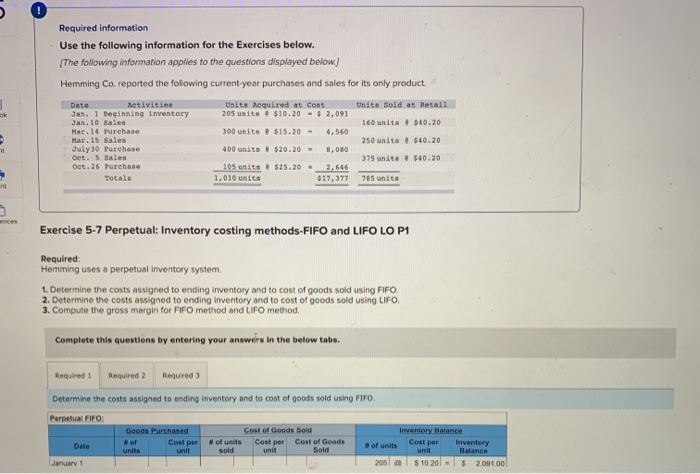

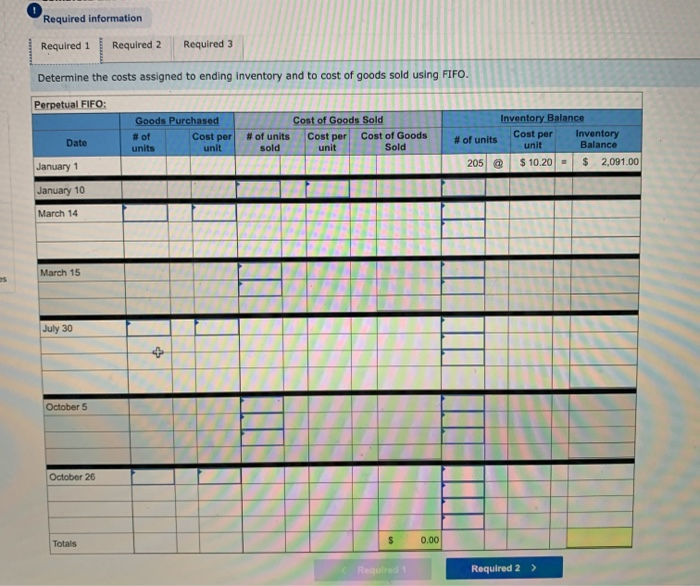

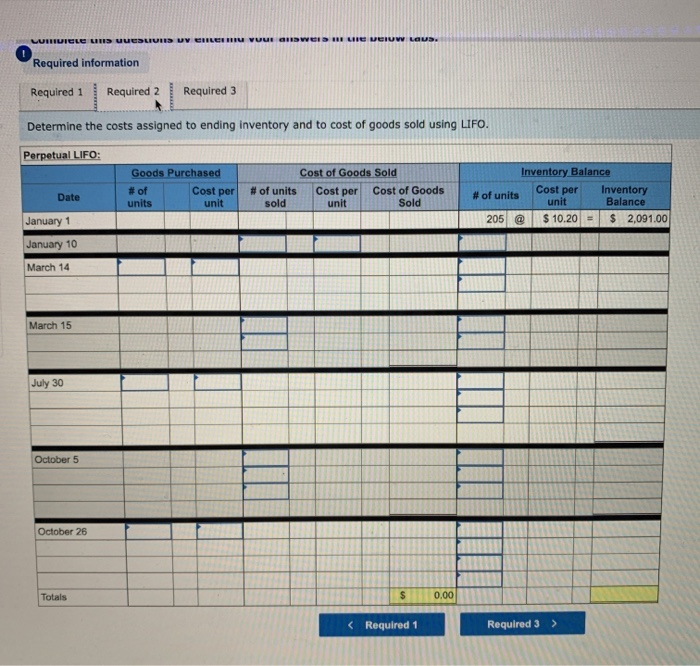

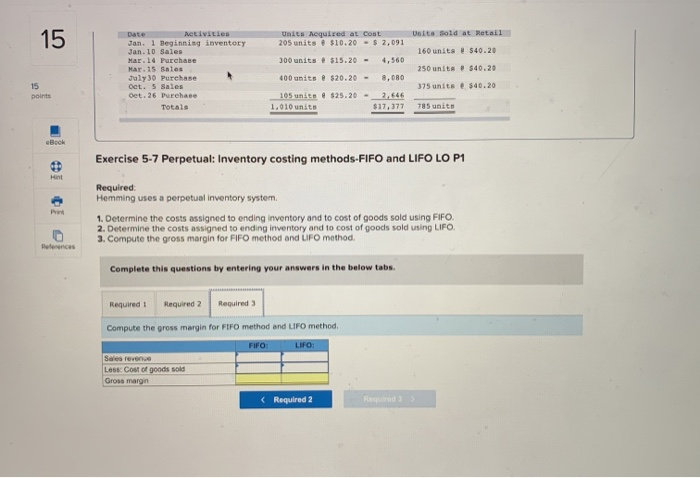

Required information Use the following information for the Exercises below. (The following information applies to the questions displayed below) Hemming Co. reported the following current-year purchases and sales for its only product Date Activities Units acquired at Cost Units Sold at Retail Jan. 1 Beginning inventory 205 units $10.20 - $ 2,091 Jan. 10 sales 160 units $40.20 Mar. 14 Purchase 300 units $15.20 - 4,560 Mar. 15 Sales 250 units $40.20 July 30 Purchase 400 units & $20.20 - 8,080 Oet. 5 Sales 375 units $40.20 Oct.26 Parehase 105 units. $25.20 - Totals 1,010 units $17,377 785 units ences Exercise 5-7 Perpetual: Inventory costing methods-FIFO and LIFO LO P1 Required: Hemming uses a perpetual inventory system, 1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. 2. Determine the costs assigned to ending Inventory and to cost of goods sold using LIFO, 3. Compute the gross margin for FIFO method and LIFO method Complete this questions by entering your answers in the below tabs. Required 2 Required Required: Determine the costs assigned to ending Inventory and to cost of goods sold using FIFO. Perpetual FIFO: Goods Purchased W of Cost per units Cost of Goods Sold W of units Cost per Cost of Goods sold unit Sold Cost per Date Inventory Balance of units Inventory unit Balance 205 $10.201 - S 209100 January 1 Required information Required 1 Required 2 Required 3 Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. Perpetual FIFO: Goods Purchased # of Cost per