Answered step by step

Verified Expert Solution

Question

1 Approved Answer

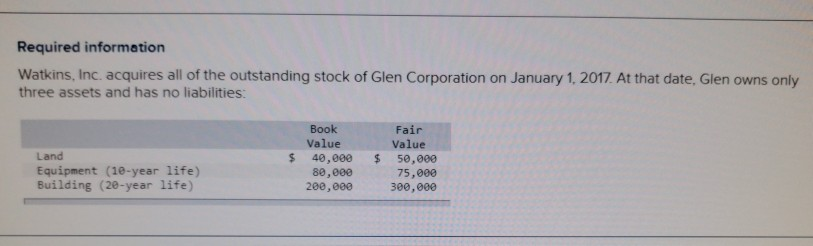

Required information Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on three assets and has no liabilities: January 1, 2017 At that

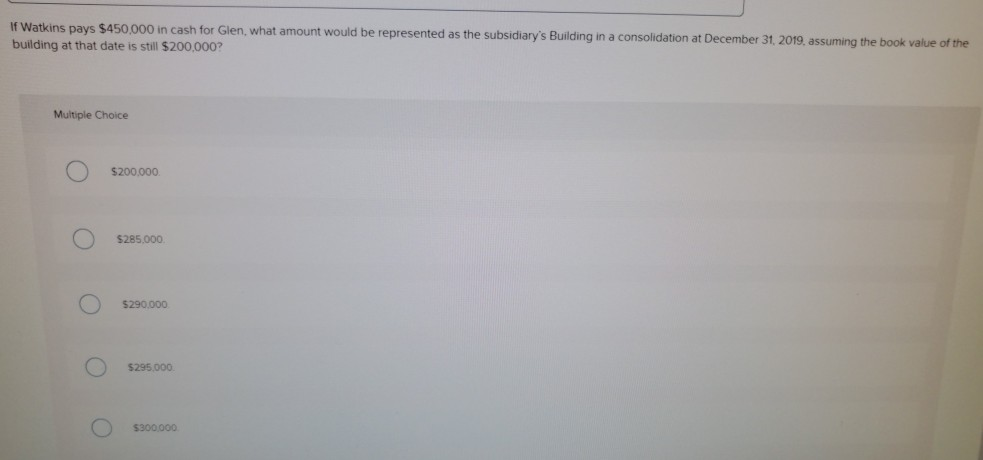

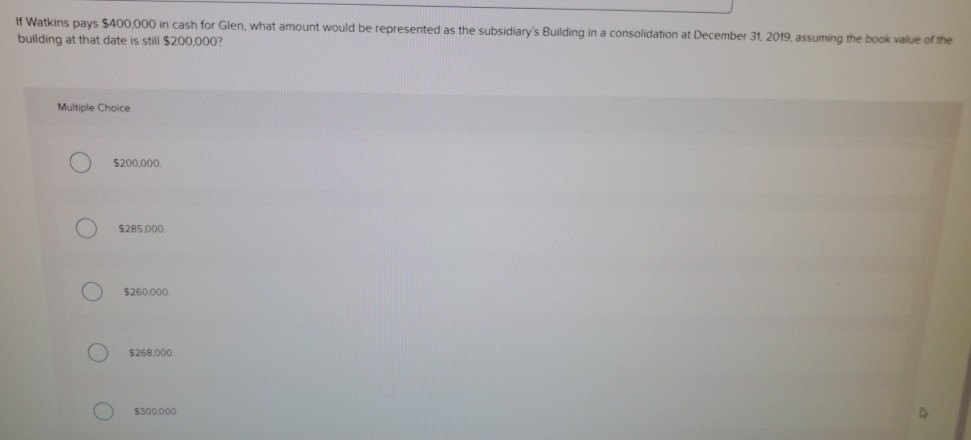

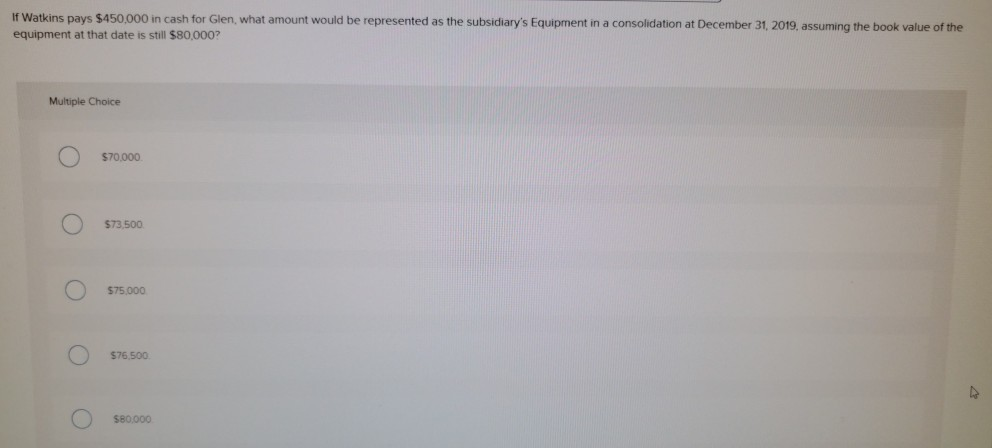

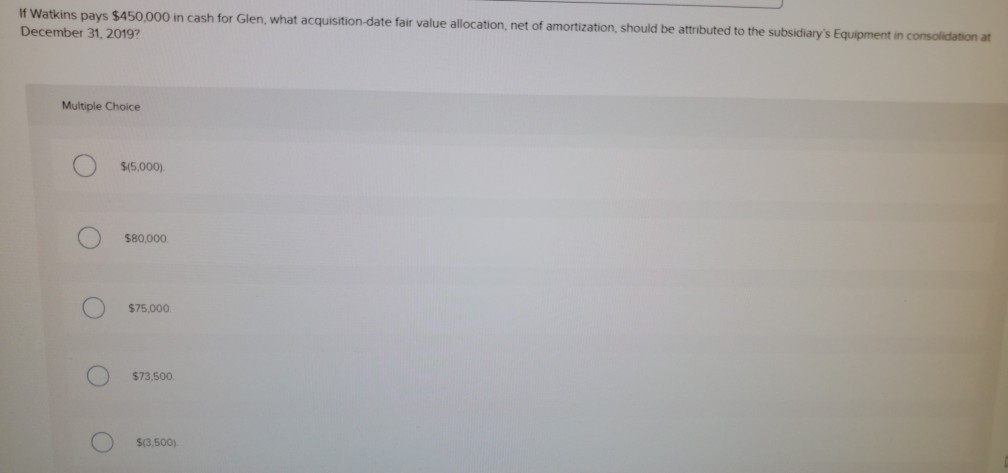

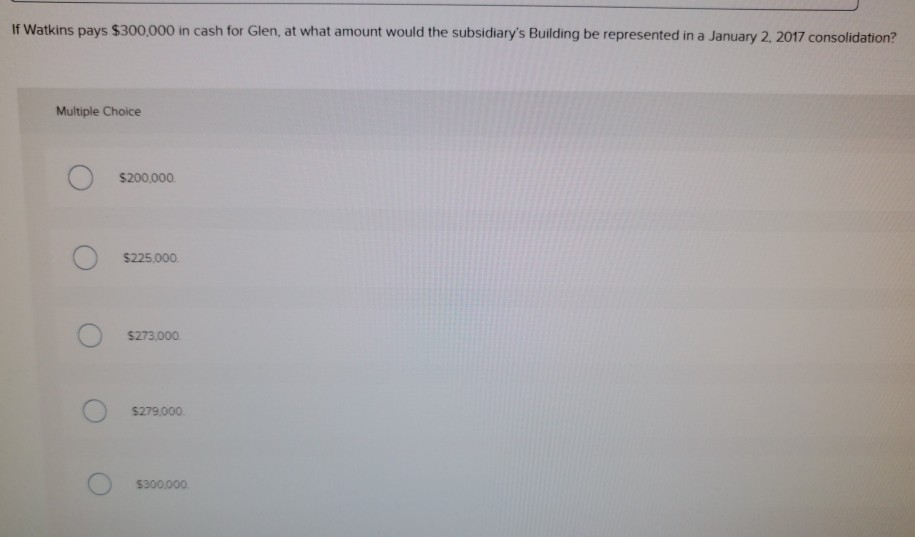

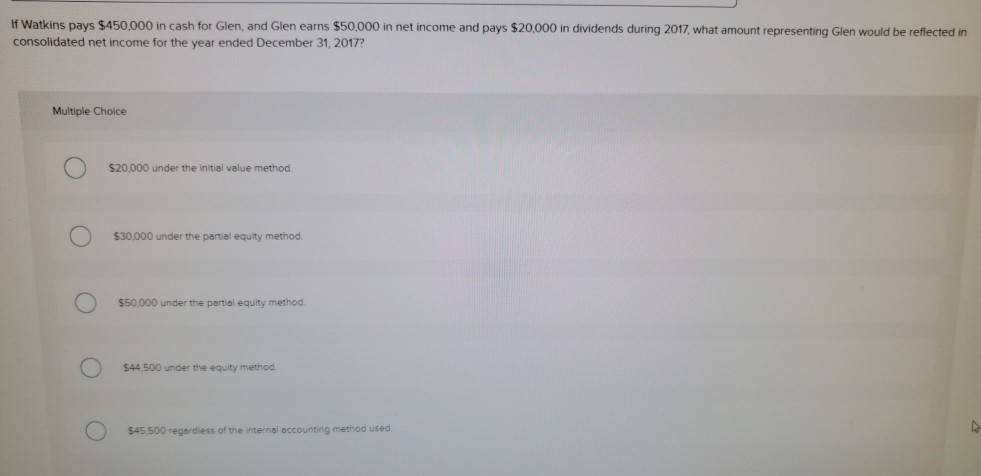

Required information Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on three assets and has no liabilities: January 1, 2017 At that date, Glen owns only Book Fair Value Value 50,000 75,000 300,000 Land $ 48,e , 200,000 Equipment (10-year life) Building (20-year