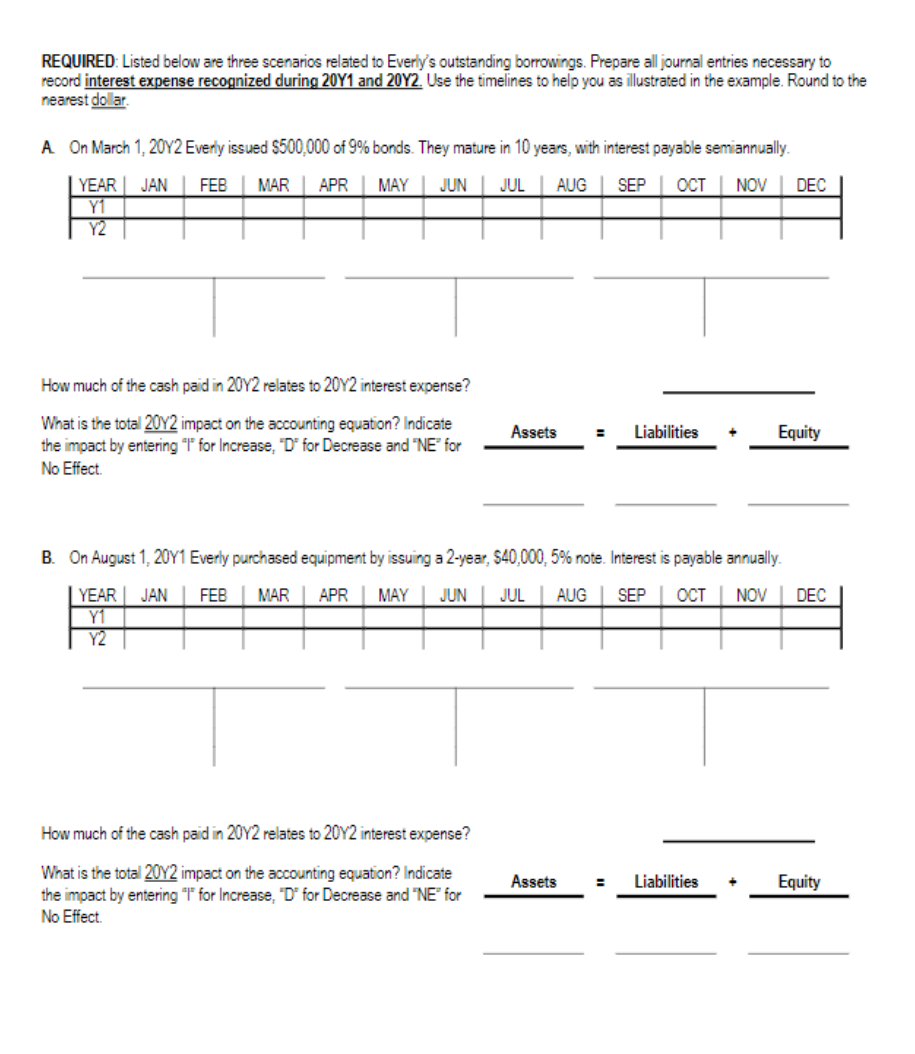

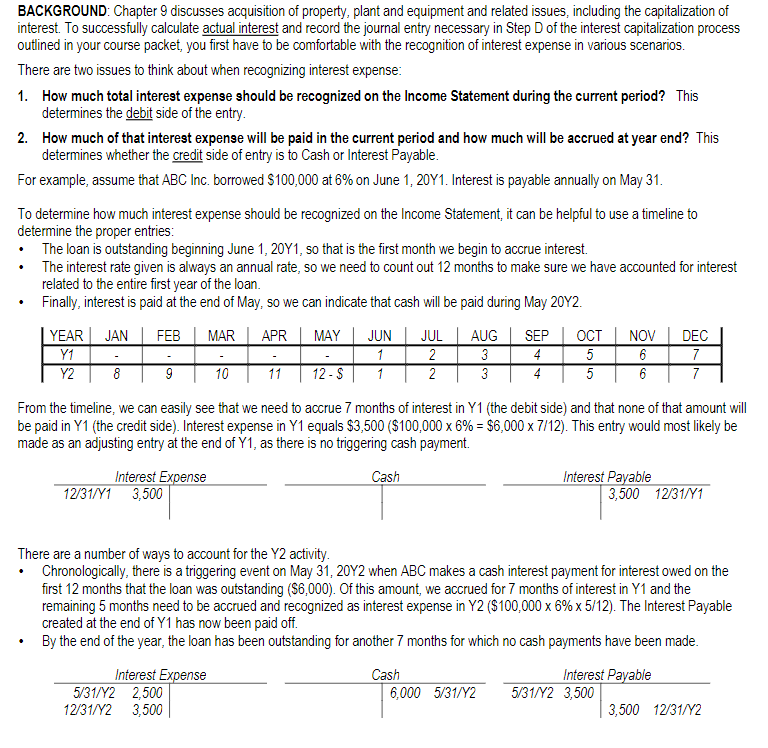

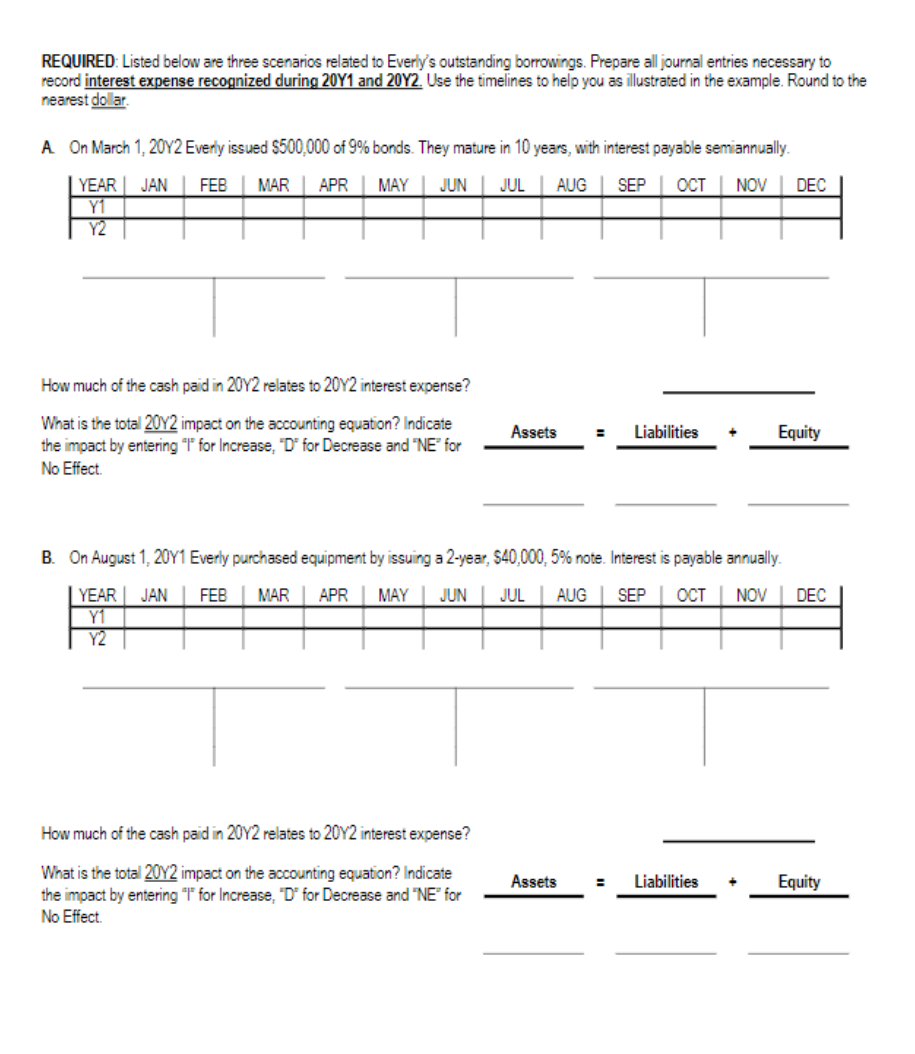

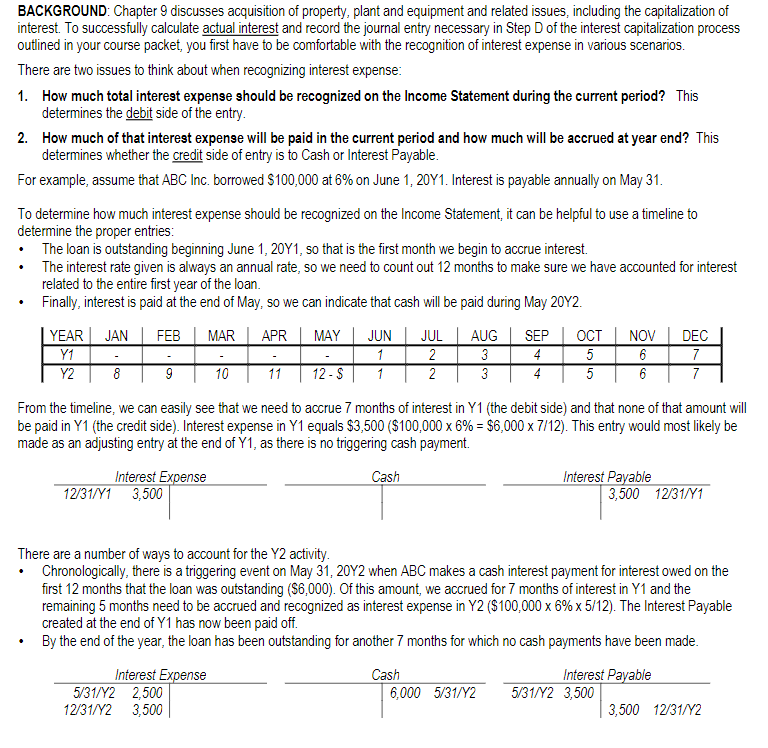

REQUIRED: Listed below are three scenarios related to Everly's outstanding borrowings. Prepare all journal entries necessary to record interest expense recognized during 20Y1 and 20Y2. Use the timelines to help you as illustrated in the example. Round to the nearest dolar. A. On March 1, 20Y2 Every issued $500,000 of 9% bonds. They mature in 10 years, with interest payable semiannually. How much of the cash paid in 20Y2 relates to 20Y2 interest expense? What is the total 20Y2 impact on the accounting equation? Indicate the impact by entering " 1 " for Increase, "D" for Decrease and "NE" for No Effect. B. On August 1, 20 Y1 Everly purchased equipment by issuing a 2-year, $40,000,5% note. Interest is payable annually. How much of the cash paid in 20Y2 relates to 20Y2 interest expense? What is the total 20Y2 impact on the accounting equation? Indicate the impact by entering "I" for Increase, "D" for Decrease and "NE" for Assets = Liabilities + Equity No Effect. BACKGROUND: Chapter 9 discusses acquisition of property, plant and equipment and related issues, including the capitalization of interest. To successfully calculate actual interest and record the journal entry necessary in Step D of the interest capitalization process outlined in your course packet, you first have to be comfortable with the recognition of interest expense in various scenarios. There are two issues to think about when recognizing interest expense: 1. How much total interest expense should be recognized on the Income Statement during the current period? This determines the debit side of the entry. 