units unit Cost of Goods Sold # of units Cost per Cost of Goods sold unit Sold Date Inventory Balance # of units Cost per Inventory unit Balance 205 $ 10.20 $ 2,091.00 January 1 January 10 March 14 March 15 es July 30 October 5 October 26 Totals $ 0.00 Required Required 2 > LULILIELE UUDLUIS UV LETU VUI WEIS A Le Veluw LOUS. Required information Required 1 Required 2 Required 3 Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. Perpetual LIFO: Goods Purchased # of units unit Cost per Cost of Goods Sold # of units Cost of Goods sold unit Sold Cost per Date Inventory Balance Cost per Inventory # of units unit Balance 205 @ $ 10.20 = $ 2,091.00 January 1 January 10 March 14 March 15 July 30 October 5 October 26 Totals $ 0.00 Units Aequired at cost 205 units $10.20 - $ 2,091 Unita Sold at Retail 15 160 units $40.20 300 units 515.20 - Date Netivities Jan. 1 Beginning inventory Jan. 10 Sales Mar.14 Purchase Mar. 15 Sales July 30 Purchase Oet. 5 Sales Oet. 26 Purehase Totals 250 units # $40.20 400 units @ $20.20 - 8,080 15 points 375 units $40.20 105 units # $25.20 - 1.010 units 2.646 $17.377 785 units Book Exercise 5-7 Perpetual: Inventory costing methods-FIFO and LIFO LO P1 Required: Hemming uses a perpetual inventory system 1. Determine the costs assigned to ending inventory and to cost of goods sold using Fifo. 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross margin for FIFO method and UFO method. Defence Complete this questions by entering your answers in the below tabs. Required: Required 2 Required 3 Compute the gross margin for FIFO method and UFO method FIFO LIFO: Sales revende Lost Cost of goods sold Gross margin