Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: Prepare the adjusting entries to Stark Sdn. Bhd.'s accounts at 30 June 2020. Each entry should be made in general journal format (without narratives).

Required:

Prepare the adjusting entries to Stark Sdn. Bhd.'s accounts at 30 June 2020. Each entry should be made in general journal format (without narratives).

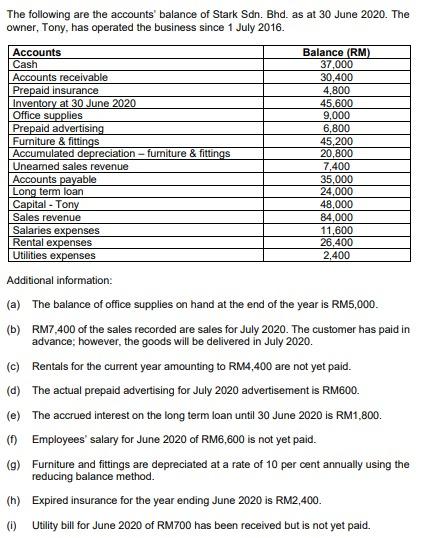

The following are the accounts' balance of Stark Sdn. Bhd. as at 30 June 2020. The owner, Tony, has operated the business since 1 July 2016. Accounts Cash Accounts receivable Prepaid insurance Inventory at 30 June 2020 Office supplies Prepaid advertising Furniture & fittings Accumulated depreciation- furniture & fittings Uneamed sales revenue Accounts payable Long term loan Capital - Tony Sales revenue Salaries expenses Rental expenses Utilities expenses Additional information: Balance (RM) 37,000 30,400 4,800 45,600 9,000 6,800 45,200 20,800 7,400 35,000 24,000 48,000 84,000 11,600 26,400 2,400 (a) The balance of office supplies on hand at the end of the year is RM5,000. (b) RM7.400 of the sales recorded are sales for July 2020. The customer has paid in advance; however, the goods will be delivered in July 2020. (c) Rentals for the current year amounting to RM4,400 are not yet paid. (d) The actual prepaid advertising for July 2020 advertisement is RM600. (e) The accrued interest on the long term loan until 30 June 2020 is RM1,800. Employees' salary for June 2020 of RM6,600 is not yet paid. (f) (g) Furniture and fittings are depreciated at a rate of 10 per cent annually using the reducing balance method. (h) Expired insurance for the year ending June 2020 is RM2,400. (i) Utility bill for June 2020 of RM700 has been received but is not yet paid.

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided we can prepare the necessary adjusting entries as of June 30 2020 for Stark Sdn Bhd Below are the adjustments requir...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started