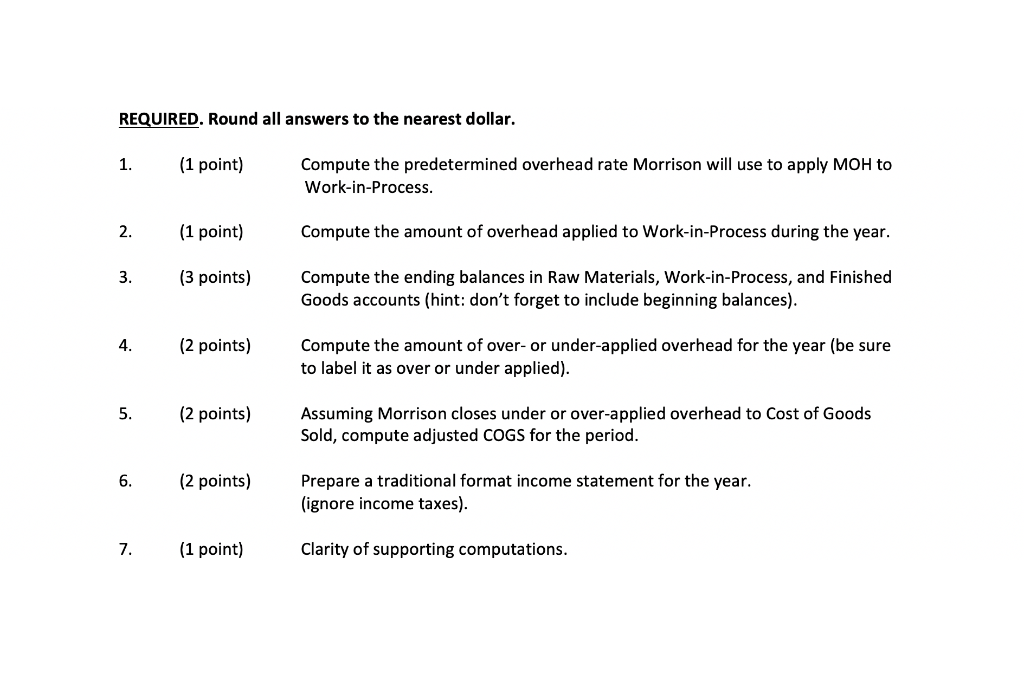

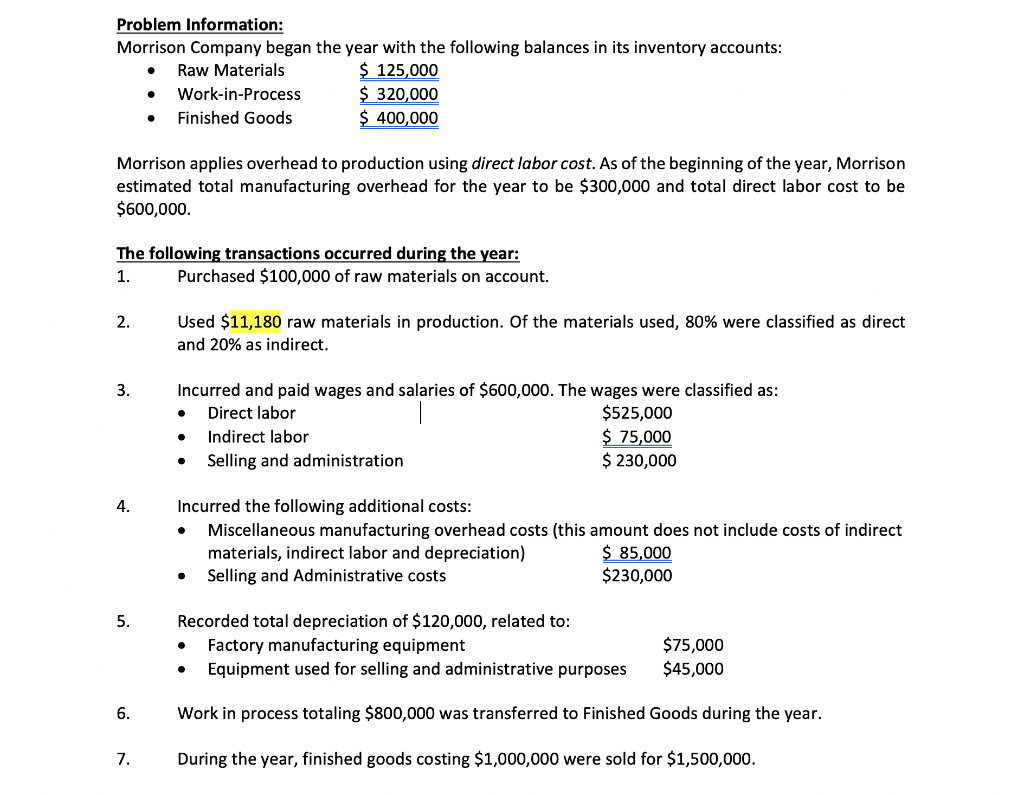

REQUIRED. Round all answers to the nearest dollar. 1. (1 point) Compute the predetermined overhead rate Morrison will use to apply MOH to Work-in-process. 2. (1 point) Compute the amount of overhead applied to Work-in-process during the year. 3. (3 points) Compute the ending balances in Raw Materials, Work-in-process, and Finished Goods accounts (hint: don't forget to include beginning balances). 4. (2 points) Compute the amount of over- or under-applied overhead for the year (be sure to label it as over or under applied). 5. (2 points) Assuming Morrison closes under or over-applied overhead to Cost of Goods Sold, compute adjusted COGS for the period. 6. (2 points) Prepare a traditional format income statement for the year. (ignore income taxes). 7. (1 point) Clarity of supporting computations. Problem Information: Morrison Company began the year with the following balances in its inventory accounts: Raw Materials $ 125,000 Work-in-Process $ 320,000 Finished Goods $ 400,000 Morrison applies overhead to production using direct labor cost. As of the beginning of the year, Morrison estimated total manufacturing overhead for the year to be $300,000 and total direct labor cost to be $600,000 The following transactions occurred during the year: 1. Purchased $100,000 of raw materials on account. 2. Used $11,180 raw materials in production. Of the materials used, 80% were classified as direct and 20% as indirect. 3. Incurred and paid wages and salaries of $600,000. The wages were classified as: Direct labor $525,000 Indirect labor $ 75,000 Selling and administration $ 230,000 . 4. . Incurred the following additional costs: Miscellaneous manufacturing overhead costs (this amount does not include costs of indirect materials, indirect labor and depreciation) $ 85,000 Selling and Administrative costs $230,000 . 5. . Recorded total depreciation of $120,000, related to: Factory manufacturing equipment Equipment used for selling and administrative purposes $75,000 $45,000 6. Work in process totaling $800,000 was transferred to Finished Goods during the year. 7. During the year, finished goods costing $1,000,000 were sold for $1,500,000