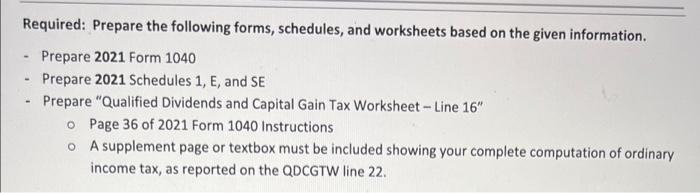

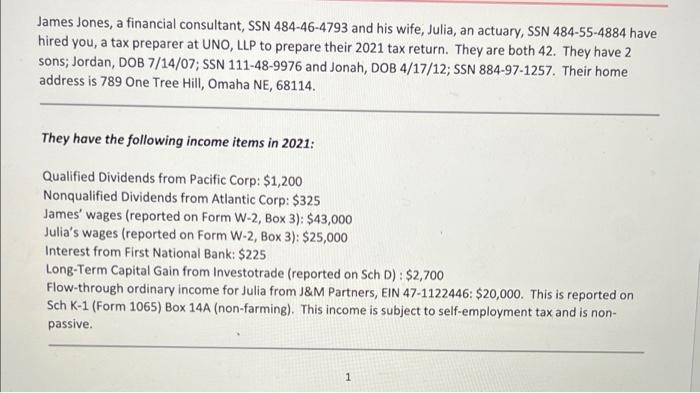

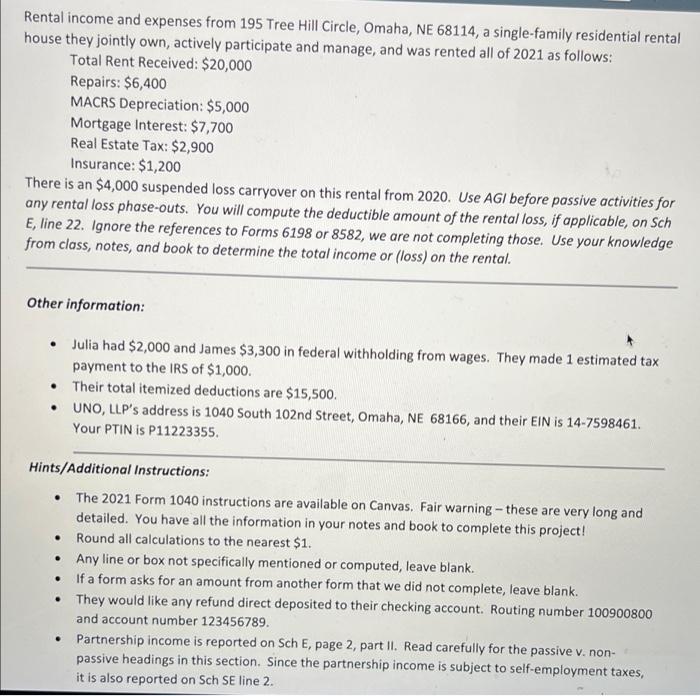

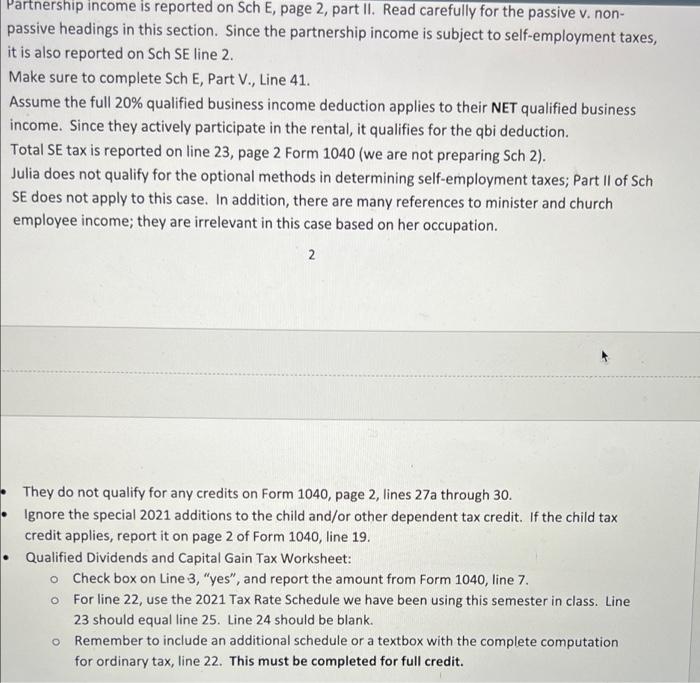

Required: Prepare the following forms, schedules, and worksheets based on the given information. Prepare 2021 Form 1040 Prepare 2021 Schedules 1, E, and SE - Prepare "Qualified Dividends and Capital Gain Tax Worksheet - Line 16" o Page 36 of 2021 Form 1040 Instructions o A supplement page or textbox must be included showing your complete computation of ordinary income tax, as reported on the QDCGTW line 22. James Jones, a financial consultant, SSN 484-46-4793 and his wife, Julia, an actuary, SSN 484-55-4884 have hired you, a tax preparer at UNO, LLP to prepare their 2021 tax return. They are both 42. They have 2 sons; Jordan, DOB 7/14/07; SSN 111-48-9976 and Jonah, DOB 4/17/12; SSN 884-97-1257. Their home address is 789 One Tree Hill, Omaha NE, 68114. They have the following income items in 2021: Qualified Dividends from Pacific Corp: $1,200 Nonqualified Dividends from Atlantic Corp: $325 James' wages (reported on Form W-2, Box 3): $43,000 Julia's wages (reported on Form W-2, Box 3): $25,000 Interest from First National Bank: $225 Long-Term Capital Gain from Investotrade (reported on Sch D): $2,700 Flow-through ordinary income for Julia from J&M Partners, EIN 47-1122446: $20,000. This is reported on Sch K-1 (Form 1065) Box 14A (non-farming). This income is subject to self-employment tax and is non- passive. 1 Rental income and expenses from 195 Tree Hill Circle, Omaha, NE 68114, a single-family residential rental house they jointly own, actively participate and manage, and was rented all of 2021 as follows: Total Rent Received: $20,000 Repairs: $6,400 MACRS Depreciation: $5,000 Mortgage Interest: $7,700 Real Estate Tax: $2,900 Insurance: $1,200 There is an $4,000 suspended loss carryover on this rental from 2020. Use AGI before passive activities for any rental loss phase-outs. You will compute the deductible amount of the rental loss, if applicable, on Sch E, line 22. Ignore the references to Forms 6198 or 8582, we are not completing those. Use your knowledge from class, notes, and book to determine the total income or (loss) on the rental. Other information: Julia had $2,000 and James $3,300 in federal withholding from wages. They made 1 estimated tax payment to the IRS of $1,000. Their total itemized deductions are $15,500. . UNO, LLP's address is 1040 South 102nd Street, Omaha, NE 68166, and their EIN is 14-7598461. Your PTIN is P11223355. Hints/Additional Instructions: . The 2021 Form 1040 instructions are available on Canvas. Fair warning - these are very long and detailed. You have all the information in your notes and book to complete this project! Round all calculations to the nearest $1. . Any line or box not specifically mentioned or computed, leave blank. . If a form asks for an amount from another form that we did not complete, leave blank. . They would like any refund direct deposited to their checking account. Routing number 100900800 and account number 123456789. Partnership income is reported on Sch E, page 2, part II. Read