Required: Prepare three-part consolidation work paper at December 31, 20x1

In this simulation, you will need to create a three-part worksheet and consolidate the entities.

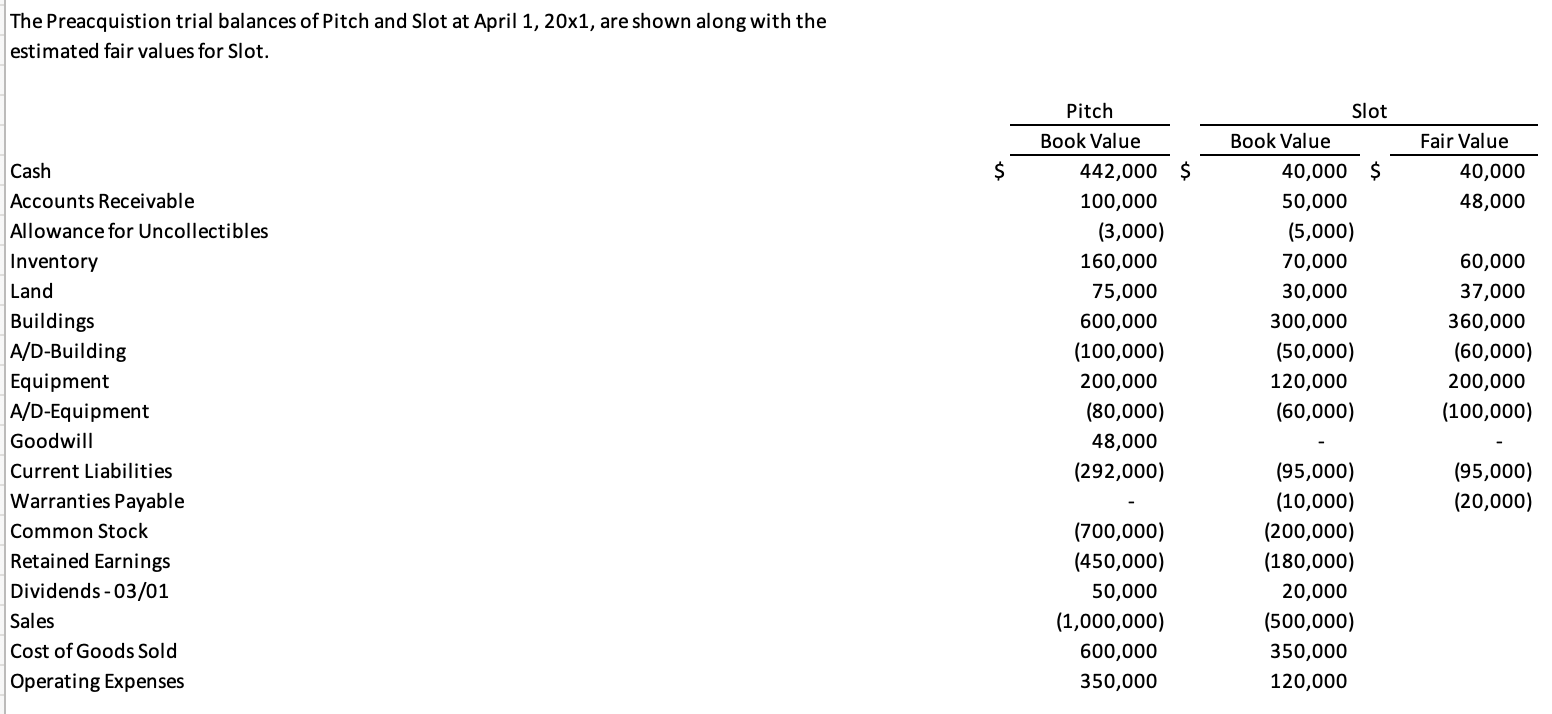

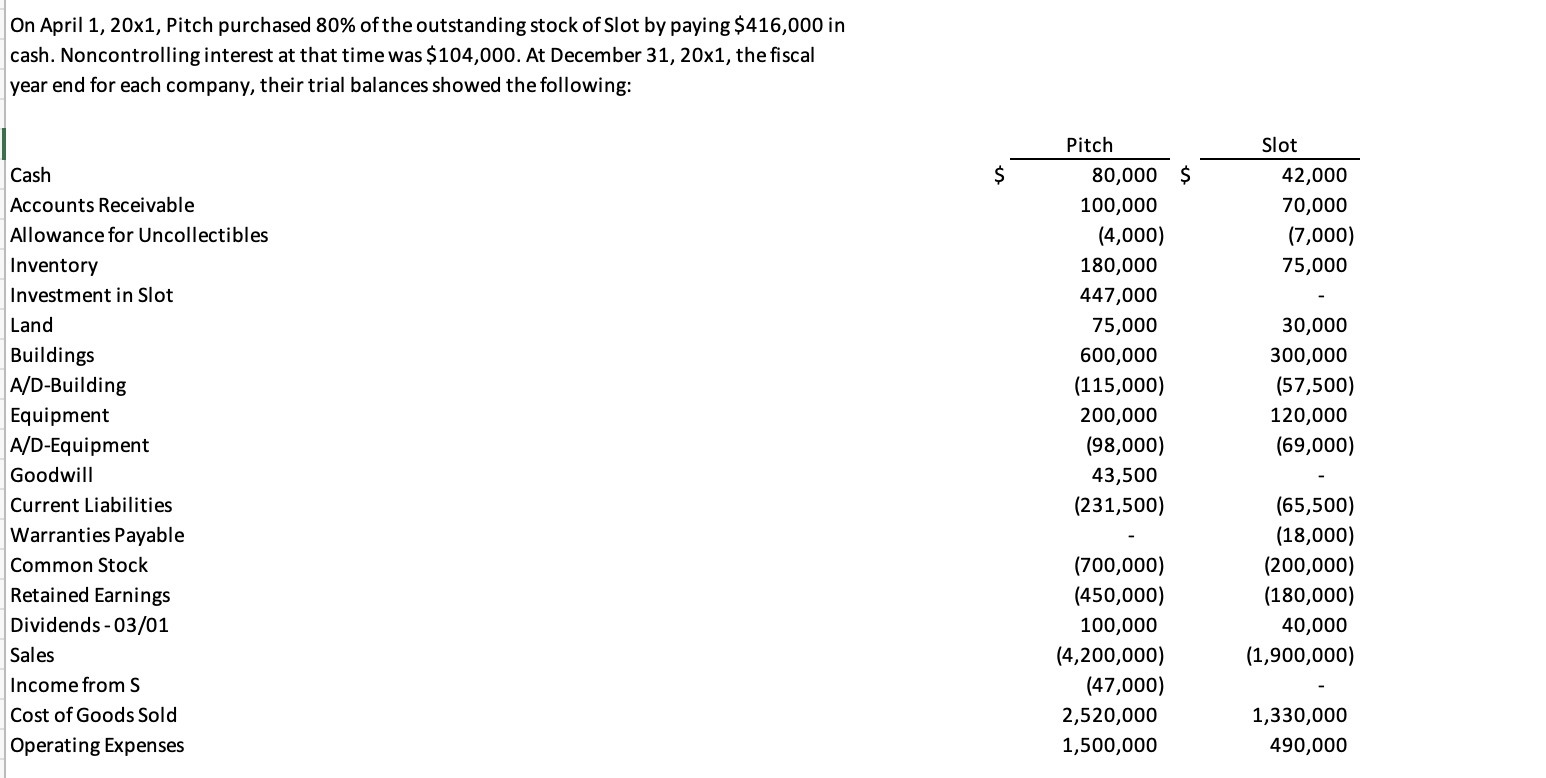

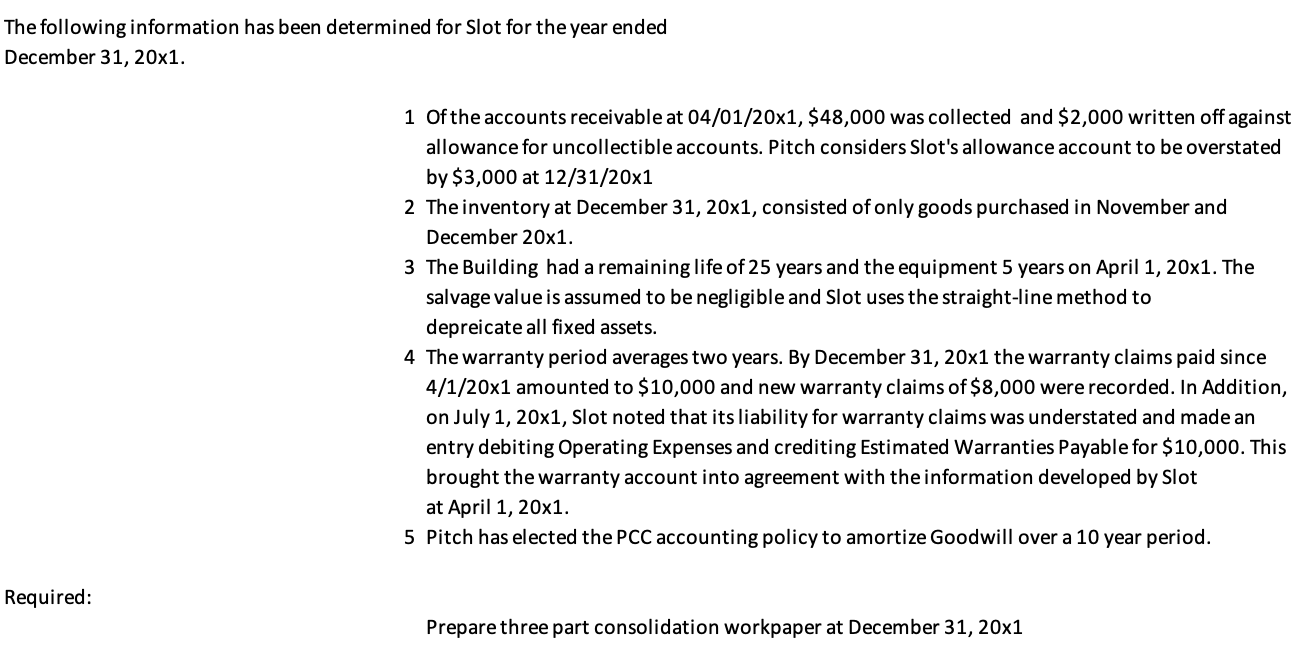

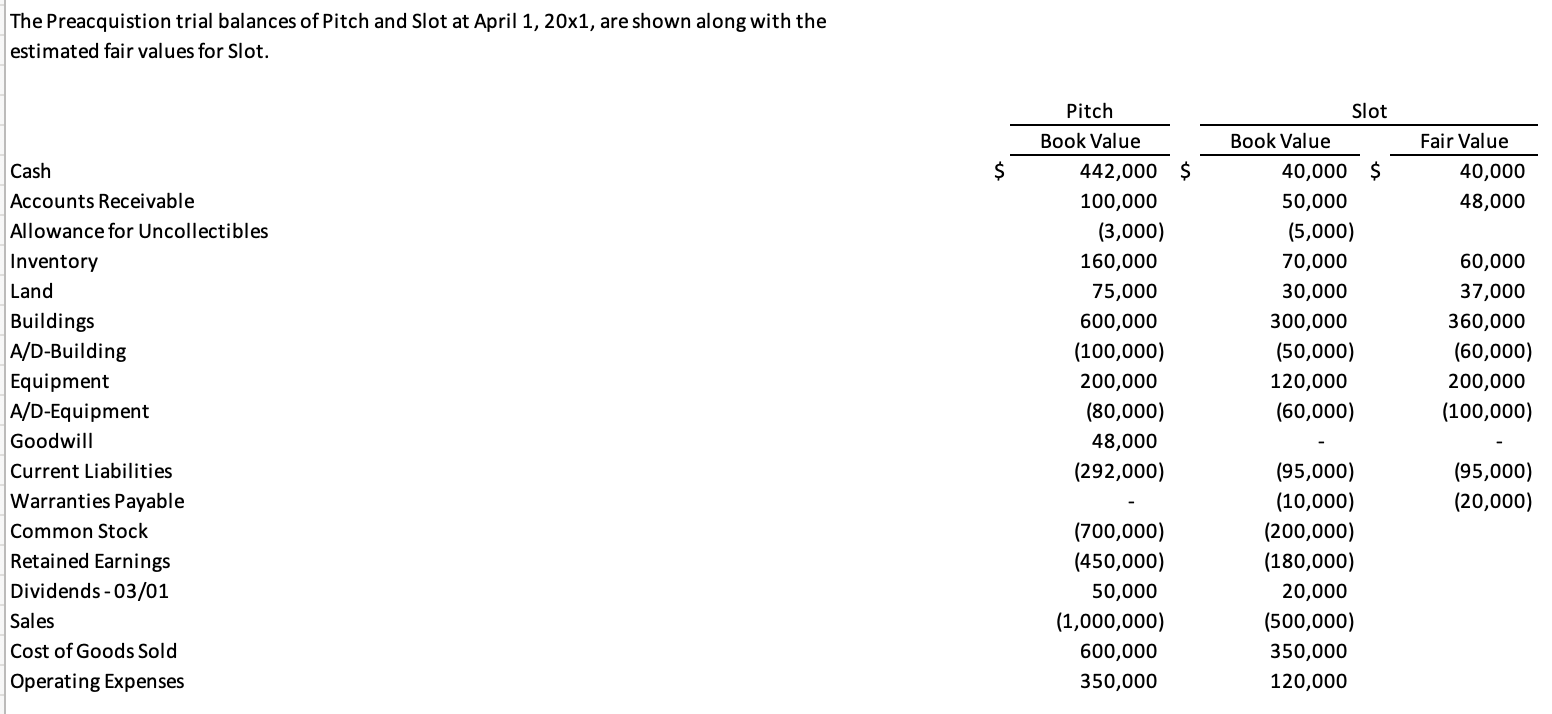

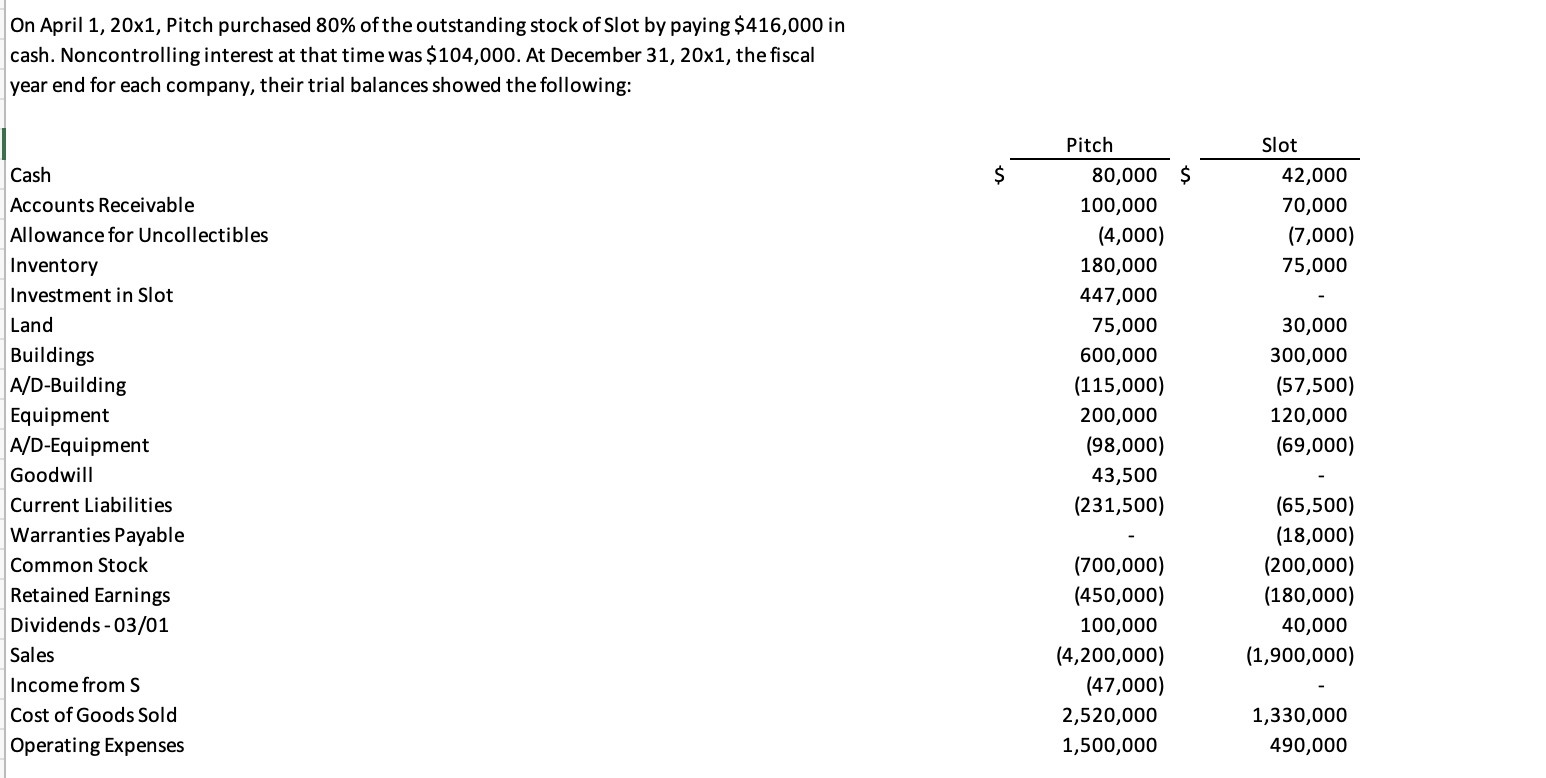

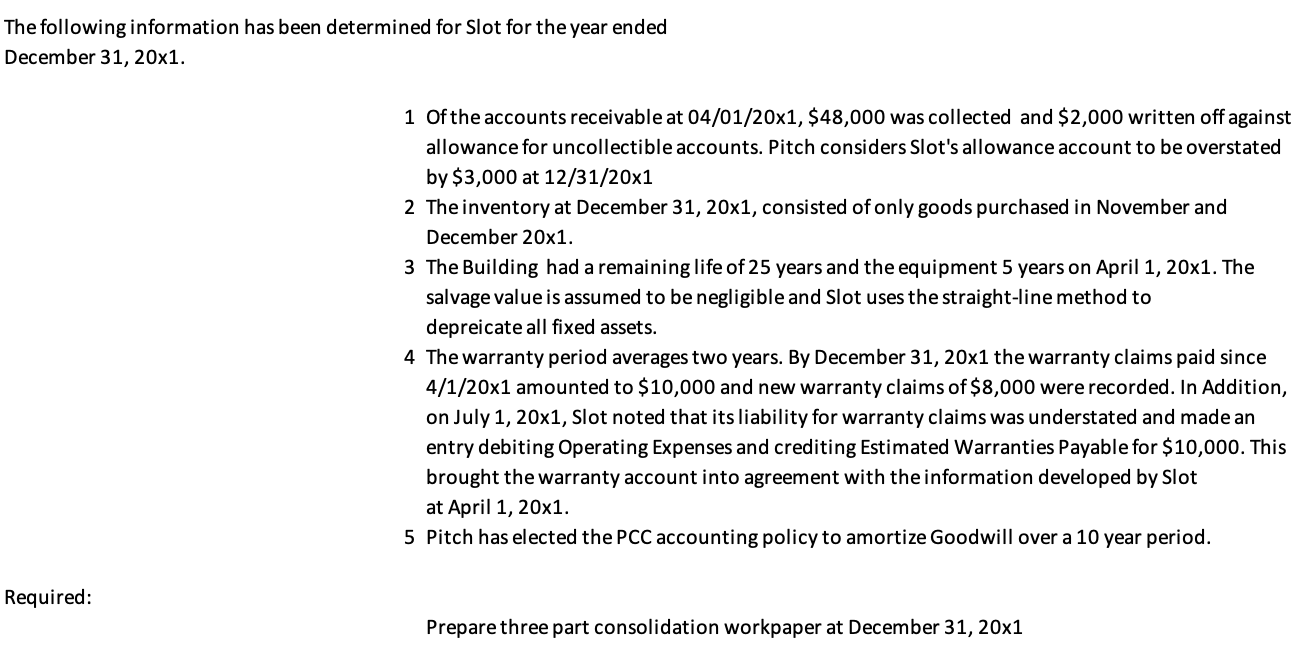

The Preacquistion trial balances of Pitch and Slot at April 1,201, are shown along with the estimated fair values for Slot. Cash Accounts Receivable Allowance for Uncollectibles Inventory Land Buildings A/D-Building Equipment A/D-Equipment Goodwill Current Liabilities Warranties Payable Common Stock Retained Earnings Dividends - 03/01 Sales Cost of Goods Sold Operating