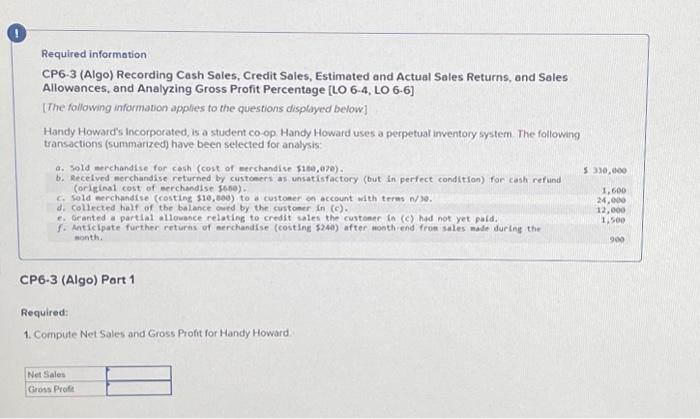

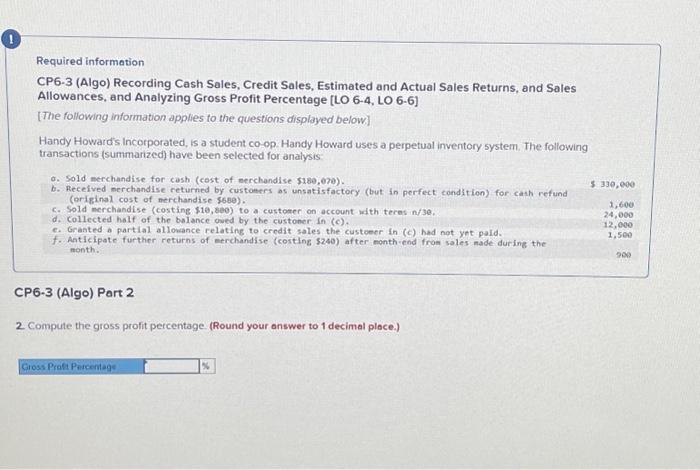

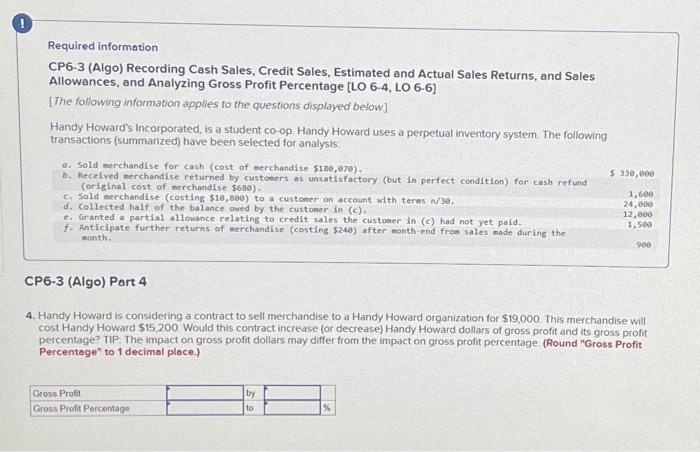

Required informotion CP6.3 (Algo) Recording Cash Soles, Credit Sales, Estimated and Actual Sales Returns, and Sales Allowances, and Analyzing Gross Profit Percentage [LO 6.4, LO 6.6] [The following information apples to the questions displayed below] Handy Howard's incorporated, is a student co-op. Handy Howard uses a perpetual inventory system. The followno transactions (summarized) have been selected for analysis: a. Sold erehandise for cash (cost of mecchandise $180,070). b. Recelved nerchandise returned by custoners as unsatisfactory (but in perfect condition) for cash refund (original cost of eerchandise j650). c. Sold erchandise (costine $10,000 ) to a custoner be account with terms n/se. d. Collected half of the balance onrd by the customer in (c). e. Geanted a partlal allowance relating to credit sales the custoner in (c) had not yet paid. f. Anticipate further returns of erchandise (costing \$240) after month-end from sales made during the month. CP6-3 (Algo) Part 1 Required: 1. Compute Net Sales and Gross Profit for Handy Howard Required information CP6-3 (Algo) Recording Cash Sales, Credit Sales, Estimated and Actual Sales Returns, and Sales Allowances, and Analyzing Gross Profit Percentage [LO 6-4, LO 6-6] [The following information applies to the questions displayed below] Handy Howard's incorporated, is a student co-op. Handy Howard uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: 0. Sold merchandise for cash (cest of merchandise $180,070 ). b. Recelved merchandise returned by customers os unsatisfactory (but in perfect condition) for cath refund (original cost of merchandise s6se). c. Sold merchandise (costing $10, see) to a custoner on account with teras n/3e. d. Collected half of the bolance owed by the custoner in (c). c. Grasted a partial allowance relating to credit sales the custoeer in (c) had not yet pald. f. Anticipate further returns of eerchandise (costing $240 ) after month-end from sales made during the 5330,000 nonth. CP6-3 (Algo) Part 2 2 Compute the gross profit percentage. (Round your answer to 1 decimal place.) Required information CP6-3 (Algo) Recording Cash Sales, Credit Sales, Estimated and Actual Sales Returns, and Sales Allowances, and Analyzing Gross Profit Percentage [LO 6-4, LO 6.6] [The following information applies to the questions displayed below] Handy Howard's Incorporated, is a student co-op. Handy Howard uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis. 0. Sold merchandise for cash (cost of merchandise $130,070 ). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $680 ). c. Sold merchandise (costing $10,800 ) to a custoner on account with terns n/30. d. Collected half of the balance oned by the customer in (c). e. Granted a partial allonance relating to credit sales the customer in (c) had not yet paid. f. Anticipate further returns of merchandise (costing \$24e) ofter month-end from sales made during the month. $330,000 1, see 24,000 12, eeo 1,500 900 CP6-3 (Algo) Port 4 4. Handy Howard is considering a contract to sell merchandise to a Handy Howard organization for $19,000. This merchandise will cost Handy Howard \$15,200. Would this contract increase (or decrease) Handy Howard dollars of gross profit and its gross profit percentage? TIP. The impact on gross profit dollars may differ from the impact on gross profit percentage (Round "Gross Profit Percentage" to 1 decimal place.)