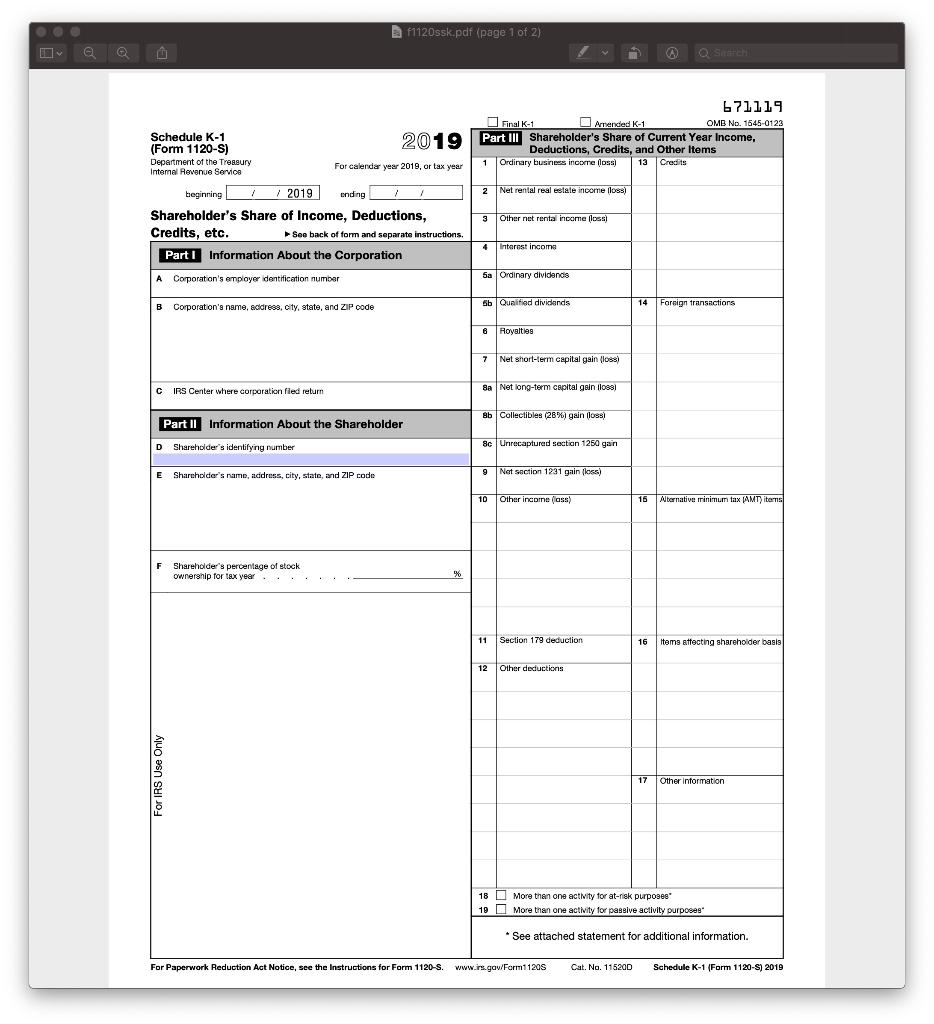

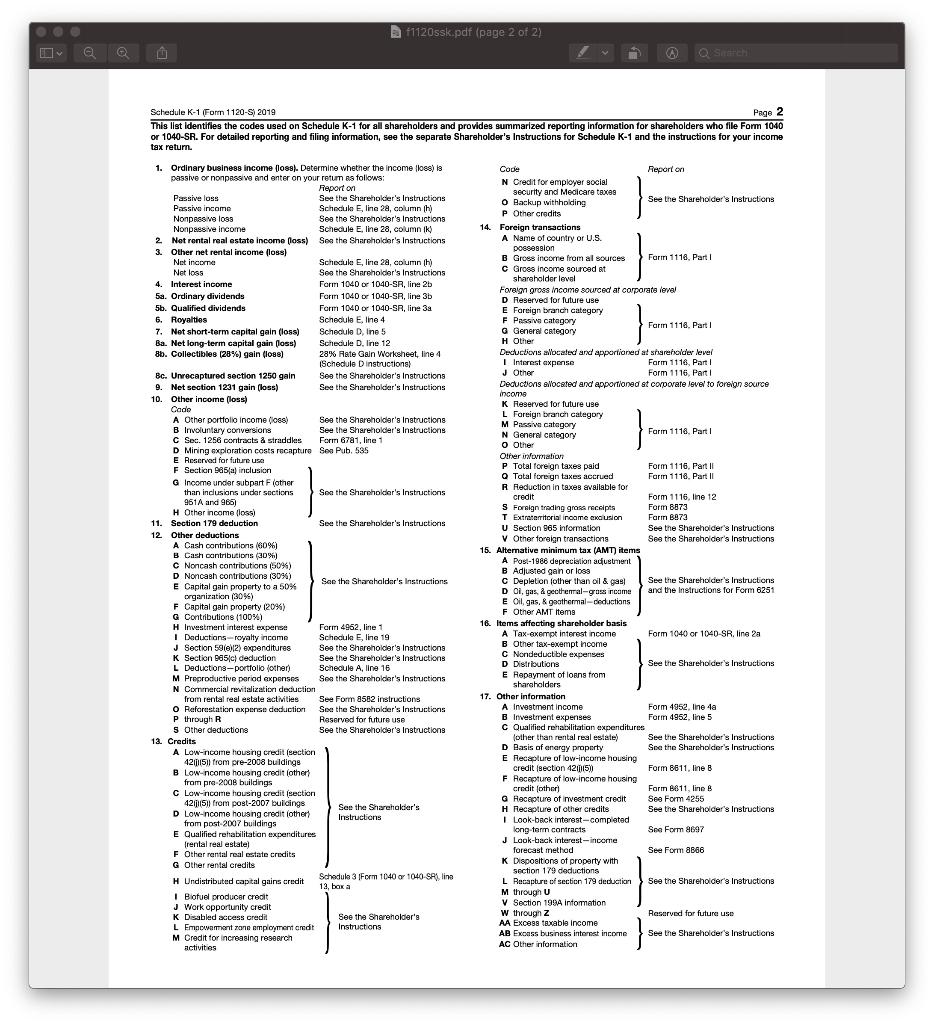

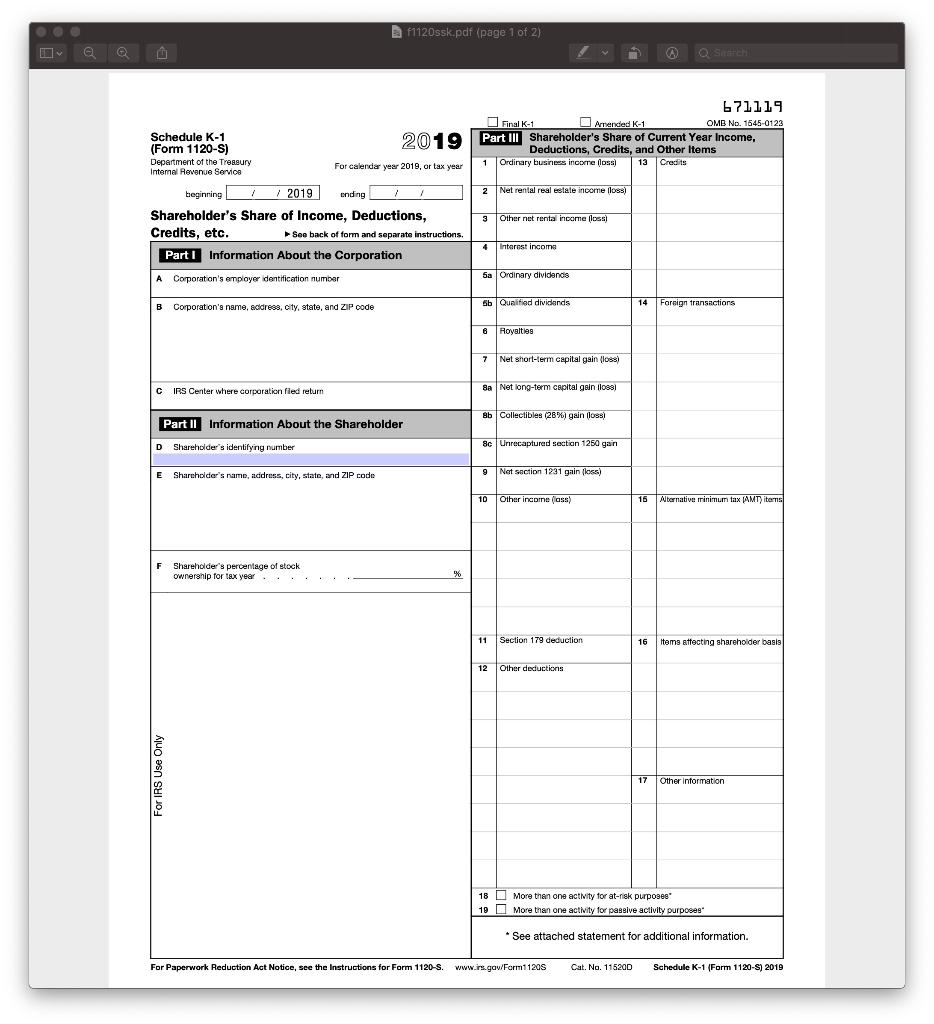

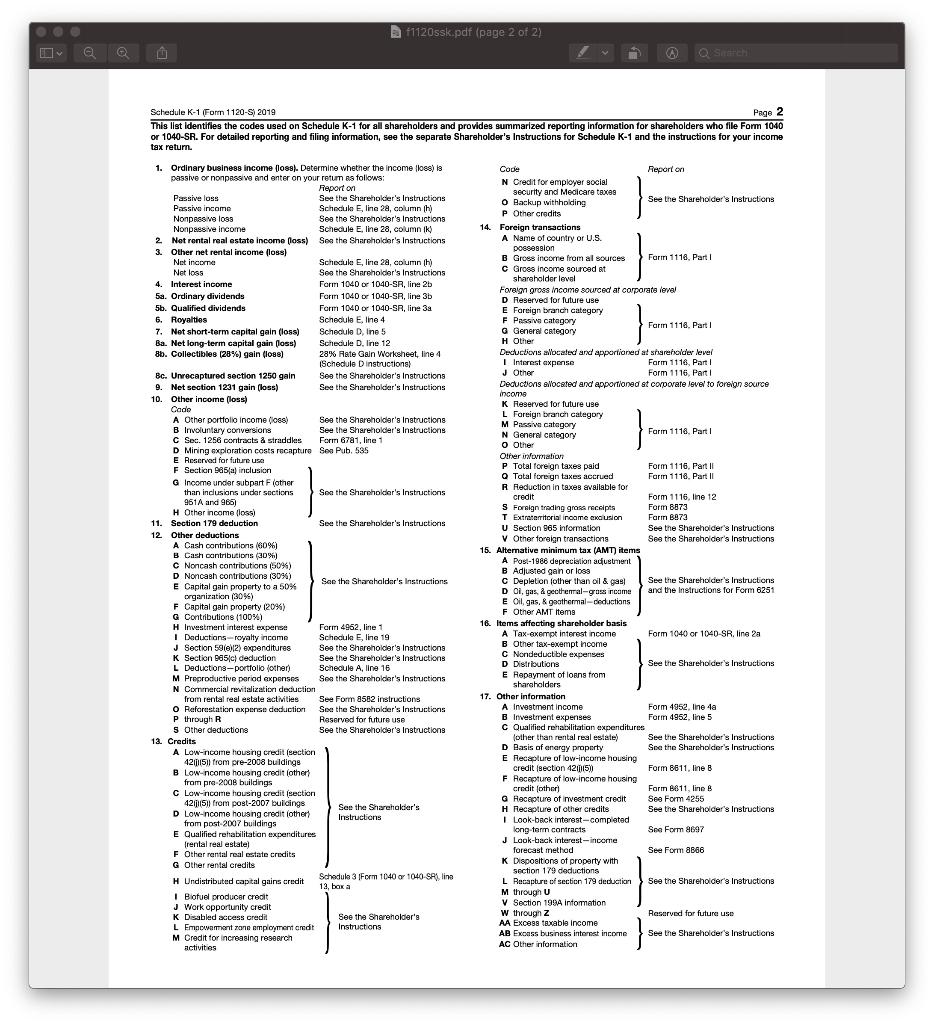

Required information While James Craig and his former classmate Paul Dolittle both studied accounting at school, they ended up pursuing careers in professional cake decorating. Their company, Good to Eat (GTE), specializes in custom-sculpted cakes for weddings, birthdays, and other celebrations. James and Paul formed the business at the beginning of 2020, and each contributed $50,000 in exchange for a 50 percent ownership interest. GTE also borrowed $200,000 from a local bank. Both James and Paul had to personally guarantee the loan. Both owners provide significant services for the business. The following information pertains to GTE's 2020 activities: . . . GTE uses the cash method of accounting (for both book and tax purposes) and reports income on a calendar-year basis. GTE received $450,000 of sales revenue and reported $210,000 of cost of goods sold (it did not have any ending inventory). GTE paid $30,000 compensation to James, $30,000 compensation to Paul, and $40,000 of compensation to other employees (assume these amounts include applicable payroll taxes, if any). GTE paid $15,000 of rent for a building and equipment, $20,000 for advertising, $14,000 in interest expense, $4,000 for utilities, and $2,000 for supplies. GTE contributed $5,000 to charity. GTE received a $1,000 qualified dividend from a great stock investment (it owned 2 percent of the corporation distributing the dividend), and it recognized $1,500 in short-term capital gain when it sold some of the stock. On December 1, 2020, GTE distributed $20,000 to James and $20,000 to Paul. GTE has qualified property of $300,000 (unadjusted basis). . . . (Leave no answer blank. Enter zero if applicable. Enter N/A if not applicable.) a-2. Assume James and Paul formed GTE as an S corporation. Complete Paul's Form 1120-S, Schedule K-1. Download the Tax Form and enter the required values in the appropriate fields. (Use 2020 tax rules regardless of year on tax form.) Please right click on the attached Adobe document and select open in new window. Then, download the Tax Form and enter the required values in the appropriate fields. Save your completed Tax Form to your computer and then upload it here by clicking "Browse." Next, click "Save." 11120ssk.pdf (page 1 of 2) @ OSHE 671119 Final K-1 Amended K-1 OMB No. 1645 0123 Schedule K-1 2019 Part II Shareholder's Share of Current