Expenses On April 1, 20x1, Pitch purchased 80% of the outstanding stock of Slot by paying $416,000 in cash. Noncontrolling interest at that time was $104,000. At December 31,201, the fiscal year end for each company, their trial balances showed the following: Cash Accounts Receivable Allowance for Uncollectibles Inventory Investment in Slot Land Buildings A/D-Building Equipment A/D-Equipment Goodwill Current Liabilities Warranties Payable Common Stock Retained Earnings Dividends - 03/01 Sales Income from S Cost of Goods Sold Operating Expenses The following information has been determined for Slot for the year ended December 31, 20x1. 1 Of the accounts receivable at 04/01/20x1, \$48,000 was collected and \$2,000 written off against allowance for uncollectible accounts. Pitch considers Slot's allowance account to be overstated by $3,000 at 12/31/201 2 The inventory at December 31,201, consisted of only goods purchased in November and December 201. 3 The Building had a remaining life of 25 years and the equipment 5 years on April 1,201. The salvage value is assumed to be negligible and Slot uses the straight-line method to depreicate all fixed assets. 4 The warranty period averages two years. By December 31, 20x1 the warranty claims paid since 4/1/20x1 amounted to $10,000 and new warranty claims of $8,000 were recorded. In Addition, on July 1,201, Slot noted that its liability for warranty claims was understated and made an entry debiting Operating Expenses and crediting Estimated Warranties Payable for $10,000. This brought the warranty account into agreement with the information developed by Slot at April 1, 20x1. 