Answered step by step

Verified Expert Solution

Question

1 Approved Answer

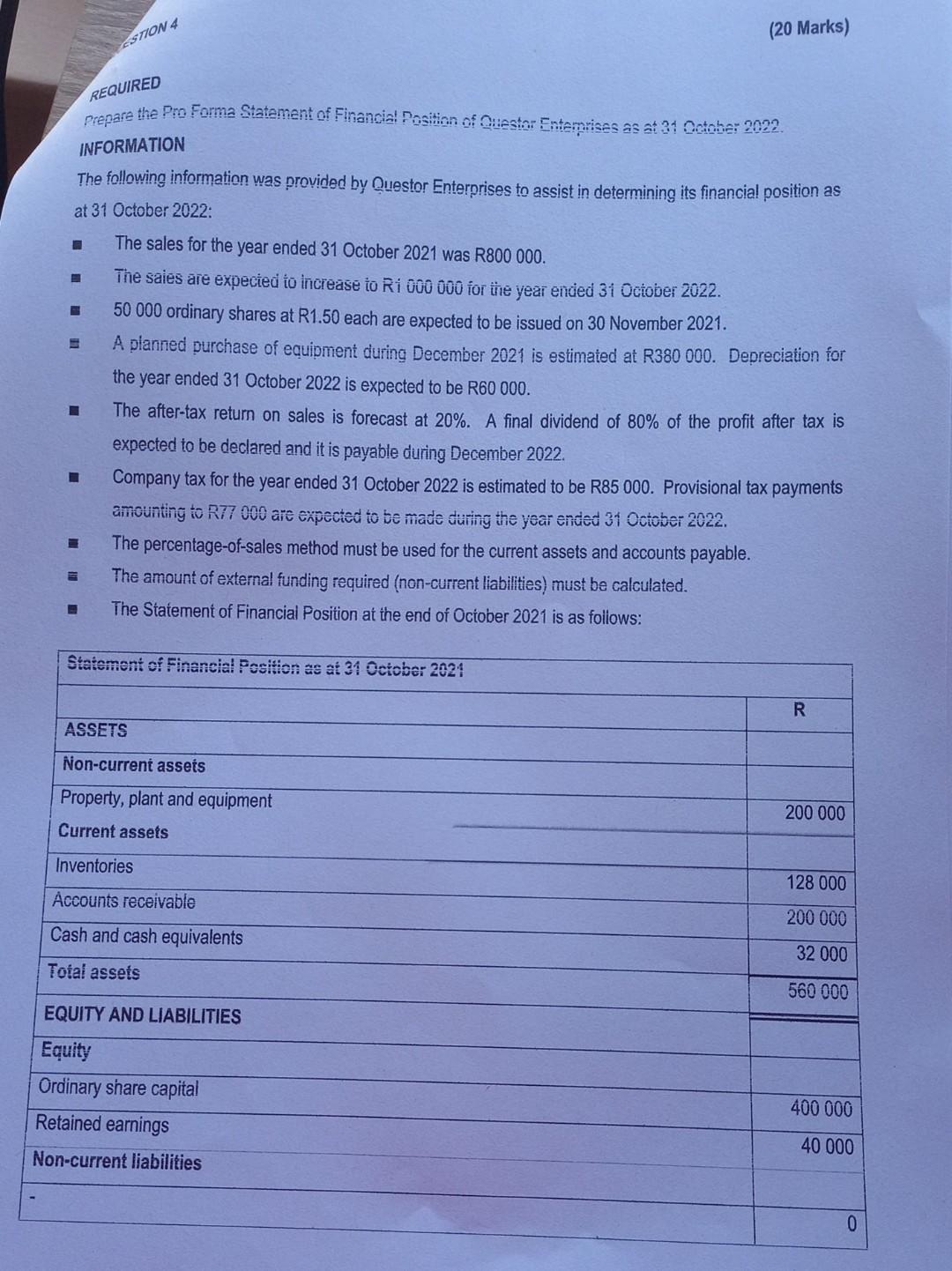

REQUIRED prepare the Pro Forma Statement of Financial Fositinn of Ouestor Entemrises as at 34 Cotnher 2022 INFORMATION The following information was provided by nuestor

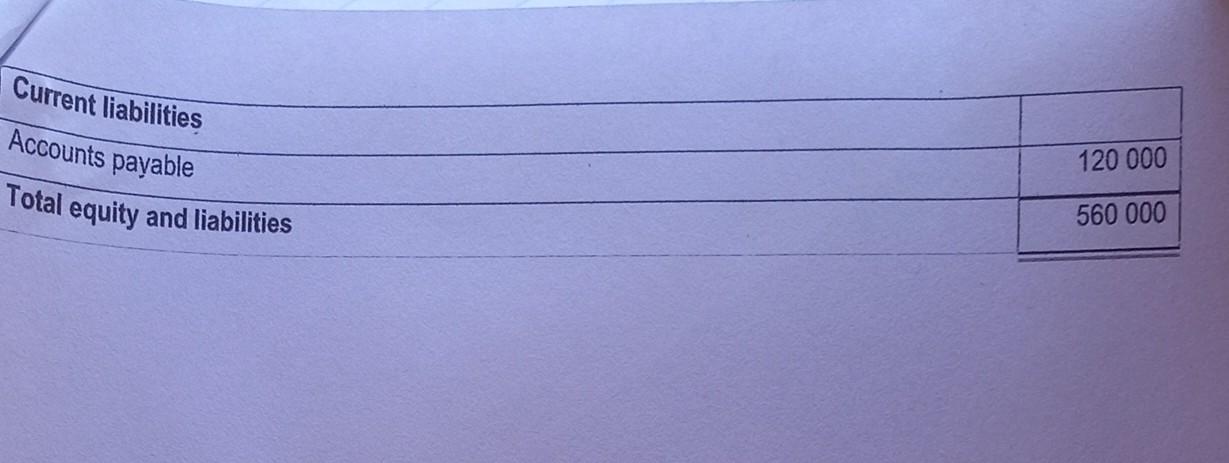

REQUIRED prepare the Pro Forma Statement of Financial Fositinn of Ouestor Entemrises as at 34 Cotnher 2022 INFORMATION The following information was provided by nuestor Enterprises to assist in determining its financial position as at 31 October 2022 : The sales for the year ended 31 October 2021 was R800000. The saies are expected to increase to Ri 00 000 ior e year encied 3i october 2022. 50000 ordinary shares at R1.50 each are expected to be issued on 30 November 2021. - A planned purchase of equipment during December 2021 is estimated at R380 000. Depreciation for the year ended 31 October 2022 is expected to be R60000. The after-tax return on sales is forecast at 20%. A final dividend of 80% of the profit after tax is expected to be declared and it is payable during December 2022 . Company tax for the year ended 31 October 2022 is estimated to be R85000. Provisional tax payments amounting to R77 o00 are expected to be made during the year ended 31 October 2022. The percentage-of-sales method must be used for the current assets and accounts payable. The amount of external funding required (non-current liabilities) must be calculated. The Statement of Financial Position at the end of Ociober 2021 is as follows: Current liabilities Accounts payable Total equity and liabilities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started