Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information Which of the statements relating to the use of a company's job - order costing system to create a balance sheet and income

Required information

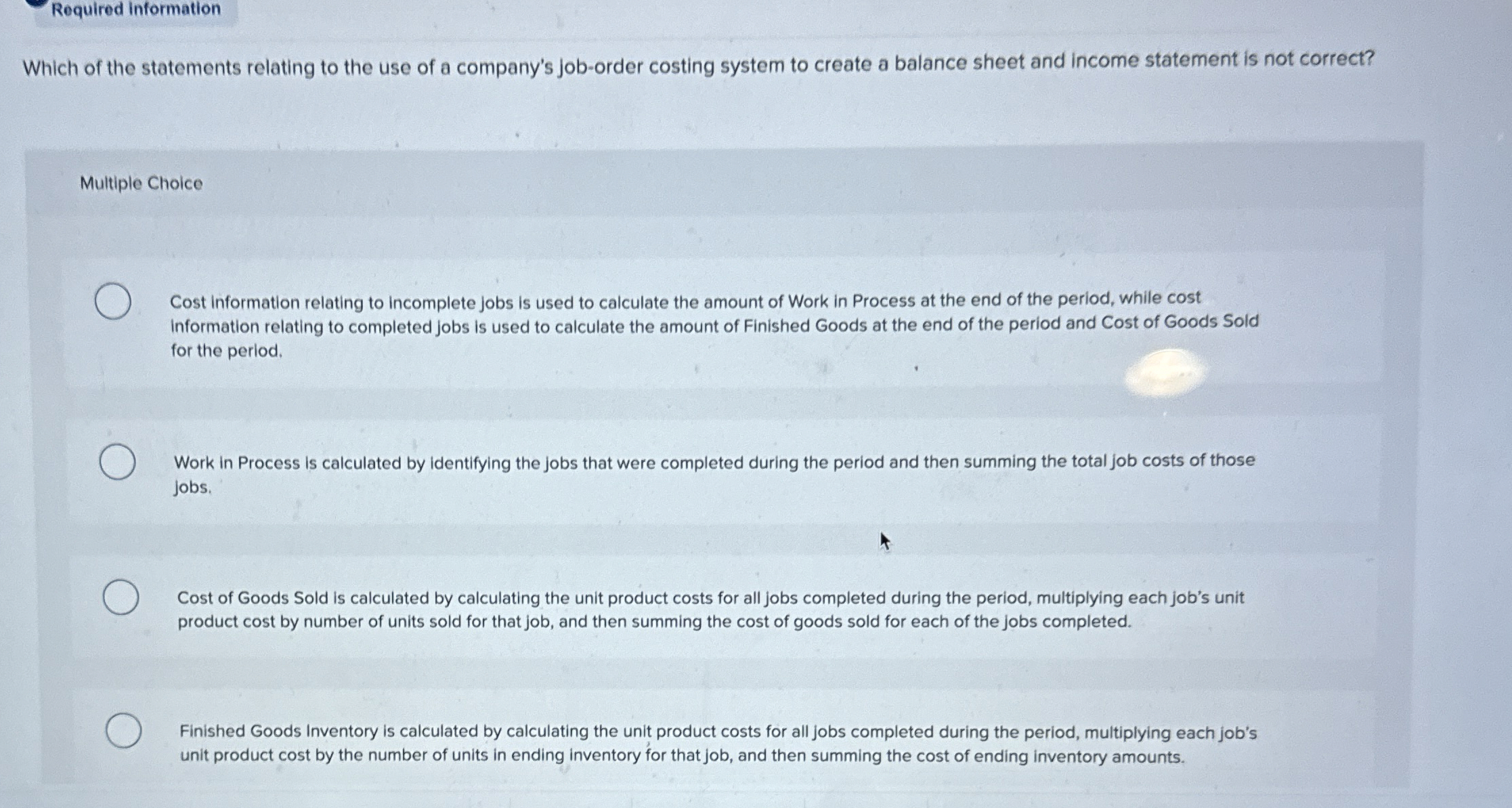

Which of the statements relating to the use of a company's joborder costing system to create a balance sheet and income statement is not correct?

Multiple Choice

Cost information relating to incomplete jobs is used to calculate the amount of Work in Process at the end of the period, while cost information relating to completed jobs is used to calculate the amount of Finished Goods at the end of the period and Cost of Goods Sold for the perlod.

Work in Process is calculated by identifying the jobs that were completed during the period and then summing the total job costs of those jobs.

Cost of Goods Sold is calculated by calculating the unit product costs for all jobs completed during the period, multiplying each job's unit product cost by number of units sold for that job, and then summing the cost of goods sold for each of the jobs completed.

Finished Goods Inventory is calculated by calculating the unit product costs for all jobs completed during the period, multiplying each job's unit product cost by the number of units in ending inventory for that job, and then summing the cost of ending inventory amounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started