Answered step by step

Verified Expert Solution

Question

1 Approved Answer

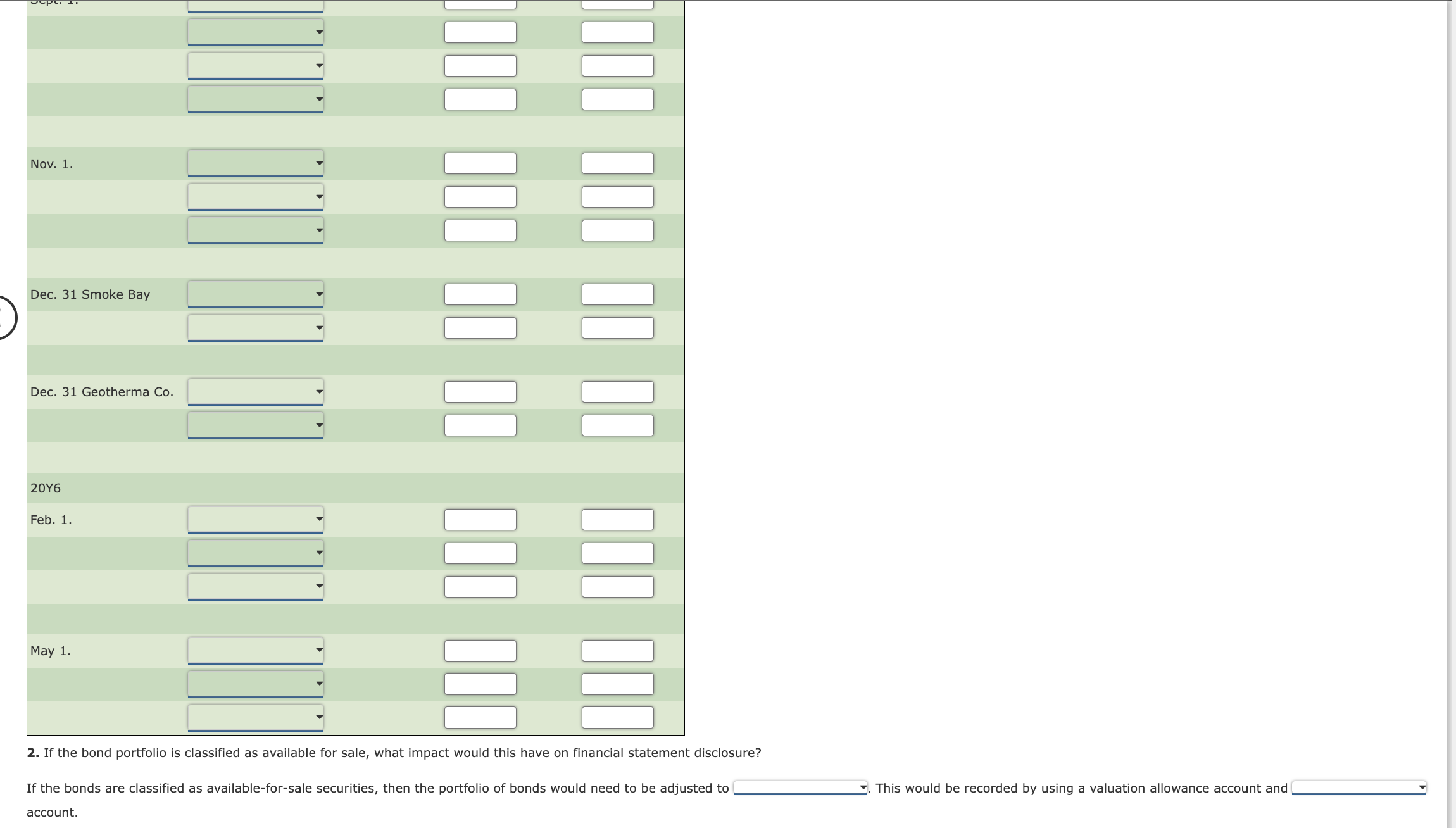

Required: nearest whole month for the interest period. disclosure? If the bonds are classified as available-for-sale securities, then the portfolio of bonds would need to

