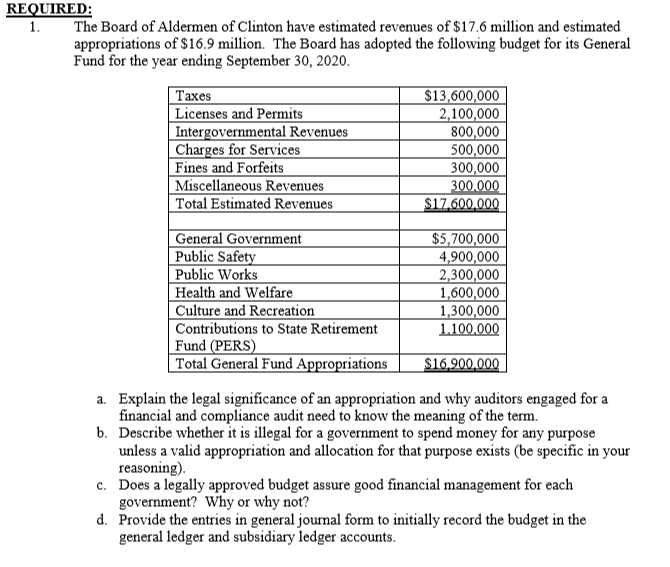

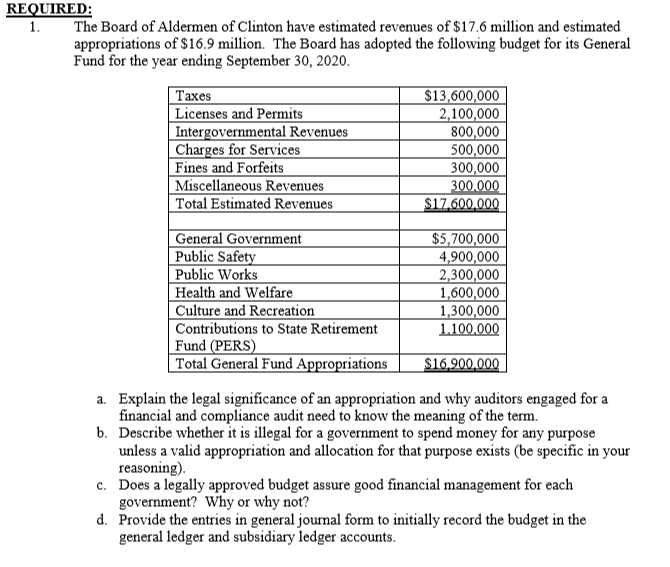

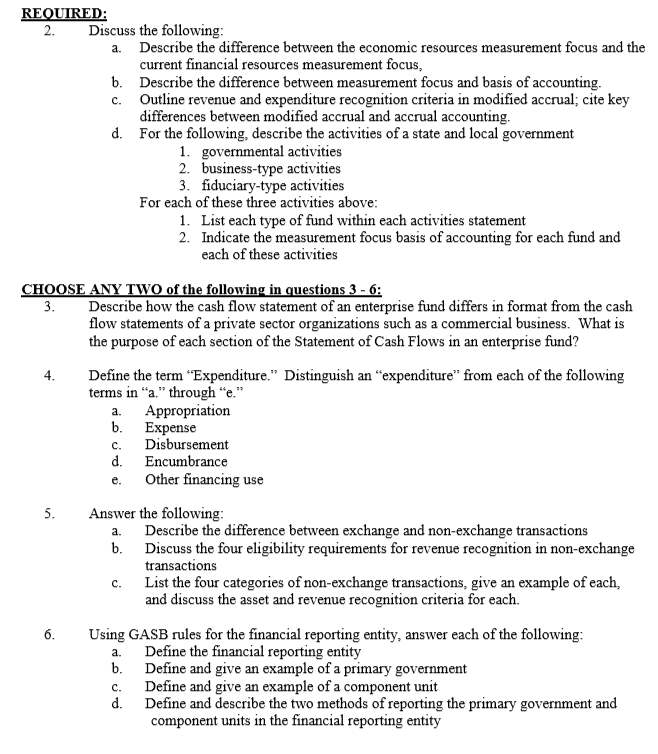

REQUIRED: The Board of Aldermen of Clinton have estimated revenues of $17.6 million and estimated appropriations of $16.9 million. The Board has adopted the following budget for its General Fund for the year ending September 30, 2020. Taxes Licenses and Permits Intergovernmental Revenues Charges for Services Fines and Forfeits Miscellaneous Revenues Total Estimated Revenues $13,600,000 2,100,000 800,000 500,000 300,000 300.000 $17.600.000 General Government Public Safety Public Works Health and Welfare Culture and Recreation Contributions to State Retirement Fund (PERS) Total General Fund Appropriations $5,700,000 4,900,000 2,300,000 1,600,000 1,300,000 1.100.000 $16.900.000 rendoning a. Explain the legal significance of an appropriation and why auditors engaged for a financial and compliance audit need to know the meaning of the term. b. Describe whether it is illegal for a government to spend money for any purpose unless a valid appropriation and allocation for that purpose exists (be specific in your reasoning) c. Does a legally approved budget assure good financial management for each government? Why or why not? d. Provide the entries in general journal form to initially record the budget in the general ledger and subsidiary ledger accounts. REQUIRED: Discuss the following: a. Describe the difference between the economic resources measurement focus and the current financial resources measurement focus, b. Describe the difference between measurement focus and basis of accounting. c. Outline revenue and expenditure recognition criteria in modified accrual, cite key differences between modified accrual and accrual accounting. d. For the following, describe the activities of a state and local government 1. governmental activities 2. business-type activities 3. fiduciary-type activities For each of these three activities above: 1. List each type of fund within each activities statement 2. Indicate the measurement focus basis of accounting for each fund and each of these activities CHOOSE ANY TWO of the following in questions 3 - 6: Describe how the cash flow statement of an enterprise fund differs in format from the cash flow statements of a private sector organizations such as a commercial business. What is the purpose of each section of the Statement of Cash Flows in an enterprise fund? 4. Define the term "Expenditure." Distinguish an "expenditure" from each of the following terms in "a." through "e." a. Appropriation Expense Disbursement d. Encumbrance e. Other financing use Answer the following: Describe the difference between exchange and non-exchange transactions Discuss the four eligibility requirements for revenue recognition in non-exchange transactions c. List the four categories of non-exchange transactions, give an example of each, and discuss the asset and revenue recognition criteria for each. 6. Using GASB rules for the financial reporting entity, answer each of the following: a. Define the financial reporting entity Define and give an example of a primary government Define and give an example of a component unit d. Define and describe the two methods of reporting the primary