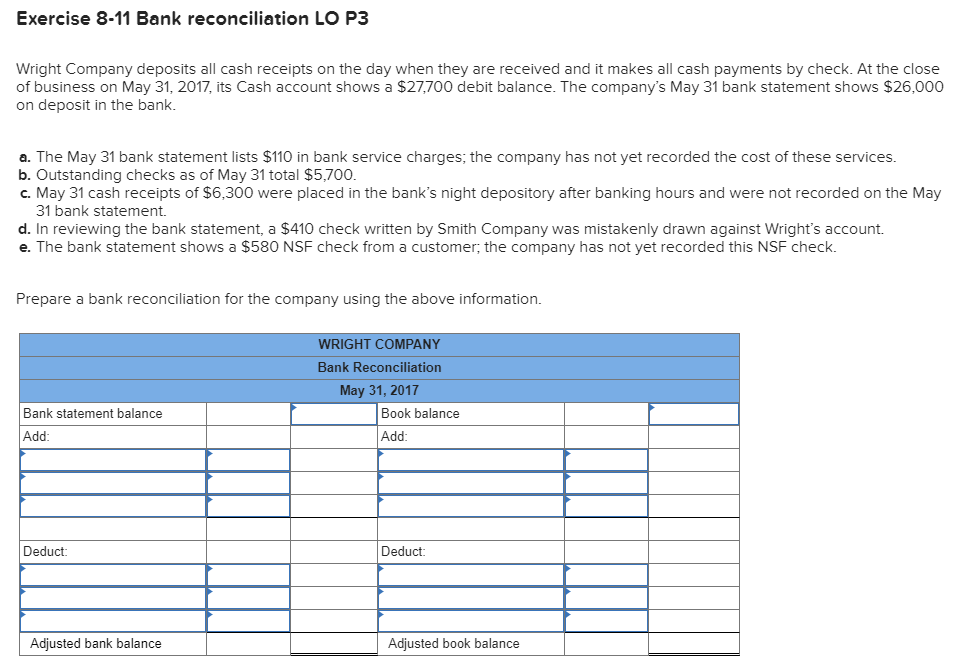

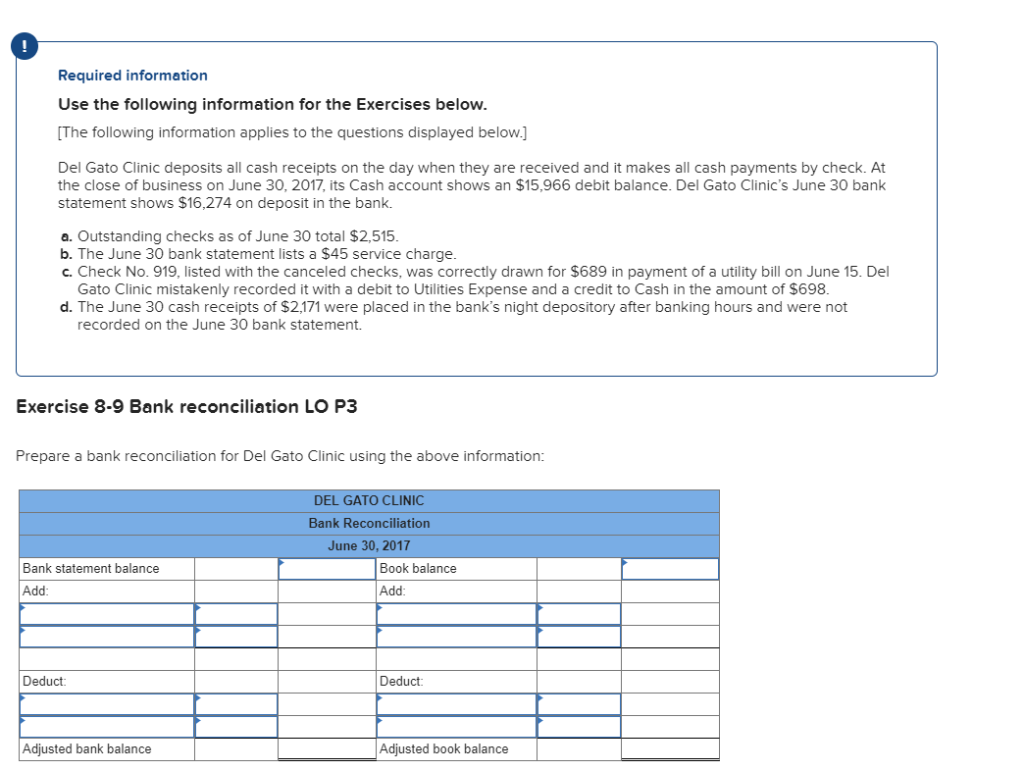

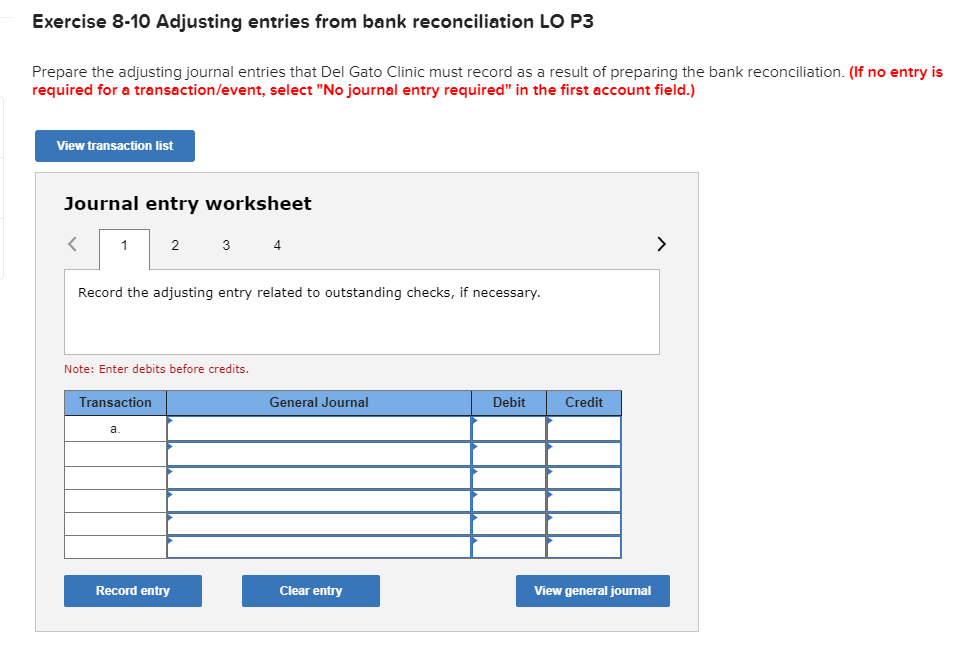

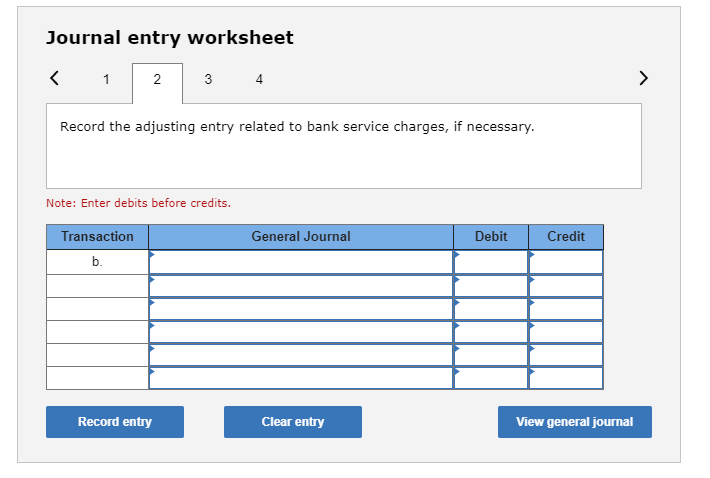

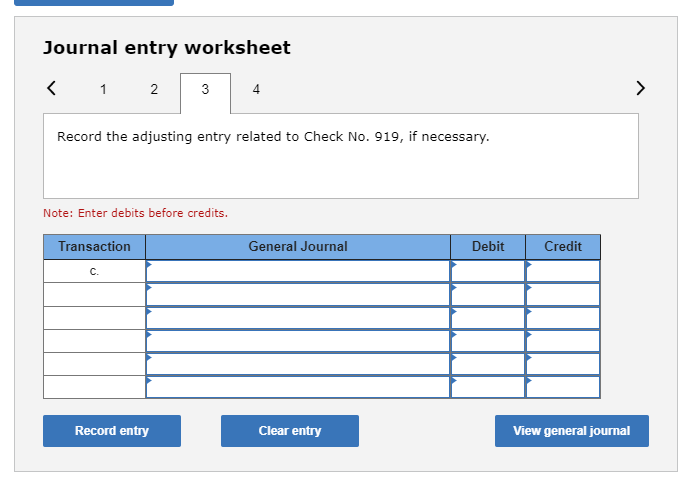

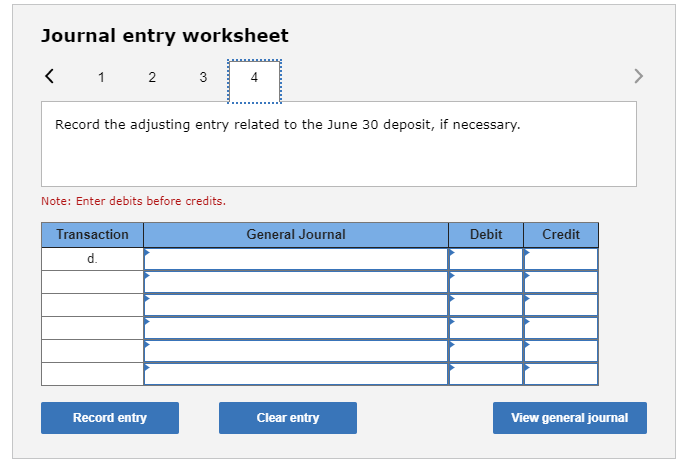

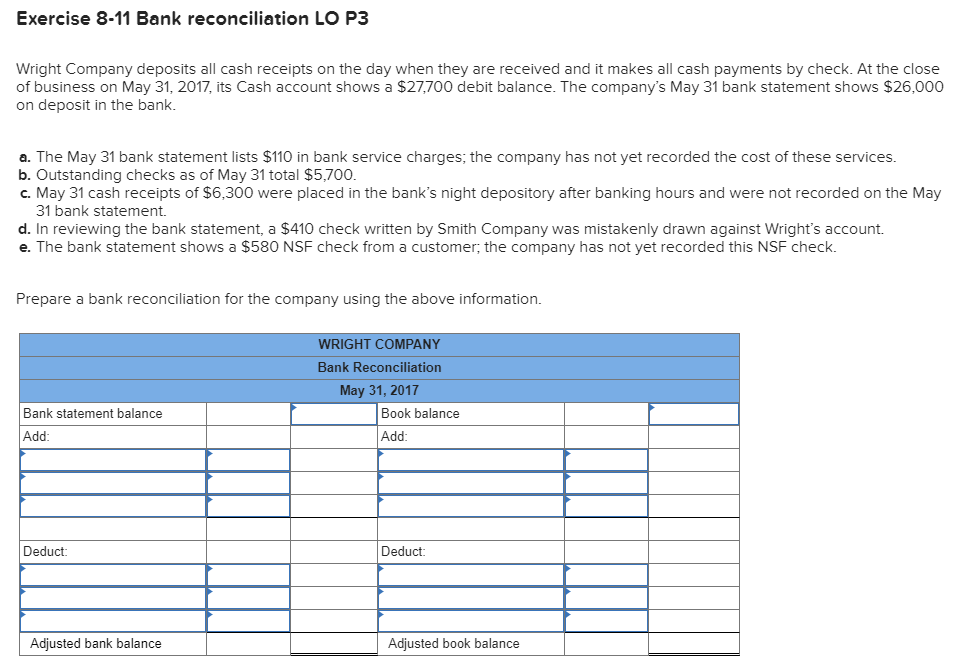

Required information Use the following information for the Exercises below The following information applies to the questions displayed below.] Del Gato Clinic deposits all cash receipts on the day when they are received and it makes all cash payments by check. At the close of business on June 30, 2017, its Cash account shows an $15,966 debit balance. Del Gato Clinic's June 30 bank statement shows $16,274 on deposit in the bank. a. Outstanding checks as of June 30 total $2,515 b. The June 30 bank statement lists a $45 service charge c. Check No. 919, listed with the canceled checks, was correctly drawn for $689 in payment of a utility bill on June 15. Del Gato Clinic mistakenly recorded it with a debit to Utilities Expense and a credit to Cash in the amount of $698 d. The June 30 cash receipts of $2,171 were placed in the bank's night depository after banking hours and were not recorded on the June 30 bank statement. Exercise 