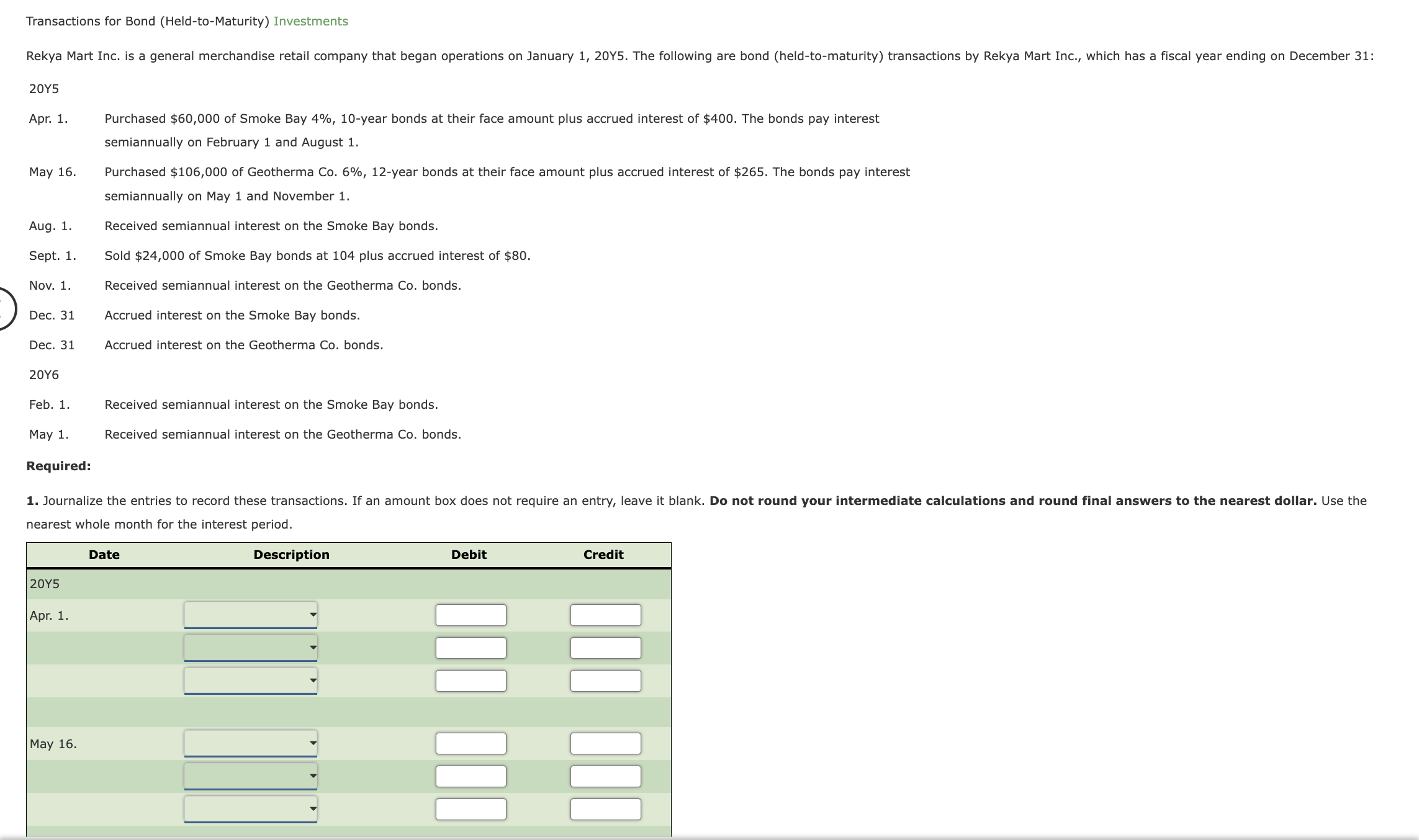

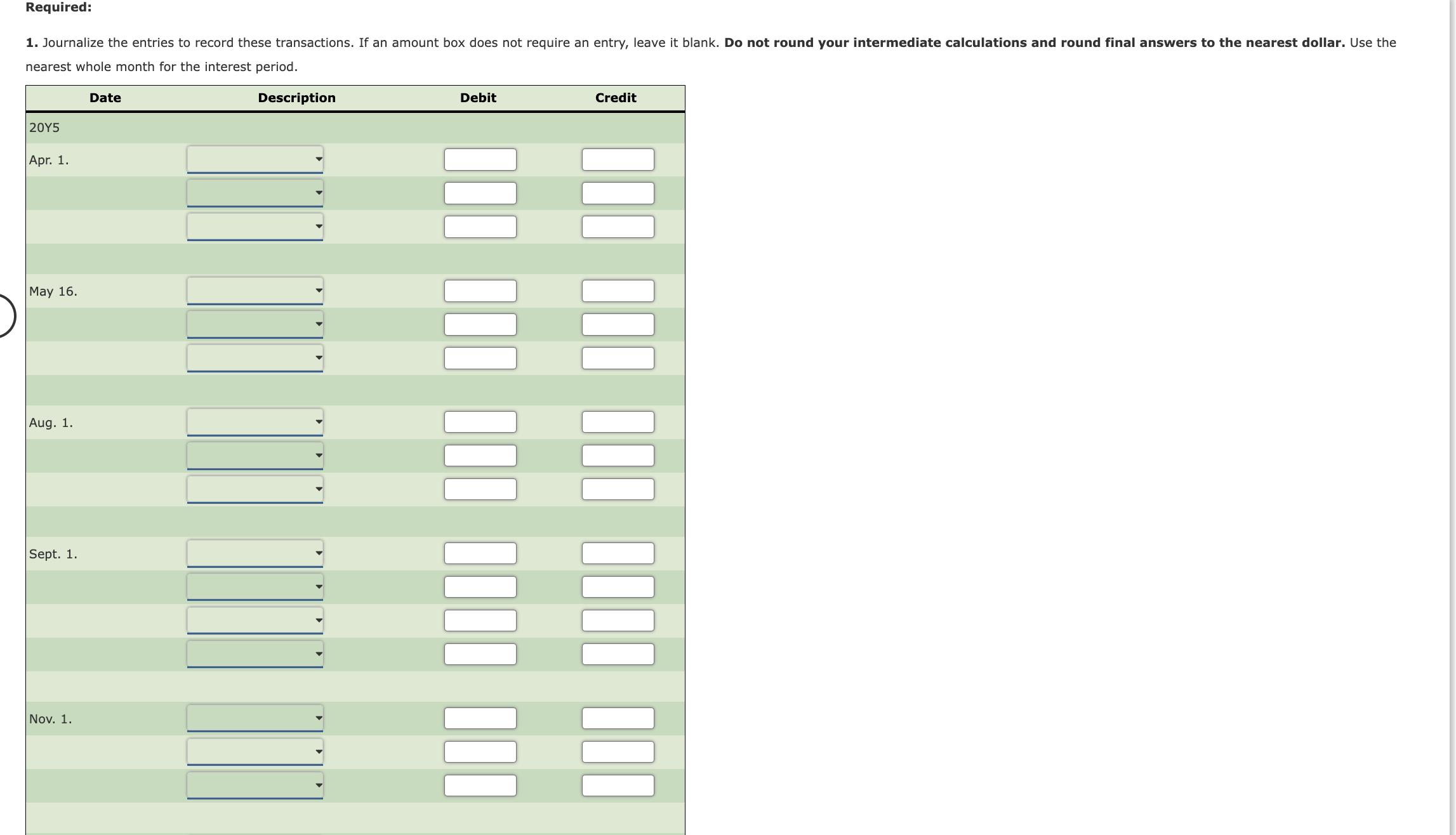

Required: nearest whole month for the interest period. disclosure? If the bonds are classified as available-for-sale securities, then the portfolio of bonds would need to be adjusted to . This would be recorded by using a valuation allowance account and account. Transactions for Bond (Held-to-Maturity) Investments 20Y5 Apr. 1. Purchased $60,000 of Smoke Bay 4%,10-year bonds at their face amount plus accrued interest of $400. The bonds pay interest semiannually on February 1 and August 1. May 16. Purchased $106,000 of Geotherma Co. 6%, 12 -year bonds at their face amount plus accrued interest of $265. The bonds pay interest semiannually on May 1 and November 1. Aug. 1. Received semiannual interest on the Smoke Bay bonds. Sept. 1. Sold $24,000 of Smoke Bay bonds at 104 plus accrued interest of $80. Nov. 1. Received semiannual interest on the Geotherma Co. bonds. Dec. 31 Accrued interest on the Smoke Bay bonds. Dec. 31 Accrued interest on the Geotherma Co. bonds. 20Y6 Feb. 1. Received semiannual interest on the Smoke Bay bonds. May 1. Received semiannual interest on the Geotherma Co. bonds. Required

Required: nearest whole month for the interest period. disclosure? If the bonds are classified as available-for-sale securities, then the portfolio of bonds would need to be adjusted to . This would be recorded by using a valuation allowance account and account. Transactions for Bond (Held-to-Maturity) Investments 20Y5 Apr. 1. Purchased $60,000 of Smoke Bay 4%,10-year bonds at their face amount plus accrued interest of $400. The bonds pay interest semiannually on February 1 and August 1. May 16. Purchased $106,000 of Geotherma Co. 6%, 12 -year bonds at their face amount plus accrued interest of $265. The bonds pay interest semiannually on May 1 and November 1. Aug. 1. Received semiannual interest on the Smoke Bay bonds. Sept. 1. Sold $24,000 of Smoke Bay bonds at 104 plus accrued interest of $80. Nov. 1. Received semiannual interest on the Geotherma Co. bonds. Dec. 31 Accrued interest on the Smoke Bay bonds. Dec. 31 Accrued interest on the Geotherma Co. bonds. 20Y6 Feb. 1. Received semiannual interest on the Smoke Bay bonds. May 1. Received semiannual interest on the Geotherma Co. bonds. Required Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started