Question: required: Once the board and management are set, a location is selected and the overall vision for the bank is created. The organizing group then

required:

Once the board and management are set, a location is selected and the overall vision for the bank is created. The organizing group then sends its plan, along with information on the board and management, to regulators who review it and decide if the bank can be granted a charter. The review costs thousands of dollars, and the plan may be sent back with recommendations that need to be addressed for approval.

Since then, the old distinction between a commercial bank and an investment bank is essentially meaningless. For example, as of 2013, JPMorgan Chase Bank is among the largest commercial banks in the U.S. by assets; in 2012, the same bank was one of the lead underwriters in the Facebook IPO.23

For better or worse, we've lost the issuance of securities and active investment in securities as defining actions that a commercial bank cannot take. Instead, we can look at the actions all commercial banks share.

Commercial Banks

- Accept deposits

- Lend money

- Process payments

- Issue bank drafts and checks

- Offer safety deposit boxes for items and documents

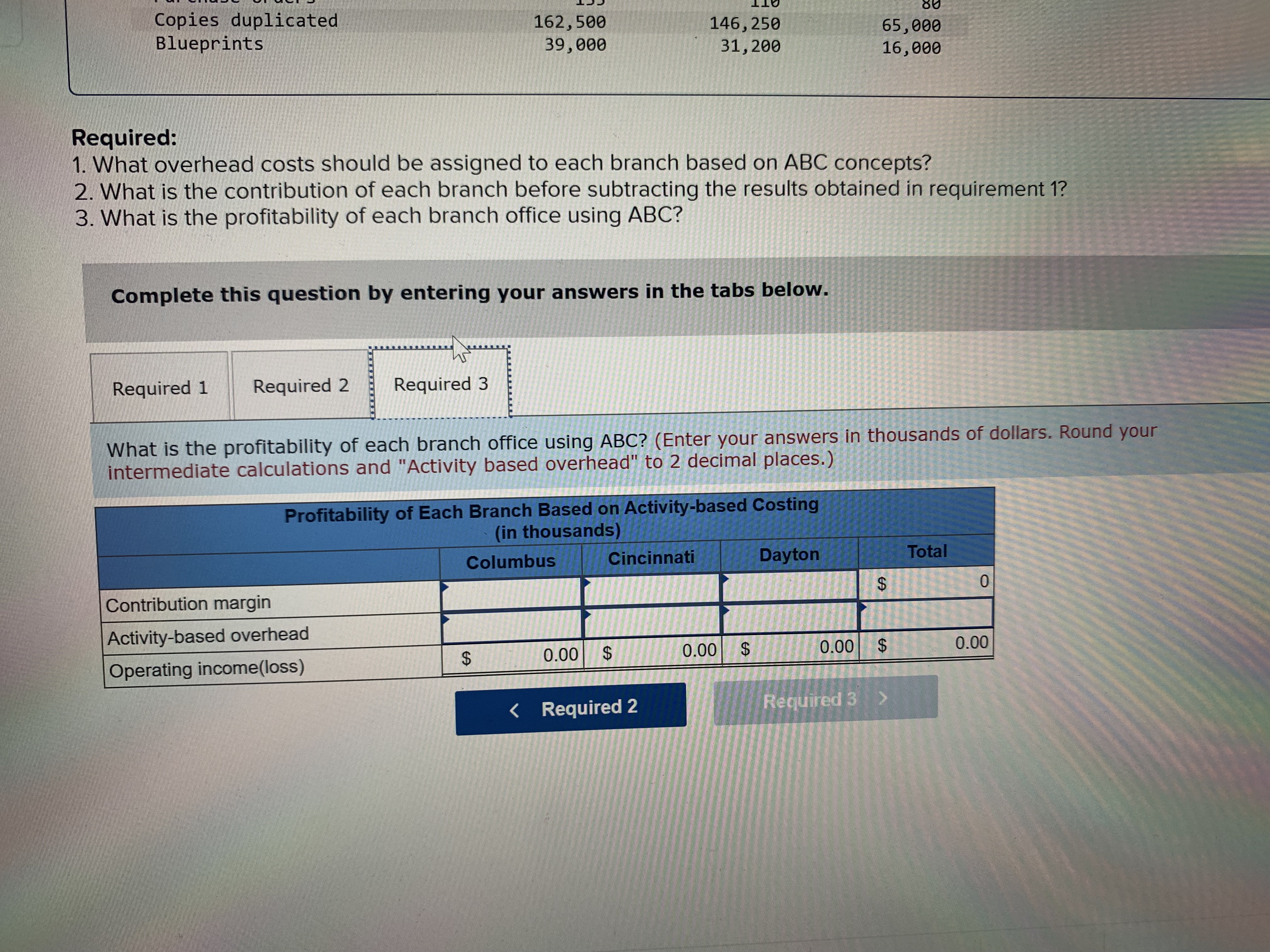

#4 (Chapter 5) i Saved Fleet Street Incorporated a manufacturer of high-fashion clothing for women, is located in South London in the UK. Its product line consists of trousers (33%), skirts (32%), dresses (10%), and other (25%). Fleet Street has been using a volume-based rate to assign overhead to each product; the rate it uses is $2.36 per unit produced. The results for the trousers line, using the volume-based approach, are as follows: Number of units produced 13 , 000 Price (all figures in f) 27 . 61 Total revenue 358,930 Direct materials 59 , 000 Direct labor 197, 000 Overhead (volume-based) 30 , 680 Total product cost 286 , 680 Nonmanufacturing expenses 53 , 600 Total cost 340 , 280 Profit margin for trousers 18 , 650 Recently, Fleet Street conducted a further analysis of the trousers line of product, using ABC. In the study, eight activities were identified, and direct labor was assigned to the activities. The total conversion cost (labor and overhead) for the eight activities, after allocation to the trousers line, is as follows: Pattern cutting f 34, 380 Grading 29 , 400 Lay planning 28 , 600 Sewing 32 , 80 0 Finishing 21 , 700 Inspection 9 , 60 0 Boxing up 5 , 200 Storage 10 , 400 Required: 1. Determine the profit margin for trousers using ABC. Profit marginnment #4 (Chapter 5) i Saved Drilling Company uses activity-based costing and provides this information: Driver Manufacturing Activity Cost Driver Rate Materials handling Number of parts $ 0. 30 Machinery Number of machine hours 42.00 Assembly Number of parts 2. 46 Inspection Number of finished units 21.00 Drilling has just completed 71 units of a component for a customer. Each unit required 91 parts and 2.55 machine hours. The prime cost is $1,210 per finished unit. All other manufacturing costs are classified as manufacturing overhead. Required: 1. Compute the total manufacturing costs and the unit costs of the 71 units just completed using ABC costing. 2. In addition to the manufacturing costs, the firm has determined that the total cost of upstream activities, including research and development and product design, is $171 per unit. The total cost of downstream activities, such as distribution, marketing, and customer service, is $291 per unit. Compute the full product cost per unit, including upstream, manufacturing, and downstream activities. Also compute the relative proportion of each main cost category. Complete this question by entering your answers in the tabs below. Required 1 Required 2 In addition to the manufacturing costs, the firm has determined that the total cost of upstream activities, including research and development and product design, is $171 per unit. The total cost of downstream activities, such as distribution, marketing, and customer service, is $291 per unit. Compute the full product cost per unit, including upstream, manufacturing, and downstream activities. Also compute the relative proportion of each main cost category. (Round your final answers to 2 decimal places. For percentages . 