2. How much of that interest expense will be paid in the current period and how much will be accrued at year end? This determines whether the credit side of entry is to Cash or Interest Payable. For example, assume that ABC Inc. borrowed $100,000 at 6% on June 1,20Y1. Interest is payable annually on May 31. To determine how much interest expense should be recognized on the Income Statement, it can be helpful to use a timeline to determine the proper entries: - The loan is outstanding beginning June 1,20Y1, so that is the first month we begin to accrue interest. - The interest rate given is always an annual rate, so we need to count out 12 months to make sure we have accounted for interest related to the entire first year of the loan. - Finally, interest is paid at the end of May, so we can indicate that cash will be paid during May 20Y2. From the timeline, we can easily see that we need to accrue 7 months of interest in Y1 (the debit side) and that none of that amount will be paid in Y1 (the credit side). Interest expense in Y1 equals $3,500($100,0006%=$6,0007/12). This entry would most likely be made as an adjusting entry at the end of Y1, as there is no triggering cash payment. There are a number of ways to account for the Y2 activity. - Chronologically, there is a triggering event on May 31,20Y2 when ABC makes a cash interest payment for interest owed on the first 12 months that the loan was outstanding ($6,000). Of this amount, we accrued for 7 months of interest in Y1 and the remaining 5 months need to be accrued and recognized as interest expense in Y2($100,0006%5/12). The Interest Payable created at the end of Y1 has now been paid off. - By the end of the year, the loan