8-9 Bank reconciliation LO P3 Prepare a bank reconciliation for Del Gato Clinic using the above information: DEL GATO CLINIC Bank Reconciliation June 30, 2017 Bank statement balance Book balance Add Add Deduct Deduct Adjusted bank balance Adjusted book balance Exercise 8-10 Adjusting entries from bank reconciliation LO P3 Prepare the adjusting journal entries that Del Gato Clinic must record as a result of preparing the bank reconciliation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 4 Record the adjusting entry related to outstanding checks, if necessary. Note: Enter debits before credits. Debit Transaction General Journal Credit a. Record entry Clear entry View general journal Journal entry worksheet 3 4 Record the adjusting entry related to bank service charges, if necessary. Note: Enter debits before credits. Debit Credit Transaction General Journal b. Clear entry Record entry View general journal Journal entry worksheet 2 4 Record the adjusting entry related to Check No. 919, if necessary. Note: Enter debits before credits. Transaction General Journal Debit Credit C. Record entry Clear entry View general journal Journal entry worksheet 4 Record the adjusting entry related to the June 30 deposit, if necessary Note: Enter debits before credits. Transaction General Journal Debit Credit d. Record entry Clear entry View general journal Exercise 8-11 Bank reconciliation LO P3 Wright Company deposits all cash receipts on the day when they are received and it makes all cash payments by check. At the close of business on May 31, 2017, its Cash account shows a $27,700 debit balance. The company's May 31 bank statement shows $26,000 on deposit in the bank a. The May 31 bank statement lists $110 in bank service charges; the company has not yet recorded the cost of these services. b. Outstanding checks as of May 31 total $5,700. c. May 31 cash receipts of $6,300 were placed in the bank's night depository after banking hours and were not recorded on the May 31 bank statement. d. In reviewing the bank statement, a $410 check written by Smith Company was mistakenly drawn against Wright's account. e. The bank statement shows a $580 NSF check from a customer, the company has not yet recorded this NSF check. Prepare a bank reconciliation for the company using the above information. WRIGHT COMPANY Bank Reconciliation May 31, 2017 Bank statement balance Book balance Add: Add: Deduct Deduct Adjusted bank balance Adjusted book balance