1234 = 12.34%.) Show less A Computation of full cost: Upstream activity costs % Manufacturing costs % Downstream activity costs % % Full product cost per unit Coffee Bean Incorporated (CBI) processes and distributes high-quality coffee. CBI buys coffee beans from around the world and roasts, blends, and packages them for resale. Currently, the firm offers 2 coffees to gourmet shops in 1-pound bags. The major cost is direct materials; however, a substantial amount of factory overhead is incurred in the predominantly automated roasting and packing process. The company uses relatively little direct labor. CBI prices its coffee at full product cost, including allocated overhead, plus a markup of 30%. If its prices are significantly higher than the market, CBI lowers its prices. The company competes primarily on the quality of its products, but customers are price conscious as well . Data for the current budget include factory overhead of $3,112,000, which has been allocated on the basis of each product's direct labor cost. The budgeted direct labor cost for the current year totals $600,000. The firm budgeted $6,000,000 for purchase and use of direct materials (mostly coffee beans). The budgeted direct costs for 1-pound bags are as follows: Mona Loa Malaysian Direct materials $ 4.20 $ 3. 20 Direct labor 0. 30 0 . 30 CBI's controller, Mona Clin, believes that its current product costing system could be providing misleading cost information. She has developed this analysis of the current year's budgeted factory overhead costs: Budgeted Driver Activity Cost Driver Consumption Budgeted Cost Purchasing Purchase orders 1, 238 $ 619, 000 Materials handling Setups 1, 880 752, 000 Quality control Batches 800 160, 000 Roasting Roasting hours 96, 900 969, 000 Blending Blending hours 34, 400 344, 000 Packaging hours 26, 800 268, 000 Packaging Total factory overhead cost $ 3, 112, 000 Data regarding the current year's production for the Mona Loa and Malaysian lines follow. There is no beginning or ending direct materials inventory for either of these coffees Mona Loa Malaysian Budgeted sales 100, 000 pounds 2, 000 pounds Batch size 10, 000 pounds 500 pounds Setuns 3 ner hatch ner hatch 2:34 PM 9 w 5.C Mostly cloudy ~ 09/02/2022 Type here to searchMona Loa Malaysian Budgeted sales 100, 000 pounds 2, 000 pounds Batch size 10, 000 pounds 500 pounds Setups 3 per batch 3 per batch Purchase order size 25, 000 pounds 500 pounds Roasting time 1 hour per 100 pounds 1 hour per 100 pounds Blending time 0.5 hour per 100 pounds 0.5 hour per 100 pounds Packaging time 0.1 hour per 100 pounds 0.1 hour per 100 pounds Coffee Bean has total practical capacity as noted in the table below, i.e. processing 1,560 purchase orders, 2,560 setups, etc. These are the levels of activity work that are sustainable. Practical Activity Capacity Purchasing 1, 560 Materials handling 2, 560 Quality control 1, 360 Roasting 101, 600 Blending 37, 600 Packaging 31, 600 Required: 1. Determine the activity rates based on practical capacity and the cost of idle capacity for each activity. (Round "Usage %" and "Practical Capactity Rate" to 2 decimal places. For percentages .1234 = 12.34%.) Practical Usage Based Capacity at Practical Unused Idle Capacity Budgeted Usage % Activity Budgeted Cost Rate Current Capacity Rate Capacity Cost Activity Spending 1,238 $ 619,000 ,560 Purchasing Materials handling 1,880 $ 752,000 2,560 160,000 1,360 Quality control 300 $ 96,900 969,000 101,600 Roasting 344,000 37,600 Blending 34,400 26,800 $ 268,000 31,600 Packaging $ 3, 112,000 2:34 PM 5C Mostly cloudy 09/02/2022 27 9 W ype here to searchMiami Valley Architects Inc. provides a wide range of engineering and architectural consulting services through its three branch offices in Columbus, Cincinnati, and Dayton, Ohio. The company allocates resources and bonuses to the three branches based on the net income of the period. The results of the firm's performance for the most recent year follows ($ in thousands): Columbus Cincinnati Dayton Total Sales $ 1, 500 $ 1, 419 $ 1, 067 $ 3,986 Less : Direct labor 382 317 317 1, 016 Direct materials 281 421 185 887 Overhead 710 589 589 1 , 888 Net income $ 127 $ 92 $ (24) $ 195 Miami Valley accumulates overhead items in one overhead pool and allocates it to the branches based on direct labor dollars. For this year, the predetermined overhead rate was $1.859 for every direct labor dollar incurred by an office. The overhead pool includes rent, depreciation, and taxes, regardless of which office incurred the expense. Some branch managers complain that the overhead allocation method forces them to absorb a portion of the overhead incurred by the other offices. Management is concerned with the recent operating results. During a review of overhead expenses, management noticed that many overhead items were clearly not correlated to the movement in direct labor dollars as previously assumed. Management decided that applying overhead based on activity-based costing and direct tracing wherever possible should provide a more accurate picture of the profitability of each branch. An analysis of the overhead revealed that the following dollars for rent, utilities, depreciation, and taxes could be traced directly to the office that incurred the overhead ($ in thousands): Columbus Cincinnati Dayton Total Direct overhead $ 180 $ 270 $ 177 $ 627 Activity pools and their corresponding cost drivers were determined from the accounting records and staff surveys as follows: General administration $ 409 , 000 Project costing 48 , 000 Accounts payable/receiving 139, 000 Accounts receivable 47 , 000 Payroll/Mail sort and delivery 30 , 000 Personnel recruiting 38 , 000 Employee insurance processing 14, 000 Proposals 139 ,000 Sales meetings/Sales aids 202 , 000 - . .Proposals 139,000 Sales meetings/Sales aids 202, 000 Shipping 24, 000 Ordering 48 , 000 Duplicating costs 46, 000 Blueprinting 77, 000 $ 1, 261, 000 Amount of Cost Driver Use by Location Cost Driver Columbus Cincinnati Dayton Direct labor cost $ 382, 413 $ 317, 086 $ 317, 188 Timesheet entries 6 , 000 3, 800 3,500 Vendor invoices 1, 020 850 400 Client invoices 588 444 96 Employees 23 26 18 New hires 8 Insurance claims filed 230 260 180 Proposals 200 250 60 Contracted sales 1, 824, 439 1, 399, 617 571, 208 Projects shipped 99 124 30 Purchase orders 135 110 80 Copies duplicated 162, 500 146, 250 65,000 Blueprints 39, 000 31, 200 16, 000 Required: 1. What overhead costs should be assigned to each branch based on ABC concepts? 2. What is the contribution of each branch before subtracting the results obtained in requirement 1? 3. What is the profitability of each branch office using ABC? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What overhead costs should be assigned to each branch based on ABC concepts? (Do not round intermediate calculations. Enter your answers in thousands of dollars, rounded to two decimal places.) Activity-based Overhead Allocation (in thousands) Cost Driver Columbus Cincinnati Dayton TotalRequired: 1. What overhead costs should be assigned to each branch based on ABC concepts? 2. What is the contribution of each branch before subtracting the results obtained in requirement 1? 3. What is the profitability of each branch office using ABC? