Question

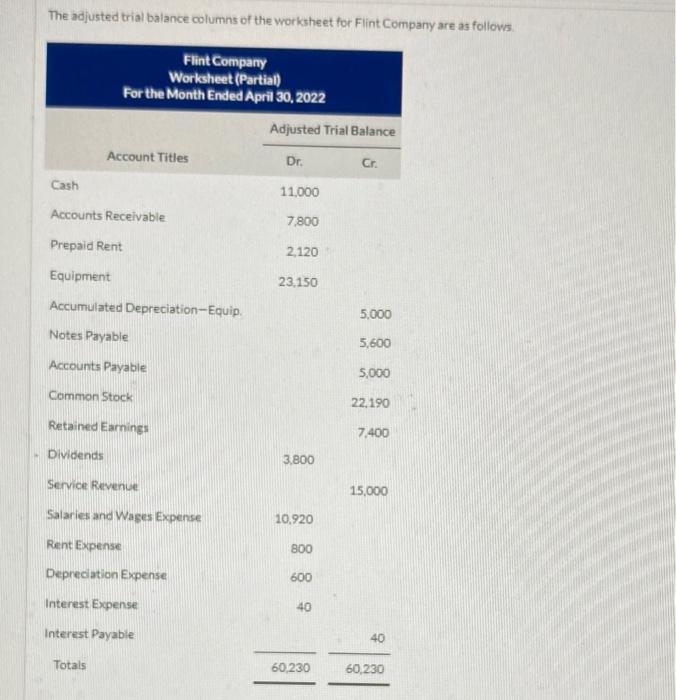

Required Prepare an income statement Prepare a retained earnings statement. Prepare a classified balance sheet The adjusted trial balance columns of the worksheet for Flint

Required

RequiredPrepare an income statement

Prepare a retained earnings statement.

Prepare a classified balance sheet

The adjusted trial balance columns of the worksheet for Flint Company are as follows. Cash Flint Company Worksheet (Partial) For the Month Ended April 30, 2022 Account Titles Accounts Receivable Prepaid Rent Equipment Accumulated Depreciation-Equip. Notes Payable Accounts Payable Common Stock Retained Earnings Dividends Totals Service Revenue Salaries and Wages Expense Rent Expense Depreciation Expense Interest Expense Interest Payable Adjusted Trial Balance Dr. 11,000 7,800 2,120 23,150 3,800 10,920 800 600 40 60,230 Cr. 5,000 5,600 5,000 22,190 7,400 15,000 40 60,230

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Flint Company Income Statement For the month ended April 30 2022 Revenues Service revenue 15000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial accounting

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel

IFRS Edition

9781119153726, 978-1118285909

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App