Year Income, (Form 1120-5) Deductions, Credits, and Other Items Department of the Treasury 1 13 Ordinary business incore loss For calendar year 2019, or tax year Credits Internal Revenue Service beginning 7 / 2019 ending / 1 2 Net rental real estate income foss) Shareholder's Share of Income, Deductions, 3 Other net rental income loss Credits, etc. See back of form and separate instructions, 4 Interest income Part I Information About the Corporation A Corporation's employer dentification number 5a Ordinary dividends 5b Qualified dividends 14 B Corporation's name, address, city, state, and ZIP code Foreign transactions 6 Royalties 7 Net short-term capital gain (los) CIRS Center where corporation filed return 8a Net long-term capital gain flossi 8b Collectibles (20%) gain loss! Part II Information About the Shareholder D Shareholder's identifying number 8c Unrecaptured section 1250 gan E Shareholder's name, address, city, state, and ZIP code 9 9 Net section 1231 gain floss) 10 Other income (ass) 16 Alternative rrinimum tax (AMT) items F Shareholder's percentage of stock ownership for tax year.. % 11 Section 179 deduction 16 items atfecting shareholder basis 12 Other deductions For IRS Use Only 17 Other Information 18 More than one activity for at-risk purposes 19 D More than one activity for passive activity purposes * See attached statement for additional information. For Paperwork Reduction Act Notice, see the instructions for Form 1120-S. www.irs.ga/Form11208 Cat No. 115200 Schedule K-1 (Form 1120-S) 2019 11120ssk.pdf (page 2 of 2) @ OSCH Schedule K-1 Form 1120-S) 2019 Page 2 This list identifies the codes used on Schedule K-1 for all shareholders and provides summarized reporting information for shareholders who file Form 1040 or 1040-SR. For detailed reporting and filing information, see the separate Shareholder's Instructions for Schedule K-1 and the instructions for your income tax return. 1. Ordinary business income (1088). Determine whether the income foss) is passive or nonpassive and enter on your return as follows: Report on Passive loss See the Sharehokler's Instructions Passive income Schedule E, line 28, column Nonpassive logs See the Shareholder's Instructions Nonpass ve income Schedule Eline 28, column ik 2 Net rontal real estate income loss) See the Shareholder's Instructions 3. Other net rental income foss) Net income Schedule Eline 22, column) Net loss See the Shareholder's Instructions 4. Interest income Form 1040 or 1040-SR, line 25 5a. Ordinary dividends Form 1040 or 