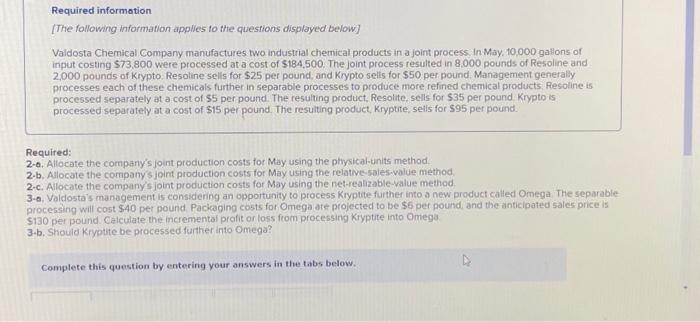

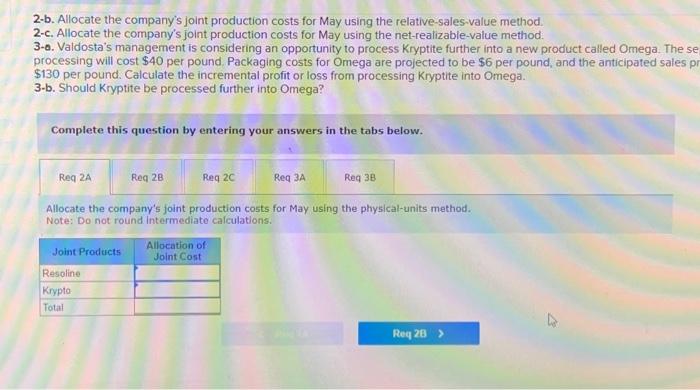

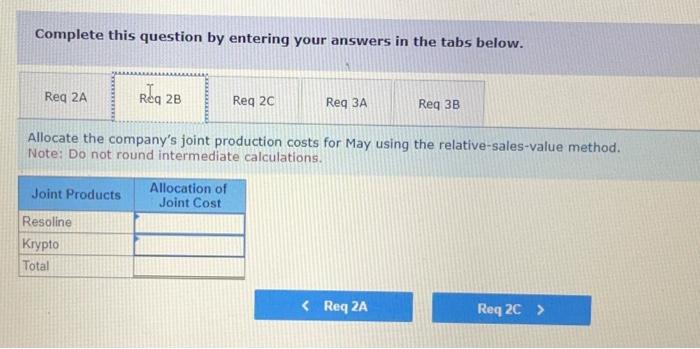

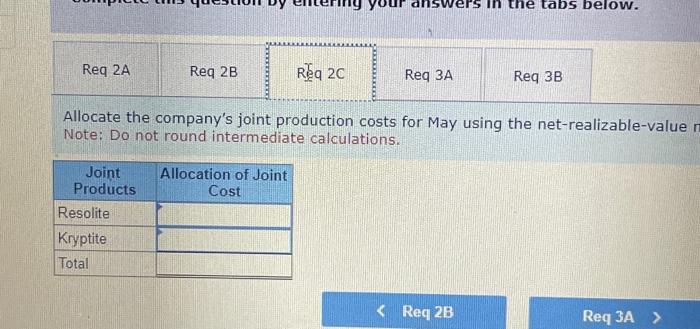

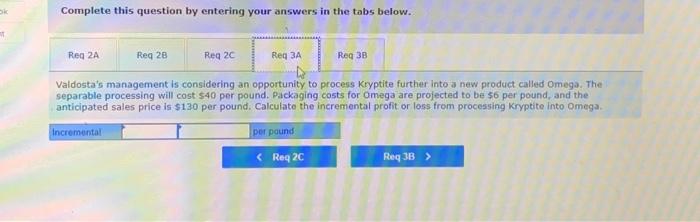

Required informotion [The following information applies to the questions displayed below] Valdosta Chemical Company manufactures two industrial chemical products in a joint process, In May, 10,000 gallons of input costing \\( \\$ 73,800 \\) were processed at a cost of \\( \\$ 184,500 \\). The joint process resulted in 8,000 pounds of Resoline and 2,000 pounds of Krypto. Resoline sells for \\( \\$ 25 \\) per pound, and Krypto sells for \\( \\$ 50 \\) per pound. Management generally processes each of these chemicals further in separable processes to produce more refined chemical products, Resoline is processed separately at a cost of \\( \\$ 5 \\) per pound. The resulung product, Resolite, sells for \\( \\$ 35 \\) per pound Krypto is processed separately at a cost of \\( \\$ 15 \\) per pound. The resulting product Kryptite, sells for \\( \\$ 95 \\) per pound. Required: 2-0. Allocate the company's joint production costs for May using the physical-units method. 2.b. Allocate the company's joint production costs for May using the relative-sales-value method. 2-c. Allocate the company's joint production costs for May using the net-realizable-value method. 3-a. Valdosta's management is considering an opportunity to process Kryptite further into a new product called Omega The separable processing will cost \\( \\$ 40 \\) per pound Packaging costs for Omega ate projected to be \\( \\$ 6 \\) per pound and the anticipated sales price is \\( \\$ 130 \\) per pound. Calculate the incremental profit or loss from processing Kryptite into Omega 3-b. Should Kryptite be processed further into Omega? Complete this question by entering your answers in the tabs below. 2-b. Allocate the company's joint production costs for May using the relative-sales-value method. 2-c. Allocate the company's joint production costs for May using the net-realizable-value method: 3-o. Valdosta's management is considering an opportunity to process Kryptite further into a new product called Omega. The se processing will cost \\( \\$ 40 \\) per pound. Packaging costs for Omega are projected to be \\( \\$ 6 \\) per pound, and the anticipated sales p \\( \\$ 130 \\) per pound. Calculate the incremental profit or loss from processing Kryptite into Omega. 3-b. Should Kryptite be processed further into Omega? Complete this question by entering your answers in the tabs below. Allocate the company's joint production costs for May using the physical-units method. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Allocate the company's joint production costs for May using the relative-sales-value method. Note: Do not round intermediate calculations. Allocate the company's joint production costs for May using the net-realizable-value Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Valdosta's management is considering an opportunity to process Kryptite further into a new product called Omega. The separable processing will cost \\( \\$ 40 \\) per pound. Packaging costs for omega are projected to be \\( \\$ 6 \\) per pound, and the anticipated sales price is \\( \\$ 130 \\) per pound. Calculato the incremental profit or loss from processing Kryptite into Omega. pro Valdosta's management is considering an opportunity to process Kryptite further into a new product called Omega. processing will cost \\( \\$ 40 \\) per pound. Packaging costs for Omega are projected to be \\( \\$ 6 \\) per pound, and the anticipated \\( \\$ 130 \\) per pound. Calculate the incremental profit or loss from processing Kryptite into Omega. 3-b. Should Kryptite be processed further into Omega? Complete this question by entering your answers in the tabs below. Should Kryptite be processed further into Omega