has been outstanding for another 7 months for which no cash payments have been made. REQUIRED: Listed below are three scenarios related to Everly's outstanding borrowings. Prepare all journal entries necessary to record interest expense recognized during 20Y1 and 20Y2. Use the timelines to help you as illustrated in the example. Round to the nearest dolar. A. On March 1, 20Y2 Every issued $500,000 of 9% bonds. They mature in 10 years, with interest payable semiannually. How much of the cash paid in 20Y2 relates to 20Y2 interest expense? What is the total 20Y2 impact on the accounting equation? Indicate the impact by entering " 1 " for Increase, "D" for Decrease and "NE" for No Effect. B. On August 1, 20 Y1 Everly purchased equipment by issuing a 2-year, $40,000,5% note. Interest is payable annually. How much of the cash paid in 20Y2 relates to 20Y2 interest expense? What is the total 20Y2 impact on the accounting equation? Indicate the impact by entering "I" for Increase, "D" for Decrease and "NE" for Assets = Liabilities + Equity No Effect. BACKGROUND: Chapter 9 discusses acquisition of property, plant and equipment and related issues, including the capitalization of interest. To successfully calculate actual interest and record the journal entry necessary in Step D of the interest capitalization process outlined in your course packet, you first have to be comfortable with the recognition of interest expense in various scenarios. There are two issues to think about when recognizing interest expense: 1. How much total interest expense should be recognized on the Income Statement during the current period? This determines the debit side of the entry. 