government and component units in the financial reporting entity REQUIRED: The Board of Aldermen of Clinton have estimated revenues of $17.6 million and estimated appropriations of $16.9 million. The Board has adopted the following budget for its General Fund for the year ending September 30, 2020. Taxes Licenses and Permits Intergovernmental Revenues Charges for Services Fines and Forfeits Miscellaneous Revenues Total Estimated Revenues $13,600,000 2,100,000 800,000 500,000 300,000 300.000 $17.600.000 General Government Public Safety Public Works Health and Welfare Culture and Recreation Contributions to State Retirement Fund (PERS) Total General Fund Appropriations $5,700,000 4,900,000 2,300,000 1,600,000 1,300,000 1.100.000 $16.900.000 rendoning a. Explain the legal significance of an appropriation and why auditors engaged for a financial and compliance audit need to know the meaning of the term. b. Describe whether it is illegal for a government to spend money for any purpose unless a valid appropriation and allocation for that purpose exists (be specific in your reasoning) c. Does a legally approved budget assure good financial management for each government? Why or why not? d. Provide the entries in general journal form to initially record the budget in the general ledger and subsidiary ledger accounts. REQUIRED: Discuss the following: a. Describe the difference between the economic resources measurement focus and the current financial resources measurement focus, b. Describe the difference between measurement focus and basis of accounting. c. Outline revenue and expenditure recognition criteria in modified accrual, cite key differences between modified accrual and accrual accounting. d. For the following, describe the activities of a state and local government 1. governmental activities 2. business-type activities 3. fiduciary-type activities For each of these three activities above: 1. List each type of fund within each activities statement 2. Indicate the measurement focus basis of accounting for each fund and each of these activities CHOOSE ANY TWO of the following in questions 3 - 6: Describe how the cash flow statement of an enterprise fund differs in format from the cash flow statements of a private sector organizations such as a commercial business. What is the purpose of each section of the Statement of Cash Flows in an enterprise fund? 4. Define the term "Expenditure." Distinguish an "expenditure" from each of the following terms in "a." through "e." a. Appropriation Expense Disbursement d. Encumbrance e. Other financing use Answer the following: Describe the difference between exchange and non-exchange transactions Discuss the four eligibility requirements for revenue recognition in non-exchange transactions c. List the four categories of non-exchange transactions, give an example of each, and discuss the asset and revenue recognition criteria for each. 6. Using GASB rules for the financial reporting entity, answer each of the following: a. Define the financial reporting entity Define and give an example of a primary government Define and give an example of a component unit d. Define and describe the two methods of reporting the primary government and component units in the financial reporting entity