Required: Prepare Form 1040, Sch. 1, Sch. A, Sch. E and Sch. SE for 2022 for Adam and Anna Andersen. No other forms are required. Although these forms will reference other form numbers, those other forms not listed above are NOT required. In addition to the above listed forms, the computation of total income tax liability is required. Projects can be completed manually or typed into the fillable PDF Forms.

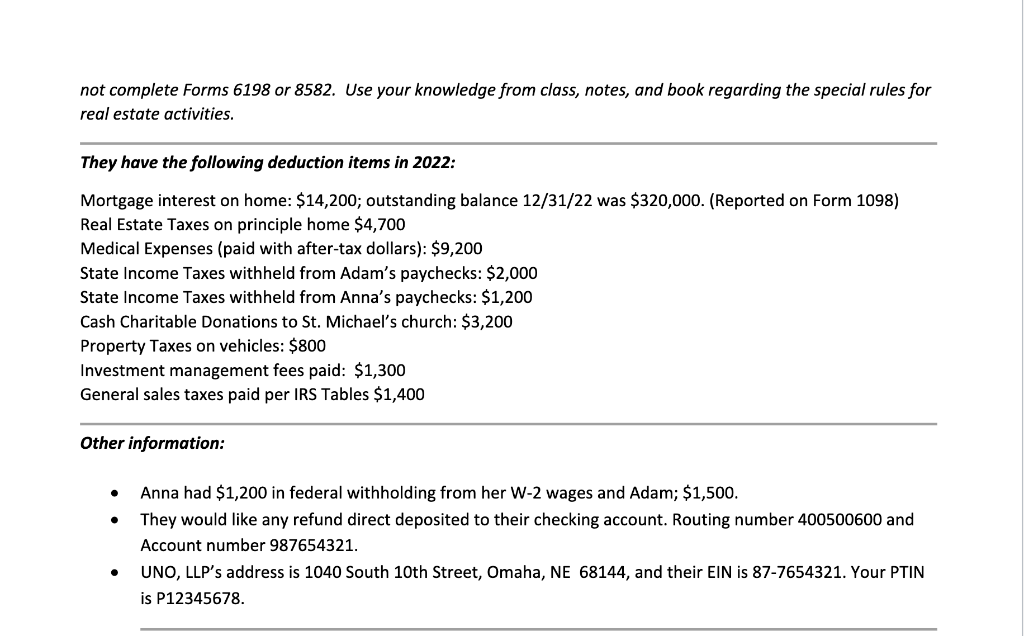

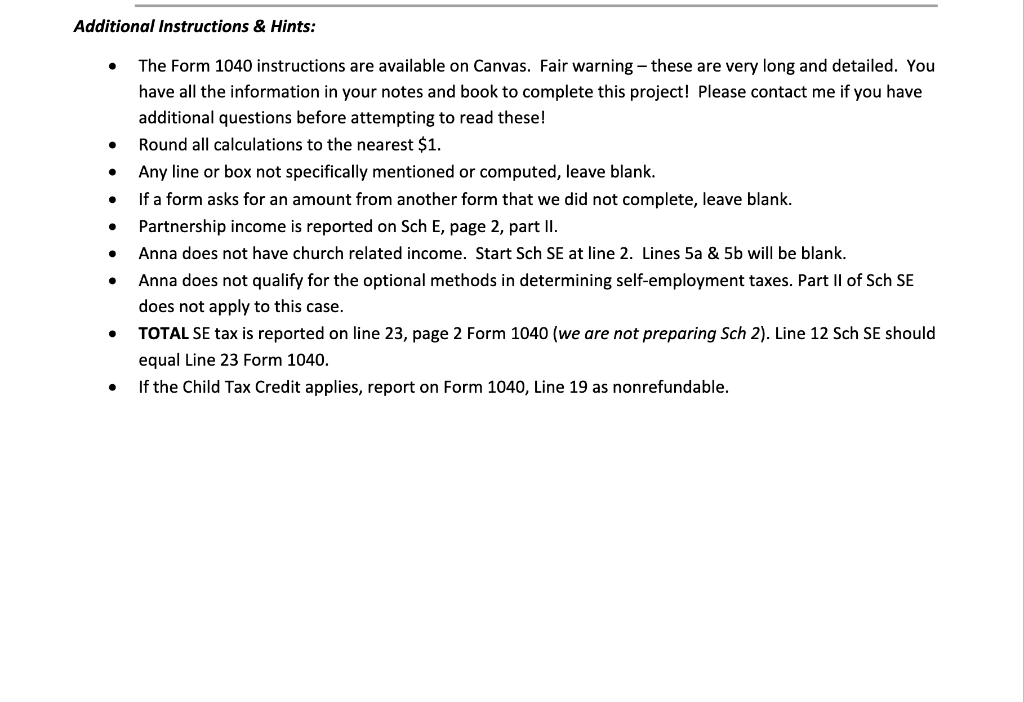

Adam Andersen, an art associate, SSN 111-33-4444 and his wife, Anna, an Amazon re-seller, SSN 123-44-5555 have hired you, a tax preparer at UNO, LLP to prepare their 2022 tax return. They are both 37 . They have 2 daughters; Amelia, DOB 6/17/08; SSN 555-99-3434 and Abigail, DOB 1/30/11; SSN 888-73-1212. Their home address is 123 Aksarben Street, Omaha NE, 68114. They have the following income items in 2022: Qualified Dividends from North Corp: $325 Nonqualified Dividends from South Corp: $175 Adam's wages (reported on Form W-2, Box 1 and Box 3 ): $50,000 Anna's wages (reported on Form W-2, Box 1 and Box 3): $36,000 Interest from First National Bank: $200 Long-Term Capital Gain from TD Ameritrade (Sch D is not required) : $1,700 Flow-through ordinary income for Anna from A2 Partners, EIN 47-1234567: $9,800. This is reported on Sch K-1 (Form 1065) Box 14A (non-farming). This income is subject to self-employment tax and is non-passive. Rental income and expenses from 25 Aksarben Street, Omaha, NE 68114, a single-family residential rental house they jointly own, actively participate and manage, and was rented all of 2022 as follows: Total Rent Received: $20,000 Repairs and Maintenance: $9,500 MACRS Depreciation: $5,000 Mortgage Interest: $7,700 Real Estate Taxes: $4,500 Insurance: $1,200 Utilities: $2,200 There is a $4,000 suspended loss carryover on this rental from 2021. Use AGI before passive activities for any rental loss phase-outs. You will compute the deductible amount of a rental loss, if applicable, on Sch E, line 