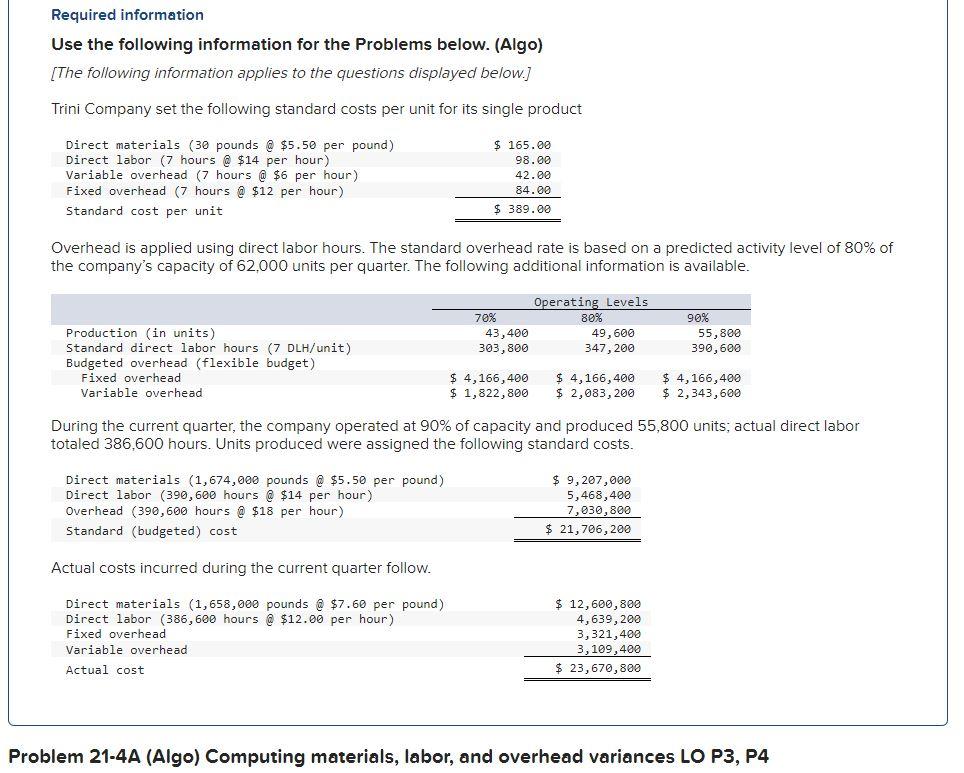

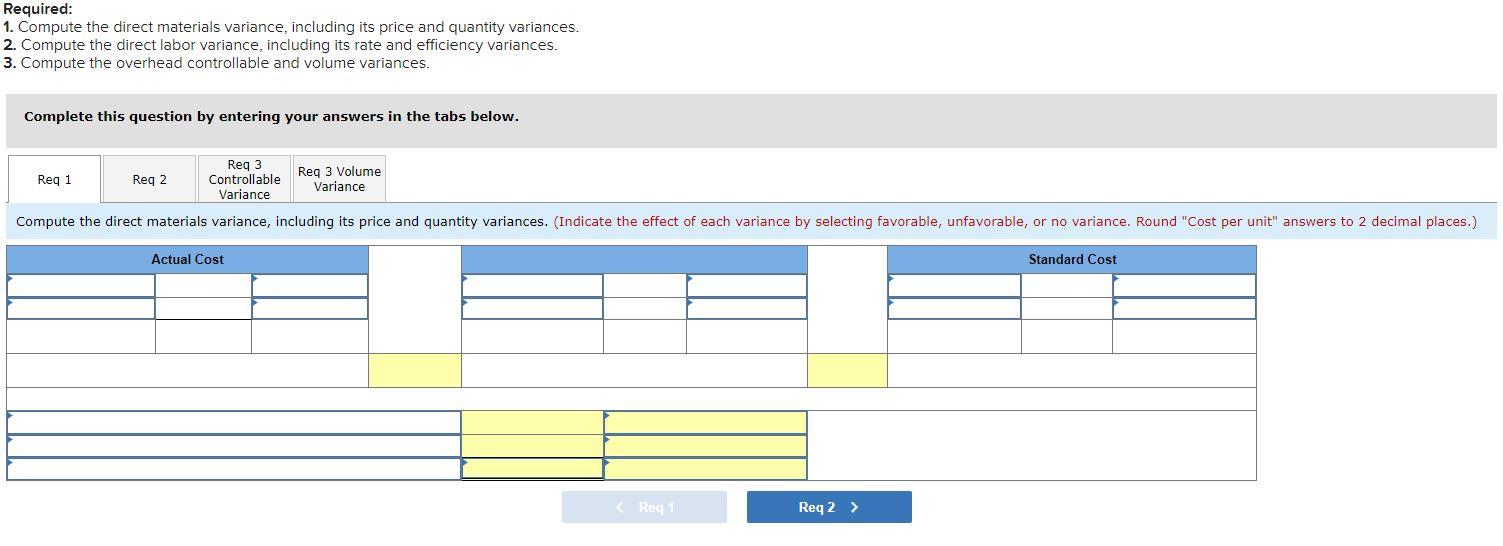

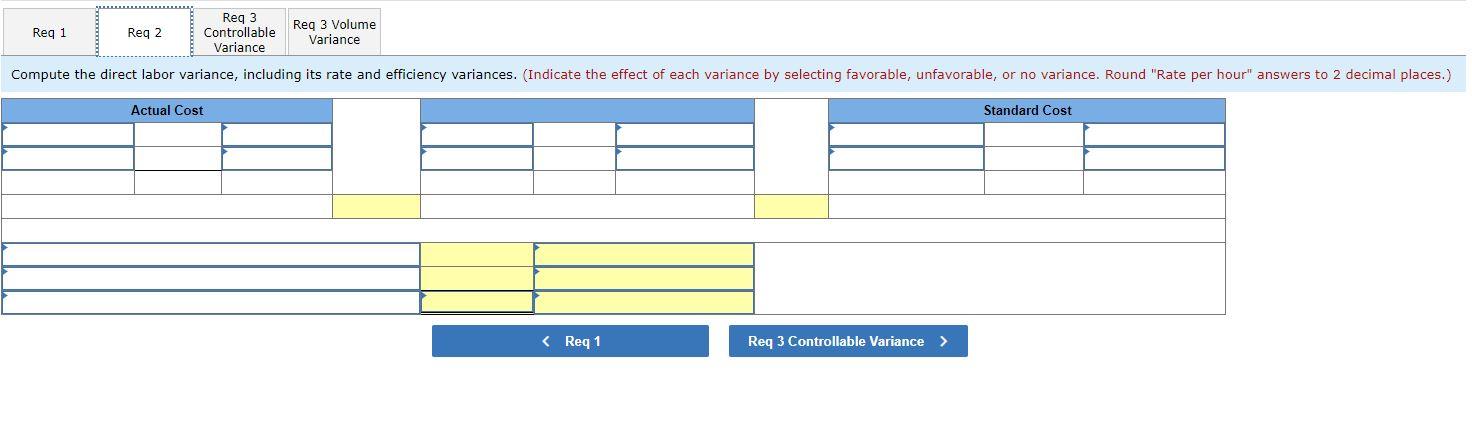

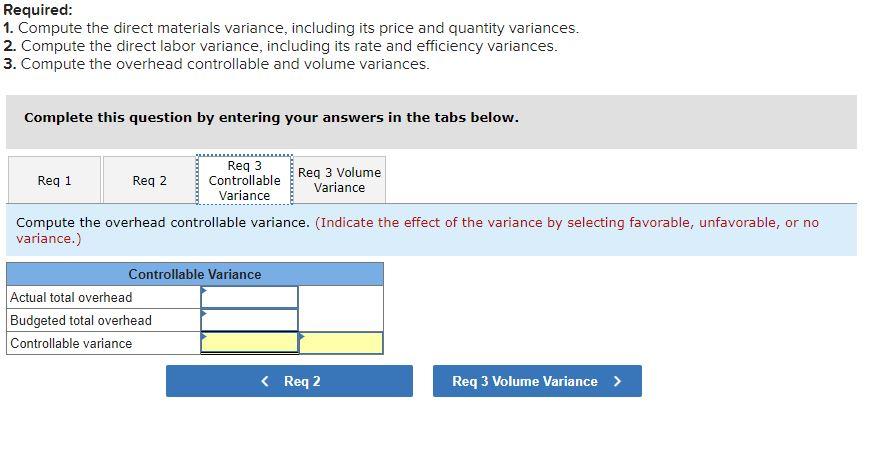

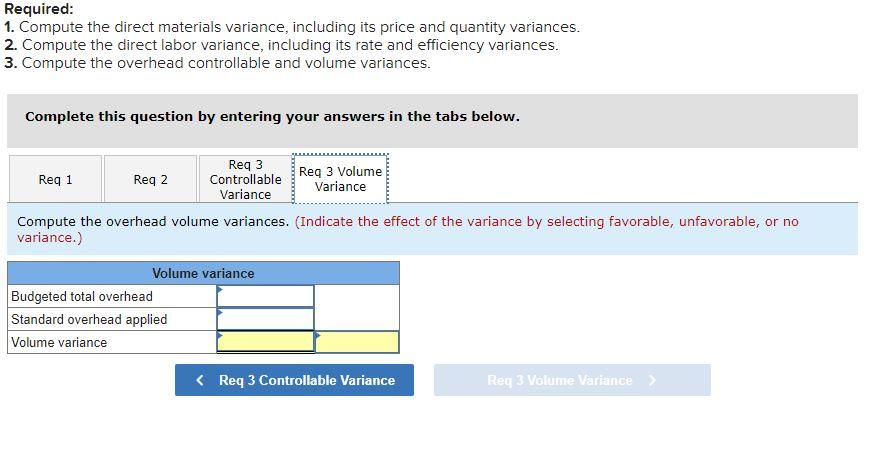

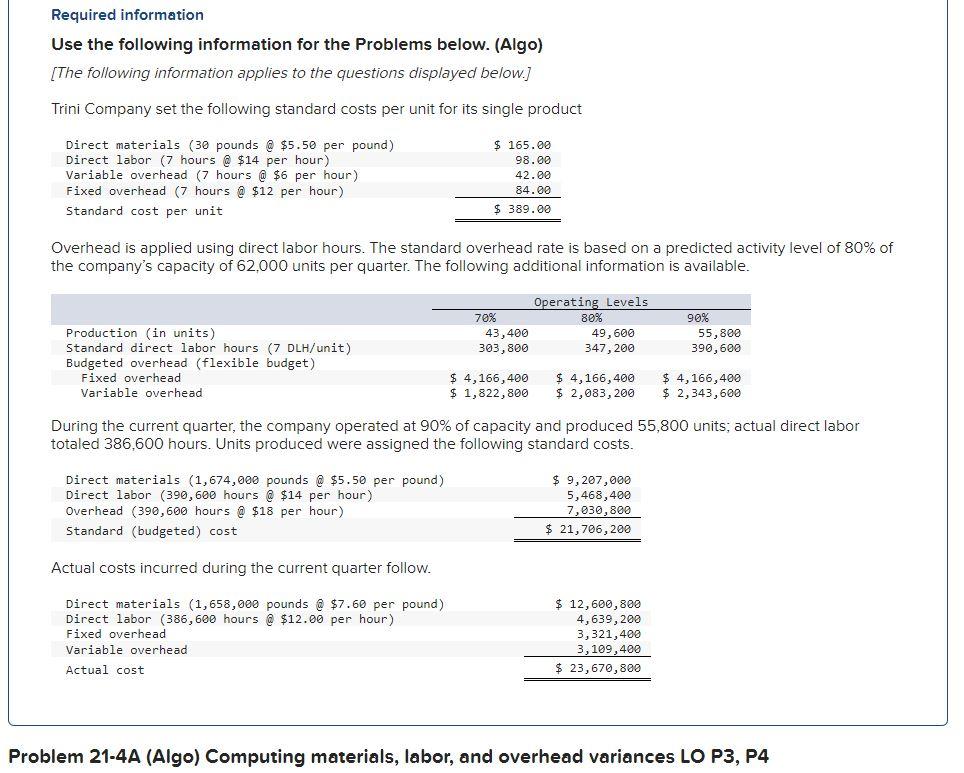

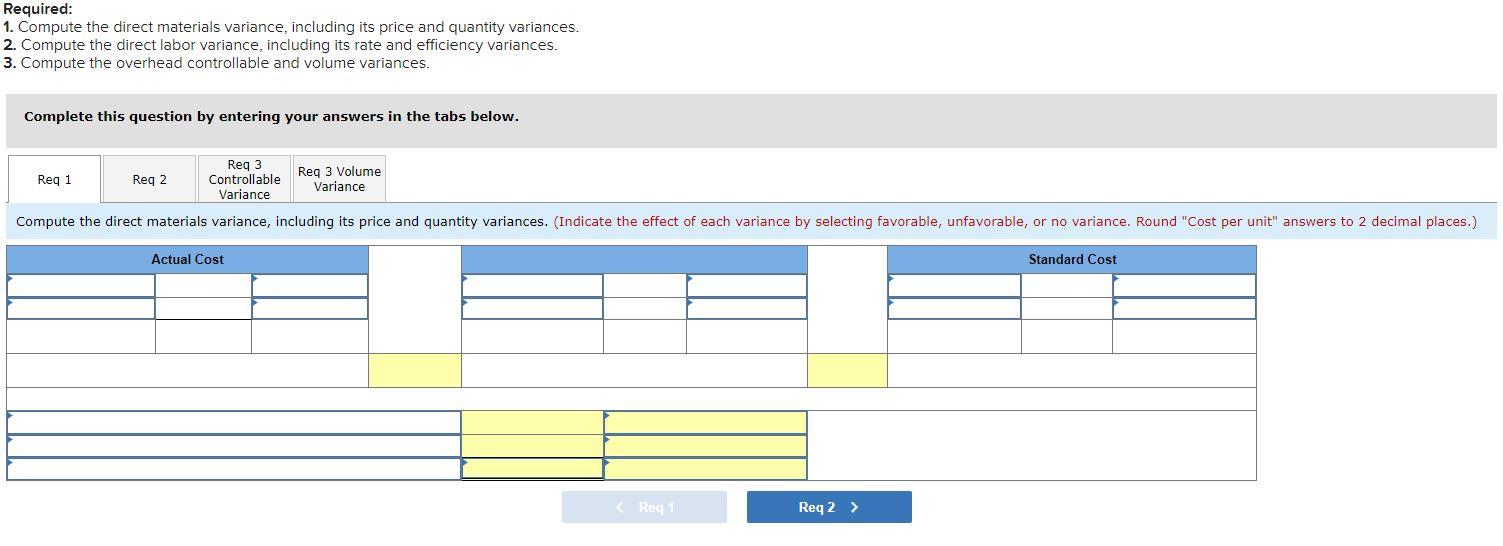

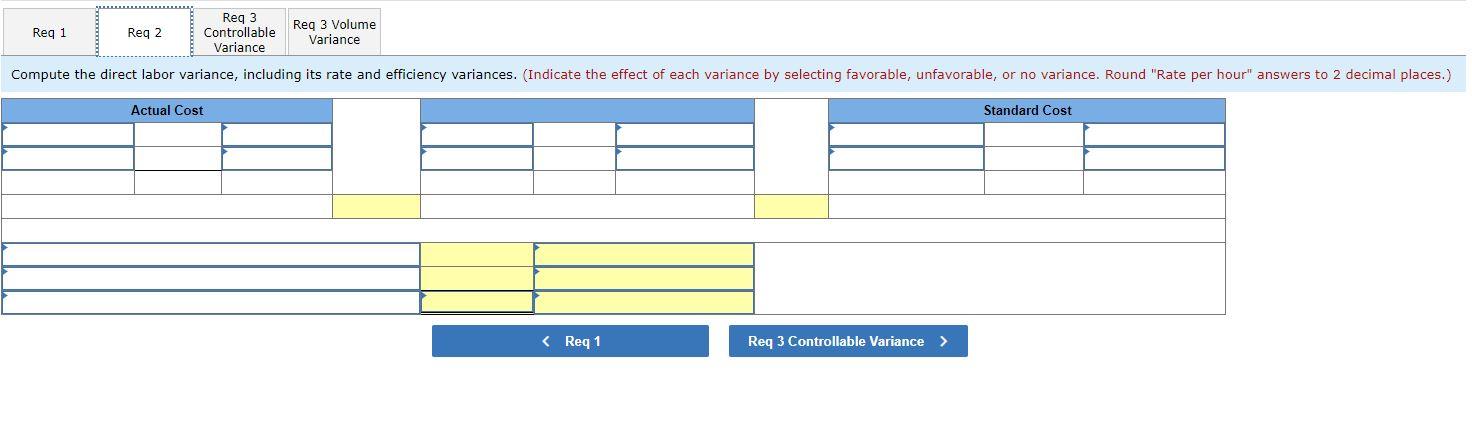

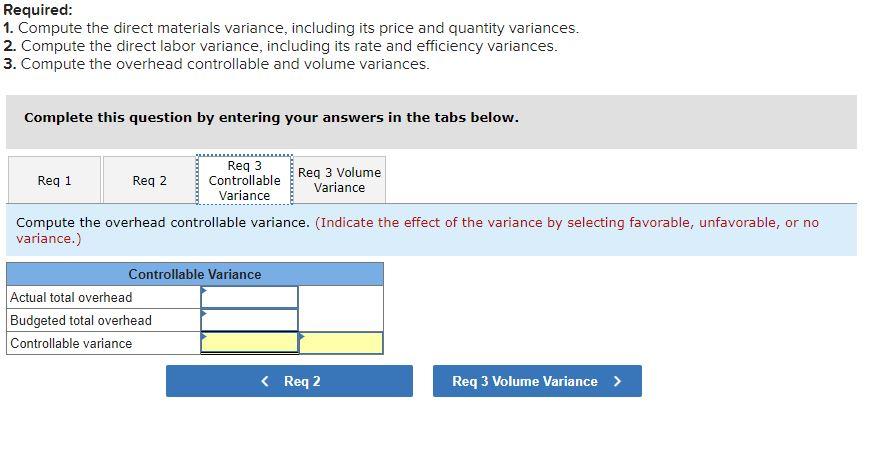

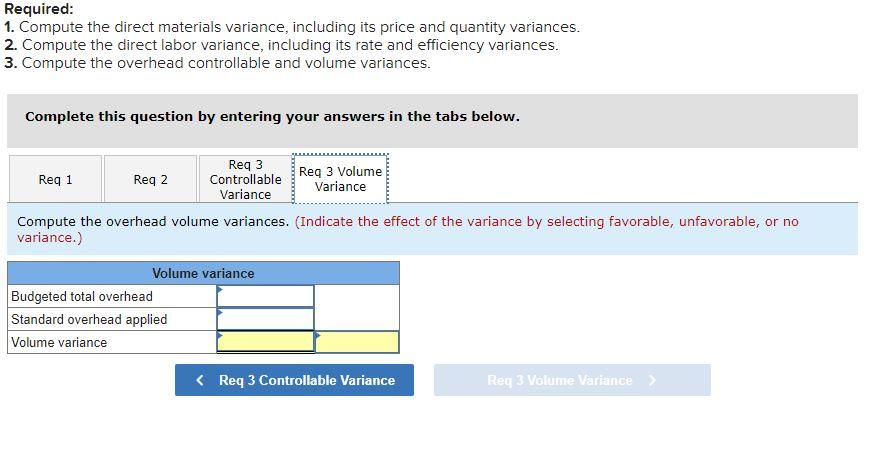

Required information Use the following information for the Problems below. (Algo) [The following information applies to the questions displayed below.] Trini Company set the following standard costs per unit for its single product $ 165.00 98.00 Direct materials (30 pounds @ $5.50 per pound) Direct labor (7 hours @ $14 per hour) Variable overhead (7 hours @ $6 per hour) Fixed overhead (7 hours @ $12 per hour) Standard cost per unit 42.00 84.00 $ 389.00 Overhead is applied using direct labor hours. The standard overhead rate is based on a predicted activity level of 80% of the company's capacity of 62,000 units per quarter. The following additional information is available. Operating Levels 70% 80% 43,400 49,600 303,800 347,200 90% 55,800 390,600 Production (in units) Standard direct labor hours (7 DLH/unit) Budgeted overhead (flexible budget) Fixed overhead Variable overhead $ 4,166,400 $ 1,822, 800 $ 4,166,400 $ 2,083,200 $ 4,166,400 $ 2,343,600 During the current quarter, the company operated at 90% of capacity and produced 55,800 units; actual direct labor totaled 386,600 hours. Units produced were assigned the following standard costs. Direct materials (1,674,000 pounds @ $5.50 per pound) Direct labor (390, 600 hours @ $14 per hour) Overhead (390,600 hours @ $18 per hour) Standard (budgeted) cost $ 9,207,000 5,468,400 7,030,800 $ 21,706,200 Actual costs incurred during the current quarter follow. Direct materials (1,658,000 pounds @ $7.60 per pound) Direct labor (386,600 hours @ $12.00 per hour) Fixed overhead Variable overhead Actual cost $ 12,600,800 4,639,200 3,321,400 3,109,400 $ 23,670,800 Problem 21-4A (Algo) Computing materials, labor, and