2. How much of that interest expense will be paid in the current period and how much will be accrued at year end? This determines whether the credit side of entry is to Cash or Interest Payable. For example, assume that ABC Inc. borrowed $100,000 at 6% on June 1,20Y1. Interest is payable annually on May 31. To determine how much interest expense should be recognized on the Income Statement, it can be helpful to use a timeline to determine the proper entries: - The loan is outstanding beginning June 1,20Y1, so that is the first month we begin to accrue interest. - The interest rate given is always an annual rate, so we need to count out 12 months to make sure we have accounted for interest related to the entire first year of the loan. - Finally, interest is paid at the end of May, so we can indicate that cash will be paid during May 20Y2. From the timeline, we can easily see that we need to accrue 7 months of interest in Y1 (the debit side) and that none of that amount will be paid in Y1 (the credit side). Interest expense in Y1 equals $3,500($100,0006%=$6,0007/12). This entry would most likely be made as an adjusting entry at the end of Y1, as there is no triggering cash payment. There are a number of ways to account for the Y2 activity. - Chronologically, there is a triggering event on May 31,20Y2 when ABC makes a cash interest payment for interest owed on the first 12 months that the loan was outstanding ($6,000). Of this amount, we accrued for 7 months of interest in Y1 and the remaining 5 months need to be accrued and recognized as interest expense in Y2($100,0006%5/12). The Interest Payable created at the end of Y1 has now been paid off. - By the end of the year, the loan has been outstanding for another 7 months for which no cash payments have been made