Answered step by step

Verified Expert Solution

Question

1 Approved Answer

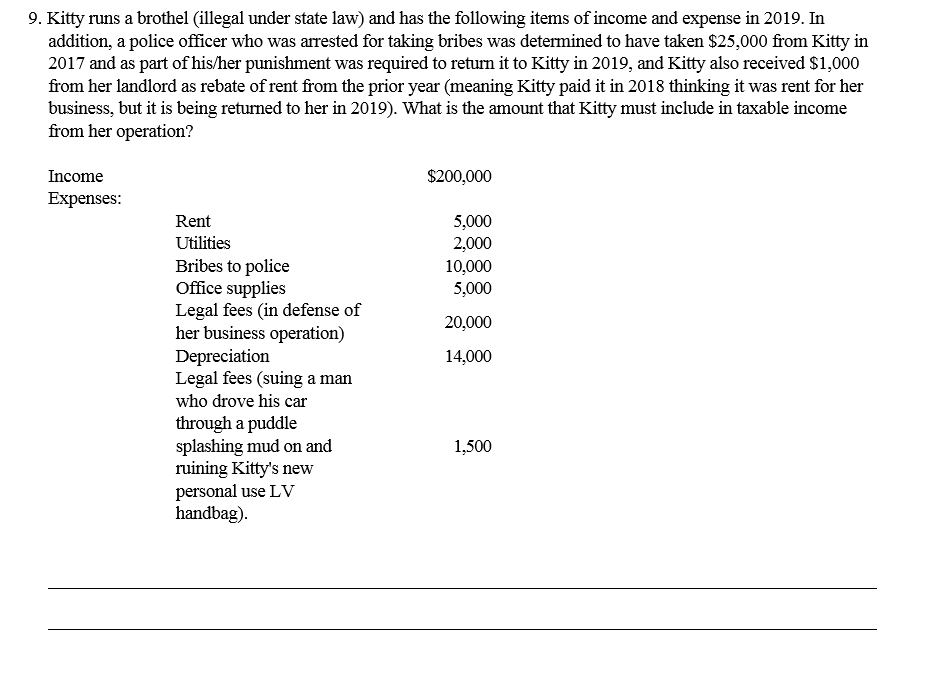

Required US taxation knowledge. 9. Kitty runs a brothel (illegal under state law) and has the following items of income and expense in 2019. In

Required US taxation knowledge.

9. Kitty runs a brothel (illegal under state law) and has the following items of income and expense in 2019. In addition, a police officer who was arrested for taking bribes was determined to have taken $25,000 from Kitty in 2017 and as part of his/her punishment was required to return it to Kitty in 2019, and Kitty also received $1,000 from her landlord as rebate of rent from the prior year (meaning Kitty paid it in 2018 thinking it was rent for her business, but it is being returned to her in 2019). What is the amount that Kitty must include in taxable income from her operation? $200,000 Income Expenses: 5,000 2.000 10.000 5,000 20,000 14,000 Rent Utilities Bribes to police Office supplies Legal fees in defense of her business operation) Depreciation Legal fees (suing a man who drove his car through a puddle splashing mud on and ruining Kitty's new personal use LV handbag). 1,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started