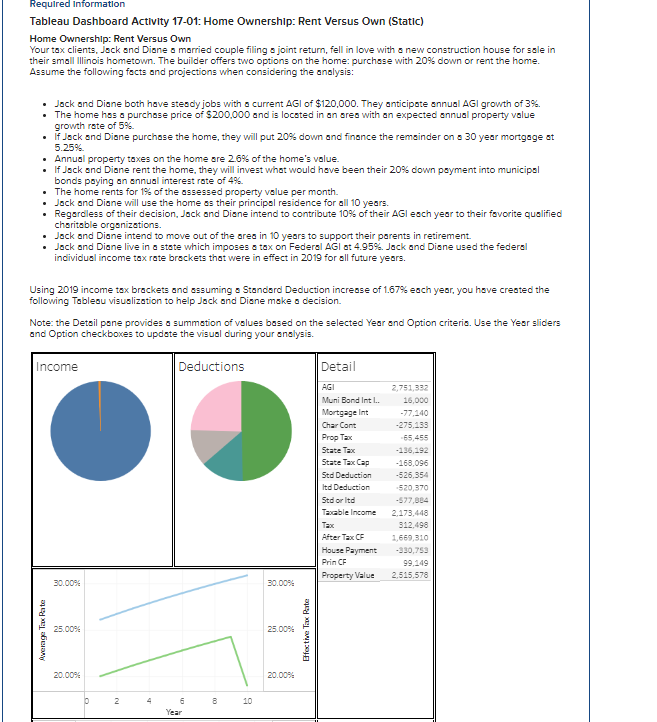

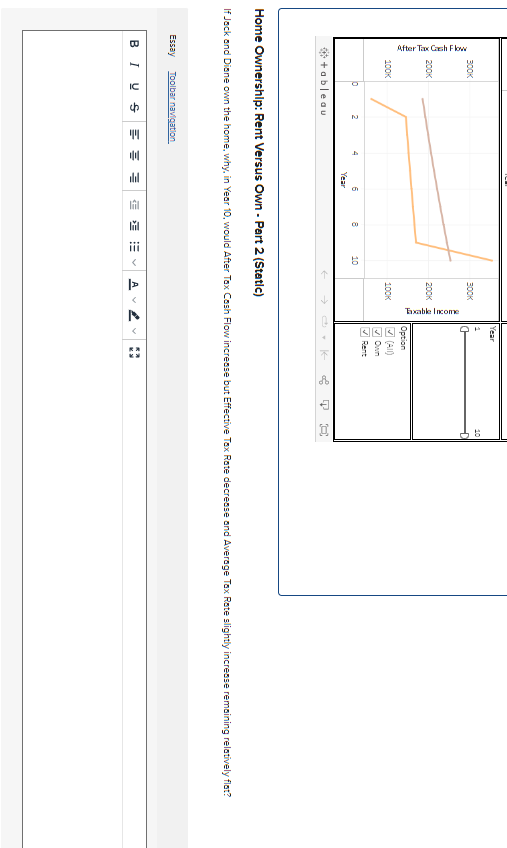

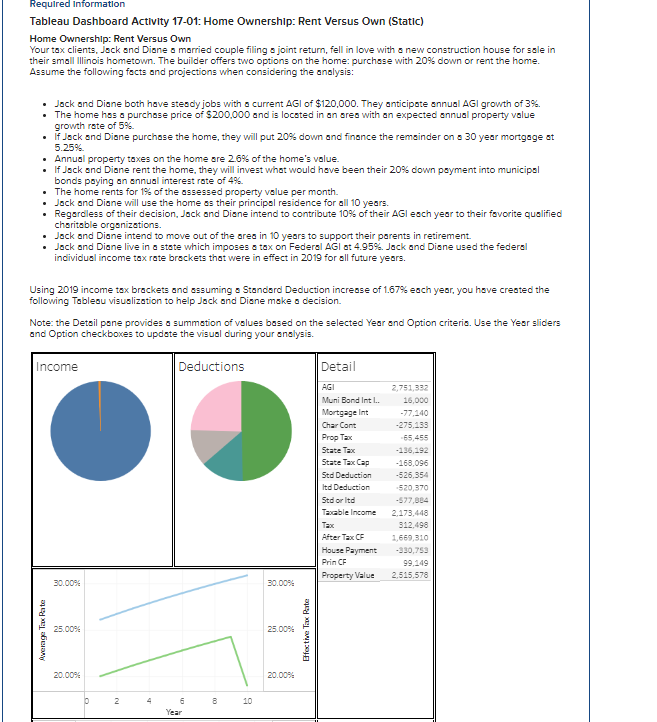

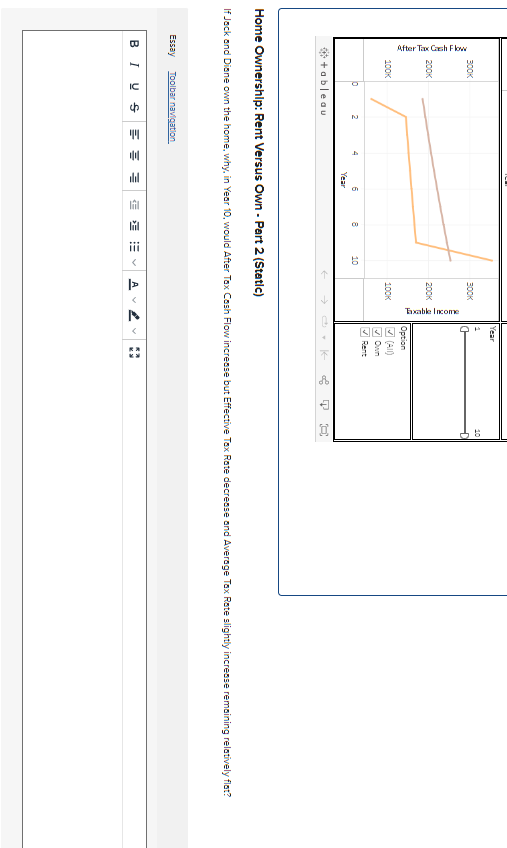

Required intormation Tableau Dashboard Activity 17-01: Home Ownership: Rent Versus Own (Static) Home Ownership: Rent Versus Own Your tax clients, Juck and Diane a married couple filing a joint return, fell in love with a new construction house for sale in their small Illinois hometown. The builder offers two options on the home: purchase with 20% down or rent the home. Assume the following facts and projections when considering the analysis: - Jock and Diane both have stesdy jobs with o current AGI of $120,000. They anticipote annual AGI grovth of 3%. - The home has a purchase price of $200,000 and is located in an areo with an expected annual property value growth rate of 5% - If Juck and Diane purchase the home, they will put 20% down and finance the remainder on a 30 year mortgage at 5.25% - Annual property taxes on the home are 2.6% of the home's value. - If Jock and Diane rent the home, they will invest whot would have been their 20% down payment into municips bonds paying an annual interest rate of 4%. - The home rents for 1% of the assessed property value per month. - Jack and Diane will use the home as their princips residence for all 10 years. - Regarcless of their decision, Jock and Diane intend to contribute 10% of their AGI each year to their fovorite qualified charitable orgenizations. - Jack and Diane intend to move out of the ares in 10 years to support their parents in retirement. - Jack and Diane live in a state which imposes a tax on Federal AGI at 4.95%. Jack and Diane used the federal individual income tax rate brackets that were in effect in 2019 for all future years. Using 2019 income tax brackets and assuming a Standsrd Deduction increase of 1.67% each year, you have created the following Tableau visuslization to help Jack and Diane make a decision. Note: the Detail pone provides a summation of volues based on the selected Year and Option criteria. Use the Yes sliders and Option checkbokes to update the visual during your analysis. Home Ownership: Rent Versus Own - Part 2 (Static) Required intormation Tableau Dashboard Activity 17-01: Home Ownership: Rent Versus Own (Static) Home Ownership: Rent Versus Own Your tax clients, Juck and Diane a married couple filing a joint return, fell in love with a new construction house for sale in their small Illinois hometown. The builder offers two options on the home: purchase with 20% down or rent the home. Assume the following facts and projections when considering the analysis: - Jock and Diane both have stesdy jobs with o current AGI of $120,000. They anticipote annual AGI grovth of 3%. - The home has a purchase price of $200,000 and is located in an areo with an expected annual property value growth rate of 5% - If Juck and Diane purchase the home, they will put 20% down and finance the remainder on a 30 year mortgage at 5.25% - Annual property taxes on the home are 2.6% of the home's value. - If Jock and Diane rent the home, they will invest whot would have been their 20% down payment into municips bonds paying an annual interest rate of 4%. - The home rents for 1% of the assessed property value per month. - Jack and Diane will use the home as their princips residence for all 10 years. - Regarcless of their decision, Jock and Diane intend to contribute 10% of their AGI each year to their fovorite qualified charitable orgenizations. - Jack and Diane intend to move out of the ares in 10 years to support their parents in retirement. - Jack and Diane live in a state which imposes a tax on Federal AGI at 4.95%. Jack and Diane used the federal individual income tax rate brackets that were in effect in 2019 for all future years. Using 2019 income tax brackets and assuming a Standsrd Deduction increase of 1.67% each year, you have created the following Tableau visuslization to help Jack and Diane make a decision. Note: the Detail pone provides a summation of volues based on the selected Year and Option criteria. Use the Yes sliders and Option checkbokes to update the visual during your analysis. Home Ownership: Rent Versus Own - Part 2 (Static)