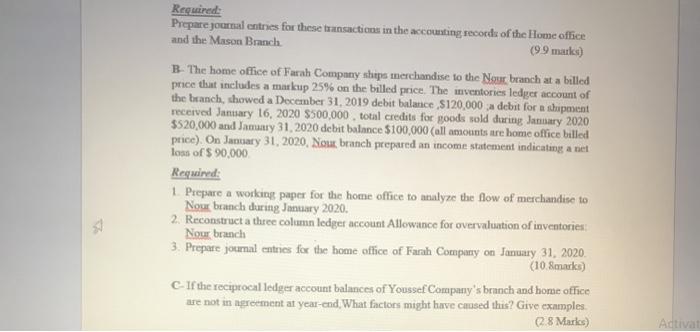

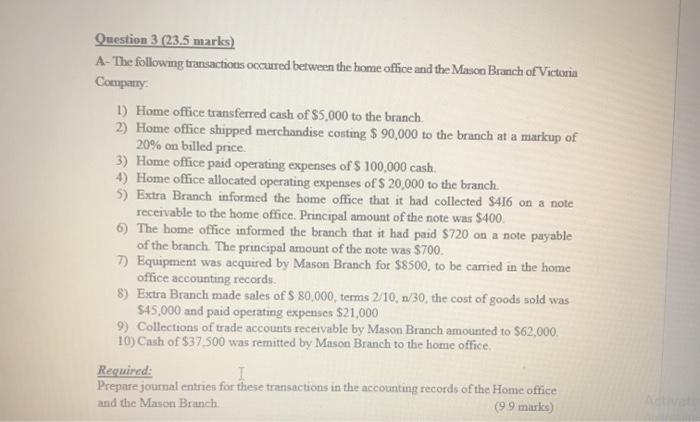

Required: Prepare journal entries for these transactions in the accounting records of the Home office and the Mason Branch (9.9 marks) B. The home office of Furah Company shops merchandise to the Nour branch at a billed price that includes a markup 25% on the billed price. The inventories ledger account of the branch, showed a December 31, 2019 debit balance $120,000 za debit for a shipment received January 16, 2020 $500,000 total credits for goods sold during January 2020 $520,000 and Samay 31, 2020 debit balance $100,000 (all amounts are home office billed price). On January 31, 2020, Nour branch prepared an income statement indicating a net loss of $ 90,000 Required: 1. Prepare a working paper for the home office to malyze the Row of merchandise to Nos branch during January 2020. 2. Reconstruct a three column ledger account Allowance for overvaluation of inventories Nour branch 3. Prepare journal entries for the home office of Farah Company on January 31, 2020 (108marks) If the reciprocal ledger account balances of Youssef Company's branch and home office are not in agreement at year-end. What factors might have caused this? Give examples 0.8 Maris) Activa Question 3 (23.5 marks) A-The following transactions occured between the home office and the Mason Branch of Victoria Company 1) Home office transferred cash of $5,000 to the branch. 2) Home office shipped merchandise costing $ 90,000 to the branch at a markup of 20% on billed price 3) Home office paid operating expenses of S 100,000 cash. 4) Home office allocated operating expenses of $ 20,000 to the branch. 5) Extra Branch informed the home office that it had collected $416 on a note receivable to the home office. Principal amount of the note was $400. 6) The home office informed the branch that it had paid $720 on a note payable of the branch. The principal amount of the note was $700. 7) Equipment was acquired by Muson Branch for $8500, to be carried in the home office accounting records. 8) Extra Branch made sales of $ 80,000, terms 2/10, 1/30, the cost of goods sold was $45,000 and paid operating expenses $21,000 9) Collections of trade accounts receivable by Mason Branch amounted to 562,000. 10) Cash of $37 500 was remitted by Mason Branch to the home office. Required: Prepare journal entries for these transactions in the accounting records of the Home office and the Mason Branch (9 9 marks)