carefully for the passive v. non- passive headings in this section. Since the partnership income is subject to self-employment taxes, it is also reported on Sch SE line 2. Partnership income is reported on Sch E, page 2, part II. Read carefully for the passive v. non- passive headings in this section. Since the partnership income is subject to self-employment taxes, it is also reported on Sch SE line 2. Make sure to complete Sch E, Part V., Line 41. Assume the full 20% qualified business income deduction applies to their NET qualified business income. Since they actively participate in the rental, it qualifies for the qbi deduction. Total SE tax is reported on line 23, page 2 Form 1040 (we are not preparing Sch 2). Julia does not qualify for the optional methods in determining self-employment taxes; Part II of Sch SE does not apply to this case. In addition, there are many references to minister and church employee income; they are irrelevant in this case based on her occupation. 2 They do not qualify for any credits on Form 1040, page 2, lines 27a through 30. Ignore the special 2021 additions to the child and/or other dependent tax credit. If the child tax credit applies, report it on page 2 of Form 1040, line 19. Qualified Dividends and Capital Gain Tax Worksheet: o Check box on Line 3, "yes", and report the amount from Form 1040, line 7. o For line 22, use the 2021 Tax Rate Schedule we have been using this semester in class. Line 23 should equal line 25. Line 24 should be blank. o Remember to include an additional schedule or a textbox with the complete computation for ordinary tax, line 22. This must be completed for full credit. Required: Prepare the following forms, schedules, and worksheets based on the given information. Prepare 2021 Form 1040 Prepare 2021 Schedules 1, E, and SE - Prepare "Qualified Dividends and Capital Gain Tax Worksheet - Line 16" o Page 36 of 2021 Form 1040 Instructions o A supplement page or textbox must be included showing your complete computation of ordinary income tax, as reported on the QDCGTW line 22. James Jones, a financial consultant, SSN 484-46-4793 and his wife, Julia, an actuary, SSN 484-55-4884 have hired you, a tax preparer at UNO, LLP to prepare their 2021 tax return. They are both 42. They have 2 sons; Jordan, DOB 7/14/07; SSN 111-48-9976 and Jonah, DOB 4/17/12; SSN 884-97-1257. Their home address is 789 One Tree Hill, Omaha NE, 68114. They have the following income items in 2021: Qualified Dividends from Pacific Corp: $1,200 Nonqualified Dividends from Atlantic Corp: $325 James' wages (reported on Form W-2, Box 3): $43,000 Julia's wages (reported on Form W-2, Box 3): $25,000 Interest from First National Bank: $225 Long-Term Capital Gain from Investotrade (reported on Sch D): $2,700 Flow-through ordinary income for Julia from J&M Partners, EIN 47-1122446: $20,000. This is reported on Sch K-1 (Form 1065) Box 14A (non-farming). This income is subject to self-employment tax and is non- passive. 