1040-SR, line 3b 5b. Qualified dividends Form 1040 or 1040-SR, line 3a 6. Royalties Schedule Eline 4 7. Net short-term capital gain (loss) Schedule D Ine 5 Ba. Net long-term capital gain floss) Schedule D. line 12 85. Collectibles (28%) gain (logo) 28% Mate Gain Worksheet, line 4 (Schedule Dinstructions Bc. Unrecaptured section 1250 gain See the Shareholder's Instructions 9. Net section 1231 gain (loss) See the Shareholder's Instructions 10. Other income (loss) Cade A Other portfolio income loss) See the Shareholder's Instructions B Involuntary conversions See the Shareholder's Instructions C Sec. 1256 contracts & straddles Form 6721, line 1 D Miring exploration costs recapture Ses Pub. 585 E Reserved for future use F Section 985/a) inclusion G Income under subpart Flother than inclusions under sections See the Shareholder's Instructions 961 and 965) H Other income foss) 11. Section 179 deduction See the Shareholder's Instructions 12 Other deductions A Cash contributions 100%) B Cash contributions (30%) C Noncash contributions (50%) Noncash contributions (30%) See the Shareholder's Instructions E Capital gain property to a 50% organization (305) F Capital gain property (20%) G Contributions (100%) H Investment interest exper Fariri 4962, line 1 Daductions - royalty income Schedule Eline 19 J Section 59(e)12) expenditures See the Shareholder's Instructions K Section 9851c) deduction See the Shareholder's Instructions L Deductions-portfolio (other) Schedule A, line 16 M Preproductive period expenses See the Shareholder's Instructions N Corrimercial revitalization deduction from rental real estate acties See Form 582 instructions o Reforestation experise deduction See the Shareholder's Instructions P through R Reserved for future use 5 Other deductions See the Shareholder's Instructions 12. Credits A Low-income housing credit (section 421111511 from pre-2008 buldinge B Low-ncome housing credit lother from pre-2008 buildings C Low-income housing credit (section 4201157from post-2007 buidings See the Shareholder's D Low-ncome housing credit other Instructions from post 2007 buildings E Qualified rehabilitation expenditures frental real estate) F Other rental real estate credits GOther rental credits H Undistributed capital gains credit Schedule 3 Form 1040 1040-SA line 12, baka I Biofuel producer credit J Work opportunity credit K Disabled access credit See the Shareholder's L Empowerment zone employment credit Instructions M Credit for increasing research activities Code Report on N Credit for