Answered step by step

Verified Expert Solution

Question

1 Approved Answer

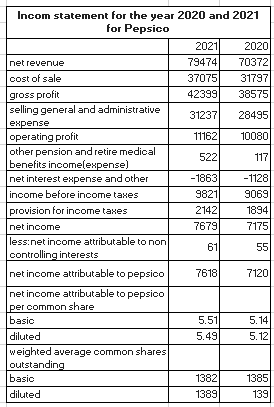

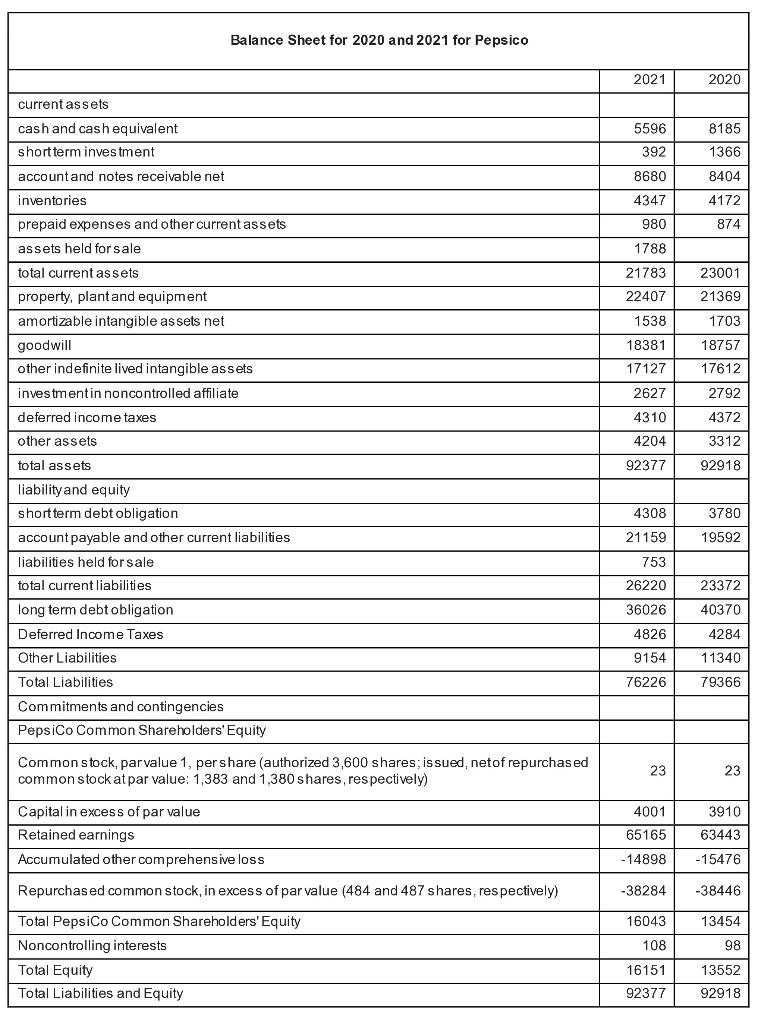

Required Question: Compute all the ratios for the company (Balance Sheet and Income statement has been mentioned) also include each ratio short analysis. . Required

Required Question: Compute all the ratios for the company (Balance Sheet and Income statement has been mentioned) also include each ratio short analysis.

.

Required Question: Compute all the ratios for the company (Balance Sheet and Income statement has been mentioned) also include each ratio short analysis.

1. Current Ratio

2. Quick Ratio

3. Networking capital

4. Debt to Equity Ratio

5. Equity ratio

6. Debt Ratio

7. Gross profit Margin

8. Operating profit Margin

.

Note: Please do it in excel format

.

\begin{tabular}{|l|r|r|} \hline \multicolumn{2}{|c|}{ Incom statement for the year 2020 and 2021} \\ \hline for Pepsico \\ \hline net revenue & 2021 & 2020 \\ \hline cost of sale & 79474 & 70372 \\ \hline gross profit & 37075 & 31797 \\ \hline selling general and administrative expense & 31237 & 28495 \\ \hline operating profit & 11162 & 10080 \\ \hline other pension and retire medical benefits incomelexpense) & 522 & 117 \\ \hline net interest expense and other & 1863 & 1128 \\ \hline income before income taxes & 9821 & 9069 \\ \hline provision for income tases & 2142 & 1894 \\ \hline net income & 7679 & 7175 \\ \hline less:net income attributable to non controlling interests & 61 & 55 \\ \hline net income attributable to pepsico & 7618 & 7120 \\ \hline net income attributable to pepsico per common share & & \\ \hline basic & 5.51 & 5.14 \\ \hline diluted & 5.49 & 5.12 \\ \hline weighted average common shares outstanding & & \\ \hline basic & 1382 & 1385 \\ \hline diluted & 1389 & 139 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started