Answered step by step

Verified Expert Solution

Question

1 Approved Answer

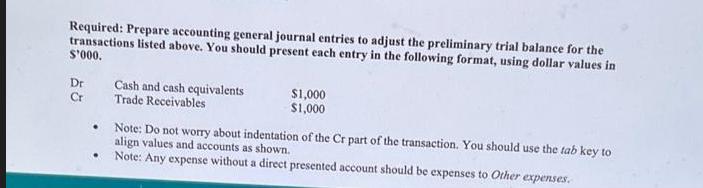

Required: Prepare accounting general journal entries to adjust the preliminary trial balance for the transactions listed above. You should present each entry in the

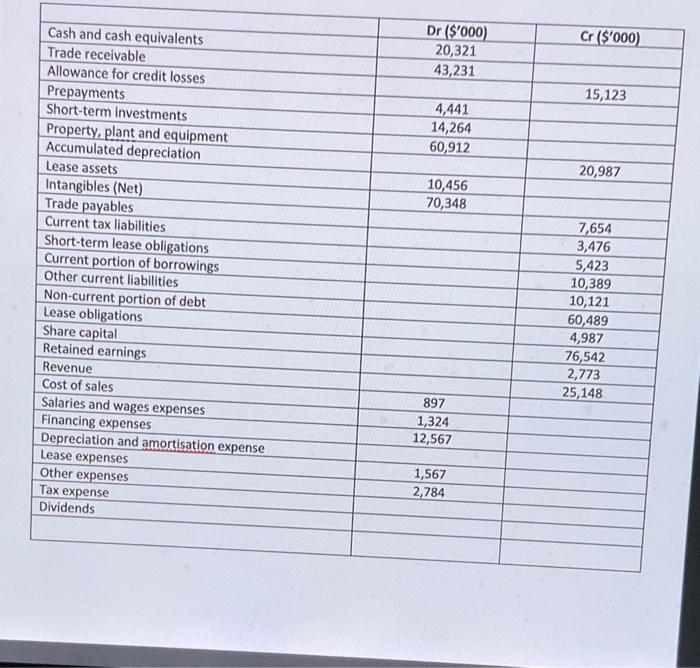

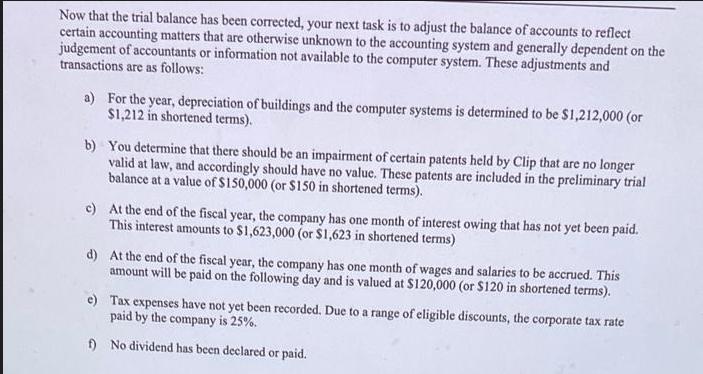

Required: Prepare accounting general journal entries to adjust the preliminary trial balance for the transactions listed above. You should present each entry in the following format, using dollar values in S'000. Dr Cr . . Cash and cash equivalents Trade Receivables $1,000 $1,000 Note: Do not worry about indentation of the Cr part of the transaction. You should use the tab key to align values and accounts as shown. Note: Any expense without a direct presented account should be expenses to Other expenses. Cash and cash equivalents Trade receivable Allowance for credit losses Prepayments Short-term investments Property, plant and equipment Accumulated depreciation Lease assets Intangibles (Net) Trade payables Current tax liabilities Short-term lease obligations Current portion of borrowings Other current liabilities Non-current portion of debt Lease obligations Share capital Retained earnings Revenue Cost of sales Salaries and wages expenses Financing expenses Depreciation and amortisation expense Lease expenses Other expenses Tax expense Dividends Dr ($'000) 20,321 43,231 4,441 14,264 60,912 10,456 70,348 897 1,324 12,567 1,567 2,784 Cr ($'000) 15,123 20,987 7,654 3,476 5,423 10,389 10,121 60,489 4,987 76,542 2,773 25,148 Now that the trial balance has been corrected, your next task is to adjust the balance of accounts to reflect certain accounting matters that are otherwise unknown to the accounting system and generally dependent on the judgement of accountants or information not available to the computer system. These adjustments and transactions are as follows: a) For the year, depreciation of buildings and the computer systems is determined to be $1,212,000 (or $1,212 in shortened terms). b) You determine that there should be an impairment of certain patents held by Clip that are no longer valid at law, and accordingly should have no value. These patents are included in the preliminary trial balance at a value of $150,000 (or $150 in shortened terms). c) At the end of the fiscal year, the company has one month of interest owing that has not yet been paid. This interest amounts to $1,623,000 (or $1,623 in shortened terms) d) At the end of the fiscal year, the company has one month of wages and salaries to be accrued. This amount will be paid on the following day and is valued at $120,000 (or $120 in shortened terms). e) Tax expenses have not yet been recorded. Due to a range of eligible discounts, the corporate tax rate paid by the company is 25%. f) No dividend has been declared or paid.

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started