Answered step by step

Verified Expert Solution

Question

1 Approved Answer

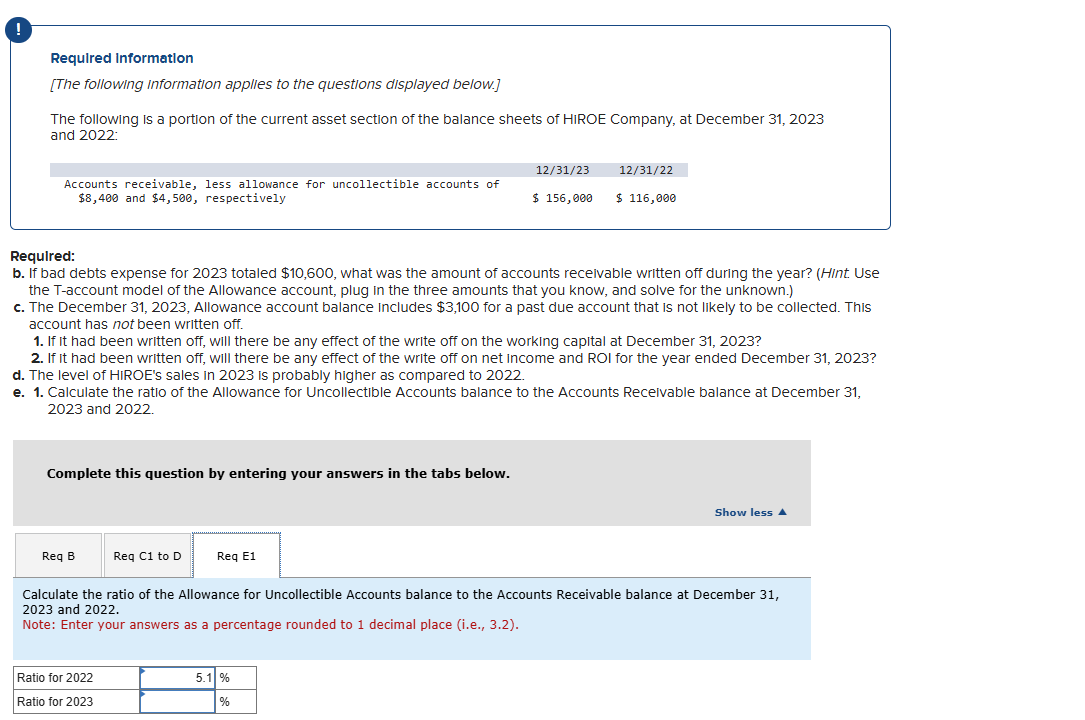

Required Informatlon [ The following information applies to the questions displayed below. ] The following is a portion of the current asset section of the

Required Informatlon

The following information applies to the questions displayed below.

The following is a portion of the current asset section of the balance sheets of HIROE Company, at December

and :

Accounts receivable, less allowance for uncollectible accounts of

$ and $ respectively

$ $

Required:

b If bad debts expense for totaled $ what was the amount of accounts recelvable written off during the year? HInt Use

the Taccount model of the Allowance account, plug in the three amounts that you know, and solve for the unknown.

c The December Allowance account balance includes $ for a past due account that is not likely to be collected. This

account has not been written off.

If It had been written off, will there be any effect of the write off on the working capital at December

If it had been written off, will there be any effect of the write off on net income and ROI for the year ended December

d The level of HIROE's sales in is probably higher as compared to

e Calculate the ratio of the Allowance for Uncollectible Accounts balance to the Accounts Recelvable balance at December

and

Complete this question by entering your answers in the tabs below.

Calculate the ratio of the Allowance for Uncollectible Accounts balance to the Accounts Receivable balance at December

and

Note: Enter your answers as a percentage rounded to decimal place ie

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started