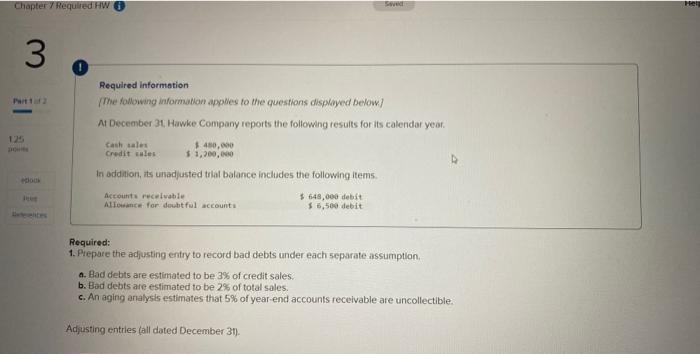

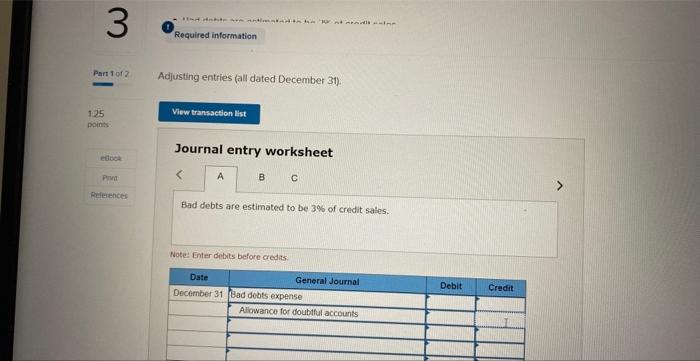

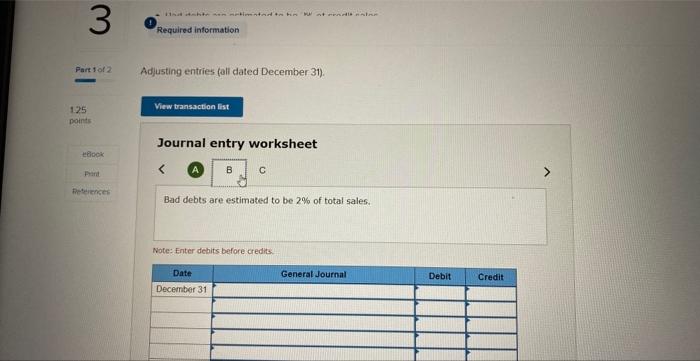

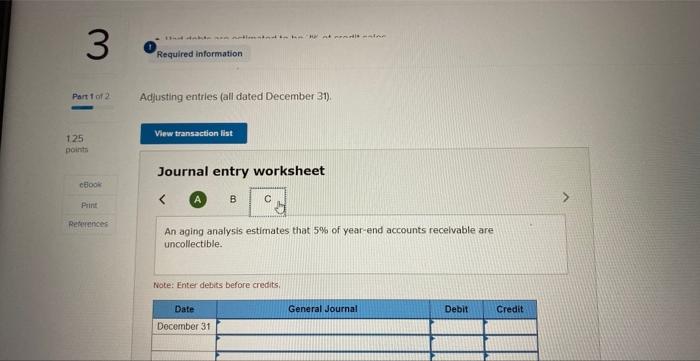

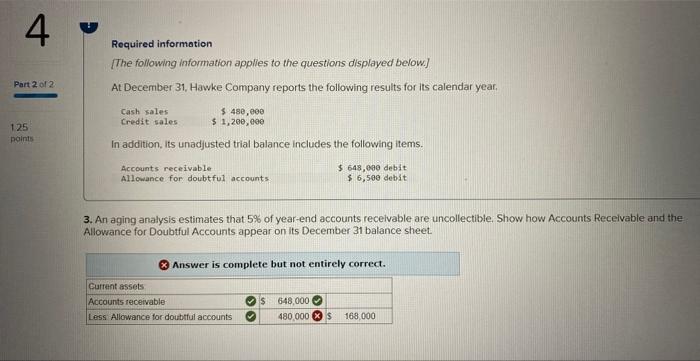

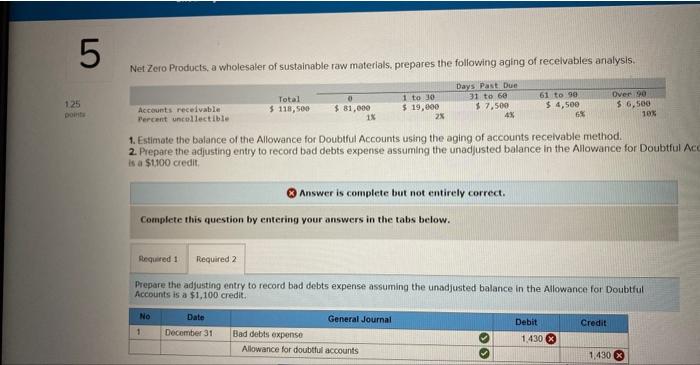

Required informetion (The following informatian appobes to the questions disployed betow] At December 34, Hawke Company reports the following results for its calendar yeor. In oddition, its unad asted tilal balance includes the following items. Required: 1. Piepare the adjusting entry to record bad debts under each separate assumption. a. Bad debts are estimated to be 39 of credit sales. b. Bad debts are estimated to be 2% of total sales. c. An aging arralysts estimates that 5% of year-end accounts receivable are uncollectible. Adjusting entries (all dated December 31). Adjusting entries (all dated December 31). Journal entry worksheet Bad debts are estimated to be 3% of credit sales. Note: Enter debits before credits. Adjusting entries (oll dated December 31). Journal entry worksheet C Bad debts are estimated to be 2% of total sales. Note: Enter dehits before credits: Adlusting entries (all dated December 31). Journal entry worksheet An aging analysis estimates that 5% of year-end accounts recelvable are uncollectible. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] At December 31, Hawke Company reports the following results for its calendar year. In addition, its unadjusted trial balance includes the following items. 3. An aging analysis estimates that 5% of year-end accounts recelvable are uncollectible. Show how Accounts Recelvable and the Allowance for Doubtful Accounts appear on its December 31 balance sheet. Net Zero Products, a wholesaler of sustainable raw materials. prepares the following aging of recelvables analysis. 1. Estimate the balance of the Allowance for Doubtful Accounts using the aging of accounts recelvable method. 2. Prepare the adjusting entry to record bad debts expense assuming the unadjusted balance in the Allowance for Doubtful is a $1,100 credit. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Prepare the adjusting entry to record bad debts expense assuming the unadjusted balarce In the Allowance for Doubtful Accounts is a $1,100 credit