overhead variances LO P3, P4 Required: 1. Compute the direct materials variance, including its price and quantity variances. 2. Compute the direct labor variance, including its rate and efficiency variances. 3. Compute the overhead controllable and volume variances. Complete this question by entering your answers in the tabs below. Req 1 Reg 2 Reg 3 Controllable Variance Req 3 Volume Variance Compute the direct materials variance, including its price and quantity variances. (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance. Round "Cost per unit" answers to 2 decimal places.) Actual Cost Standard Cost Req1 Req 2 > Req 3 Req 1 Reg 2 Controllable Variance Req 3 Volume Variance Compute the direct labor variance, including its rate and efficiency variances. (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance. Round "Rate per hour" answers to 2 decimal places.) Actual Cost Standard Cost Required: 1. Compute the direct materials variance, including its price and quantity variances. 2. Compute the direct labor variance, including its rate and efficiency variances. 3. Compute the overhead controllable and volume variances. Complete this question by entering your answers in the tabs below. Reg 3 Req 3 Volume Req 1 Req 2 Controllable Variance Variance Compute the overhead controllable variance. (Indicate the effect of the variance by selecting favorable, unfavorable, or no variance.) Controllable Variance Actual total overhead Budgeted total overhead Controllable variance Required: 1. Compute the direct materials variance, including its price and quantity variances. 2. Compute the direct labor variance, including its rate and efficiency variances. 3. Compute the overhead controllable and volume variances. Complete this question by entering your answers in the tabs below. Req3 Req 1 Reg 2 Controllable Req 3 Volume Variance Variance Compute the overhead volume variances. (Indicate the effect of the variance by selecting favorable, unfavorable, or no variance.) Volume variance Budgeted total overhead Standard overhead applied Volume variance