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What overhead costs should be assigned to each branch based on ABC concepts? (Do not round intermediate calculations. Enter your answers in thousands of dollars, rounded to two decimal places.) Activity-based Overhead Allocation (in thousands) Cost Driver Columbus Cincinnati Dayton Total General administration Direct labor cost $ 0.00 Project costing Timesheet entries 0.00 ts payable/receiving Vendor Invoices 0.00 Accounts receivable Client invoices 0.00 Payroll/Mail sort and delivery Employees 0.00 Personnel recruiting New hires 0.00 Employee insurance processing Insurance claims filed 0.00 Proposals Proposals 0.00 0.00 Sales meetings/Sales aids Contracted sales Shipping Projects shipped 0.00 Purchase orders 0.00 Ordering 0.00 Duplicating costs Copies duplicated 0.00 Blueprinting Blueprints 0.00 $ 0.00 $ 0.00 $ 0.00 Total $ Blueprints 39, 000 31, 200 16,000 Required: 1. What overhead costs should be assigned to each branch based on ABC concepts? 2. What is the contribution of each branch before subtracting the results obtained in requirement 1? 3. What is the profitability of each branch office using ABC? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the contribution of each branch before subtracting the results obtained in requirement 1? (Enter your answers in thousands of dollars.) Contribution of Each Branch (in thousands) Columbus Cincinnati Dayton Total Sales Less: Direct labor Less: Direct materials Less: Direct overhead Contribution margin $ o $ o $ o $ Mc GrawCopies duplicated 162, 500 Blueprints 146, 250 65, 000 39, 000 31, 200 16,000 Required: 1. What overhead costs should be assigned to each branch based on ABC concepts? 2. What is the contribution of each branch before subtracting the results obtained in requirement 1? 3. What is the profitability of each branch office using ABC? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the profitability of each branch office using ABC? (Enter your answers in thousands of dollars. Round your intermediate calculations and "Activity based overhead" to 2 decimal places.) Profitability of Each Branch Based on Activity-based Costing (in thousands) Columbus Cincinnati Dayton Total Contribution margin $ Activity-based overhead Operating income(loss) $ 0.00 $ 0.00 $ 0.00 $ 0.00 Copies duplicated 162, 500 Blueprints 146, 250 65, 000 39, 000 31, 200 16,000 Required: 1. What overhead costs should be assigned to each branch based on ABC concepts? 2. What is the contribution of each branch before subtracting the results obtained in requirement 1? 3. What is the profitability of each branch office using ABC? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the profitability of each branch office using ABC? (Enter your answers in thousands of dollars. Round your intermediate calculations and "Activity based overhead" to 2 decimal places.) Profitability of Each Branch Based on Activity-based Costing (in thousands) Columbus Cincinnati Dayton Total Contribution margin $ Activity-based overhead Operating income(loss) $ 0.00 $ 0.00 $ 0.00 $ 0.00 6 5. A) Increasingly, new ventures are being formed by teams rather than individuals. If you were thinking about who you might like to partner with when starting a new venture, what would your 'TOP 5' partner selection criteria be? b) gives some examples of agency relationships. From a business owner's perspective, any time we give decision-making authority to someone who then acts on your behalf, we are essentially involved in an agency relationship. The textbook tells us that such relationships are potentially dangerous but provides limited insight as to why. Can someone tell us what the fundamentals of the 'agency problem' are? What do we mean by agency risks and agency costs? C) There are a variety of resources available to entrepreneurs that can help guide them through the business plan development process. Can anyone identify what sources of help might be available? Can anyone identify a good on-line business planning resource and tell us what makes it "good

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts