Answered step by step

Verified Expert Solution

Question

1 Approved Answer

REQUIRED Set your calculator on four decimal places for the calculations of this question and round your final answers to two decimal places Final rand

REQUIRED

Set your calculator on four decimal places for the calculations of this question and round your final answers to two decimal places Final rand values should be rounded to the nearest rand. Show the formulas used and detailed calculations as well as inputs for financial calculator calculations where applicable.

A) Calculate the market value of debentures. (4) B) Calculate the market value of the loan. (4) C) Calculate the market value of equity. (4)

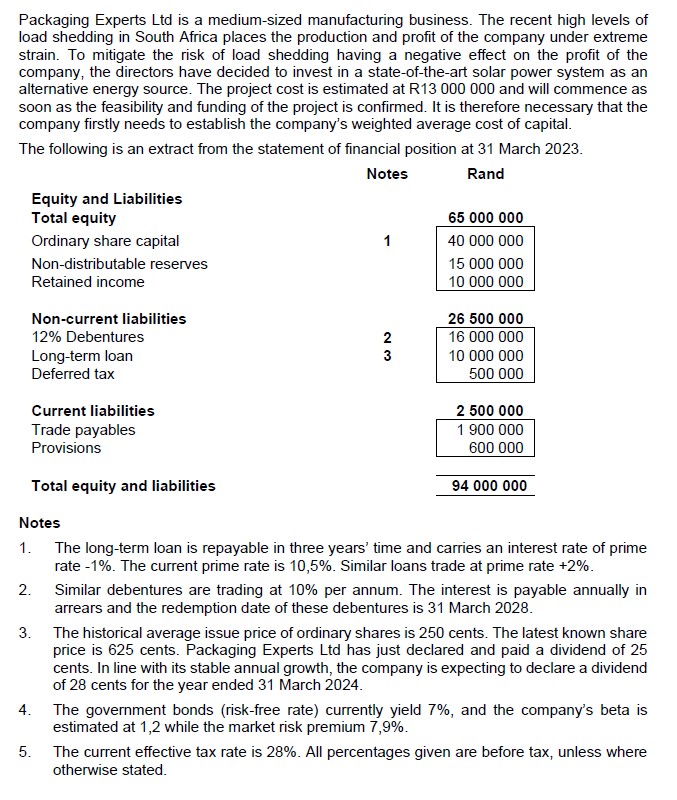

Packaging Experts Ltd is a medium-sized manufacturing business. The recent high levels of load shedding in South Africa places the production and profit of the company under extreme strain. To mitigate the risk of load shedding having a negative effect on the profit of the company, the directors have decided to invest in a state-of-the-art solar power system as an alternative energy source. The project cost is estimated at R13 000000 and will commence as soon as the feasibility and funding of the project is confirmed. It is therefore necessary that the company firstly needs to establish the company's weighted average cost of capital. The following is an extract from the statement of financial position at 31 March 2023. Notes 1. The long-term loan is repayable in three years' time and carries an interest rate of prime rate 1%. The current prime rate is 10,5%. Similar loans trade at prime rate +2%. 2. Similar debentures are trading at 10% per annum. The interest is payable annually in arrears and the redemption date of these debentures is 31 March 2028. 3. The historical average issue price of ordinary shares is 250 cents. The latest known share price is 625 cents. Packaging Experts Ltd has just declared and paid a dividend of 25 cents. In line with its stable annual growth, the company is expecting to declare a dividend of 28 cents for the year ended 31 March 2024. 4. The government bonds (risk-free rate) currently yield 7%, and the company's beta is estimated at 1,2 while the market risk premium 7,9%. 5. The current effective tax rate is 28%. All percentages given are before tax, unless where otherwise statedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started