employer social security and Medicare taxes See the Shareholder's Instructions O Backup withholding P Other credits 14. Foreign transactions A Name of country or U.S. possession B Gross incorne from al sources Farm 1118, Part 1 C Gross income sourced at shareholder level Foreign gross income sourced at corporate level D Reserved for future use E Foreign branch category F Passive category Farm 1118. Part 1 G General Category H Other Deductions alocated and apportioned at refroider level Interest axpense Farm 1116, Parti J Other Form 1116, Parti Deductions silocated and apportioned et corporate Isvel to foreign source Income K Reserved for future use L Foreign branch category M Passive category N General Category Farin 1118. Parti 0 Other Other information P Total foreign taxes pald Form 1116. Part II Tatal foreign taxes accrued Farm 1118. Part 1 R Reduction in taxes available for credit Form 1116. line 12 S Foreign trading gross receipts Form 8873 T Extraterritorial income anclusion Farm B873 U Section 565 information See the Shareholder's Instructions V Other foreign transactions See the Shareholder's Instructions 15. Alternative minimum tax (AMT) items A Posl-1986 depreciation austenit B Adjusted gan or loss C Depletion other than oil & gas See the Shareholder's Instructions D Oi, gas, & geothermal-gros income and the instructions for Form 6251 E Oil, gas, & geothermal -deductions F Other AMT items 16. Items affecting shareholder basis A Tax-exempt interest income Form 1040 or 104D-SR, line 29 B Other tax-exempt hoome C Nondeductible expenses D Distributions See the Shareholder's Instructions E Repayment of loans from shareholders 17. Other information A Investment income Form 4952, line 49 B Investment expenses Form 4952, line 5 C Qualified rehabilitation expenditures (other than rental real estate) See the Shareholder's Instructions D Basis of energy property See the Shareholder's Instructions E Recapture of low-income housing credit section 42015) Form 8611, line 8 F Recepture of low-income housing credit (other) Farm B811, lino GRecepture of investment credit See Form 4255 H Receplure of other credits See the Shareholder's Instructions I Look back interest.