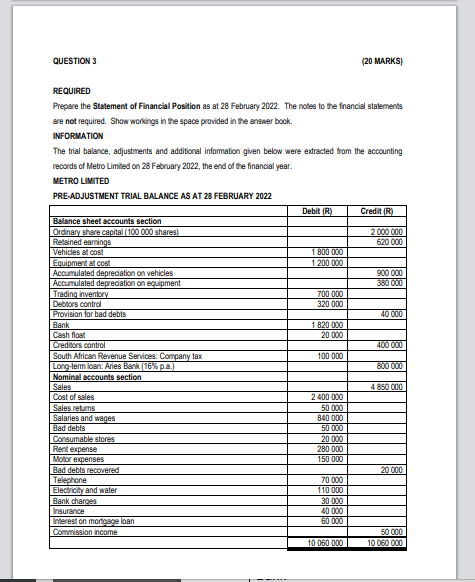

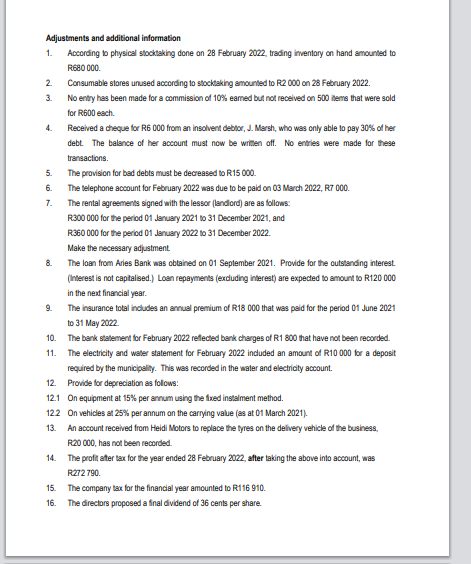

REQUIRED Prepere the Statement of Financial Position as at 28 February 2022. The notes to the fnancial stalements are not required. Show workings in the space provided in the answer book. INFORMATION The trial balance, adjustments and additional information given below were extracted from the accounting records of Metro Limited on 28 February 2022, the end of the financial year. METRO LINITED PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2022 Adjustments and additional information 1. According to physical stocklaking done on 28 February 2022 , trading imentory on hand amounted to R680 000. 2. Consumable stares unused according to stocksking amounted to R2 000 on 28 Fetruary 2022. 3. No enty has been made for a commission of 10% eamed but not received on 500 thems that were sold for R600 each. 4. Received a cheque for R6 000 from an insolvent deblor, J. Marsh, who was only able to pay 30% of her debt. The balance of her account must now be wriken off. No entries were made for these transactions. 5. The provision for bed debts must be decreased to R15 000. 6. The telephone account for February 2022 was due to be paid on 03 March 2022, R7 000. 7. The rental agreements signed with the lessor (landord) are as follows: R300 000 for the period 01 Jenuary 2021 to 31 December 2021, and R360 000 for the period 01 Jenuary 2022 to 31 December 2022. Make the necessary adjustment. 8. The laan from Aries Bank was obtained on 01 September 2021. Provide for the outstanding interest. (Interest is not captalised.) Loen repayments (excluding interest) are expected to amourt to R120 000 in the next financial year. 9. The insurance total includes an annul premium of R18 000 that was peid for the period 01 June 2021 to 31 May 2022. 10. The berk statement for February 2022 relected berk charges of R1 800 that have not been recorded. 11. The electricity and water statement for February 2022 included an amount of R10 000 for a deposit required by the municipalify. This was recorded in the water and electricty account. 12. Provide for depreciation as folows: 12.1 On equipment at 15% per arrum using the fixed instalment method. 122 On vehicles at 25% per annum on the carrying value (as at 01 March 2021). 13. An account received from Heidi Motors to replace the byres on the delivery vehicle of the business, R20 000, has not been recorded. 14. The profin ater tax for the year ended 28 February 2022 , after taking the above into account, was Re72790. 15. The company tax for the financial year amounted to R:16 910. 16. The directors proposed a final dividend of 36 cents per share. REQUIRED Prepere the Statement of Financial Position as at 28 February 2022. The notes to the fnancial stalements are not required. Show workings in the space provided in the answer book. INFORMATION The trial balance, adjustments and additional information given below were extracted from the accounting records of Metro Limited on 28 February 2022, the end of the financial year. METRO LINITED PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2022 Adjustments and additional information 1. According to physical stocklaking done on 28 February 2022 , trading imentory on hand amounted to R680 000. 2. Consumable stares unused according to stocksking amounted to R2 000 on 28 Fetruary 2022. 3. No enty has been made for a commission of 10% eamed but not received on 500 thems that were sold for R600 each. 4. Received a cheque for R6 000 from an insolvent deblor, J. Marsh, who was only able to pay 30% of her debt. The balance of her account must now be wriken off. No entries were made for these transactions. 5. The provision for bed debts must be decreased to R15 000. 6. The telephone account for February 2022 was due to be paid on 03 March 2022, R7 000. 7. The rental agreements signed with the lessor (landord) are as follows: R300 000 for the period 01 Jenuary 2021 to 31 December 2021, and R360 000 for the period 01 Jenuary 2022 to 31 December 2022. Make the necessary adjustment. 8. The laan from Aries Bank was obtained on 01 September 2021. Provide for the outstanding interest. (Interest is not captalised.) Loen repayments (excluding interest) are expected to amourt to R120 000 in the next financial year. 9. The insurance total includes an annul premium of R18 000 that was peid for the period 01 June 2021 to 31 May 2022. 10. The berk statement for February 2022 relected berk charges of R1 800 that have not been recorded. 11. The electricity and water statement for February 2022 included an amount of R10 000 for a deposit required by the municipalify. This was recorded in the water and electricty account. 12. Provide for depreciation as folows: 12.1 On equipment at 15% per arrum using the fixed instalment method. 122 On vehicles at 25% per annum on the carrying value (as at 01 March 2021). 13. An account received from Heidi Motors to replace the byres on the delivery vehicle of the business, R20 000, has not been recorded. 14. The profin ater tax for the year ended 28 February 2022 , after taking the above into account, was Re72790. 15. The company tax for the financial year amounted to R:16 910. 16. The directors proposed a final dividend of 36 cents per share