Answered step by step

Verified Expert Solution

Question

1 Approved Answer

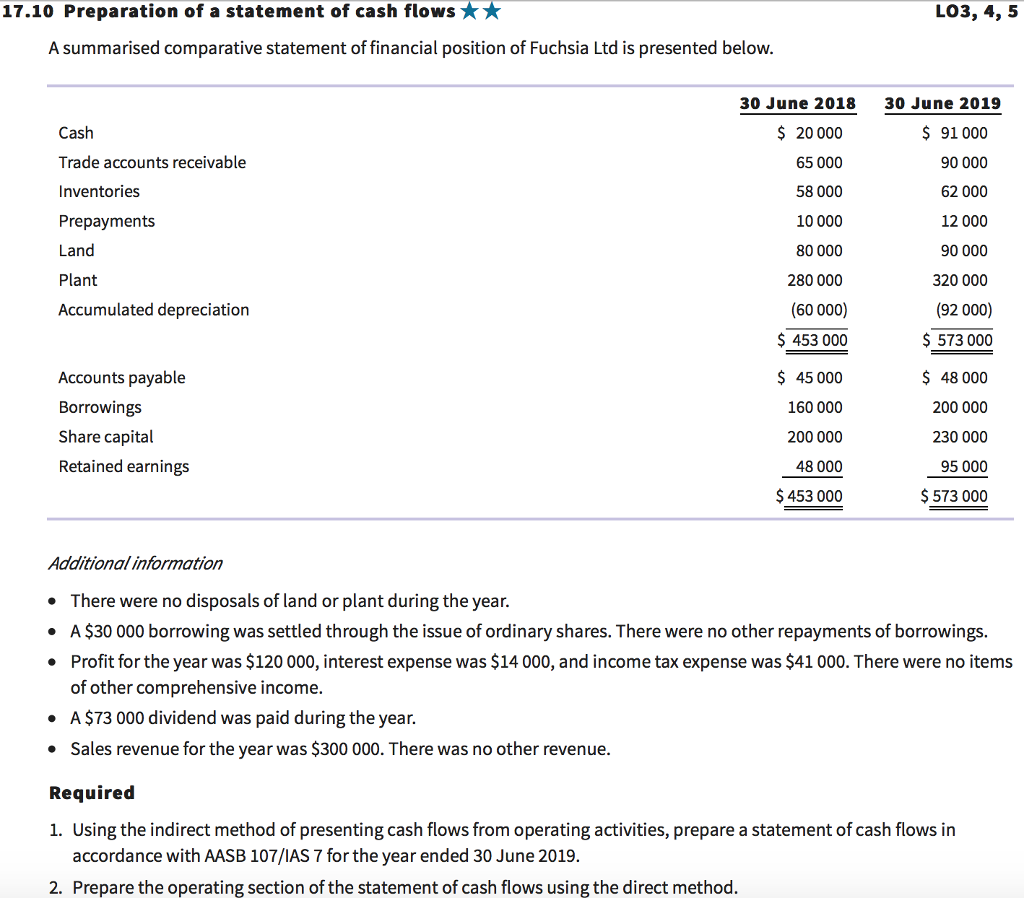

Required: PART 2 ONLY! Prepare cash flows from operating activities section ONLY of a cash flow statement. Use the direct method. LO3, 4, 5 17.10

Required: PART 2 ONLY! Prepare cash flows from operating activities section ONLY of a cash flow statement. Use the direct method.

LO3, 4, 5 17.10 Preparation of a statement of cash flows ** A summarised comparative statement of financial position of Fuchsia Ltd is presented below. Cash Trade accounts receivable Inventories Prepayments Land Plant Accumulated depreciation 30 June 2018 $ 20 000 65 000 58 000 10 000 80 000 280 000 (60 000) $ 453 000 30 June 2019 $ 91 000 90 000 62 000 12 000 90 000 320 000 (92 000) $ 573 000 Accounts payable Borrowings Share capital Retained earnings $ 45 000 160 000 200 000 48 000 $ 453 000 $ 48 000 200 000 230 000 95 000 $ 573 000 Additional information There were no disposals of land or plant during the year. A $30 000 borrowing was settled through the issue of ordinary shares. There were no other repayments of borrowings. Profit for the year was $120 000, interest expense was $14 000, and income tax expense was $41 000. There were no items of other comprehensive income. A$73 000 dividend was paid during the year. Sales revenue for the year was $300 000. There was no other revenue. Required 1. Using the indirect method of presenting cash flows from operating activities, prepare a statement of cash flows in accordance with AASB 107/IAS 7 for the year ended 30 June 2019. 2. Prepare the operating section of the statement of cash flows using the direct methodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started