--completed long-term contracts See Form 2697 J Look-back interest-income forecast method See Form 2866 K Dispositions of property with section 179 deductions L Recapture of section 179 deduction See the Shareholder's Instructions M through U V Section 1994 intomation w through z Reserved for future use AA Exc899 taxable income AB Excess business interest income See the Shareholder's Instructions AC Other information Required information While James Craig and his former classmate Paul Dolittle both studied accounting at school, they ended up pursuing careers in professional cake decorating. Their company, Good to Eat (GTE), specializes in custom-sculpted cakes for weddings, birthdays, and other celebrations. James and Paul formed the business at the beginning of 2020, and each contributed $50,000 in exchange for a 50 percent ownership interest. GTE also borrowed $200,000 from a local bank. Both James and Paul had to personally guarantee the loan. Both owners provide significant services for the business. The following information pertains to GTE's 2020 activities: . . . GTE uses the cash method of accounting (for both book and tax purposes) and reports income on a calendar-year basis. GTE received $450,000 of sales revenue and reported $210,000 of cost of goods sold (it did not have any ending inventory). GTE paid $30,000 compensation to James, $30,000 compensation to Paul, and $40,000 of compensation to other employees (assume these amounts include applicable payroll taxes, if any). GTE paid $15,000 of rent for a building and equipment, $20,000 for advertising, $14,000 in interest expense, $4,000 for utilities, and $2,000 for supplies. GTE contributed $5,000 to charity. GTE received a $1,000 qualified dividend from a great stock investment (it owned 2 percent of the corporation distributing the dividend), and it recognized $1,500 in short-term capital gain when it sold some of the stock. On December 1, 2020, GTE distributed $20,000 to James and $20,000 to Paul. GTE has qualified property of $300,000 (unadjusted basis). . . . (Leave no answer blank. Enter zero if applicable. Enter N/A if not applicable.) a-2. Assume James and Paul formed GTE as an S corporation. Complete Paul's Form 1120-S, Schedule K-1. Download the Tax Form and enter the required values in the appropriate fields. (Use 2020 tax rules regardless of year on tax form.) Please right click on the attached Adobe document and select open in new window. Then, download the Tax Form and enter the required values in the appropriate fields. Save your completed Tax Form to your computer and then upload it here by clicking "Browse." Next, click "Save." 11120ssk.pdf (page 1 of 2) @ OSHE 671119 Final K-1 Amended K-1 OMB No. 1645 0123 Schedule K-1 2019 Part II Shareholder's Share of Current Year Income, (Form 1120-5) Deductions, Credits, and Other Items Department of the