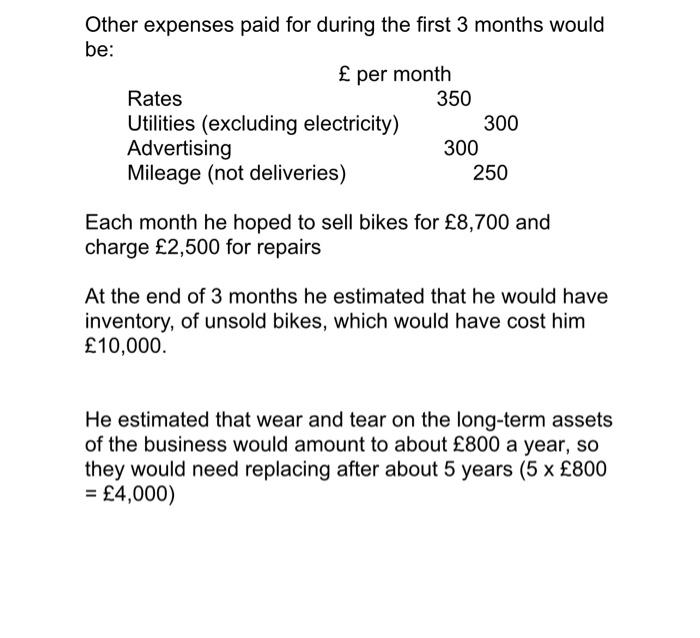

Required: Read the case study about Ebikum Ltd, at the end of this question, and produce a report on the risks, rewards and viability of the plans for this business. Your report should include a section summarising the recommendations you have made earlier, for dealing with any problems you identify. Your answer must not exceed 1,000 words, plus any tables or calculations. You are advised to show any substantial calculations in an Appendix. You are advised to include citations for any sources other than lecture materials. Please show in italics the material from cited sources Your report should have a suitable title and contain the following sections: 1 Forecast cashflow 2 Discounted payback period 3 Summary of Recommendations 4 References Appendix You are not required to provide an abstract, management summary or introduction In order to calculate the discounted payback period, you should assume that, after March, cash from sales increases by 5% a month. Also, that cash outflow in April is 12,500 and then increases by 2% a month. Assume a cost of capital of 1% per month Case study: Ebikum Ltd. When Hans left university, he decided to run a business selling and repairing e-bikes. In order to do this, he set up a limited company, Ebikum Limited. He planned to deposit 500 in the company's bank account on 1 January 2022, in exchange for 500 shares, with a nominal value of 1 each. He also planned for the company to borrow 8,000 from his father Hans planned to rent premises for his business at 2,000 a month and lease test and IT equipment for 580 a month. He would pay 4,000 for signage and furniture. For each of the first two months he would spend 7,500 on bikes for resale and components for repairs. In the third month he hoped to buy 7,000 of bikes on credit. At the outset, he would hire a technician, at a cost of 2,000 a month, to do the repair work, whilst he mostly dealt with selling and administration. He would pay himself 1,000 a month in salary and planned to take further income as dividends. He estimated that he would use 200 worth of electricity per month and expected to get the first bill at the beginning of April. He would pay 1,200, in January, for 12 months' insurance. Other expenses paid for during the first 3 months would be: Each month he hoped to sell bikes for 8,700 and charge 2,500 for repairs At the end of 3 months he estimated that he would have inventory, of unsold bikes, which would have cost him 10,000. He estimated that wear and tear on the long-term assets of the business would amount to about 800 a year, so they would need replacing after about 5 years (5800 =4,000)