1 Rental income and expenses from 195 Tree Hill Circle, Omaha, NE 68114, a single-family residential rental house they jointly own, actively participate and manage, and was rented all of 2021 as follows: Total Rent Received: $20,000 Repairs: $6,400 MACRS Depreciation: $5,000 Mortgage Interest: $7,700 Real Estate Tax: $2,900 Insurance: $1,200 There is an $4,000 suspended loss carryover on this rental from 2020. Use AGI before passive activities for any rental loss phase-outs. You will compute the deductible amount of the rental loss, if applicable, on Sch E, line 22. Ignore the references to Forms 6198 or 8582, we are not completing those. Use your knowledge from class, notes, and book to determine the total income or (loss) on the rental. Other information: Julia had $2,000 and James $3,300 in federal withholding from wages. They made 1 estimated tax payment to the IRS of $1,000. Their total itemized deductions are $15,500. . UNO, LLP's address is 1040 South 102nd Street, Omaha, NE 68166, and their EIN is 14-7598461. Your PTIN is P11223355. Hints/Additional Instructions: . The 2021 Form 1040 instructions are available on Canvas. Fair warning - these are very long and detailed. You have all the information in your notes and book to complete this project! Round all calculations to the nearest $1. . Any line or box not specifically mentioned or computed, leave blank. . If a form asks for an amount from another form that we did not complete, leave blank. . They would like any refund direct deposited to their checking account. Routing number 100900800 and account number 123456789. Partnership income is reported on Sch E, page 2, part II. Read carefully for the passive v. non- passive headings in this section. Since the partnership income is subject to self-employment taxes, it is also reported on Sch SE line 2. Partnership income is reported on Sch E, page 2, part II. Read carefully for the passive v. non- passive headings in this section. Since the partnership income is subject to self-employment taxes, it is also reported on Sch SE line 2. Make sure to complete Sch E, Part V., Line 41. Assume the full 20% qualified business income deduction applies to their NET qualified business income. Since they actively participate in the rental, it qualifies for the qbi deduction. Total SE tax is reported on line 23, page 2 Form 1040 (we are not preparing Sch 2). Julia does not qualify for the optional methods in determining self-employment taxes; Part II of Sch SE does not apply to this case. In addition, there are many references to minister and church employee income; they are irrelevant in this case based on her occupation. 2 They do not qualify for any credits on Form 1040, page 2, lines 27a through 30. Ignore the special 2021 additions to the child and/or other dependent tax credit. If the child tax credit applies, report it on page 2 of Form 1040, line 19. Qualified Dividends and Capital Gain Tax Worksheet: o Check box on Line 3, "yes", and report the amount from Form 1040, line 7. o For line 22, use the 2021 Tax Rate Schedule we have been using this semester in class. Line 23 should equal line 25. Line 24 should be blank. o Remember to include an additional schedule or a textbox with the complete computation for ordinary tax, line 22. This must be completed for full credit