Question

Required Open the City of Smithville software by clicking on the Cities of Smithville and Bingham program. If creating a new project, click [Create New

Required Open the City of Smithville software by clicking on the Cities of Smithville and Bingham program. If creating a new project, click [Create New Project], when the [Create New Project] window appears choose City of Smithville from the [Choose a City] drop down menu. In addition, in the [Enter your name] box type your name so that it will appear on all printable reports and then click [Create]. This will create the project and provide all of the funds and accounts that you will need to complete the Short Version City of Smithville cumulative problem.

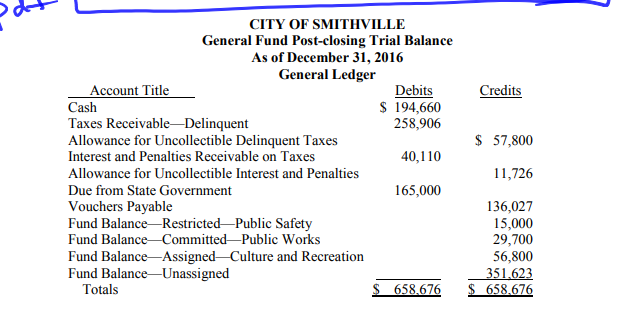

Select [Reports, Trial Balances, Post-Closing Trial Balance] and print or save as a .pdf file the post-closing trial balance for year 2016. Retain the printed trial balance in your personal cumulative folder until the due date assigned by your instructor for the project, or submit a saved version of the trial balance electronically if directed to do so by your instructor. CITY OF SMITHVILLE General Fund Post-closing Trial Balance As of December 31, 2016 General Ledger Account Title Debits Credits Cash $ 194,660 Taxes ReceivableDelinquent 258,906 Allowance for Uncollectible Delinquent Taxes $ 57,800 Interest and Penalties Receivable on Taxes 40,110 Allowance for Uncollectible Interest and Penalties 11,726 Due from State Government 165,000 Vouchers Payable 136,027 Fund BalanceRestrictedPublic Safety 15,000 Fund BalanceCommittedPublic Works 29,700 Fund BalanceAssignedCulture and Recreation 56,800 Fund BalanceUnassigned 351,623 Totals $ 658,676 $ 658,676

RECORD the entry

CITY OF SMITHVILLE General Fund Post-closing Trial Balance As of December 31, 2016 General Ledger Account Title Cash Taxes Receivable-Delinquent Allowance for Uncollectible Delinquent Taxes Interest and Penalties Receivable on Taxes Allowance for Uncollectible Interest and Penalties Due from State Gove Vouchers Payable Fund Balance-Restricted -Public Safety Fund Balance Committed-Public Works Fund Balance - Assigned-Culture and Recreation Fund Balance-Unassigned Debits 258,906 40,110 165,000 S 194,660 $ 57,800 11,726 rnment 136,027 15,000 29,700 56,800 Totals CITY OF SMITHVILLE General Fund Post-closing Trial Balance As of December 31, 2016 General Ledger Account Title Cash Taxes Receivable-Delinquent Allowance for Uncollectible Delinquent Taxes Interest and Penalties Receivable on Taxes Allowance for Uncollectible Interest and Penalties Due from State Gove Vouchers Payable Fund Balance-Restricted -Public Safety Fund Balance Committed-Public Works Fund Balance - Assigned-Culture and Recreation Fund Balance-Unassigned Debits 258,906 40,110 165,000 S 194,660 $ 57,800 11,726 rnment 136,027 15,000 29,700 56,800 TotalsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started