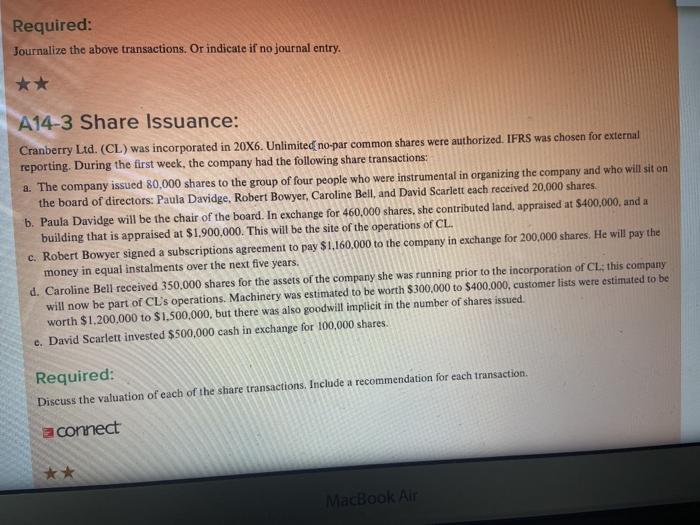

Required: Journalize the above transactions. Or indicate if no journal entry. A14-3 Share Issuance: Cranberry Ltd. (CL) was incorporated in 20X6. Unlimited no-par common shares were authorized. IFRS was chosen for external reporting. During the first week, the company had the following share transactions: a. The company issued 80,000 shares to the group of four people who were instrumental in organizing the company and who will sit on the board of directors: Paula Davidge, Robert Bowyer, Caroline Bell, and David Scarlett each received 20,000 shares b. Paula Davidge will be the chair of the board. In exchange for 460,000 shares, she contributed land, appraised at $400,000, and a building that is appraised at $1.900,000. This will be the site of the operations of CL. c. Robert Bowyer signed a subscriptions agreement to pay $1,160,000 to the company in exchange for 200,000 shares. He will pay the money in equal instalments over the next five years, d. Caroline Bell received 350,000 shares for the assets of the company she was running prior to the incorporation of Ch: this company will now be part of CL's operations. Machinery was estimated to be worth $300,000 to $400.000, customer lists were estimated to be worth $1,200,000 to $1,500,000, but there was also goodwill implicit in the number of shares issued. e. David Scarlett invested $500,000 cash in exchange for 100,000 shares. Required: Discuss the valuation of each of the share transactions. Include a recommendation for each transaction. a connect MacBook Air Required: Journalize the above transactions. Or indicate if no journal entry. A14-3 Share Issuance: Cranberry Ltd. (CL) was incorporated in 20X6. Unlimited no-par common shares were authorized. IFRS was chosen for external reporting. During the first week, the company had the following share transactions: a. The company issued 80,000 shares to the group of four people who were instrumental in organizing the company and who will sit on the board of directors: Paula Davidge, Robert Bowyer, Caroline Bell, and David Scarlett each received 20,000 shares b. Paula Davidge will be the chair of the board. In exchange for 460,000 shares, she contributed land, appraised at $400,000, and a building that is appraised at $1.900,000. This will be the site of the operations of CL. c. Robert Bowyer signed a subscriptions agreement to pay $1,160,000 to the company in exchange for 200,000 shares. He will pay the money in equal instalments over the next five years, d. Caroline Bell received 350,000 shares for the assets of the company she was running prior to the incorporation of Ch: this company will now be part of CL's operations. Machinery was estimated to be worth $300,000 to $400.000, customer lists were estimated to be worth $1,200,000 to $1,500,000, but there was also goodwill implicit in the number of shares issued. e. David Scarlett invested $500,000 cash in exchange for 100,000 shares. Required: Discuss the valuation of each of the share transactions. Include a recommendation for each transaction. a connect MacBook Air