Treasury 1 13 Ordinary business incore loss For calendar year 2019, or tax year Credits Internal Revenue Service beginning 7 / 2019 ending / 1 2 Net rental real estate income foss) Shareholder's Share of Income, Deductions, 3 Other net rental income loss Credits, etc. See back of form and separate instructions, 4 Interest income Part I Information About the Corporation A Corporation's employer dentification number 5a Ordinary dividends 5b Qualified dividends 14 B Corporation's name, address, city, state, and ZIP code Foreign transactions 6 Royalties 7 Net short-term capital gain (los) CIRS Center where corporation filed return 8a Net long-term capital gain flossi 8b Collectibles (20%) gain loss! Part II Information About the Shareholder D Shareholder's identifying number 8c Unrecaptured section 1250 gan E Shareholder's name, address, city, state, and ZIP code 9 9 Net section 1231 gain floss) 10 Other income (ass) 16 Alternative rrinimum tax (AMT) items F Shareholder's percentage of stock ownership for tax year.. % 11 Section 179 deduction 16 items atfecting shareholder basis 12 Other deductions For IRS Use Only 17 Other Information 18 More than one activity for at-risk purposes 19 D More than one activity for passive activity purposes * See attached statement for additional information. For Paperwork Reduction Act Notice, see the instructions for Form 1120-S. www.irs.ga/Form11208 Cat No. 115200 Schedule K-1 (Form 1120-S) 2019 11120ssk.pdf (page 2 of 2) @ OSCH Schedule K-1 Form 1120-S) 2019 Page 2 This list identifies the codes used on Schedule K-1 for all shareholders and provides summarized reporting information for shareholders who file Form 1040 or 1040-SR. For detailed reporting and filing information, see the separate Shareholder's Instructions for Schedule K-1 and the instructions for your income tax return. 1. Ordinary business income (1088). Determine whether the income foss) is passive or nonpassive and enter on your return as follows: Report on Passive loss See the Sharehokler's Instructions Passive income Schedule E, line 28, column Nonpassive logs See the Shareholder's Instructions Nonpass ve income Schedule Eline 28, column ik 2 Net rontal real estate income loss) See the Shareholder's Instructions 3. Other net rental income foss) Net income Schedule Eline 22, column) Net loss See the Shareholder's Instructions 4. Interest income Form 1040 or 1040-SR, line 25 5a. Ordinary dividends Form 1040 or 1040-SR, line 3b 5b. Qualified dividends Form 1040 or 1040-SR, line 3a 6. Royalties Schedule Eline 4 7. Net short-term capital gain (loss) Schedule D Ine 5 Ba. Net long-term capital gain floss) Schedule D. line 12 85. Collectibles (28%) gain (logo) 28% Mate Gain Worksheet, line 4 (Schedule Dinstructions Bc. Unrecaptured section 1250 gain See the Shareholder's Instructions 9. Net section 1231 gain (loss) See the Shareholder's Instructions 10. Other income (loss) Cade A Other portfolio income loss) See the Shareholder's Instructions B Involuntary conversions See the Shareholder's Instructions C Sec. 1256 contracts & straddles Form 6721, line 1 D Miring exploration costs recapture Ses Pub. 585 E Reserved for future use F Section 985/a) inclusion G Income under subpart Flother than inclusions under sections See the Shareholder's Instructions 961 and 965) H Other income foss) 11. Section 179 deduction See the Shareholder's Instructions 12 Other deductions A Cash contributions 100%) B Cash contributions (30%) C Noncash contributions (50%) Noncash contributions (30%) See the Shareholder's Instructions E Capital gain property to a 50% organization (305) F Capital gain property (20%) G Contributions (100%) H Investment interest exper Fariri 4962, line 1 Daductions - royalty income Schedule Eline 19 J Section 59(e)12) expenditures See the Shareholder's Instructions K Section 9851c) deduction See the Shareholder's Instructions L Deductions-portfolio (other) Schedule A, line 16 M Preproductive period expenses See the Shareholder's Instructions N Corrimercial revitalization deduction from rental real estate acties See Form 582 instructions o Reforestation experise deduction See the Shareholder's Instructions P through R Reserved for future use 5 Other deductions See the Shareholder's Instructions 12. Credits A Low-income housing credit (section 421111511 from pre-2008 buldinge B Low-ncome housing credit lother from pre-2008 buildings C Low-income housing credit (section 4201157from post-2007 buidings See the Shareholder's D Low-ncome housing credit other Instructions from post 2007 buildings E Qualified rehabilitation expenditures frental real estate) F Other rental real estate credits GOther rental credits H Undistributed capital gains credit Schedule 3 Form 1040 1040-SA line 12, baka I Biofuel producer credit J Work opportunity credit K Disabled access credit See the Shareholder's L Empowerment zone employment credit Instructions M Credit for increasing research activities Code Report on N Credit for employer social security and Medicare taxes See the Shareholder's Instructions O