life) If Watkins pays $400,000 in cash for Glen, what amount would be represented as the subsidiary's Building in a consolidation at December 31, 2019 assuming the book value of the building at that date is still $200,000? Multiple Choice $200,000. $285,000 $260,000 $268.000 $300,000 If Watkins pays $450,000 in cash for Glen, what amount would be represented as the subsidiary's Equipment in a consolidation at December 31, 2019, assuming the book value of the equipment at that date is still $80,000? Multiple Choice $70,000 $73,500 $75,000 $76,500 $80.000 If Watkins pays $450,000 in cash for Glen, what acquisition-date fair value allocation, net of amortization, should be attributed to the subsidiary's Equipment in consolidation at December 31, 2019? Multiple Choice $(5,000). $80,000 $75,000 $73,500 $(3.500) If Watkins pays $300,000 in cash for Glen, at what amount would the subsidiary's Building be represented ina January 2, 2017 consolidation? Multiple Choice $200,000 $225,000 $273,000. $279,000 $300,000 If Watkins pays $450,000 in cash for Glen, and Glen earns $50,000 in net income and pays $20,000 in dividends during 2017, what amount representing Glen would be reflected in consolidated net income for the year ended December 31, 2017? Multiple Choice $20.000 under the initial value method $30,000 under the partial equity method. $50,000 under the partiol equity method $44,500 under the equity method $45,500 regordiess of the internal occounting method used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started