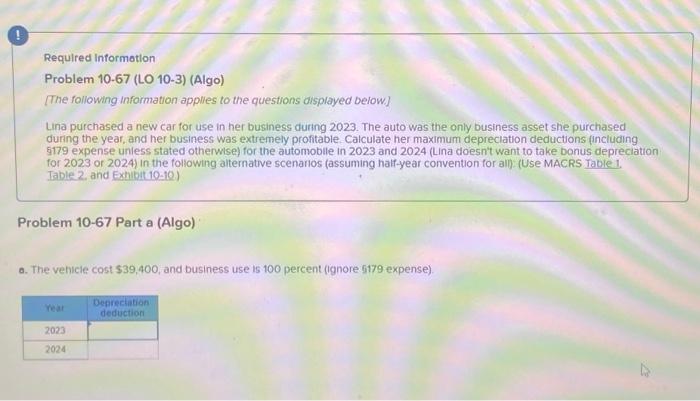

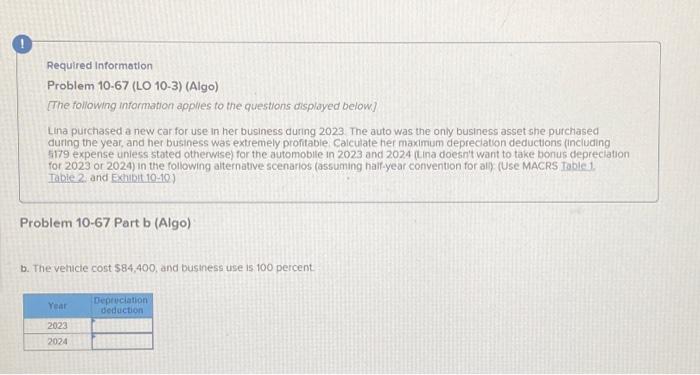

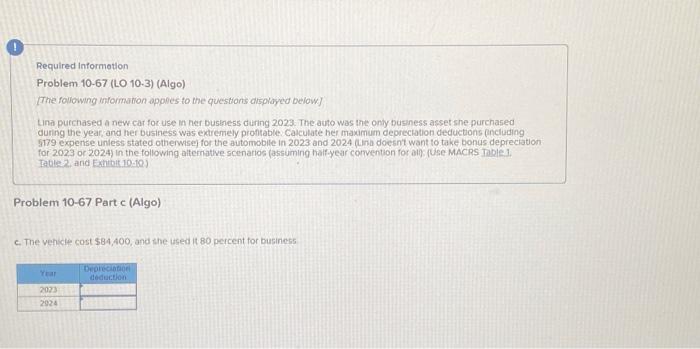

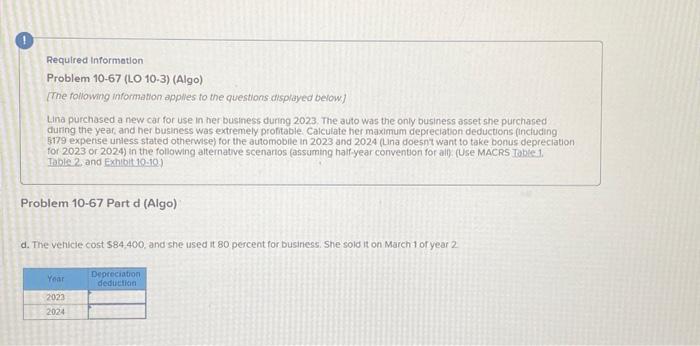

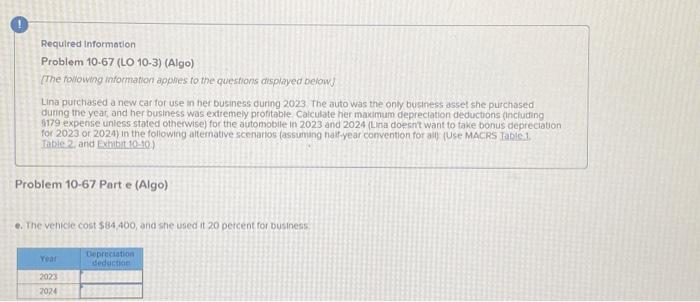

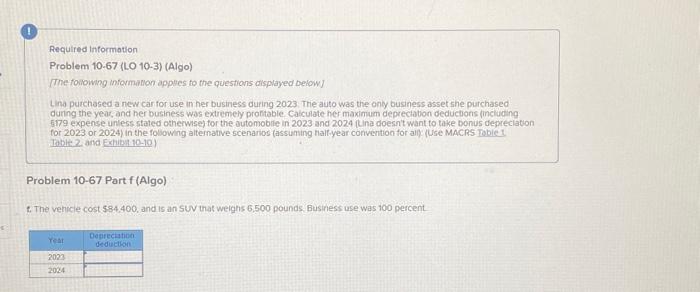

Required Informotion Problem 10-67 (LO 10-3) (Algo) [The following information applies to the questions oisplayed below] Una purchased a new car for use in her business during 2023. The auto was the only business asset she purchased during the year, and her business was extremely profitable Calculate her maximum depreciation deductions including 5179 expense unless stated otherwise) for the automobile in 2023 and 2024 (Lina doesn't want to take bonus depreciation for 2023 or 2024 ) in the following alternative scenarlos (assuming half-year convention for all) (USe MACRS Table 1. Table? 2 and Fxhithat 10-10) Problem 10-67 Part a (Algo) a. The vehicie cost $39,400, and business use is 100 percent (ignore 5179 expense) Required Information Problem 10-67 (LO 10-3) (Algo) [The following information applies to the questions displayed below] Eina purchased a new ear for use in her business during 2023 . The auto was the only business asset she purchased during the year, and her business was extremely profitable Calculate her maximum depreciaton deductions including $179 expense uniess stated otherwse) for the automoblie in 2023 and 2024 (cina doesn't want to take bonus depreciation for 2023 or 2024) in the following alternative scenarios (assuming half-year conventon for al) (Use MACRS Table 1. Table 2 and Exhibit 1010 ) Problem 10-67 Part b (Algo) b. The vehicie cost $84,400, and business use is 100 percent. Required informotion Problem 10-67 (t.O 10.3) (Algo) (The following information appies to the questions displayed below] Lina purchased a new car for use in her business duning 2023 . The auto was the only business asset she purchased during the year, and her business was extremely proftable, Calculate her maxamum depreciation deductions including 5779 expense unlest stated ofherwiser for the automobile in 2023 and 2024 Aina doesn't want to take bonus depreciation for 2023 or 2024) in the following alternative scemarios (assuming