22. Do not complete Forms 6198 or 8582. Use your knowledge from class, notes, and book regarding the special rules for real estate activities. They have the following deduction items in 2022: Mortgage interest on home: $14,200; outstanding balance 12/31/22 was $320,000. (Reported on Form 1098) Real Estate Taxes on principle home $4,700 Medical Expenses (paid with after-tax dollars): $9,200 State Income Taxes withheld from Adam's paychecks: $2,000 State Income Taxes withheld from Anna's paychecks: $1,200 Cash Charitable Donations to St. Michael's church: $3,200 Property Taxes on vehicles: $800 Investment management fees paid: $1,300 General sales taxes paid per IRS Tables $1,400 Other information: - Anna had $1,200 in federal withholding from her W-2 wages and Adam; $1,500. - They would like any refund direct deposited to their checking account. Routing number 400500600 and Account number 987654321. - UNO, LLP's address is 1040 South 10th Street, Omaha, NE 68144, and their EIN is 87-7654321. Your PTIN is P12345678. Additional Instructions \& Hints: - The Form 1040 instructions are available on Canvas. Fair warning - these are very long and detailed. You have all the information in your notes and book to complete this project! Please contact me if you have additional questions before attempting to read these! - Round all calculations to the nearest $1. - Any line or box not specifically mentioned or computed, leave blank. - If a form asks for an amount from another form that we did not complete, leave blank. - Partnership income is reported on Sch E, page 2, part II. - Anna does not have church related income. Start Sch SE at line 2. Lines 5a \& 5b will be blank. - Anna does not qualify for the optional methods in determining self-employment taxes. Part II of Sch SE does not apply to this case. - TOTAL SE tax is reported on line 23, page 2 Form 1040 (we are not preparing Sch 2). Line 12 Sch SE should equal Line 23 Form 1040. - If the Child Tax Credit applies, report on Form 1040, Line 19 as nonrefundable