Backup withholding P Other credits 14. Foreign transactions A Name of country or U.S. possession B Gross incorne from al sources Farm 1118, Part 1 C Gross income sourced at shareholder level Foreign gross income sourced at corporate level D Reserved for future use E Foreign branch category F Passive category Farm 1118. Part 1 G General Category H Other Deductions alocated and apportioned at refroider level Interest axpense Farm 1116, Parti J Other Form 1116, Parti Deductions silocated and apportioned et corporate Isvel to foreign source Income K Reserved for future use L Foreign branch category M Passive category N General Category Farin 1118. Parti 0 Other Other information P Total foreign taxes pald Form 1116. Part II Tatal foreign taxes accrued Farm 1118. Part 1 R Reduction in taxes available for credit Form 1116. line 12 S Foreign trading gross receipts Form 8873 T Extraterritorial income anclusion Farm B873 U Section 565 information See the Shareholder's Instructions V Other foreign transactions See the Shareholder's Instructions 15. Alternative minimum tax (AMT) items A Posl-1986 depreciation austenit B Adjusted gan or loss C Depletion other than oil & gas See the Shareholder's Instructions D Oi, gas, & geothermal-gros income and the instructions for Form 6251 E Oil, gas, & geothermal -deductions F Other AMT items 16. Items affecting shareholder basis A Tax-exempt interest income Form 1040 or 104D-SR, line 29 B Other tax-exempt hoome C Nondeductible expenses D Distributions See the Shareholder's Instructions E Repayment of loans from shareholders 17. Other information A Investment income Form 4952, line 49 B Investment expenses Form 4952, line 5 C Qualified rehabilitation expenditures (other than rental real estate) See the Shareholder's Instructions D Basis of energy property See the Shareholder's Instructions E Recapture of low-income housing credit section 42015) Form 8611, line 8 F Recepture of low-income housing credit (other) Farm B811, lino GRecepture of investment credit See Form 4255 H Receplure of other credits See the Shareholder's Instructions I Look back interest.--completed long-term contracts See Form 2697 J Look-back interest-income forecast method See Form 2866 K Dispositions of property with section 179 deductions L Recapture of section 179 deduction See the Shareholder's Instructions M through U V Section 1994 intomation w through z Reserved for future use AA Exc899 taxable income AB Excess business interest income See the Shareholder's Instructions AC Other information