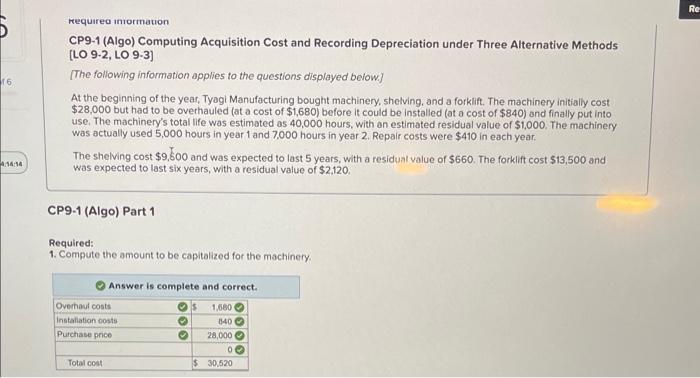

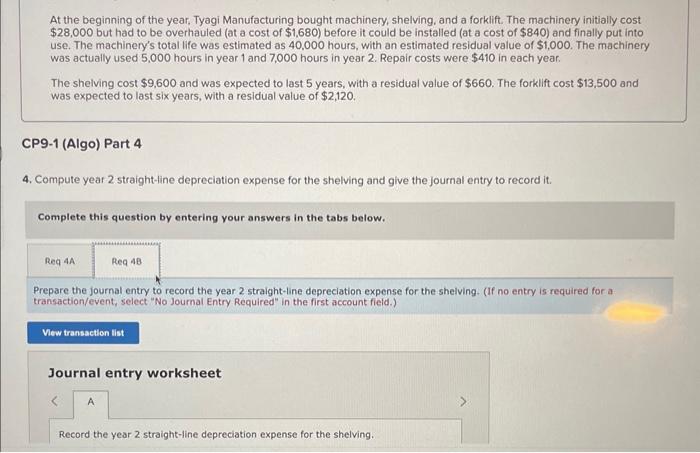

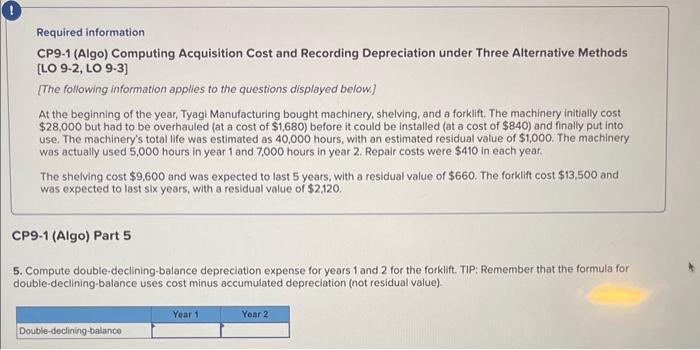

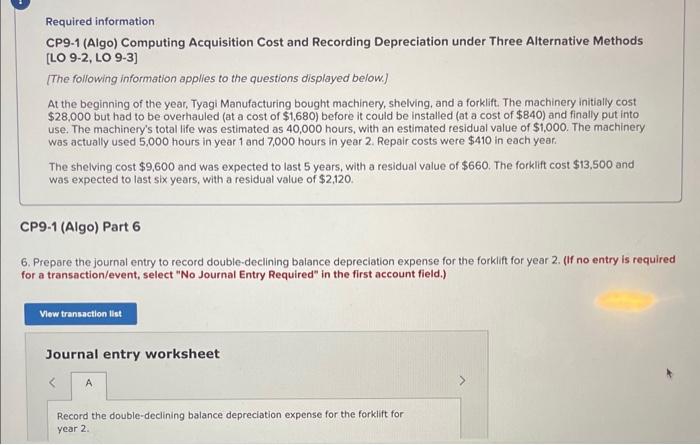

required iniormation CP9-1 (Algo) Computing Acquisition Cost and Recording Depreciation under Three Alternative Methods [LO 9-2, LO 9-3] [The following information applies to the questions displayed below] At the beginning of the year, Tyagi Manufacturing bought machinery, shelving, and a forklift. The machinery initially cost $28,000 but had to be overhauled (at a cost of $1,680 ) before it could be installed (at a cost of $840 ) and finally put into use. The machinery's total life was estimated as 40,000 hours, with an estimated residual value of $1,000. The machinery was actually used 5,000 hours in year 1 and 7,000 hours in year 2. Repair costs were $410 in each year. The shelving cost $9,600 and was expected to last 5 years, with a residual value of $660. The forklift cost $13,500 and was expected to last six years, with a residual value of $2,120. CP9-1 (Algo) Part 1 Required: 1. Compute the amount to be capitalized for the machinery. Required information CP9-1 (Algo) Computing Acquisition Cost and Recording Depreciation under Three Alternative Methods [LO 9-2, LO 9-3] [The following information applies to the questions displayed below] At the beginning of the year, Tyagi Manufacturing bought machinery, shelving, and a forklift. The machinery initially cost $28.000 but had to be overhauled (at a cost of $1,680 ) before it could be installed (at a cost of $840 ) and finally put into use. The machinery's total life was estimated as 40,000 hours, with an estimated residual value of $1,000. The machinery was actually used 5,000 hours in year 1 and 7,000 hours in year 2 . Repair costs were $410 in each year. The shelving cost $9,600 and was expected to last 5 years, with a residual value of $660. The forklift cost $13,500 and was expected to last six years, with a residual value of $2,120. CP9-1 (Algo) Part 2 2. Compute year 2 units-of-production depreciation expense for the machinery. (Do not round intermediate calculations.) [The following information applies to the questions displayed below.] At the beginning of the year, Tyagi Manufacturing bought machinery, shelving, and a forklift. The machinery initially cost $28,000 but had to be overhauled (at a cost of $1,680 ) before it could be installed (at a cost of $840 ) and finally put into use. The machinery's total life was estimated as 40,000 hours, with an estimated residual value of $1,000. The machinery was actually used 5,000 hours in year 1 and 7,000 hours in year 2 . Repair costs were $410 in each year. The shelving cost $9,600 and was expected to last 5 years, with a residual value of $660. The forklift cost $13,500 and was expected to last six years, with a residual value of $2,120. CP9-1 (Algo) Part 3 3. Prepare the journal entry to record year 2 depreciation expense for the machinery. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) [The following information applies to the questions displayed below.] At the beginning of the year, Tyagi Manufacturing bought machinery, shelving, and a forklift. The machinery initially cost $28,000 but had to be overhauled (at a cost of $1,680 ) before it could be installed (at a cost of $840 ) and finally put into use. The machinery's total life was estimated as 40,000 hours, with an estimated residual value of $1,000. The machinery was actually used 5,000 hours in year 1 and 7,000 hours in year 2 . Repair costs were $410 in each year. The shelving cost $9,600 and was expected to last 5 years, with a residual value of $660. The forklift cost $13,500 and was expected to last six years, with a residual value of $2,120. CP9-1 (Algo) Part 4 4. Compute year 2 straight-line depreciation expense for the shelving and give the journal entry to record it. Complete this question by entering your answers in the tabs below. Compute year 2 straight-line depreciation expense for the shelving. At the beginning of the year. Tyagi Manufacturing bought machinery, shelving, and a forklift. The machinery initially cost $28,000 but had to be overhauled (at a cost of $1,680 ) before it could be installed (at a cost of $840 ) and finally put into use. The machinery's total life was estimated as 40,000 hours, with an estimated residual value of $1,000. The machinery was actually used 5,000 hours in year 1 and 7,000 hours in year 2 . Repair costs were $410 in each year. The shelving cost $9,600 and was expected to last 5 years, with a residual value of $660. The forklift cost $13,500 and was expected to last six years, with a residual value of $2,120. CP9-1 (Algo) Part 4 4. Compute year 2 straight-line depreciation expense for the shelving and give the journal entry to record it. Complete this question by entering your answers in the tabs below. Prepare the journal entry to record the year 2 straight-ine depreciation expense for the shelving. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the year 2 straight-line depreciation expense for the shelving. Required information CP9-1 (Algo) Computing Acquisition Cost and Recording Depreciation under Three Alternative Methods [LO 9-2, LO 9-3] [The following information applies to the questions displayed below] At the beginning of the year, Tyagi Manufacturing bought machinery, shelving, and a forklift. The machinery initially cost $28,000 but had to be overhauled (at a cost of $1,680 ) before it could be installed (at a cost of $840 ) and finally put into use. The machinery's total life was estimated as 40,000 hours, with an estimated residual value of $1,000. The machinery was actually used 5,000 hours in year 1 and 7,000 hours in year 2. Repair costs were $410 in each yeat. The shelving cost $9,600 and was expected to last 5 years, with a residual value of $660. The forklift cost $13,500 and was expected to last six years, with a residual value of $2,120. CP9-1 (Algo) Part 5 5. Compute double-declining-balance depreciation expense for years 1 and 2 for the forklift. TIP: Remember that the formula for double-declining-balance uses cost minus accumulated depreciation (not residual value). Required information CP9-1 (Algo) Computing Acquisition Cost and Recording Depreciation under Three Alternative Methods [LO 9-2, LO 9-3] [The following information applies to the questions displayed below.] At the beginning of the year, Tyagi Manufacturing bought machinery, shelving, and a forklift. The machinery initially cost $28,000 but had to be overhauled (at a cost of $1,680 ) before it could be installed (at a cost of $840 ) and finally put into use. The machinery's total life was estimated as 40,000 hours, with an estimated residual value of $1,000. The machinery was actually used 5,000 hours in year 1 and 7,000 hours in year 2. Repair costs were $410 in each year. The shelving cost $9,600 and was expected to last 5 years, with a residual value of $660. The forklift cost $13,500 and was expected to last six years, with a residual value of $2,120. SP9-1 (Algo) Part 6 . Prepare the journal entry to record double-declining balance depreciation expense for the forklift for year 2 . (If no entry is required or a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the double-declining balance depreciation expense for the forklift for year 2