Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: Prepare the consolidation journal entries for 30 June 2022. (Business Combination valuation entries, Preacquisition entries and intragroup transactions) lopic; Consolidated worksheet, consolidated tinancial statements.

Required: Prepare the consolidation journal entries for 30 June 2022. (Business Combination valuation entries, Preacquisition entries and intragroup transactions)

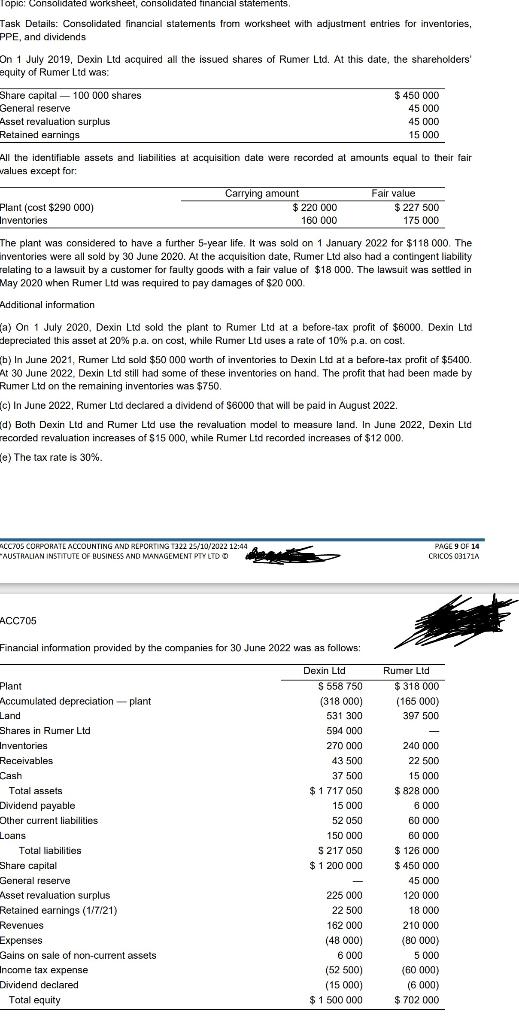

lopic; Consolidated worksheet, consolidated tinancial statements. Task Datails: Consolidated financial statements from worksheet with adjustment entries for inventories, PPE, and dividends On 1 July 2019. Dexin Ltd acquired all the issued shares of Rumer Ltd. At this date, the shareholders' equity of Rumer Ltd was: All the identifiable assets and liabilities at acquisition date were recorded at amounts equal to their fair values except for: The plant was considered to have a further 5-year life. It was sold on 1 January 2022 for $118000. The inventories were all sold by 30 June 2020. At the acquisition date, Rumer Ltd also had a contingent liability ralating to a lawsuit by a customer for faulty goods with a fair value of $18000. The lawsuit was setted in May 2020 when Rumer Ltd was required to pay damages of $20000. Additional information (a) On 1 July 2020. Dexin Ltd sold the plant to Rumer Ltd at a before-tax profit of $6000. Dexin Ltd depreciated this asset at 20% p.a. on cost, while Rumer Ltd uses a rate of 10% p.a. on cost. (b) In June 2021, Rumer Ltd sold $50000 worth of inventories to Dexin Ltd at a before-tax profit of $5400. At 30 June 2022, Dexin Ltd still had some of these inventories on hand. The profit that had been made by Rumer Ltd on the remaining inventories was $750. (c) In June 2022, Rumer Ltd declared a dividend of $6000 that will be paid in August 2022. (d) Both Dexin Ltd and Rumer Ltd use the revaluation model to measure land. In June 2022, Dexin Ltd recorded revaluation increases of $15000, while Rumer Ltd recorded increases of $12000. (e) The tax rate is 30%. ACCNS COPPORATE ACCOUNIING AND REPCRTNSG T322 2S/10/2022 12:44 RUSTRALAN INSTITUTE OF GUSINESS ANO MANAGEMENT PTY LTO U PAGE 9 of 14 CRicos 03171A Financial information provided by the companies for 30 June 2022 was as follows: ACC705

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started