5 Pitch has elected the PCC accounting policy to amortize Goodwill over a 10 year period. Required: Prepare three part consolidation workpaper at December 31,201 The Preacquistion trial balances of Pitch and Slot at April 1,201, are shown along with the estimated fair values for Slot. Cash Accounts Receivable Allowance for Uncollectibles Inventory Land Buildings A/D-Building Equipment A/D-Equipment Goodwill Current Liabilities Warranties Payable Common Stock Retained Earnings Dividends - 03/01 Sales Cost of Goods Sold Operating Expenses On April 1, 20x1, Pitch purchased 80% of the outstanding stock of Slot by paying $416,000 in cash. Noncontrolling interest at that time was $104,000. At December 31,201, the fiscal year end for each company, their trial balances showed the following: Cash Accounts Receivable Allowance for Uncollectibles Inventory Investment in Slot Land Buildings A/D-Building Equipment A/D-Equipment Goodwill Current Liabilities Warranties Payable Common Stock Retained Earnings Dividends - 03/01 Sales Income from S Cost of Goods Sold Operating Expenses The following information has been determined for Slot for the year ended December 31, 20x1. 1 Of the accounts receivable at 04/01/20x1, \$48,000 was collected and \$2,000 written off against allowance for uncollectible accounts. Pitch considers Slot's allowance account to be overstated by $3,000 at 12/31/201 2 The inventory at December 31,201, consisted of only goods purchased in November and December 201. 3 The Building had a remaining life of 25 years and the equipment 5 years on April 1,201. The salvage value is assumed to be negligible and Slot uses the straight-line method to depreicate all fixed assets. 4 The warranty period averages two years. By December 31, 20x1 the warranty claims paid since 4/1/20x1 amounted to $10,000 and new warranty claims of $8,000 were recorded. In Addition, on July 1,201, Slot noted that its liability for warranty claims was understated and made an entry debiting Operating Expenses and crediting Estimated Warranties Payable for $10,000. This brought the warranty account into agreement with the information developed by Slot at April 1, 20x1. 5 Pitch has elected the PCC accounting policy to amortize Goodwill over a 10 year period. Required: Prepare three part consolidation workpaper at December 31,201