halfyear corvention for ail) (Use MACRS TaDle I. Problem 10-67 Part c (Algo) c. The vehicle cost $84,400, and the itsed it 80 percent for business Required informetion Problem 10-67 (t.O 10.3) (Algo) (The following information applles to the questions displayed below) Lina purchased a new car for use in her business during 2023. The auto was the only business asset she purchased during the year, and her business was extremely probitable. Caiculate her maximum depreciation deductions finctuding 5179 expense unless stated otherwsel for the athomobile in 2023 and 2024 f ina doesnt want to take honus deprectation for 2023 or 2024 ) in the following alternatve scenarios (assuming halfyear convention for alif). (USe MACRS Table: . Thble 2 and Exhibitio:10) Problem 10-67 Part d (Algo) d. The vehicie cost $84,400, and she used it 80 percent for business. She soid it on March 1 of year 2 Required informotion Problem 10-67 (LO 10-3) (Algo) The followng information apples to the questions displayed below] Lina putchased a new car for use in her businese during 2023 The auto was the only bushess asset she puitchased during the yeat, and her business was extremely profitable Calculate her maximum depreciation deductions (incfuding 1779 expetse unless stated otherwise) for the automobile in 2023 and 2024 (Lita doesnt want to take bonus deprecation fable 2 , and Exhbrt 10-4) Problem 10-67 Part e (Algo) e. The venicle cost $84,400, and she used it 20 percent for business. Requifed information Probtem 10.67 (t.0 10-3) (Algo) The foliowing informanon apples to the questions displayed below] Lino purchased a new car for use in her business during 2023. The auto was the ony business asset she purchased during the year, and her business was extremely probtable. Calculate her maximum depreciation deductions fincluding 5179 expence uniess stated otherwisel for the sutomobsie in 2023 and 2024 it ina doesn"t want to take bonus depreclatbon for 2023 or 2024 ) in the followng altemative scenarios (assuming flalf-year convention for alf (Use MACRS Toble 1 . Iable 2 and Exisin 10-10) Problem 10-67 Port f(Algo) 6. The vericle cost $84,400, and is an suv that weighs 6,500 pounds, Business use was 100 percent