Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: Prepare a Statement of profit or loss and other comprehensive income for the year ended 30 June 2021 in compliance with International Financial Reporting

Required: Prepare a Statement of profit or loss and other comprehensive income for the year ended 30 June 2021 in compliance with International Financial Reporting Standards appropriate to Samke Ltds business activties. (20)

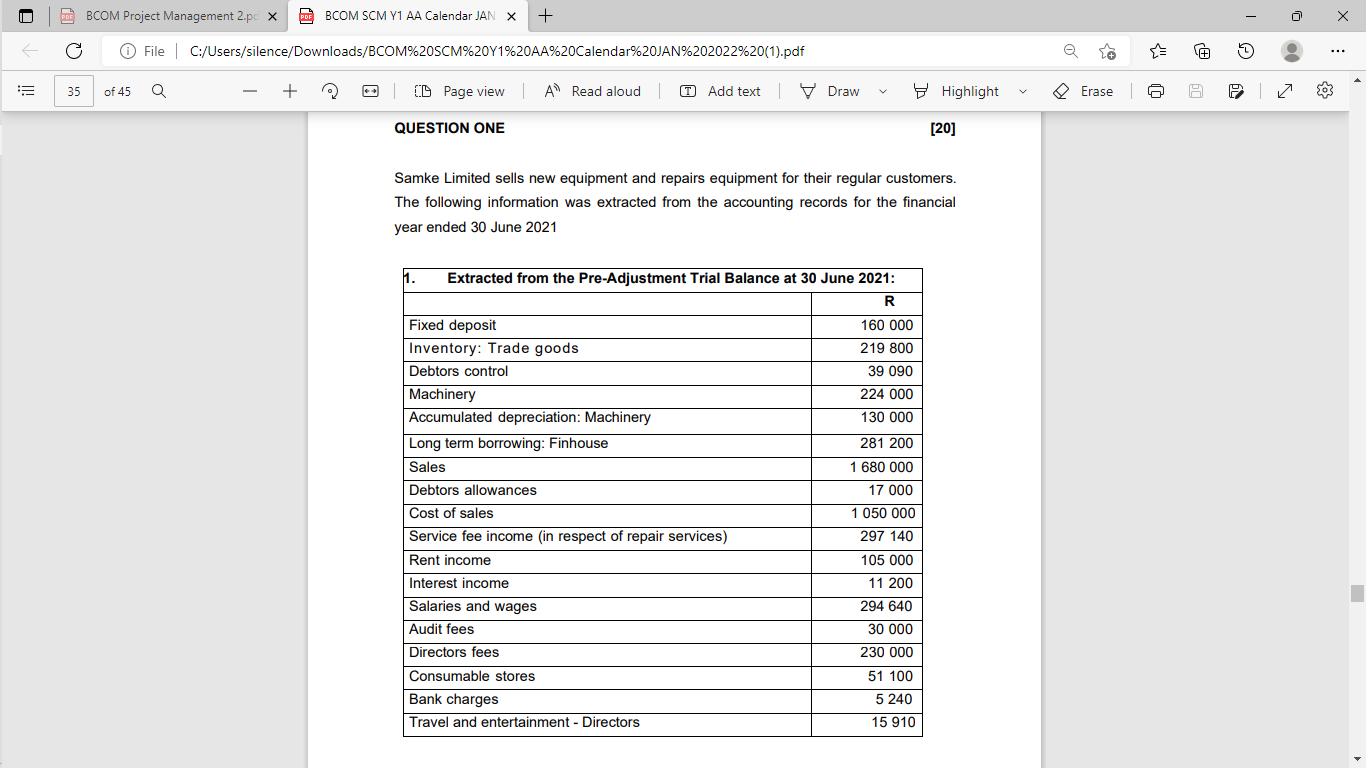

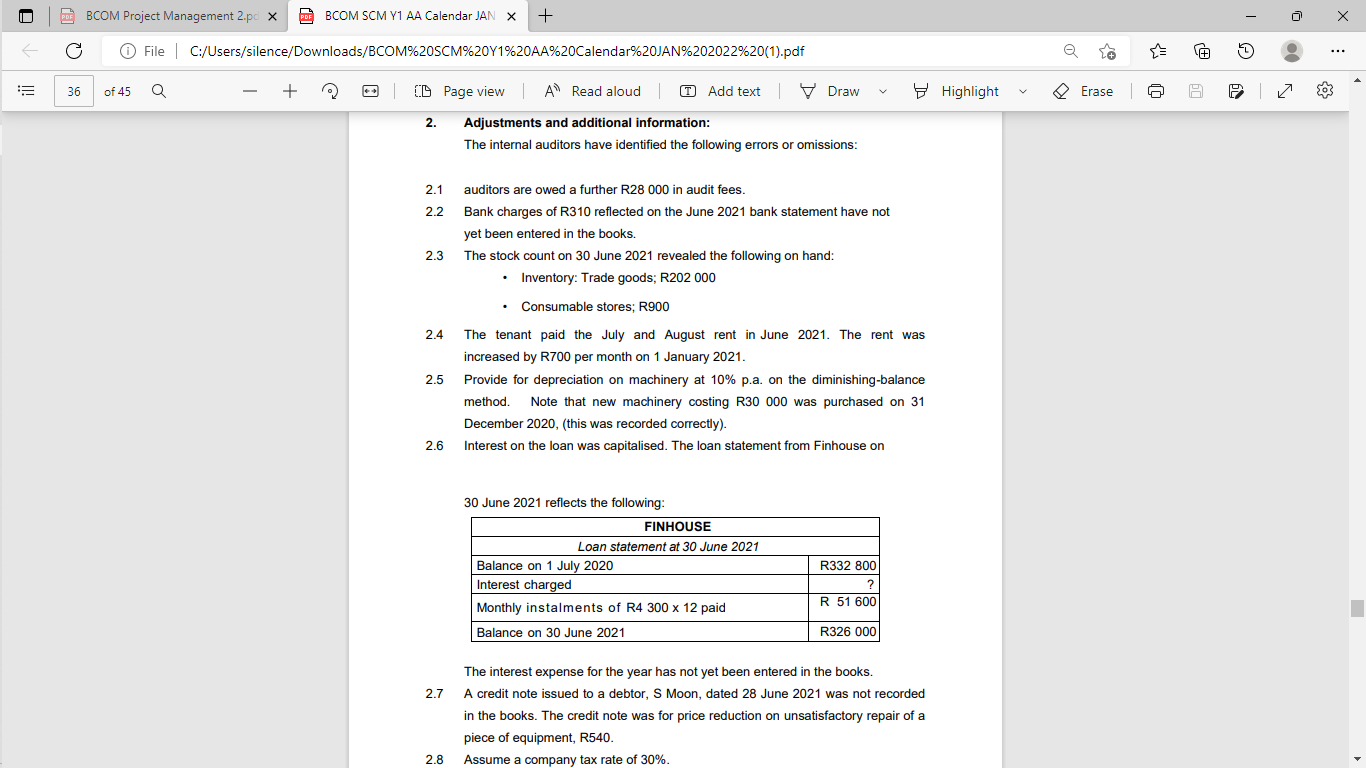

Samke Limited sells new equipment and repairs equipment for their regular customers. The following information was extracted from the accounting records for the financial year ended 30 June 2021 2. Adjustments and additional information: The internal auditors have identified the following errors or omissions: 2.1 auditors are owed a further R28 000 in audit fees. 2.2 Bank charges of R310 reflected on the June 2021 bank statement have not yet been entered in the books. 2.3 The stock count on 30 June 2021 revealed the following on hand: - Inventory: Trade goods; R202 000 - Consumable stores; R900 2.4 The tenant paid the July and August rent in June 2021. The rent was increased by R700 per month on 1 January 2021. 2.5 Provide for depreciation on machinery at 10\% p.a. on the diminishing-balance method. Note that new machinery costing R30 000 was purchased on 31 December 2020, (this was recorded correctly). 2.6 Interest on the loan was capitalised. The loan statement from Finhouse on 30 June 2021 reflects the followina: The interest expense for the year has not yet been entered in the books. 2.7 A credit note issued to a debtor, S Moon, dated 28 June 2021 was not recorded in the books. The credit note was for price reduction on unsatisfactory repair of a piece of equipment, R540. 2.8 Assume a company tax rate of 30%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started